|

市场调查报告书

商品编码

1645151

印度车队管理软体市场:份额分析、产业趋势与成长预测(2025-2030 年)India Fleet Management Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

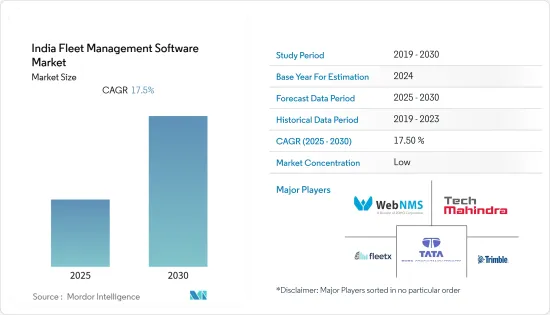

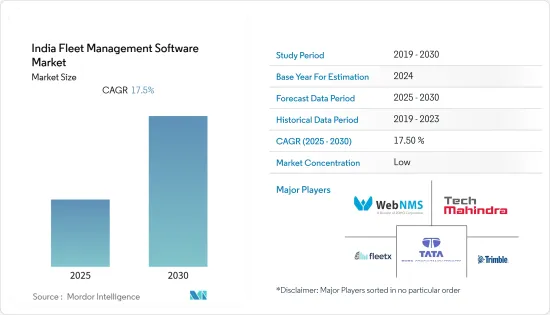

预测期内,印度车队管理软体市场预计复合年增长率为 17.5%

关键亮点

- 车队管理软体包括一系列功能,包括车队财务、车队维护、追踪和诊断、驾驶员管理、速度管理、燃料管理、健康和安全管理等。印度此类解决方案的市场仍处于起步阶段,供应商们看到了充足的商机。

- 根据印度政府的报告,印度的国家公路和州公路仅占全国公路总长度的5%多一点,但却造成了61%以上的道路交通事故死亡人数。这些道路每天承载着数百万辆车辆,管理价值超过10亿美元的货物运输,并为采矿、建筑、运输和公共服务等行业提供服务。预计预测期内道路事故数量的增加将推动成长。

- 印度是世界上经济成长最快的国家。在过去五年中的四年中,由于对商品和服务的需求增加,经济规模非常大。境内和跨境的货物运输为数百万印度人创造了经济机会。

- 物流业目前占印度国内生产总值(GDP)的5%,僱用人员2.2亿人。印度每年处理 46 亿吨货物,每年总成本为 95 万印度卢比(11,421 美元)。这些产品代表了全国各地各种各样的行业和产品。 22%的商品为农产品,39%为矿产品,39%为製造业相关商品。这些货物的运输主要由卡车和其他车队进行。其余运输涉及铁路、内陆水道、沿海、管道和航空。

- 此外,2022 年 8 月,公路运输和公路部 (MoRTH) 将强制要求所有用于运输危险或危险产品的货运车队配备位置追踪设备,适用于 2022 年 9 月 1 日之后建造的车队。

- 由于人们认识的提高和提供的福利不断增加,该地区对车队管理的资金正在增加。例如,2023 年 5 月,第三方物流新兴企业Zyngo EV 在 Delta Corp Holdings主导的A 轮融资前筹集了 500 万美元。现有投资者 LC Nueva Investment Partners LLP 也参与了此轮融资。该笔资金筹措将用于扩大机队、拓展新区域和技术升级。

- 纵观市场中的其他相关人员,即车队租赁公司,趋势表明可再生能源的成长可能会进一步推动车队管理采用市场。

印度车队管理软体市场趋势

物联网应用预计将大幅成长

- 市场上的供应商之所以选择云端服务,是因为与本地部署相比,云端服务具有上市时间更快、效率更高、功能更多、成本更低等优势。物联网对于驾驶员、物流人员和车队管理人员近乎即时地做出明智的决策至关重要。在边缘处理资料(也称为在资料产生时收集和分析资料)使这成为可能。车队管理人员、云端和车队透过网路连接,使用具有整合处理器功能的支援物联网的设备。

- 例如,Zoho Corporation 正在利用云端、物联网 (IoT) 和人工智慧 (AI) 等技术来利用 IRDA 报价。例如,WebNMS 透过人工智慧和机器学习为其车队管理解决方案提供支持,声称持有25-50 辆车的中型车队透过使用其产品可以节省 10-15% 的燃料。此外,该公司还与印度两轮车製造商合作,监控和管理他们的测试车队。追踪、报告和分析位置、状态等有助于最大限度地降低营运成本并提高产品品质。

- 例如,支援边缘的物联网远端资讯处理解决方案可以透过 GPS、支援人工智慧的电脑视觉技术和车载诊断系统收集、储存和分析有关车辆健康和道路状况的资讯。向车队所有者和管理人员提供这些资讯可以让他们专注于驾驶员的表现、车队维护和货物管理。

- 新兴企业进一步成为印度车队管理软体市场中新兴但重要的供应商。使用云端基础的GPS 追踪系统和射频识别软体等先进技术,使他们在与知名全球参与企业的竞争中占据竞争优势。

- 例如,LocoNav 以前是新兴企业,但最近已发展成为一个综合车队管理平台。该公司提供车队管理解决方案、车队追踪系统、FASTag 和 AIS 140 认证的 GPS 追踪器服务。凭藉智慧分析和物联网作为其产品的核心,该公司能够降低车队运作成本、提高安全性并增加销售额。

- 到2025年,预计交通运输业将在全球范围内透过蜂窝方式连接到物联网,占据整体市场占有率的12%。造成这种情况的因素有很多,包括对车队管理软体的需求不断增加以及 5G 技术的采用。这也可能是促进印度市场成长的因素。

物流将大幅成长

- 根据世界银行的物流绩效指数,印度的物流业是全球最大的,价值1,600亿美元,直接僱用2,200万人。预计到 2022 年将以 10% 的复合年增长率成长,达到 2,150 亿美元。车队管理实践在当前情况下至关重要,不仅对业务效率而且对车队和驾驶员的安全都有重大影响。

- 新技术的采用,尤其是人工智慧和物联网,可能会对印度的物流业产生重大影响。这种变化已经发生,许多公司正在开发智慧解决方案来帮助车队所有者和营运商更有效地经营业务。例如,LocoNav 为印度和全球各地的车队提供客製化的、全面的 SaaS 车队管理解决方案,使多位车队所有者和司机受益。

- 印度对燃油效率和燃油盗窃问题的日益担忧促使全球公司纷纷在市场上提供先进的解决方案。例如,Aeris Communications 已与 Omnicomm 合作在印度推出燃料监控解决方案。此次合作将把 Omnicomm 的燃料监控功能加入其包装物联网解决方案组合中。目标包括物流运输、施工机械和机车,该公司将打击印度的燃料窃盗行为。

- 同月,壳牌车队解决方案进入印度,带来一系列产品和服务——壳牌燃料、壳牌车队预付费计划和壳牌远端资讯处理——旨在降低总拥有成本 (TCO) 并提高车队所有者的效率。据说车队解决方案的这三个关键部分可以提供更好的营运管理并增强对诈欺活动的防范。

- 同时,物流公司也透过提供车队管理解决方案进入市场。 Kale Logistics 等公司为车队所有者和营运商提供 Helios Fleet 综合车队维护软体。该软体可以管理从行程单、司机报销、燃料追踪和车队週转时间到发票和帐单等活动。

- 印度货柜公司截至 2023 年 7 月的市值约为 4,130 亿印度卢比(4,965,281,100 美元),是印度领先的物流公司。在此期间,Blue Dart Express是印度第二重要的物流公司。

印度车队管理软体产业概况

印度车队管理软体市场竞争激烈,有本地小型供应商、多家泛印度供应商和几家大型国际远端资讯处理公司。市场竞争的关键驱动因素是所提供解决方案的技术整合水准不断提高。市场上有几家公司正在采用物联网、资产追踪和 RFID 等先进技术来提高车队性能。随着国内外参与企业将这些技术融入其产品中,预测期内竞争预计会加剧。

2023 年 1 月,EVaaS 平台 Zypp Electric 宣布推出名为 ZyppDash 的电动车队管理系统。该新兴企业旨在透过其新的乘客追踪应用程式简化申请流程和车队管理。 Zypp 得到了印度最大线上零售商的支持,它希望透过在印度 20 个城市推出 2,000 辆电动Scooter来扩大其服务。该公司得到了 Zomato、Swiggy、Zepto、BlinkIt、BigBasket、亚马逊、Flipkart、Myntra、Easy Pharm、JioMart、Delhivery 和 Spencers 等电子商务公司的支持。

2022年9月,印度成长最快的低温运输市场营运商Celcius Logistics推出了智慧最后一哩配送平台,以针对性地解决印度脆弱的冷链供应链中的关键问题。该品牌还与车队所有者和汽车製造商 (IMS) 合作,打造一个整合智慧平台并基于专有库存管理系统的强大的冷冻车地面网路。在接下来的六个月里,Celcius 希望在六个大都市推出这个平台,然后将其扩展到更多的二线城市和城镇。

2022 年 12 月,Trucknetic推出其电动卡车「EVolev」平台,颠覆印度卡车运输产业的电动车生态系统并加速其应用。 Trucknetic 正在解决退货问题,以降低物流成本并降低该国的碳排放。然而,这家总部位于德里的公司并非采用 EVolev,而是致力于消除广泛应用电动车的障碍,并将整个电动车生态系统整合到一个平台上。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 市场定义和范围

- 调查前提

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 印度车队管理软体市场概况

- 印度车队管理相关人员分析(车队管理解决方案供应商、车队租赁公司、车队管理公司等)

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 市场驱动因素

- 降低车队营运商的整体拥有成本

- 行动性需求和数位转型趋势日益增长

- 市场问题

- 对传统车队管理公司不愿采用技术的担忧

- COVID-19 对印度车队管理市场的影响

第五章印度车队管理软体市场格局

- 主要船队统计数据

- 印度商用车产销售(2014-2019年)

- 车队产业概况 - 全面分析车队营运商趋势

- 关键市场洞察与机会

- 软体供应商/供应商创新与伙伴关係-全球与本地

- OEM在印度车队管理生态系统中的作用

- 影响印度车队管理市场的线上聚合器分析

第六章 市场细分

- 按部署

- 本地

- 云

- 按最终用户

- 后勤

- 製造业

- 其他最终用户(商业、教育等)

第七章 竞争格局

- 公司简介

- Trimble Inc.(Trimble Mobility Solutions India)

- TATA Consultancy Services Limited

- Mahindra Group(Mahindra Telematics)

- Zoho Corporation(WebNMS)

- fleetx Technologies Private Limited

- Efkon India Private Limited

- Kale Logistics Solutions Pvt Ltd

- iTriangle Infotech Pvt Ltd

- BT TechLabs(LocoNav)

- Uffizio India Software Consultants Pvt Ltd

- Orange GPS Solutions Pvt Ltd(iTrack)

第八章投资分析

第九章:未来市场展望

The India Fleet Management Software Market is expected to register a CAGR of 17.5% during the forecast period.

Key Highlights

- Fleet management software includes a range of functions, such as vehicle financing, vehicle maintenance, tracking and diagnostics, driver management, speed management, fuel management, and health and safety management, to name a few. The market for such solutions in India is observed to be still at a nascent stage, thereby portraying ample opportunities for the vendors.

- According to the Government of India report, Indian national and state highways account for a little over 5% of all road length but are responsible for more than 61% of traffic fatalities. Millions of cars drive through these roads every day, either managing the movement of goods exceeding a billion dollars or being used by industries like mining, construction, transport, and even public services. Rising cases of road accidents are anticipated to drive growth during the projected period.

- India has become the world's hottest-growing economy. For four of the last five years, this is a very big economy due to an increase in demand for goods and services. The movement of goods in and out of the country and beyond its borders has created economic opportunities for millions of Indians.

- The logistics sector currently accounts for 5% of India's Gross Domestic Product (GDP) and employs 2.2 crore people. India handles 4.6 billion tons of goods every year, amounting to a total annual cost of INR 9.5 lacs (USD 11421). These products represent a wide variety of industries in the country and products: 22% of the goods are agriculture, Mining products represent 39%, and 39% are manufacturing-related commodities. Trucks and other vehicles majorly handle the movement of these goods. Railways, inland waterways, coastal, pipelines, and airways are involved for the rest of transport.

- Additionally, in August 2022, the Ministry of Road Transport and Highways (MoRTH) mandated that all goods vehicles used for transporting dangerous or hazardous products must be equipped with a location tracking device, effective for any vehicles constructed on or after September 1, 2022.

- The region is witnessing increased funding towards fleet management due to increasing awareness and offered benefits. For instance, in May 2023, third-party logistics startup Zyngo EV raised USD 5 million in a Pre-Series A round led by Delta Corp Holdings. This round was also attended by an existing investor, LC Nueva Investment Partners LLP. The funding will allow for fleet enlargement, entering new regions, and improving technology.

- Looking at other stakeholders in the market, that is, fleet leasing companies, the trend suggests that the growth of renewable energy resources is likely to further push the market in the adoption of fleet management.

India Fleet Management Software Market Trends

IoT Deployment is expected to Witness Significant Growth

- The vendors in the market are opting for cloud offerings due to their offered benefits, such as faster time to market, High efficiency, more features, and lower cost as compared to On-premise. IoT is essential in enabling drivers, logistics managers, and fleet managers to make well-informed decisions in close to real-time. Processing data at the edge, also known as gathering and analyzing data as it is generated, makes this possible. The fleet manager, the cloud, and the vehicle are connected via network connectivity using IoT-enabled devices with integrated processor capabilities.

- For instance, Zoho Corporation is banking on technologies such as the cloud, the Internet of Things (IoT), and artificial intelligence (AI) to leverage IRDA's estimates. For instance, WebNMS enhanced its fleet management solutions with AI and machine learning and claimed that a midsized fleet with 25-50 vehicles could benefit from 10-15% fuel savings by using its offerings. The company, in addition, has collaborated with a bike manufacturer in India to monitor and manage their test vehicles. Location, condition, and, among others, can be tracked, reported, and analyzed to minimize operational costs and improve product quality.

- For instance, edge-enabled IoT telematics solutions may gather, store, and analyze information about the state of a car and the condition of the road through GPS, AI-enabled computer vision technologies, and onboard diagnostics. Giving this information to fleet owners and managers can aid them in keeping an eye on driver performance, vehicle upkeep, and cargo management.

- Startups additionally form an emerging yet key vendor for the Indian fleet management software market. The use of advanced technologies, such as cloud-based GPS tracking systems and radio-based frequency identifying software, will offer a competitive advantage while competing with global players that are already present.

- For instance, LocoNav, a startup offering fleet solutions earlier, recently evolved into an integrated vehicle management platform. The company offers Fleet Management Solutions, Vehicle Tracking systems, FASTag, and AIS 140 Certified GPS Trackers services. Via intelligent analytics and IoT as the core of their offerings, the startup is able to achieve lower running costs of vehicles, greater security, and repeated sales.

- In 2025, the transport industry is expected to have cellular Internet of Things connections around the world, with a predicted 12 percent market share overall. A number of factors contribute to this, such as increased demand for fleet management software and the use of 5G technology. This can be another factor in driving market growth in India.

Logistics is Expected to Witness Significant Growth

- According to the World Bank's Logistics Performance Index, India has the largest logistics sector in the world, with a total value of USD 160 billion and 22 million direct jobs. By 2022, this was expected to grow at a 10% annual growth rate, reaching USD 215 billion. Fleet management practices are extremely important in the current scenario, with a significant impact on business efficiency as well as the safety of vehicles and drivers.

- The adoption of new technologies, in particular AI and IoT, will have a profound impact on the Indian logistics sector. This change has already started to take place, as a number of companies have developed smart solutions that help fleet owners and operators run their businesses more effectively. For instance, LocoNav provides fleets in India and throughout the world with a bespoke, total SaaS fleet management solution that benefits several fleet owners and drivers.

- The rising concern about fuel efficiency and fuel theft activity in the country is supporting the emergence of global players to offer sophisticated solutions in the market. For instance, Aeris Communications partnered with Omnicomm to launch a fuel monitoring solution in India. The collaboration is expected to add fuel monitoring features from Omnicomm to the former's portfolio of packaged IoT solutions. With the target audience being logistics & transportation, construction equipment, and locomotives, the company will address fuel pilferage in India.

- At the same time of the month, Shell Fleet Solutions, with the aim of lowering the total cost of ownership (TCO) of the fleet owners and increasing efficiency, entered India with its portfolio of products and services, namely Shell Fuels, Shell Fleet Prepaid program and Shell Telematics. These three main segments of the Fleet Solution are said to provide better control over operations and increased protection against fraud.

- Logistic companies, on the other hand, are observed to have entered the market by offering fleet management solutions. Companies like Kale Logistics offer Helios Fleet, a comprehensive fleet maintenance software catering to fleet owners and operators. The software is capable of managing activities ranging from trip sheets, driver settlement, fuel tracking, and vehicle turn-around time to billing and invoicing.

- According to the market capitalization of about INR 413 billion (USD 4965280110) on July 2023, Container Corporation of India is the leading logistics company in India. In this period, Blue Dart Express was the second most important logistics company in the country.

India Fleet Management Software Industry Overview

The Indian fleet management software market is highly competitive, with the presence of small local vendors, several pan-Indian players, and a few international telematics giants. The competitiveness in the market is driven majorly by the increasing level of technology integration in the solutions offered. Several players in the market are adopting advanced technologies such as IoT, Asset Tracking, and RFID, among others, to enhance the performance of their fleets. As domestic and international players integrate these technologies into their offerings, the competition is expected to grow during the forecast period.

In January 2023, Electric vehicle-as-a-service platform Zypp Electric launched an EV fleet management system called ZyppDash. The startup seeks to simplify the request process and fleet management via its new rider-tracking app. Zypp, backed by India's biggest online retailers, wants to roll out two thousand electric scooters in 20 Indian cities and is expanding its services. The firm has the backing of e-commerce players such as Zomato, Swiggy, Zepto, BlinkIt, BigBasket, Amazon, Flipkart, Myntra, Easy Pharm, JioMart, Delhivery, and Spencers.

In September 2022, Celcius Logistics, the cold-chain marketplace business with India's highest growth rate, launched its intelligent last-mile delivery platform, which targets and resolves the critical problems in India's vulnerable cold supply chains. To build a solid on-ground network of reefer cars that were integrated with the smart platform and made with a unique Inventory Management System, the brand also partnered with vehicle owners and automakers (IMS). In the following six months, Celcius wanted to roll out this platform to more tier-2 cities and towns after launching it in six metro areas.

In December 2022, Trucknetic launched the "EVolev" platform for electric trucks to upend the Indian truck industry's EV ecosystem and hasten its widespread adoption. Trucknetic has already resolved the return load issue to lower logistical costs and lessen the nation's carbon footprint. With the introduction of EVolev, however, the Delhi-based business aimed to eliminate obstacles to the widespread use of electric vehicles and integrate the entire EV ecosystem into one platform.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Market Definition and Scope of the Study

- 1.2 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 India Fleet Management Software Market Overview

- 4.2 India Fleet Management Stakeholders Analysis (Fleet management solution providers, fleet leasing companies, fleet management companies, etc.)

- 4.3 Industry Attractiveness -Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Market Drivers

- 4.4.1 Lowering Total Cost of Ownership Among Fleet Operators

- 4.4.2 Growing Demand for Mobility and Digital Transformation Trends

- 4.5 Market Challenges

- 4.5.1 Concerns Regarding Traditional Fleet Management Companies Reluctant to Adopt Technology

- 4.6 Impact of COVID-19 on the India Fleet Management Market

5 INDIA FLEET MANAGEMENT SOFTWARE MARKET LANDSCAPE

- 5.1 Key Fleet Statistics

- 5.1.1 Commercial Vehicle Production and Sales in India (2014-2019)

- 5.1.2 Fleet Industry Overview -Analysis covering trends across Fleet Operators (<10, 11-50, 51-100, and >100)

- 5.2 Key Market Insights and Opportunities

- 5.2.1 Software Provider/Vendor Innovations and Partnerships -Global vs Local

- 5.2.2 Role of Vehicle Manufacturers(OEMs) in the Fleet Management Ecosystem in India

- 5.2.3 Analysis on Online Aggregators Impacting Fleet Management Market in India

6 MARKET SEGMENTATION

- 6.1 By Deployment

- 6.1.1 On-Premise

- 6.1.2 Cloud

- 6.2 By End User

- 6.2.1 Logistics

- 6.2.2 Manufacturing

- 6.2.3 Other End Users (Corporate, Education, etc.)

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Trimble Inc. (Trimble Mobility Solutions India)

- 7.1.2 TATA Consultancy Services Limited

- 7.1.3 Mahindra Group (Mahindra Telematics)

- 7.1.4 Zoho Corporation (WebNMS)

- 7.1.5 fleetx Technologies Private Limited

- 7.1.6 Efkon India Private Limited

- 7.1.7 Kale Logistics Solutions Pvt Ltd

- 7.1.8 iTriangle Infotech Pvt Ltd

- 7.1.9 BT TechLabs (LocoNav)

- 7.1.10 Uffizio India Software Consultants Pvt Ltd

- 7.1.11 Orange GPS Solutions Pvt Ltd (iTrack)