|

市场调查报告书

商品编码

1645116

欧洲、中东和非洲隔膜泵:市场占有率分析、行业趋势、统计数据和成长预测(2025-2030 年)Europe, Middle-East And Africa Diaphragm Pump - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

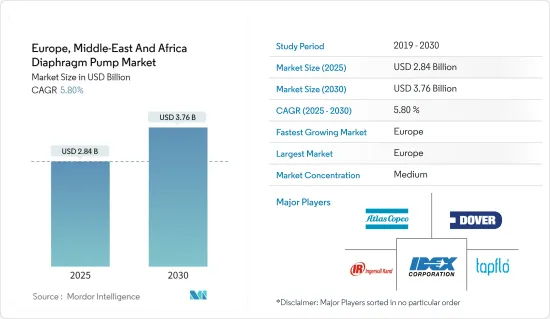

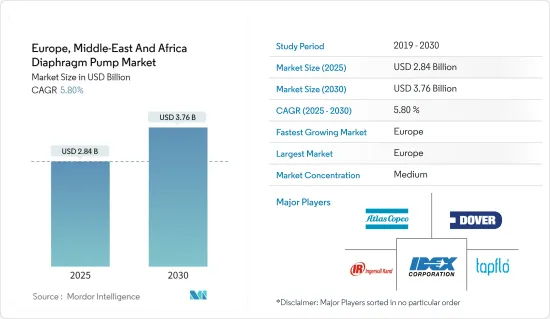

欧洲、中东和非洲的隔膜泵市场规模预计在 2025 年为 28.4 亿美元,预计到 2030 年将达到 37.6 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.8%。

关键亮点

- 从中期来看,石油和天然气需求的成长、油价的回升、越来越多陆上和海上油田达到勘探成熟度以及生产活动的活性化预计将推动更深的海上区域转移。因此,预计预测期内海上超深水计划的增加将推动隔膜泵市场的发展。

- 预计在预测期内,太阳能泵等传统泵替代方案的技术进步将阻碍隔膜泵市场的成长。

- 欧洲和中东的泵浦製造采用了 3D 列印技术和电脑建模相结合的方式,从而推动了泵浦设计、维修和更换领域的前沿发展。这很可能在未来几年为全球隔膜泵市场创造商机。

- 由于用水和污水等领域的需求不断增加,预计德国在预测期内将显着增长。

欧洲、中东和非洲隔膜泵市场趋势

用水和污水领域可能主导市场

- 大多数用水的人类活动和工业活动都会产生污水。由于对水的需求不断增加,全球污水产量及其总污染负荷不断增加。因此,欧洲、中东和非洲各国政府正在针对市政和工业部门的污水处理推出严格的政策和措施。

- 非洲近三分之二的人口生活在每年至少一个月缺水的地区。约有 50% 面临这种程度的水资源短缺的人口生活在衣索比亚、赖比瑞亚、利比亚、索马利亚和南苏丹。为了提高用水效率和满足用水需求,预计人类和工业部门用水产生的污水处理需求将会增加。

- 随着城市人口的成长和用水量的增加,需要建立新的供水系统来满足城市人口的需求。例如,2024年4月,欧洲投资银行核准投资约1,000万欧元,用于解决非洲和亚洲的饮用水供应问题。

- 非洲拥有超过14亿人口,预计2030年将达17亿人。这比 1980 年的 4.8 亿有了显着成长。非洲大陆近60%的人口居住在农村地区,那里的卫生服务和安全饮用水取得能力落后于都市区。截至 2023 年,非洲有近 6.52 亿人居住在都市区。因此,非洲在污水处理产业具有巨大的潜力。各家公司都在投资该行业,预计这将在预测期内推动对泵浦的需求。

- 2023 年 3 月,欧盟委员会核准凝聚基金投资超过 1.59 亿欧元,用于开发罗马尼亚雅西县的用水和污水基础设施。这个新的大型计划预计将改善雅西县的用水和污水状况。该计划计划铺设256公里的主管道和312公里的配水管网。此外,还将兴建23座水处理厂、43个储水容器及50座泵送装置(其中43座为网路泵送装置,7座位于处理厂内)。

- 在这种情况下,用水和污水部门预计将主导 EMEA 地区的隔膜泵市场。

德国可望主导市场

- 隔膜泵采用化学和物理分离技术来帮助去除有害废液。在德国,隔膜泵通常用于处理各种黏性流体,包括固体颗粒、危险化合物和液体。散装输送、精製、循环钻井泥浆输送、废弃物处理、加油、装卸、井口注入等都是使用此类泵浦的应用范例。

- 食品和饮料产业、化学製造业和发电厂是德国成熟的产业。这就是隔膜泵应用于各个工业阶段的原因。保护环境和人类健康在德国至关重要。由于其重要性,正在建造适当的水和污水处理系统。德国几乎所有的污水都经过处理,符合欧盟最高标准。

- 在德国,3913个都市区的家庭和部分工业每天排放1.113亿磅污水,相当于约2.23亿个浴缸或2225万立方公尺。但为了避免环境污染,都市废水必须经过处理后才能排放。在德国,都市废水在全国3,796个工厂处理后才排放。

- 因此,各公司都在投资该行业,以满足国家日益增长的水处理需求。例如,2024 年 1 月,Membion 获得了约 500 万欧元的投资。这项多项专利技术使市政和工业污水处理厂营运商能够满足日益增长的水质要求,并显着降低营运成本。预计这些投资将在预测期内推动对隔膜泵的需求。

- 2023 年 10 月,该公司宣布计划在其位于德国施万多夫原址工厂投资 300 万欧元建造一座新的水处理厂。我们与地方政府密切合作,并在当地专家的支持下,在施万多夫进行计划。未来两年内,该公司计划向其位于上普法尔茨州施万多夫和斯图尔的现有工厂投资约 500 万至 600 万欧元。

- 因此,在工业和住宅领域的污水处理方面,德国有望透过对处理流程的投资成为特定地区的参与企业。

欧洲、中东和非洲隔膜泵产业概况

欧洲、中东和非洲的隔膜泵市场减少了一半。市场的主要企业包括 Dover Corporation、Ingersoll-Rand PLC、Idex Corporation、Atlas Copco AB 和 Tapflo Group。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第二章调查方法

第三章执行摘要

第四章 市场概况

- 介绍

- 2029 年市场规模与需求预测(十亿美元)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 石油和天然气需求不断成长

- 用水和污水产业的成长

- 限制因素

- 传统泵浦替代方案的技术进步

- 驱动程式

- 供应链分析

- 波特分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 投资分析

第五章 市场区隔

- 机制

- 气动

- 电动式的

- 排气压力

- 80 bar 或更低

- 80 至 200 bar

- 超过 200 巴

- 最终用户

- 用水和污水

- 石油和天然气

- 化工和石化

- 药品

- 饮食

- 其他的

- 地区

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 欧洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 其他中东和非洲地区

- 欧洲

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- Dover Corporation

- Ingersoll-Rand PLC

- Flowserve Corporation

- Idex Corporation

- Ingersoll-Rand PLC

- Tapflo Group

- Atlas Copco AB

- 市场排名/份额分析

- 其他知名公司名单

第七章 市场机会与未来趋势

- 加大深海和超深海探勘

简介目录

Product Code: 50002233

The Europe, Middle-East And Africa Diaphragm Pump Market size is estimated at USD 2.84 billion in 2025, and is expected to reach USD 3.76 billion by 2030, at a CAGR of 5.8% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, the growing demand for oil and gas, recovery in oil price, increasing number of onshore and offshore fields reaching their maturity with exploration, and increased production activities are expected to make a shift toward deeper offshore regions. This is expected to result in a growing number of offshore ultra-deepwater projects, driving the diaphragm pump market during the forecast period.

- Technological advancements in alternative options of conventional pumps, such as solar pumps, are expected to hinder the growth of the diaphragm pump market during the forecast period.

- The manufacturing of pumps in Europe and the Middle East utilizes a combination of 3D printing technology with computer modeling, leading to cutting-edge development in pump design, repair, and replacement. This is likely to create an opportunity for the diaphragm pump market globally in the coming years.

- Germany is expected to have a significant growth during the forecast period due it its increasing demand in sector like water and wastewater.

Europe, Middle-East And Africa Diaphragm Pump Market Trends

The Water and Wastewater Sector is Likely to Dominate the Market

- Wastewater is produced by most human and industrial activities that use water. As water demand grows, the quantity of wastewater produced and its overall pollution load continuously increase worldwide. As a result, governments across Europe and the Middle East and Africa have introduced strict policies and regulations regarding wastewater treatment for both the municipal and industrial sectors.

- Around two-thirds of Africa's population lives in areas that experience water scarcity for at least one month a year. Around 50% of the people facing this level of water scarcity live in Ethiopia, Liberia, Libya, Somalia, and South Sudan. The demand for wastewater treatment, produced as a result of human and industrial sector water usage, is expected to grow to improve the efficiency of water usage and meet the water demands.

- As the urban population grows and consumes more water, new water distribution systems are built to fulfill the requirements of the urban population. For instance, in April 2024, the European Investment Bank approved an investment of around EUR 10 million to solve the drinking water supply problem in Africa and Asia.

- Africa is home to over 1.4 billion people, and the population is expected to reach 1.7 billion by 2030. This is a huge increase from 480 million in 1980. Almost 60% of the continent's population lives in rural areas, where sanitation services and access to safe drinking water lag behind those in urban areas. As of 2023, nearly 652 million African people stay in urban areas. Thus, Africa has significant potential in the wastewater treatment industry. Various companies are investing in the industry, which is expected to boost the demand for pumps in the forecast period.

- In March 2023, the European Commission approved a Cohesion Fund investment of more than EUR 159 million to develop a water and wastewater infrastructure in Iasi County, Romania. This new major project is anticipated to improve access to water and sewerage in Iasi County. The project is expected to install 256 kilometers of main pipes and 312 kilometers of water distribution network. It will also construct 23 water treatment facilities, 43 water storage containers, and 50 pumping units, 43 of which will be network-based and seven within treatment facilities.

- Owing to such a scenario, the water and wastewater sector is expected to dominate the Europe and Middle and Africa diaphragm pump market.

Germany is Expected to Dominate the Market

- The diaphragm pump employs chemical and physical separation techniques and aids in the removal of harmful effluents. Diaphragm pumps generally handle various viscous fluids with solid particles, hazardous compounds, or liquids in Germany. Bulk transfer, refining, circulation drilling mud transfer, waste processing, refueling, loading and unloading, and wellhead injection are all examples of applications where these types of pumps are used.

- The food and beverage industry, chemical manufacturing, and power plants are well-established sectors in Germany. It boosts the use of diaphragm pumps in various industrial phases. Environmental and human health protection is vitally important in Germany. Its importance resulted in adequate water and wastewater treatment systems. Practically, all wastewater in Germany is treated to satisfy the highest European Union standards.

- In Germany, households and certain industries in 3913 urban areas generate 111.3 million p.e. of wastewater every day, which is an amount equivalent to around 223 million bathtubs or 22.25 million m3. However, urban wastewater must be treated before discharge to avoid environmental pollution. In Germany, urban wastewater is treated in 3,796 plants across the country before it is discharged.

- Thus, various companies are investing in the industry to cater to the rising demand for water treatment in the country. For instance, in January 2024, Membion received an investment of around EUR 5 million. With the multi-patented technology, municipal and industrial wastewater treatment plant operators can meet the growing demands on water quality and significantly reduce operating costs. These types of investments are expected to boost the demand for diaphragm pumps during the forecast period.

- In October 2023, Hydro announced that it aims to invest EUR 3 million in a new water treatment plant at the Schwandorf legacy site in Germany. Hydro is carrying out the project at Schwandorf in close collaboration with local authorities and with support from local expertise. Over the next two years, Hydro plans to invest approximately EUR 5-6 million at the legacy sites in Schwandorf and Stulln in the Region of Oberpfalz.

- Hence, to treat wastewater in the industrial and residential sector, Germany's investment in the treatment process is expected to make the country a dominant player in the regions selected.

Europe, Middle-East And Africa Diaphragm Pump Industry Overview

The Europe and Middle East and Africa diaphragm pump market is semi-fragmented. Some of the major players in the market include Dover Corporation, Ingersoll-Rand PLC, Idex Corporation, Atlas Copco AB., and Tapflo Group.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Demand for Oil and Gas

- 4.5.1.2 Growing Water and Wastewater Industry

- 4.5.2 Restraints

- 4.5.2.1 Technological Advancements in the Alternative Options of Conventional Pumps

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Mechanism

- 5.1.1 Air Operated

- 5.1.2 Electrically Operated

- 5.2 Discharge Pressure

- 5.2.1 Up to 80 Bar

- 5.2.2 Between 80 to 200 Bar

- 5.2.3 Above 200 Bar

- 5.3 End-User

- 5.3.1 Water and Wastewater

- 5.3.2 Oil and Gas

- 5.3.3 Chemicals and Petrochemicals

- 5.3.4 Pharmaceutical

- 5.3.5 Food and Beverage

- 5.3.6 Other End-Users

- 5.4 Geography

- 5.4.1 Europe

- 5.4.1.1 United Kingdom

- 5.4.1.2 Germany

- 5.4.1.3 France

- 5.4.1.4 Italy

- 5.4.1.5 Spain

- 5.4.1.6 Rest of Europe

- 5.4.2 Middle East and Africa

- 5.4.2.1 Saudi Arabia

- 5.4.2.2 United Arab Emirates

- 5.4.2.3 South Africa

- 5.4.2.4 Rest of Middle East and Africa

- 5.4.1 Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Dover Corporation

- 6.3.2 Ingersoll-Rand PLC

- 6.3.3 Flowserve Corporation

- 6.3.4 Idex Corporation

- 6.3.5 Ingersoll-Rand PLC

- 6.3.6 Tapflo Group

- 6.3.7 Atlas Copco AB

- 6.4 Market Ranking/Share Analysis

- 6.5 List of Other Prominent Companies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Deep-water and Ultra Deep Water Explorations

02-2729-4219

+886-2-2729-4219