|

市场调查报告书

商品编码

1645125

大数据即服务 (BDaaS):市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Big Data As A Service - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

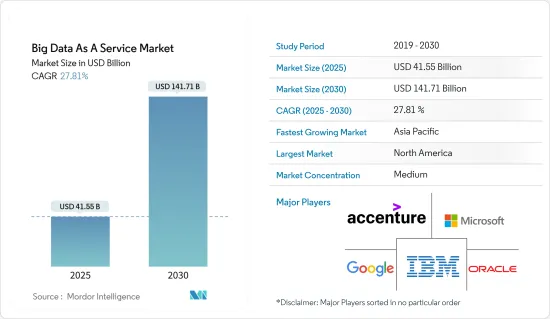

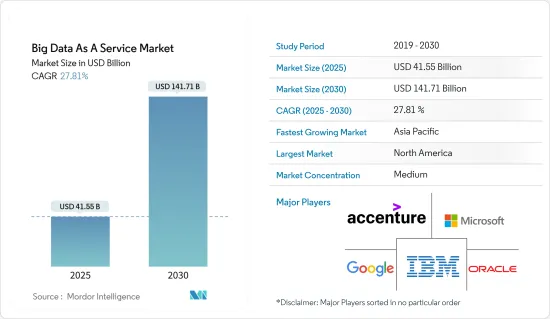

大数据即服务 (BDaaS) 市场规模预计在 2025 年为 415.5 亿美元,预计到 2030 年将达到 1417.1 亿美元,预测期内(2025-2030 年)的复合年增长率为 27.81%。

技术的进步导致了基于服务的解决方案的兴起,从而产生了 SaaS(软体即服务)、PaaS(平台即服务)和 DaaS(数据即服务)。巨量资料供应商将这些服务视为潜在的成长机会,因为它们可以带来许多好处。随着企业越来越多地采用资料主导的行销策略、行动和混合环境以及全球交付网络,云端处理变得无所不在。

主要亮点

- 云端处理不断发展,为各种规模和行业的企业提供了购买、使用和受益于云端投资的新方式。在政府的支持下,开放资料技术正变得越来越普及,阿根廷的布宜诺斯艾利斯、秘鲁的拉利伯塔德和巴西的圣保罗等城市都对提高政府透明度等措施表示欢迎。

- 阿布雷拉坦、美洲开发银行 (IADB) 和拉丁美洲开放资料倡议 (ODI) 等组织正在共同合作,扩大整个拉丁美洲的开放资料努力,帮助减少腐败、增强城市復原力、减少对妇女的暴力行为并改善医疗服务。

- 资料分析在企业中发挥着至关重要的作用,帮助他们组织、储存和简化庞大的资料集,帮助他们即时处理大量资料并提高决策能力。此外,巨量资料和商业分析的一个关键目标是帮助组织更了解目标受众和客户,从而加强本地行销宣传活动。

- 网路普及率的提高和技术的进步正在推动拉丁美洲巨量资料市场的蓬勃发展。透过社群网路所能产生的资料量正在迅速扩大,并且呈指数级增长。然而,由于缺乏对投资回报率的认可以及传统公司面临的营运挑战,市场面临限制。

- 此外,最近爆发的新冠疫情凸显了不确定性对决策流程和市场的不利影响。目前的疫情后復苏为这段过渡时期提供了巨大机会。随着市场参与企业及时收到有关情况的信息,能源市场开始缓和。

BDaaS(大数据即服务)市场趋势

私有云端的普及推动了市场

- 私有云端服务专为满足组织需求而设计,通常透过私有网路或企业广域网路而不是开放网际网路来源存取。这些服务使企业能够建立指定安全性和服务等级协定要求的 IT 架构,实现云端託管和内部部署应用程式之间的无缝整合。

- 透过私有云端,基础设施和服务都透过私有网路进行管理,并且软体和硬体专用于客户的组织。这可以确保资料不会放错或遗失,并允许根据需求灵活地更改资源配置。

- 存取私有云端环境更加安全,因为存取是透过受保护的私有网路线路而不是公共互联网进行的。此外,私有云端提供固定定价模式(而非计量收费) ,使企业能够长期更有效地规划成长与预算。

- 这些优势对于工作量可预测、需要专业客製化、在受监管行业运营且必须遵守管治和安全标准的企业尤其有吸引力。金融和政府等行业更有可能采用私有云端解决方案,因为专用基础架构让您完全控制资料和应用程式。

美国占有最大的市场份额

- 在预测期内,美国将主导区域和全球大数据即服务 (BDaaS) 市场。这主要是因为市场上大多数主要供应商都位于美国,而且离散製造、银行、流程製造、专业服务以及联邦/中央政府等区域产业越来越多地采用巨量资料服务。

- 巨量资料最近在美国逐渐受到关注,但许多行业的许多公司尚未充分理解大数据。然而,采用巨量资料服务来提高内部效率的趋势日益增长。事实上,最近的一项调查显示,43% 的公司将简化内部流程列为数位转型的主要驱动力。

- 跨国公司英特尔就是美国公司中看到巨量资料巨大价值的着名例子。该公司利用巨量资料来加速晶片开发、识别製造缺陷并警告安全威胁。透过采用巨量资料,英特尔能够使用预测分析来提高质量,同时节省约 3000 万美元的品质保证成本。

- 预计製造业的成长速度也将快于整体经济。根据製造商生产力和创新联盟 (MAPI) 的数据,到 2022 年,产量预计将成长约 3.5%。此外,预计在预测期内,当地中小企业对 SaaS 的采用将不断增加,从而扩大研究市场的范围。

大数据即服务 (BDaaS) 产业概览

大数据即服务 (BDaaS) 有可能透过提供差异化和附加价值服务的新机会来颠覆竞争。然而,开放原始码工具的出现极大地扩展了巨量资料分析技术的功能,使得主要企业很难在不降低产品性能的情况下跟上竞争对手的步伐。这样的环境可能会提高成本并降低产业盈利。为了保持竞争力,领先的巨量资料解决方案供应商正在收购新兴企业并投资新技术来支援他们的整体产品。此外,由于技术进步为公司提供了永续的竞争优势,市场正在见证多个联盟和合併。

2023 年 5 月,IBM 宣布收购 Polar Security,并透露计划将 Polar Security 的 DSPM 技术整合到其旗舰 Guardium 系列资料安全产品中。透过整合 Polar Security 的 DSPM 技术,IBM Security Guardium 现在可以为安全团队提供一个资料安全平台,该平台涵盖任何储存(包括 SaaS、本地和公有云基础架构)上的任何类型资料。

2022 年 11 月,Wipro 推出了 Wipro 资料 Intelligence Suite,这是一站式服务,旨在加速云端现代化和资料收益。该套件旨在升级在 Amazon Web Services (AWS) 上运作的资料资产,其中包括资料储存、管道、视觉化等。

2022 年 8 月,混合资料新兴企业Cloudera 宣布发布 Cloudera Data Platform (CDP) One。 CDP One 是一款软体即服务 (SaaS) 产品,可为任何类型的资料提供快速、简单的自助分析和探索性资料科学。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查结果

- 调查前提

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 市场驱动因素与限制因素简介

- 市场驱动因素

- 增加云端采用和资料生成

- 对内部效率的要求越来越高

- 私有云端采用率不断成长

- 市场限制

- 资料安全问题

- 价值链/供应链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔

- 按部署

- 本地

- 云

- 私人的

- 民众

- 杂交种

- 按最终用户

- 资讯科技/通讯

- 能源和电力

- BFSI

- 卫生保健

- 零售

- 製造业

- 其他最终用户

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 拉丁美洲

- 巴西

- 墨西哥

- 其他拉丁美洲国家

- 中东和非洲

- 北美洲

第六章 竞争格局

- 公司简介

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- Hewlett-Packard Company

- SAS Institute Inc.

- Accenture PLC

- Information Builders Inc.

- Google LLC

- Amazon Web Services Inc.

- Alteryx Ltd

- Wipro Ltd

- Opera Solutions LLC

- Guavus Inc.

第七章 市场投资

第八章 市场机会与未来趋势

The Big Data As A Service Market size is estimated at USD 41.55 billion in 2025, and is expected to reach USD 141.71 billion by 2030, at a CAGR of 27.81% during the forecast period (2025-2030).

Advancements in technology have led to the rise of service-based solutions, which have given birth to Software as a Service (SaaS), Platform as a Service (PaaS), and Data as a Service (DaaS). Big data vendors have identified these as potential growth opportunities due to the benefits these services offer. As businesses increasingly adopt data-driven marketing strategies, mobile and hybrid working environments, and worldwide supply networks, cloud computing is becoming more ubiquitous.

Key Highlights

- Cloud computing continues to evolve, providing businesses of all sizes and industries with new ways to purchase, utilize, and benefit from their cloud investments. With the support of governments, open data technology is gaining traction, and cities like Buenos Aires in Argentina, La Libertad in Peru, and Sao Paolo in Brazil are welcoming initiatives such as government transparency.

- Organizations such as Abrelatam, the Inter-American Development Bank (IADB), and Latin America Open Data Initiative (ODI) are working together to scale open data initiatives across Latin America, helping to reduce corruption, increase the resilience of cities, decrease violence against women, and improve the delivery of healthcare services.

- Data Analytics plays a key role in the enterprise, enabling them to deal with large amounts of data within real time and improve their decision making capabilities by allowing them to organise, store, and simplify vast datasets. Additionally, a key goal of big data and business analytics is to assist organizations in strengthening their regional marketing campaigns by assisting them in better understanding their target audiences and customers.

- Increasing Internet penetration has expanded, and increasing technological progress has led to Latin America's booming market for big data. The rapid expansion and exponential increase in the amount of data that can be generated through social networks. However, the market faces restraints through the Relative lack of Awareness of ROI and operational challenges for Legacy Enterprises.

- In addition, the adverse impact of uncertainty on decision making processes and markets has recently become evident from an outbreak of a COVID-19 pandemic. There are significant opportunities in the current post-pandemic recovery in this transition. Energy markets had started to ease up when the market participants received timely information about the situation.

Big Data as a Service Market Trends

Growing Adoption of Private Cloud is Driving the Market

- Private cloud services are specifically designed to cater to an organization's needs and are generally accessed through a private network or corporate WAN rather than an open Internet source. These services allow organizations to establish their IT architectures by specifying their requirements for security and service-level agreements and enable seamless integration between cloud-hosted applications and in-house applications.

- In a private cloud, both infrastructure and services are maintained on a private network, and software and hardware are exclusively dedicated to the client organization. This ensures that data is not misplaced or lost and provides the flexibility to modify resource configuration in response to demand.

- Because a private cloud environment is accessed using private and protected network lines rather than the public internet, cloud access is more secure. Furthermore, private clouds offer a set pricing model, as opposed to a pay-as-you-go method, enabling organizations to plan expansion and budget more efficiently in the long run.

- These advantages are particularly appealing to enterprises that can predict their workloads, require specialized customization, operate in regulated sectors, and must comply with governance and security standards. Since the dedicated infrastructure provides complete control over data and applications, industries such as finance and government are more likely to adopt a private cloud solution.

United States Occupied the Largest Share In the Market

- The United States is poised to dominate the regional and global big data as a service market over the forecast period. This is largely because most major vendors in the market are based in the United States, and the adoption of big data services is widespread in regional sectors such as discrete manufacturing, banking, process manufacturing, professional services, and federal/central government.

- Although big data has recently gained attention in the US, it is still not fully understood by many businesses across different sectors. However, there is a growing trend in adopting big data services to enhance internal efficiency. In fact, 43% of companies in a recent survey identified internal process efficiency as the primary driving force behind their digital transformation.

- One notable example of a US-based company that has found significant value in big data is Intel, a multinational corporation. The company uses big data to speed up chip development, identify manufacturing glitches, and warn about security threats. By adopting big data, Intel has enabled predictive analysis and saved approximately USD 30 million on its quality assurance spend, while still improving quality.

- The manufacturing sector is also expected to grow faster than the general economy. According to the Manufacturers Alliance for Productivity and Innovation (MAPI), production is projected to increase by around 3.5% until 2022. Additionally, the rising adoption of SaaS among local SMEs is anticipated to expand the studied market scope over the forecast period.

Big Data as a Service Industry Overview

Big data services have the potential to disrupt competition by providing new opportunities for differentiation and value-added services and semi-conslidated. However, the availability of open-source tools has led to a significant expansion of capabilities in Big Data analytics technology, making it challenging for companies to keep up with rivals without giving away too much product performance. This environment can escalate costs and erode industry profitability. To stay competitive, major Big Data solution providers are acquiring or investing in startups and new technologies that support their overall product offerings. The market is also witnessing multiple partnerships and mergers as technological advancements bring sustainable competitive advantages to companies.

In May 2023, IBM has announced it has acquired Polar Security, and plans to integrate Polar Security's DSPM technology within its Guardium family of leading data security products. With the integration of Polar Security's DSPM technology, IBM Security Guardium will provide security teams with a data security platform that covers all types of data across all storage locations, SaaS, on premises and in public cloud infrastructure.

In November 2022, Wipro Ltd. launched the Wipro Data Intelligence Suite, a one-stop shop for accelerating cloud modernization and data monetization. The suite is designed to upgrade data estates, including data stores, pipelines, and visualizations, that run on Amazon Web Services (AWS).

In August 2022, Cloudera, a hybrid data startup, announced the release of Cloudera Data Platform (CDP) One. CDP One is a software-as-a-service (SaaS) product that provides quick and simple self-service analytics and exploratory data science on any type of data.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Increasing Cloud Adoption And Rise In The Data Volume Generated

- 4.3.2 Increasing Demand For Improving Organization's Internal Efficiency

- 4.3.3 Growing Adoption of Private Cloud

- 4.4 Market Restraints

- 4.4.1 Data Security Concerns

- 4.5 Value Chain / Supply Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Deployment

- 5.1.1 On-premise

- 5.1.2 Cloud

- 5.1.2.1 Private

- 5.1.2.2 Public

- 5.1.2.3 Hybrid

- 5.2 By End User

- 5.2.1 IT and Telecommunication

- 5.2.2 Energy and Power

- 5.2.3 BFSI

- 5.2.4 Healthcare

- 5.2.5 Retail

- 5.2.6 Manufacturing

- 5.2.7 Other End Users

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia Pacific

- 5.3.4 Latin America

- 5.3.4.1 Brazil

- 5.3.4.2 Mexico

- 5.3.4.3 Rest of Latin America

- 5.3.5 Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 IBM Corporation

- 6.1.2 Microsoft Corporation

- 6.1.3 Oracle Corporation

- 6.1.4 SAP SE

- 6.1.5 Hewlett-Packard Company

- 6.1.6 SAS Institute Inc.

- 6.1.7 Accenture PLC

- 6.1.8 Information Builders Inc.

- 6.1.9 Google LLC

- 6.1.10 Amazon Web Services Inc.

- 6.1.11 Alteryx Ltd

- 6.1.12 Wipro Ltd

- 6.1.13 Opera Solutions LLC

- 6.1.14 Guavus Inc.