|

市场调查报告书

商品编码

1645118

油轮服务-市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Fuel Tanker Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

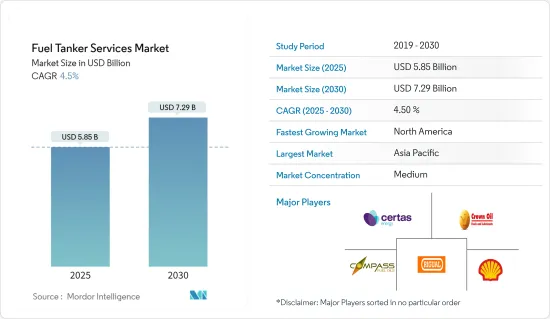

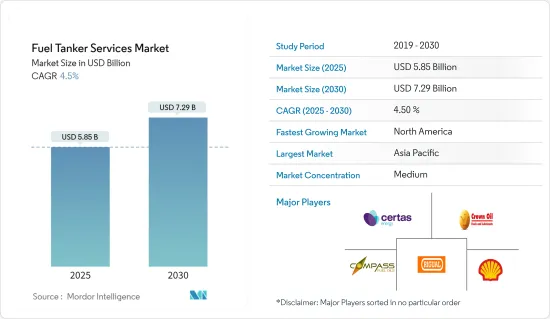

预计 2025 年燃料油罐车服务市场规模为 58.5 亿美元,到 2030 年将达到 72.9 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.5%。

关键亮点

- 从中期来看,电子商务产业兴起带来的高需求预计将推动商用车销售,从而带动物流和建筑业的成长。美国、中国、印度和德国等多个国家近期增加了零售燃料网点的部署,这是推动市场发展的主要动力。

- 电动车的日益普及和需求以及铝等基底金属价格的上涨预计将阻碍市场成长。

- 为了满足日益增长的需求和挑剔的客户要求,全球製造商正在用塑胶油箱取代金属燃料箱,以减轻车辆重量。塑胶燃料箱在汽车燃料市场上越来越受欢迎,因为它们比金属燃料箱具有许多优势。

- 预计预测期内北美将主导燃料箱服务市场。

油罐车服务市场趋势

液化天然气市场可望占据市场主导地位

- LNG(液化天然气)拖车因其多功能性、效率和环境效益而被广泛应用于各个领域。这些拖车用于将液化天然气从生产设施运输到配送点,然后在各个行业中用于各种用途。 LNG 拖车的普及受到多种因素的推动,包括作为传统燃料的清洁替代品,对天然气的需求不断增加、LNG 技术的进步以及 LNG 基础设施的扩展。

- 在运输领域,LNG 拖车在将天然气用作卡车、巴士和轮船等大型车辆的燃料方面发挥关键作用。使用液化天然气作为运输燃料具有显着的环境效益,例如与柴油相比,可减少温室气体和空气污染物的排放。 LNG拖车方便将LNG运送至加油站或直接运送给车队营运商,以支援天然气运输的成长。

- 包括美国、中国、印度、英国和德国在内的许多国家都在大力投资液化天然气(LNG)基础设施,包括建造和部署LNG储槽。随着液化天然气储槽的部署,液化天然气拖车将越来越多地用于将液化天然气从这些设施运送到最终用户和出口终端。使用 LNG 拖车可以灵活地将 LNG 运输至各种地点,包括工业设施、发电厂和海上终端。

- 2023 年 11 月,国家电网及其承包商宣布计划在其位于英国格雷恩岛的设施建造一个 190,000 立方米的液化天然气储罐,作为增加终端容量的扩建计划的一部分。此举不仅将增加该终端的储存容量,还将支持该地区日益增长的天然气需求。

- 在运输领域,LNG 拖车发挥关键作用,使卡车、巴士和轮船等大型车辆能够使用天然气作为燃料。使用液化天然气作为运输燃料具有显着的环境效益,例如与柴油相比,可减少温室气体和空气污染物的排放。 LNG拖车方便将LNG运送至加气站或直接运送给车队营运商,以支援天然气运输的成长。

- 由于上述因素,预计预测期内液化天然气产业将占据燃料油轮服务市场的主导地位。

北美可望主导市场

- 北美拥有成熟的汽车燃料分销网络,全国对汽油和柴油的需求量很大。将燃料运送到零售店是供应链的重要组成部分,而使用油罐车的道路运输在满足这一需求方面发挥关键作用。

- 美国政府目前正在考虑一项允许油罐车负载容量的提案。这一潜在的政策变化引起了交通和能源领域的极大兴趣和争论。一旦实施,这可能会对油罐车需求和相关的物流业务产生明显影响。

- 作为推动永续、环保交通运输的努力的一部分,北美越来越注重在全国范围内建立压缩天然气(CNG)站。 CNG从生产设施到加油站的运输是CNG基础设施的一个重要方面。

- 2023 年 9 月,美国运输部部 (DOT) 宣布增加商业成品油油轮的使用权,作为在紧急情况下保障军方石油运输安全的一部分。有几十艘悬挂美国国旗的商业油轮,其中大多数从事国内贸易。美国国防部表示,如果这些油轮被用于军事目的,可能会扰乱美国经济,这是一个重大问题。

- 由于上述因素,预计北美将在预测期内主导燃料油轮服务市场。

燃油运输服务产业概况

油罐车服务市场规模缩减了一半。市场的一些主要企业包括 Certas Energy UK Limited、Crown Oil Ltd、Compass Fuel Oils Ltd、Rigual SA 和 Shell International Trading and Shipping Company Limited。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第二章调查方法

第三章执行摘要

第四章 市场概况

- 介绍

- 2029 年市场规模与需求预测(十亿美元)

- 2029 年,估计/预测油轮(船隻)数量

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 商用车销售需求增加

- 扩大各国的零售燃油经销商

- 限制因素

- 电动车的普及和需求不断增加

- 驱动程式

- 供应链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁产品/服务

- 竞争对手之间的竞争

- 投资分析

第五章 市场区隔

- 材料类型

- 碳钢

- 防锈的

- 铝合金

- 容量

- 少于 20,000 公升

- 30,000 至 40,000 公升

- 超过 40,000 公升

- 燃料类型

- 汽油

- LNG

- 其他燃料

- 营运公司

- 零售汽油公司

- 炼油厂

- 地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 西班牙

- 北欧的

- 俄罗斯

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 澳洲

- 马来西亚

- 印尼

- 泰国

- 越南

- 其他亚太地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 奈及利亚

- 其他中东和非洲地区

- 埃及

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 北美洲

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- Certas Energy UK Limited

- Crown Oil Ltd

- Compass Fuel Oils Ltd

- Rigual SA

- Shell International Trading and Shipping Company Limited

- 市场排名/份额分析

- 其他知名公司名单

第七章 市场机会与未来趋势

- 世界各地的汽车製造商正在用塑胶油箱代替金属燃料箱,以减轻车辆重量。

简介目录

Product Code: 50002235

The Fuel Tanker Services Market size is estimated at USD 5.85 billion in 2025, and is expected to reach USD 7.29 billion by 2030, at a CAGR of 4.5% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, the increasing sales of commercial vehicles due to their high demand, owing to the rise in the e-commerce sector, is expected to lead to the growth of the logistics industry and the construction sector. The deployment of retail fuel outlets across various countries such as the United States, China, India, and Germany has been increasing in recent years, which will be a major driver for the market.

- The growing penetration of electric vehicles, their rising demand, and the growing prices of base metals, like aluminum, are expected to hinder the market's growth.

- Globally, manufacturers are substituting metal fuel tanks with plastic fuel to reduce vehicle weight in order to fulfill the growing demand and satisfy the discerning customer requirements. Plastic fuel has many advantages over metal fuel tanks, leading to their growing popularity in the automotive fuel market.

- North America is expected to dominate the fuel tanker services market during the forecast period.

Fuel Tanker Services Market Trends

The LNG Segment is Expected to Dominate the Market

- LNG (liquefied natural gas) trailers are widely used in various sectors due to their versatility, efficiency, and environmental benefits. These trailers are utilized to transport LNG from production facilities to distribution points, where the LNG is then used for various applications across different industries. The widespread use of LNG trailers can be attributed to factors, including the increasing demand for natural gas as a cleaner alternative to traditional fuels, advancements in LNG technology, and the expansion of LNG infrastructure.

- In the transportation sector, LNG trailers play a crucial role in enabling the use of natural gas as fuel for heavy-duty vehicles such as trucks, buses, and marine vessels. The adoption of LNG as a transportation fuel offers significant environmental advantages, including reduced emissions of greenhouse gases and air pollutants compared to diesel fuel. LNG trailers facilitate the delivery of LNG to refueling stations or directly to fleet operators, supporting the growth of natural gas-powered transportation.

- Many countries, such as the United States, China, India, the United Kingdom, and Germany, have been making significant efforts to invest in liquefied natural gas (LNG) infrastructure, including the construction and deployment of LNG tanks. As the deployment of LNG tanks increases, the transportation of LNG from these facilities to end users or export terminals often involves the use of LNG trailers. The use of LNG trailers offers flexibility in transporting LNG to various locations, including industrial facilities, power plants, and marine terminals.

- In November 2023, National Grid and its contractors announced their plans to proceed with the construction of a 190,000 cbm LNG tank at the United Kingdom's Isle of Grain facility as part of an expansion project to boost the terminal's capacity. This move will not only increase the storage capacity of the terminal but also support the growing demand for natural gas in the region.

- In the transportation sector, LNG trailers play a crucial role in enabling the use of natural gas as a fuel for heavy-duty vehicles such as trucks, buses, and marine vessels. The adoption of LNG as a transportation fuel offers significant environmental advantages, including reduced emissions of greenhouse gases and air pollutants compared to diesel fuel. LNG trailers facilitate the delivery of LNG to refueling stations or directly to fleet operators, supporting the growth of natural gas-powered transportation.

- Owing to the above-mentioned factors, the liquified natural gas segment is expected to dominate the fuel tankers services market during the forecast period.

North America is Expected to Dominate the Market

- North America has a well-established and extensive network for the distribution of automotive fuels, with a high demand for petrol and diesel across the country. The transportation of fuel to retail outlets is a critical part of the supply chain, and road transportation using tankers plays a significant role in meeting this demand.

- The United States government is currently considering a proposal to allow fuel tankers to increase their load capacity. This potential policy change has generated significant interest and discussion within the transportation and energy sectors. If implemented, it could have a notable impact on the demand for fuel tankers and related logistical operations.

- North America has been increasingly focused on deploying compressed natural gas (CNG) stations across the country as part of its efforts to promote sustainable and environmentally friendly transportation options. The transportation of CNG from production facilities to refueling stations is a critical aspect of the CNG infrastructure.

- In September 2023, the United States Department of Transportation (DOT) announced boosting access to commercial product tankers as part of safeguarding oil shipping for its armed forces in times of crisis. The United States flagged commercial fleet comprises a few dozen tankers, with the majority being involved in domestic trade. According to the Department of Defense, possible disruptions to the US economy if those vessels were sought for use by the military is a major concern.

- Owing to the above-mentioned factors, North America is expected to dominate the fuel tanker services market during the forecast period.

Fuel Tanker Services Industry Overview

The fuel tanker services market is semi-fragmented. Some of the major companies operating in the market include Certas Energy UK Limited, Crown Oil Ltd, Compass Fuel Oils Ltd, Rigual SA, and Shell International Trading and Shipping Company Limited.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Estimated Fleet Size and Forecast, Number of Tankers, in Units, till 2029

- 4.4 Recent Trends and Developments

- 4.5 Government Policies and Regulations

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.1.1 Increasing Demand for Sales of Commercial Vehicles

- 4.6.1.2 Increasing Deployment of Retail Fuel Outlets Across Various Countries

- 4.6.2 Restraints

- 4.6.2.1 Growing Penetration and Demand for Electric Vehicles

- 4.6.1 Drivers

- 4.7 Supply Chain Analysis

- 4.8 Industry Attractiveness - Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes Products and Services

- 4.8.5 Intensity of Competitive Rivalry

- 4.9 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Material Type

- 5.1.1 Carbon Steel

- 5.1.2 Stainless Steel

- 5.1.3 Aluminum Alloy

- 5.2 Capacity

- 5.2.1 Below 20000 Liters

- 5.2.2 30000 - 40000 Liters

- 5.2.3 Above 40000 Liters

- 5.3 Fuel Type

- 5.3.1 Petrol

- 5.3.2 LNG

- 5.3.3 Other Fuels

- 5.4 Operator

- 5.4.1 Retail Petrol Companies

- 5.4.2 Refineries

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 France

- 5.5.2.3 United Kingdom

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 NORDIC

- 5.5.2.7 Russia

- 5.5.2.8 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Australia

- 5.5.3.4 Malaysia

- 5.5.3.5 Indonesia

- 5.5.3.6 Thailand

- 5.5.3.7 Vietnam

- 5.5.3.8 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 Saudi Arabia

- 5.5.4.2 United Arab Emirates

- 5.5.4.3 South Africa

- 5.5.4.4 Nigeria

- 5.5.4.5 Rest of Middle East and Africa

- 5.5.4.6 Egypt

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Colombia

- 5.5.5.4 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Certas Energy UK Limited

- 6.3.2 Crown Oil Ltd

- 6.3.3 Compass Fuel Oils Ltd

- 6.3.4 Rigual SA

- 6.3.5 Shell International Trading and Shipping Company Limited

- 6.4 Market Ranking/Share Analysis

- 6.5 List of Other Prominent Companies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Manufacturers Across the World are Substituting Metal Fuel Tanks with Plastic Fuel to Reduce the Vehicle Weight

02-2729-4219

+886-2-2729-4219