|

市场调查报告书

商品编码

1690871

北美物流自动化:市场占有率分析、产业趋势与成长预测(2025-2030 年)North America Logistics Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

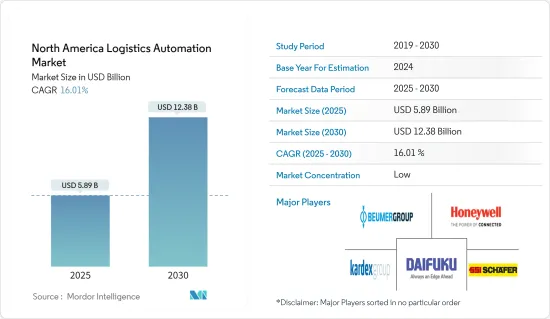

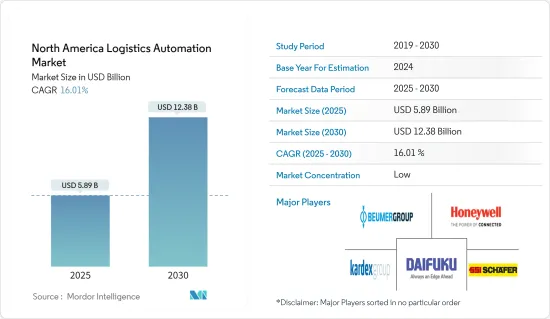

北美物流自动化市场规模预计在2025年为58.9亿美元,预计到2030年将达到123.8亿美元,预测期内(2025-2030年)的复合年增长率为16.01%。

关键亮点

- 冠状病毒大流行使物流领域采用自动化的情况变得复杂。社交距离和非接触式操作带来了独特的挑战,迫使组织改变标准作业程序并限制劳动力以应对不断增长的需求。持续到 2020 年的 COVID-19 已感染美国许多重要工作人员,并促使第一线主要企业实施新的安全流程。例如,病毒传播的严重程度足以导致一家食品生产工厂关闭,而其他几家企业则能够透过采取新的卫生措施继续运作。

- 根据 DHL 的一项调查,仓储业和卡车运输组织通常不被认为是自动化的早期采用者。事实上,2016 年全球 80% 的仓库都没有实现流程自动化。

- 物流自动化是指使用控制系统、机器和软体来提高业务效率。这通常适用于在仓库或配送中心进行的流程,并且需要最少的人为干预。自动化物流的好处包括改善客户服务、可扩展性和速度、组织控制和减少错误。

- 据田纳西大学称,就普及和应用而言,机器人技术是整个供应链中最先进的技术之一。电子商务的持续成长,预计未来仓储服务的需求将持续增加。这进一步加速了该领域透过自动化寻找节省成本的解决方案。

- 电子商务的兴起也导致分箱订单和单件货物运输量的增加,这些订单和单件货物运输量比整托盘订单更依赖自动化技术来提高效率。此外,自动化储存解决方案可将您的仓库占地面积减少 15%,同时提高生产力。

- 截至 2021 年 4 月,软银机器人公司和 SB Logistics 正在与 Berkshire Grey 合作,推动履约业务的创新。 Berkshire Grey 的机器人拣选和包装系统将透过机器人处理不同产品类型的多个 SKU 来帮助 SB Logistics 完成客户订单。 SB Logistics 的 3PL 将使用智慧企业机器人解决方案,包括由人工智慧驱动的尖端机器人自动化解决方案,可自主挑选、放置和包装客户订单,以满足日本市场典型的极高标准。这显示国内参与企业正在其他国家扩张。

北美物流自动化市场趋势

预计分类系统硬体将大幅成长

- 分类系统在各个地区的终端用户行业中的需求日益增长,包括邮政和小包裹服务、食品和饮料以及电子商务行业。人事费用上升和消费者购买行为改变等因素推动了对更快、更准确的配送业务的需求,进而推动了对自动分类系统的需求。

- 该地区的现代化製造设施依靠新技术和创新来更快、更低成本地生产更高品质的产品。实施智慧软体和硬体是当今竞争激烈的市场中生存的唯一可行方法。

- 此外,製造和加工行业越来越多地采用工业自动化来提高效率,预计也将推动该地区采用分类系统。新技术和创新进一步要求跨行业进行一些监管。

- 例如,FDA 食品安全现代化法案 (FSMA) 正在改变食品公司的业务方式,将重点从应对食源性疾病和掺假转移到预防食源性疾病和掺假。正因为如此,该行业受到严格监管,以满足食品安全标准,从而推动物料输送的自动化。预计这一因素将在预测期内推动食品和饮料行业的分类系统。

- 零售和电子商务领域的显着成长以及仓储的扩张是所研究市场成长的其他主要驱动力。 2020年第三季度,电子商务销售额贡献了零售总额的约14.3%,其中亚马逊占美国电子商务总销售额的三分之一以上。

- 该地区的大多数零售商都计划实现仓库自动化,而不是在如此高成本的租赁环境中扩张。然而,该地区近80%的仓库仍采用手工操作。

预计美国将占据主要市场占有率

- 美国是全球最大、最先进的自动化解决方案市场之一。强劲的经济、显着的港口运输量、活性化和关键製造业指标,推动了製造业的显着增长,推动了全国物流行业对自动化解决方案的需求。

- 零售、汽车、食品饮料和製药等行业是该国自动化物流解决方案的最大需求来源。食品和饮料是最大的产业,占美国每年包装运输量的35%以上。

- 这对食品和饮料製造设施中常用的设备产生了巨大的需求,例如堆垛机、单元货载AGV、标籤 AGV 和分类系统。此外,严格的食品安全法规和对生产过程中减少人为干预的偏好预计将在预测期内增加对食品和饮料行业的需求。

- 该地区已建立许多伙伴关係关係,并依靠最新技术和创新以更快的速度和更低的成本生产更高品质的产品。

- 例如,美国零售巨头克罗格(Kroger)最近开始与英国线上超级市场Ocado合作,利用该公司的技术进行仓储业务、物流、自动化和配送路线规划。此次合作将使自动化解决方案改变美国的零售业。

- 仓库空置率低和租金上升也促使公司寻找更小的空间来租用仓储。为了优化这些狭小空间内的生产力,我们可以预期会看到自动化解决方案的采用率不断提高。

- 此外,拥有许多仓库和配送单位的大公司正在利用收购策略来降低人事费用并提高盈利。例如,零售巨头亚马逊于2012年斥资7.75亿美元收购了一家名为Kiva Systems的年轻机器人公司,因此获得了新型移动机器人的所有权。这项投资为建构新版仓库机器人提供了技术基础,为机器人的未来潜力奠定了基础。

北美物流自动化行业概况

能够在核准的资本预算和预期前置作业时间内製造和整合所需设备的供应商继续主导市场。物流自动化市场由多个全球参与企业组成,在竞争激烈的市场空间中争取关注。

科技颠覆已成为永续竞争优势的关键驱动力。此外,为了使其提供的服务与众不同,参与企业正在转向服务能力。例如,Locus 已经处理了其技术的培训方面,称其 LocusEmpower 解决方案可在几天内(而不是几个月)帮助培训和引导员工。

市场上的知名参与企业包括Honeywell、Swisslog、大福和 Schaefer。这些参与企业的出现和不断的创新活动正在加剧市场格局。该市场对新参与企业的进入门槛适中,这导致几家由风险投资支持的新参与企业在市场上获得了关注。这可能会导致市场竞争更加激烈。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

- COVID-19对工业生态系的影响

- 市场驱动因素

- 电子商务的活性化

- 市场问题

- 资本投入高,技术尚处于起步阶段

第五章市场区隔

- 按解决方案类型

- 硬体

- 移动机器人(自动导引运输车(AGV)、自主移动机器人 (AMR))

- 自动储存和搜寻系统 (AS/RS)(单元货载- 固定通道和移动通道、小型负载、穿梭车和机器人系统、其他系统 - 旋转木马和垂直升降模组)

- 输送机(皮带、滚筒、托盘、高架)

- 堆垛机/堆垛机(常规型-高位+低位,机器人型)

- 分类系统

- 软体 - 仓库管理系统 (WMS)、WES、WCS

- 其他解决方案

- 运输管理解决方案

- 其他(拣货机器人、协作机器人、仓库无人机、支援基础设施)

- 硬体

- 按行业

- 通用产品

- 服饰

- 饮食

- 食物

- 邮政和小包裹

- 製造业(耐久财/非耐久财)

- 其他的

- 按国家

- 美国

- 加拿大

第六章竞争格局

- 公司简介

- SSI SCHAEFER AG

- Daifuku Co. Limited

- Kardex Group

- Honeywell Intelligrated

- Beumer Group GMBH & Co. KG

- Jungheinrich AG

- Murata Machinery Limited

- TGW Logistics Group GmbH

- Witron Logistik

- Mecalux SA

- Viastore Systems GmbH

- Swisslog Holdings AG(KUKA AG)

- Kion Group AG(包括 Dematic)

- Vanderlande Industries BV

- 供应商排名分析

- Mobile Robots

- AS/RS

- Collaborative Robots

- Palletizers/De-palletizers

- Conveyors/Sortation Systems

第七章投资分析

第八章:市场的未来

The North America Logistics Automation Market size is estimated at USD 5.89 billion in 2025, and is expected to reach USD 12.38 billion by 2030, at a CAGR of 16.01% during the forecast period (2025-2030).

Key Highlights

- The Coronavirus pandemic complicated the situation of automation adoption in logistics sector. By bringing in unique challenges of social distancing and contactless operation it has changed the standard operating procedure and organizations were forced to limit workforce, and deal with the increasing demand. COVID-19 over 2020 and continuing has infected a number of essential workers in the United States, leading companies on the front lines to implement new safety processes. While the spread of the virus has been grave enough to warrant shutdowns for instance, food production facilities, multiple other businesses have been able to continue operations with the addition of new health measures.

- Organizations within the warehousing and trucking industries, when considered, are generally not known as early adopters to automation; in fact, 80% of warehouses globally didn't have any process automation in 2016 as per DHL study.

- Automation in logistics refers to the use of control systems, machinery, and software to enhance the efficiency of operations. It usually applies to the processes performed in a warehouse or distribution center, which requires minimal human intervention. Some of the benefits of automation logistics are improved customer service, scalability and speed, organizational control, and reduced mistakes.

- As per the University of Tennessee, robotics has been one of the most advanced technologies across a supply chain in terms of its proliferation and application. The continued growth in e-commerce and the demand for warehousing services is expected to continue to increase. This is further aligned for acceleration in the segment in order to find cost-reduction solutions through automation.

- The rise of e-commerce has brought a rise in split case orders and even single-unit shipments, which rely much more heavily on automation technologies to be efficient than full-pallet orders. Additionally, an automated storage solution serves an ability to shrink a warehouse's footprint to just 15 percent while increasing productivity.

- As of April 2021, SoftBank Robotics and SB Logistics collaborated with Berkshire Grey to drive innovation in E-Commerce fulfillment operations. Berkshire Grey's robotic pick and pack systems would benefit SB Logistics to process customer orders by robotically handling multiple SKUS in different product categories. SB Logistics' 3PL would use Intelligent Enterprise Robotics solutions, including leading AI-enabled robotic automation solutions to autonomously pick, place, and pack customer orders to best meet the extremely high standards prevalent in the Japanese market. This marks domestic player's expanding in other countries.

North America Logistics Automation Market Trends

Among Hardware, Sortation System is Expected to Witness Significant Growth

- Sortation systems are witnessing increased demands from various regional end-user industries, such as post and parcel services, food and beverages, and the e-commerce industry. Factors such as increasing labor costs and changing consumer buying behavior have bolstered the demand for faster and more accurate delivery operations, which have, in turn, developed a considerable demand for automated sortation systems.

- Modern manufacturing facilities in the region rely on new technologies and innovations to produce higher quality products at faster speeds, with lower costs. Implementing smart software and hardware proves to be the only feasible way to survive in the current competitive market.

- Further, the growing adoption of industrial automation to enhance efficiency in the manufacturing and processing sectors is also expected to boost the adoption of sortation systems in the region. New technologies and innovations have further mandated the need for several regulations across the industries.

- For instance, the FDA Food Safety Modernization Act (FSMA) is transforming the operations of food companies by shifting the focus from responding to foodborne illness and foreign material contamination to preventing it. This makes the industry highly regulated to meet food safety norms that promote automation in material handling. This factor is expected to drive the sortation system in the food and beverage industry over the forecast period.

- The significant growth of the retail and e-commerce sector and warehouse expansion is another primary driver of the studied market growth. E-commerce sales contributed to about 14.3% of total retail sales in the third quarter of 2020, of which Amazon accounted for more than a third of all e-commerce sales in the United States.

- Most of the retailers in the region are planning to automate their warehouse establishments rather than expanding in such a high-priced rental environment. However, almost 80% of the warehouses in the region are still manually operated.

United States is Expected to Account for Major Market Share

- The United States is one of the largest and most advanced markets for automated solutions globally. The strong economy, with notable port traffic, increased e-commerce activity, and key manufacturing indices, all resulting in significant growth in manufacturing, drive the demand for automated solutions across the logistics sector in the country.

- Sectors, including retail, automotive, food and beverage, and pharmaceutical, are the largest sources of demand for automated logistics solutions in the country. Food and beverage is the largest industry and represents more than 35% of all US packaging shipments annually.

- This creates a significant demand for equipment, such as palletizers, unit load AGVs, tug AGVs, and sortation systems, which are extensively deployed in food and beverage manufacturing establishments. Moreover, the stringent food safety regulations and preference for low human intervention in the production process are expected to increase the demand for the food and beverage industry over the forecast period.

- The region is witnessing numerous partnerships and is relying on the latest technologies and innovations to manufacture a higher quality of products at quicker speeds and cheaper costs.

- For instance, recently, a principal American retail company, Kroger, started a partnership with the UK online supermarket, Ocado, to utilize its technology to handle warehouse operations, logistics, automation, and delivery route planning in the region. This partnership is set to transform the retail sector, with the aid of automation solutions, in the United States.

- Additionally, owing to low vacancy and a surge in the rental prices of warehouses, enterprises are progressively looking for smaller places to rent out for warehouse purposes. In order to optimize the productivity of these narrow spaces, they are expected to deploy more automated solutions soon.

- Also, the major companies with many warehouses and distribution units utilize acquisition strategies to reduce labor costs and increase their profitability. For instance, Amazon, the giant retail, has spent USD 775 million in 2012 to acquire a young robotics company called Kiva Systems that gave it ownership over a new breed of mobile robots. This investment gave a technical foundation for building new versions of warehouse robotics, setting the stage for a potential future of the robots.

North America Logistics Automation Industry Overview

The market vendors that can fabricate and integrate the required equipment within the approved capital budgets and expected leads times have been continuing to dominate the market. The logistics automation market comprises several global players, vying for attention in a fairly-contested market space.

Technological disruption has been a key factor in sustainable competitive advantage. Also, in order to differentiate amongst offerings, the players have been witnessed moving toward the service capabilities. For instance, Locus considered the training aspect of its technology, and its LocusEmpower solution aids in training and the company claims it would onboard workers in days, rather than months.

Some of the prominent players in the market include Honeywell, Swisslog, Daifuku, Schaefer, among others. The presence of these players and their constant innovative activities are intensifying the market scenario. As the market poses moderate barriers to entry for new players, several new entrants backed by VC's have been able to gain traction in the market. This could further intensify the market competition.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitute Products

- 4.4 Impact of COVID-19 on the Industry Ecosystem

- 4.5 Market Drivers

- 4.5.1 Increased E-commerce Activity

- 4.6 Market Challenge

- 4.6.1 High Capital Investment & Nascency Of The Technology

5 MARKET SEGMENTATION

- 5.1 By Solution Type

- 5.1.1 Hardware

- 5.1.1.1 Mobile Robots (Automated Guided Vehicle (AGV) and Autonomous Mobile Robots (AMR))

- 5.1.1.2 Automated Storage and Retrieval System (AS/RS) (Unit Load - Fixed and Movable Aisle, Mini Load, Shuttle & Bot Systems and Other Systems - Carousels and Vertical Lift Modules)

- 5.1.1.3 Conveyor (Belt, Roller, Pallet and Overhead)

- 5.1.1.4 Palletizer/De-palletizer (Conventional - High Level + Low Level, and Robotic)

- 5.1.1.5 Sortation System

- 5.1.2 Software - Warehouse Management Systems (WMS), WES and WCS

- 5.1.3 Other Solutions

- 5.1.3.1 Transportation Management Solutions

- 5.1.3.2 Others (Piece-picking robots, collaborative robots, warehouse drones, and supporting infrastructure)

- 5.1.1 Hardware

- 5.2 By Industry

- 5.2.1 General Merchandise

- 5.2.2 Apparel

- 5.2.3 Food and Beverages

- 5.2.4 Groceries

- 5.2.5 Post & Parcel

- 5.2.6 Manufacturing (Durable and Non-Durable)

- 5.2.7 Other Industries

- 5.3 By Country

- 5.3.1 United States

- 5.3.2 Canada

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 SSI SCHAEFER AG

- 6.1.2 Daifuku Co. Limited

- 6.1.3 Kardex Group

- 6.1.4 Honeywell Intelligrated

- 6.1.5 Beumer Group GMBH & Co. KG

- 6.1.6 Jungheinrich AG

- 6.1.7 Murata Machinery Limited

- 6.1.8 TGW Logistics Group GmbH

- 6.1.9 Witron Logistik

- 6.1.10 Mecalux SA

- 6.1.11 Viastore Systems GmbH

- 6.1.12 Swisslog Holdings AG (KUKA AG)

- 6.1.13 Kion Group AG (including Dematic)

- 6.1.14 Vanderlande Industries BV

- 6.2 Vendor Ranking Analysis

- 6.2.1 Mobile Robots

- 6.2.2 AS/RS

- 6.2.3 Collaborative Robots

- 6.2.4 Palletizers/De-palletizers

- 6.2.5 Conveyors/Sortation Systems