|

市场调查报告书

商品编码

1645109

欧洲和亚洲的潜水泵:市场占有率分析、行业趋势和成长预测(2025-2030 年)Europe Asia Submerged Pump - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

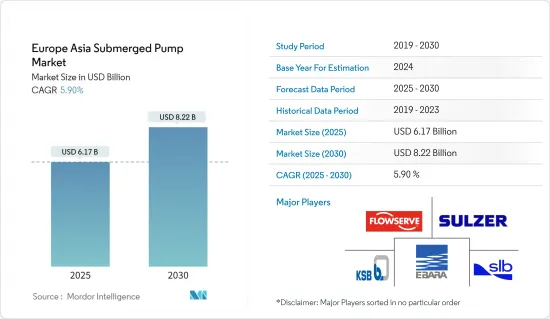

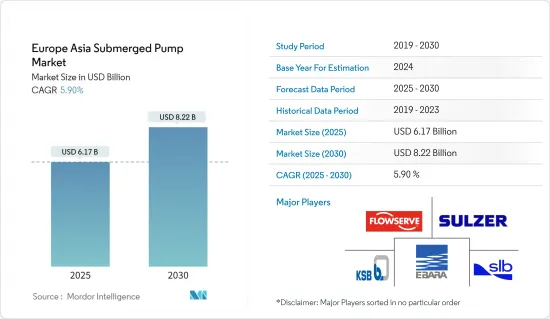

预计 2025 年欧洲和亚洲潜水泵市场规模将达到 61.7 亿美元,到 2030 年预计将达到 82.2 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.9%。

关键亮点

- 从中期来看,住宅和工业领域对污水处理的严格规定以及石油、天然气和采矿业中用于回收的泵的使用增加等因素预计将在预测期内推动欧洲和亚洲潜水泵市场的发展。

- 另一方面,高昂的营运维护成本、油气价格波动等因素将抑制欧洲和亚洲潜水泵市场的成长。

- 在欧洲和亚洲等已开发地区,不断努力对老化的污水和水处理厂基础设施进行升级,使其接近营运生命週期的末期,这可能会在预测期内为潜水泵市场创造成长机会。

- 由于新兴经济体的工业化进程快速推进、都市化不断加快,预计中国、印度、日本和韩国等国家将在预测期内占据市场主导地位。

欧洲和亚洲潜水泵浦市场趋势

预计用水和污水将成为关键领域

- 污水处理厂对其服务的社区发挥着至关重要的作用,因此必须以最高效率运作。可靠的潜水泵有助于避免计划外停机并提高对环境排放的保护。潜水泵是欧洲和亚洲各地小城镇和大城市最实用的解决方案,从而产生了强劲的潜水泵市场需求。

- 潜水泵用于污水处理厂排放液体。潜水泵直接安装在水或泥浆中,发挥泵送功率以从特定区域抽取液体。

- 与干井泵相比,潜水泵具有关键优势,包括成本更低,并且无需在污水处理厂频繁维护泵。此外,潜水泵站通常不需要大型地上结构,并且在住宅更容易融入周围环境。

- 2023年6月,欧盟宣布决定对义大利提起诉讼,指控未能充分维护和解决都市废水处理标准。欧盟表示,义大利未能对都市区、住宅和商业区的污水进行充分处理,导致未经处理的污水排放水体。为了解决这个问题,义大利许多最大的泵浦製造商已做出重大决策,目前这些决策正在全国范围内进行。

- 例如,2023年8月,SKF集团旗下的SKF Lubrication Systems Germany GmbH(SKF)与荏原製作所旗下的集团公司EBARA Pumps Europe SpA(EPE)签署了协议。两家公司都是污水处理厂潜水泵的主要製造商,荏原将接管后者的欧洲业务。 Landia 泵浦在污水处理厂中发挥着至关重要的作用,并为世界各地的市政当局提供协助。

- 2023年2月,丹麦Landia Pumps公司为中国东北山东省新建的用水和污水处理厂供应了17台水泵。该设施还包括潜水泵,用于处理高度污染的液体和干物质含量高的液体。

- 2023年,英国污水公共处理了1,650万公升污水,证明了潜水泵浦在欧洲和亚洲市场的重要性。

- 由于污水处理厂的增加,预计未来几年欧洲对潜水泵的需求将会增加。

中国可望主导市场

- 中国工业活动不断加强,对原油、天然气、化学品和其他产品的需求不断增加。中国是全球製造业的重要推手。该国是采矿业和建筑业的领导者,也是主要企业之一。

- 中国正处于成长阶段,人口成长率高,除了石油和天然气产业的需求外,对供水和污水处理的需求也日益增加。

- 在中国,潜水泵在地下水开采的应用十分广泛,潜水泵的需求日益增加。

- 中国的目标是提高页岩气等非传统资源的国内产量。预计到2035年,中国页岩油产量可能达到2,800亿立方公尺左右。 2024年1月,中国海洋石油集团有限公司(中海油)宣布,总资本投资额为176亿至190亿美元,2024年净生产量为7亿至7.2亿桶油当量(Mboe)。

- 根据能源研究所《2024年世界能源统计评论》的资料,中国石油产量维持高位,2023年较2022年成长2.1%。

- 因此,预计中国将在预测期内占据市场主导地位。

欧洲和亚洲潜水泵产业概况

欧洲和亚洲的潜水泵市场减少了一半。市场的主要企业包括福斯公司、苏尔寿有限公司、斯伦贝谢有限公司、荏原株式会社、威尔集团有限公司、格兰富集团、Borets 国际有限公司、KSB 集团和鹤井製造公司。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第 2 章执行摘要

第三章调查方法

第四章 市场概况

- 介绍

- 2029 年市场规模与需求预测(十亿美元)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 住宅和工业领域污水处理的严格规定

- 增加石油天然气和采矿业的回收应用

- 限制因素

- 运作维护成本高

- 石油和天然气价格波动

- 驱动程式

- 供应链分析

- 波特分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 投资分析

第五章 市场区隔

- 类型

- 井式潜水泵

- 开井式潜水泵

- 无堵塞型液下泵

- 驱动器类型

- 电的

- 油压

- 其他的

- 举升高度

- 少于50米

- 50~100m

- 超过100米

- 最终用户

- 用水和污水

- 石油和天然气

- 采矿和建设业

- 其他的

- 地区

- 欧洲

- 法国

- 德国

- 英国

- 俄罗斯

- 土耳其

- 西班牙

- 北欧国家

- 欧洲其他地区

- 亚洲

- 中国

- 印度

- 日本

- 亚洲其他地区

- 欧洲

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- 市场参与企业

- Flowserve Corporation

- Sulzer Limited

- Ebara Corporation

- KSB Group

- Schlumberger Limited

- Borets International Ltd

- Tsurumi Manufacturing Co. Ltd

- 市场参与企业

- 其他知名公司名单

- 市场排名分析

第七章 市场机会与未来趋势

- 加强改善老化的污水和水处理基础设施

简介目录

Product Code: 50002220

The Europe Asia Submerged Pump Market size is estimated at USD 6.17 billion in 2025, and is expected to reach USD 8.22 billion by 2030, at a CAGR of 5.9% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as the strict regulations for wastewater treatment across the residential and industrial sectors and the rising use of pumps for recovery in the oil and gas and mining industries are expected to drive the Europe-Asia submerged pump market during the forecast period.

- On the other hand, factors such as high operation and maintenance costs and volatility in oil and gas prices will restrain the growth of the Europe-Asia submerged pump market.

- Nevertheless, initiatives to upgrade aging wastewater and water treatment facilities infrastructure in developed regions like Europe and Asia toward the end of their operational life cycle are likely to create a growth opportunity for the submersible pumps market during the forecast period.

- Countries such as China, India, Japan, and South Korea are expected to dominate the market during the forecast period due to rapid industrialization and increasing urbanization in these rising economies.

Europe Asia Submerged Pump Market Trends

Water and Wastewater is Expected to be a Significant Segment

- It is essential to ensure that wastewater treatment plants operate at maximum efficiency as they perform an essential function for the communities they serve. Reliable submerged pumps can help avoid unexpected downtime and can provide added protection for environmental discharge. They are the most practical solutions for small towns and large cities across Europe and Asia, generating strong demand for the submerged pump market.

- Submersible pumps are used to drain fluids in wastewater treatment plants. They are placed directly in the water or the slurry to provide pumping power for removing fluids from a particular area.

- Submersible pumps offer key advantages that include lower costs than dry-well stations and the ability to operate without frequent pump maintenance in Wastewater treatment plants. In addition, submersible pump stations usually do not require large aboveground structures and easily blend in with the surrounding environment in residential areas.

- In June 2023, the European Union announced its decision to sue Italy for its failure to maintain the urban wastewater treatment standards properly and cope with them. As per the European Union, Italy was unable to treat its wastewater fully from urban, residential, and commercial areas, leading to the discharge of untreated wastewater into water bodies. To manage this, numerous major pump manufacturing companies in Italy undertook expansive decisions that are in progress in the country.

- For instance, in August 2023, SKF Lubrication Systems Germany GmbH (SKF), a subsidiary of SKF Group, signed an agreement with EBARA Pumps Europe SpA (EPE), a group company of Ebara Corporation (EBARA). Both are major manufacturers of submersible pumps used in wastewater treatment facilities, where Ebara will take over the latter's businesses in Europe. They play a crucial role in wastewater treatment facilities worldwide, thus helping municipalities.

- In February 2023, Landia Pumps from Denmark provided 17 pumps for a new water and wastewater treatment plant in Northeast China for the new facility in Shandong province, which included submersible pumps for handling heavily contaminated liquids, as well as liquids with a high dry matter content.

- In 2023, wastewater utilities in the United Kingdom treated 16.5 million liters of wastewater, showing the importance of submerged pumps in the market in Europe and Asia.

- In the coming years, with the increasing number of wastewater treatment plants, the demand for submerged pumps is expected to increase in Europe.

China is Expected to Dominate the Market

- China is witnessing an increase in industrial activities, thereby increasing the demand for crude oil, natural gas, and chemicals, among others. China has been an essential growth driver for the manufacturing sector worldwide. The country is the leader in the mining and construction industries and is one of the top oil and gas players.

- China is in a growing phase, and the high population growth rate has led to an increased requirement for water supply and wastewater treatment to supply water apart from the demand from the oil and gas industry.

- Submerged pumps have been actively used in underground water extraction in China, thus translating into an increase in demand for submersible water pumps.

- China targets to boost domestic production of unconventional sources like shale gas. It is also estimated that China's shale oil production may reach around 280 billion cubic meters (bcm) by 2035. In January 2024, CNOOC announced total capital expenditure in the range of USD 17.6 billion to USD 19 billion, with targeted net production of 700 million to 720 million barrels of oil equivalent (Mboe) in 2024.

- According to the Energy Institute Statistical Review of World Energy 2024 data, oil production was constantly high in China, increasing by 2.1% in 2023 compared to 2022.

- Thus, China is expected to dominate the market during the forecast period.

Europe Asia Submerged Pump Industry Overview

The submerged pump market in Europe and Asia is semi-fragmented. Some of the major players in the market include Flowserve Corporation, Sulzer Limited, Schlumberger Limited, Ebara Corporation, Weir Group PLC, Grundfos Group, Borets International Ltd, KSB Group, and Tsurumi Manufacturing Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Strict Regulations for Wastewater Treatment Across Residential and Industrial Sector

- 4.5.1.2 Rising Use for Recovery in the Oil and Gas and Mining Industries

- 4.5.2 Restraints

- 4.5.2.1 High Operation and Maintenance Costs

- 4.5.2.2 Volatility in Oil and Gas Prices

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Borewell Submerged Pump

- 5.1.2 Open-well Submerged Pump

- 5.1.3 Non-clog Submerged Pump

- 5.2 Drive Type

- 5.2.1 Electric

- 5.2.2 Hydraulic

- 5.2.3 Other Drive Types

- 5.3 Head

- 5.3.1 Below 50 m

- 5.3.2 Between 50 m To 100 m

- 5.3.3 Above 100 m

- 5.4 End User

- 5.4.1 Water and Wastewater

- 5.4.2 Oil and Gas Industry

- 5.4.3 Mining and Construction Industry

- 5.4.4 Other End Users

- 5.5 Geography

- 5.5.1 Europe

- 5.5.1.1 France

- 5.5.1.2 Germany

- 5.5.1.3 United Kingdom

- 5.5.1.4 Russia

- 5.5.1.5 Turkey

- 5.5.1.6 Spain

- 5.5.1.7 Nordic Countries

- 5.5.1.8 Rest of Europe

- 5.5.2 Asia

- 5.5.2.1 China

- 5.5.2.2 India

- 5.5.2.3 Japan

- 5.5.2.4 Rest of Asia

- 5.5.1 Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Market Players

- 6.3.1.1 Flowserve Corporation

- 6.3.1.2 Sulzer Limited

- 6.3.1.3 Ebara Corporation

- 6.3.1.4 KSB Group

- 6.3.1.5 Schlumberger Limited

- 6.3.1.6 Borets International Ltd

- 6.3.1.7 Tsurumi Manufacturing Co. Ltd

- 6.3.1 Market Players

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Initiatives to Upgrade Aging Wastewater and Water Treatment Facilities Infrastructure

02-2729-4219

+886-2-2729-4219