|

市场调查报告书

商品编码

1645104

英国叶轮:市场占有率分析、行业趋势和成长预测(2025-2030 年)United Kingdom Rotor Blade - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

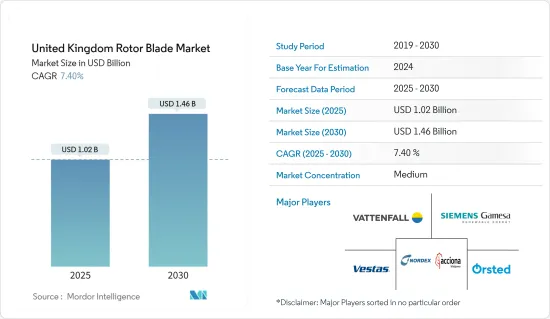

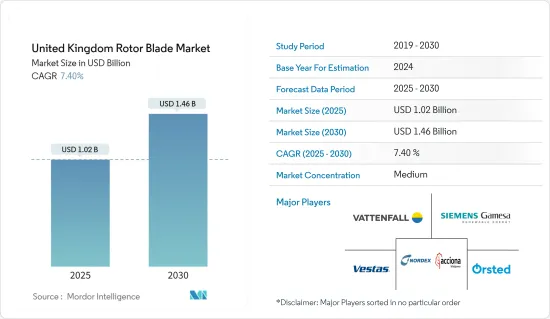

预计 2025 年英国叶轮市场规模将达到 10.2 亿美元,到 2030 年将达到 14.6 亿美元,预测期内(2025-2030 年)的复合年增长率为 7.4%。

从中期来看,预计预测期内,海上和陆上风电装置数量的增加、风力发电价格的下降以及风电领域投资的增加将推动英国叶轮市场的发展。

然而,高昂的运输成本以及来自太阳能、水力发电等替代清洁能源的价格竞争等因素可能会在预测期内限制市场成长。

风力发电领域正在探索经济的选择,高效能产品有可能改变产业的动态。在某些情况下,必须更换旧涡轮机并不是因为它们损坏了,而是因为市场上出现了更有效率的叶片。因此,技术进步最终为叶轮市场创造了巨大的机会。

英国叶轮市场趋势

海上领域占市场主导地位

在过去五年中,离岸风力发电技术不断进步,覆盖了更多风速较低的地区,每兆瓦装置容量可产生更多的电力。此外,近年来风力发电机风力发电机的数量不断增加,导致叶片更大、直径更大、轮毂更高。

2024年3月,英国政府宣布了迄今为止规模最大的预算,为可再生能源计划投入10亿英镑(12.5亿美元)。其中包括 8 亿英镑(10 亿美元)用于离岸风力发电,1.05 亿英镑(1.31 亿美元)用于浮体式海上风电和地热技术。

为了实现政府目标,英国离岸风力发电装置容量将增加 265%。到2030年,英国政府希望将离岸风力发电从13.7GW增加到50GW。据科技公司ABB称,这将需要在未来七年内建造24个平均容量为1.5GW的风电场。因此,离岸风电在英国能源结构中的份额将从 18% 增加到 62%。

英国是成长最快的风力发电生产国之一。该国是欧洲风力发电的理想地点。根据国际可再生能源机构(IRENA)的预测,2023年离岸风力发电将达到14,746兆瓦,较2014年成长2.27倍。

因此,考虑到上述因素,由于政府的支持政策和倡议以及陆上风力发电计划的增加,预计预测期内海上风力发电机叶轮将显着增长。

政府支持措施和私人投资推动市场需求

作为在联合国气候变迁大会第26次缔约国会议签署的《巴黎气候协定》的一部分,英国承诺在2050年实现净零碳排放。这些目标很快就会为参与英国风力发电市场的公司创造重大机会。

根据国际可再生能源机构(IRENA)的预测,2023年风电装置容量将达到30,215兆瓦,比2014年成长1.3倍。随着多个风力发电工程的启动,预计未来几年这一数字将大幅增加。

近年来,政府在全部区域推出了多个海上和陆上风力发电计划。例如,2023年12月,政府宣布维斯塔斯和Vattenfall已签署了英国离岸风力发电计划1.4兆瓦的优先供应协议,以及另外两个英国计划2.8兆瓦电力的独家合约。这三个计划的合约还包括针对 1,380MW 诺福克先锋西计划的优先供应商协议。

同样,英国政府在2023年9月宣布将向95个新的可再生能源项目付款差价合约(CFD),确保3.7GW的清洁能源容量。这些计划包括陆上风能、太阳能和潮汐能开发。此外,总部位于英国的Octopus Energy计划到2030年在全球整体离岸风力发电领域投资200亿美元。该公司是 Octopus Energy Group 的子公司,该公司表示,这项投资每年将产生 12 千兆吨(GW)的可再生能源发电,足以为 1,000 万户家庭供电。

英国政府已与其他国家签署了多项可再生能源投资协议,包括海上和陆上风电。例如,2023年5月,日本企业承诺投资180亿英镑(225亿美元)在英国投资离岸风电、低碳氢化合物和其他清洁能源计划。这项投资将有助于提高离岸风力发电电场的整体发电量,并可能在预测期内推动叶轮市场的发展。

因此,预计预测期内增加的投资和即将开展的计划将推动英国叶轮市场的发展。

英国叶轮产业概况

英国叶轮市场正变得半固体。市场的主要企业(不分先后顺序)包括 Vestas Wind Systems A/S、Siemens Gamesa Renewable Energy SA、Nordex SE、Orsted A/S 和 Vattenfall AB。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第 2 章执行摘要

第三章调查方法

第四章 市场概况

- 介绍

- 2029 年市场规模与需求预测(十亿美元)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 离岸风力发电设施增加

- 增加对风电领域的投资

- 限制因素

- 运输成本高

- 驱动程式

- 供应链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁产品/服务

- 竞争对手之间的竞争

- 投资分析

第五章 市场区隔

- 按位置

- 土地

- 海上

- 按刀片材质

- 碳纤维

- 玻璃纤维

- 其他的

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- Vestas Wind Systems A/S

- Siemens Gamesa Renewable Energy SA

- Nordex SE

- Orsted A/S

- Vattenfall AB

- BayWa RE AG

- Enercon GmbH

- 市场排名分析

- 其他知名公司名单

第七章 市场机会与未来趋势

- 技术进步

The United Kingdom Rotor Blade Market size is estimated at USD 1.02 billion in 2025, and is expected to reach USD 1.46 billion by 2030, at a CAGR of 7.4% during the forecast period (2025-2030).

Over the medium term, the increasing number of offshore and onshore wind energy installations, the decreasing price of wind energy, and increased investments in the wind power sector are expected to drive the United Kingdom's rotor blade market during the forecast period.

On the other hand, factors that include the high cost of transportation and the price competitiveness of alternative clean energy sources such as solar power, hydropower, and others could restrict market growth during the forecast period.

Nevertheless, the wind power sector has been looking for economical options, and a highly efficient product has the potential to change the industry's dynamics. In some cases, old turbines had to be replaced not because of damage but because more efficient blades were available on the market. Thus, technological advancements eventually create an excellent chance for the rotor blade market.

United Kingdom Rotor Blade Market Trends

Offshore Segment to Dominate the Market

In the past five years, offshore wind power generation technology has advanced to cover more locations with lower wind speeds and to enhance electricity produced per installed megawatt capability. In addition to this, the number of wind turbines has increased recently, with larger wind turbine blades, wider diameters, and taller hub heights.

In March 2024, the government of the United Kingdom announced the most significant budget of GBP 1 Billion (USD 1.25 billion) for renewable energy projects, which includes GBP 800 million (USD 1 billion) for offshore wind and GBP 105 million (USD 131 million) for floating offshore wind and geothermal technologies.

In order to meet government targets, the UK's offshore wind capacity is going to be increased by 265%. By 2030, the UK government wants to increase offshore wind power from 13.7GW to 50GW. This will require the construction of 24 more wind farms with an average capacity of 1.5GW over the course of the next seven years, according to technology company ABB. As a result, the percentage of offshore wind in the UK's energy mix would increase from 18% to 62%.

The United Kingdom is one of the fastest-growing wind energy-producing countries. The country is Europe's ideal spot for wind power. According to the International Renewable Energy Agency (IRENA), installed offshore wind energy capacity was 14,746 MW in 2023, an increase of 2.27 times compared to 2014.

Hence, considering the above-mentioned factors, the offshore wind turbine rotor blade is expected to grow significantly due to supportive government policies and initiatives coupled with an increasing number of onshore wind energy projects during the forecast period.

Supportive Government Policies and Private Investments are Driving the Market Demand

The United Kingdom committed to achieving net-zero carbon emissions by 2050 as part of the Paris Climate Accord, which was signed during COP26. These objectives should soon offer significant opportunities for businesses involved in the United Kingdom wind energy market.

According to the International Renewable Energy Agency (IRENA), installed wind energy capacity was 30,215 MW in 2023, an increase of 1.3 times compared to 2014. The number is expected to rise significantly in the upcoming years as several wind energy projects start.

In the last few years, the government has launched multiple offshore and onshore wind energy projects across the region. For instance, in December 2023, the government announced that Vestas and Vattenfall signed a 1.4 GW preferred supplier agreement for the UK offshore wind project and exclusivity agreements for 2.8 GW for two other UK projects. The three projects' agreement includes a preferred supplier agreement for the 1,380 MW Norfolk Vanguard West project.

Similarly, In September 2023, the United Kingdom's Government announced the distribution of Contract for Difference (CFDs) to 95 new renewable energy initiatives, ensuring 3.7 GW of clean energy capacity. These projects include onshore wind, solar, and tidal energy developments. Furthermore, Octopus Energy, based in the United Kingdom, plans to invest USD 20 billion globally in offshore wind by 2030. The company, which is a subsidiary of Octopus Energy Group, stated that the investment will generate 12 gigatonnes (GW) of renewable electricity per year, enough to power 10 million homes.

The government of the UK signed multiple agreements with other countries for investment in renewable energy, including offshore and onshore wind energy. For instance, in May 2023, Japanese businesses committed GBP 18 billion (USD 22.5 billion) to investment in the UK for offshore wind, low-carbon hydrogen, and other clean energy projects. The investment helps to increase energy generation across offshore wind farms and is likely to drive the rotor blade market during the forecast period.

Therefore, increasing investments and upcoming projects are expected to drive the United Kingdom rotor blade market during the forecast period.

United Kingdom Rotor Blade Industry Overview

The United Kingdom Rotor Blade Market is semi-consolidated. Some of the key players in this market (in no particular order) are Vestas Wind Systems A/S, Siemens Gamesa Renewable Energy S.A., Nordex SE, Orsted A/S, and Vattenfall AB.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Number of Offshore Wind Energy Installations

- 4.5.1.2 Increased Investments in the Wind Power Sector

- 4.5.2 Restraints

- 4.5.2.1 High Cost of Transportation

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 By Location of Deployment

- 5.1.1 Onshore

- 5.1.2 Offshore

- 5.2 By Blade Material

- 5.2.1 Carbon Fiber

- 5.2.2 Glass Fiber

- 5.2.3 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Vestas Wind Systems A/S

- 6.3.2 Siemens Gamesa Renewable Energy S.A.

- 6.3.3 Nordex SE

- 6.3.4 Orsted A/S

- 6.3.5 Vattenfall AB

- 6.3.6 BayWa R.E AG

- 6.3.7 Enercon GmbH

- 6.4 Market Ranking Analysis

- 6.5 List of other Prominent Companies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancements