|

市场调查报告书

商品编码

1645164

特种化学品-市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Specialty Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

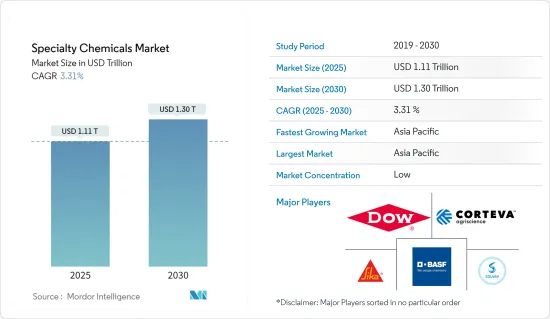

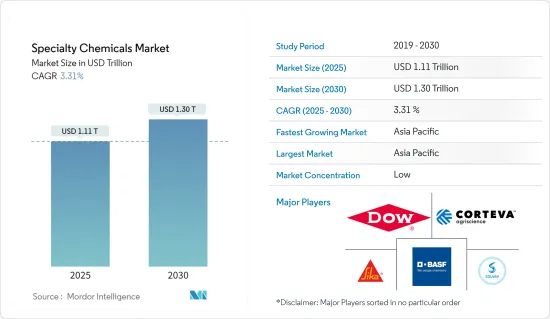

特种化学品市场规模预计在 2025 年为 1.11 兆美元,预计到 2030 年将达到 1.3 兆美元,预测期内(2025-2030 年)的复合年增长率为 3.31%。

2020 年,市场受到了 COVID-19 疫情的负面影响。疫情导致多个国家停摆,造成供应链中断、业务停顿和劳动力短缺。然而,自从限制解除以来,该行业已经恢復良好。住宅销售量的增加和新计画的推出推动了对油漆、被覆剂和建筑化学品的需求。过去两年,半导体、积体电路和农业化学品的需求增加带动市场復苏。

关键亮点

- 市场成长的主要动力是建设活动的强劲成长,尤其是在亚太地区、中东和非洲。此外,人口成长正推高全球粮食需求。

- 然而,日益严格的环境法规和日益减少的石化燃料蕴藏量正在抑制市场的成长。

- 预计在预测期内,新产品研发的发展将为市场研究提供机会。

- 亚太地区凭藉庞大的基本客群、不断增长的工业产量以及建筑业的强劲增长而占据全球市场的主导地位,从而对特种化学品的需求很高。

特种化学品市场趋势

农业化学品领域主导市场需求

- 在专用化学品市场中,农业化学品占据主导地位。这一部分的成长主要受到人均可耕地面积减少和全球粮食需求增加的推动。

- 世界人口正在迅速成长。人口增长刺激了对食物的需求。养活不断增加的人口正成为一项威胁。同时,由于工业化、都市化的发展,可耕地面积不断减少。人们长期以来一直使用肥料来提高作物产量,因此在预测期内对农药的需求将会增加。

- 随着人均收入的提高和人口的增长,全球对作物和经济作物的需求预计会增加。例如,根据粮农组织的数据,到2050年,美国的粮食需求预计将增加50-90%。

- 联合国粮食及农业组织(FAO)和国际粮食政策研究所(IFPRI)预测,2050年全球粮食需求将会增加。根据粮农组织的预测,到2050年全球粮食需求可能增加70%,其中全球粮食需求预计大部分成长将来自亚太地区、东欧和拉丁美洲消费者收入的成长。

- 此外,由于人们对植物有效吸收养分的关注度日益提高,以及对监管健康和环境问题的日益关注,微量营养素肥料、生物基肥料和特种肥料(如液体肥料)越来越受欢迎。

- 生物除草剂利用微生物作为生物害虫防治剂,与合成除草剂一起在综合害虫管理技术中也越来越受欢迎。儘管这一领域仅占行业一小部分,但预计它将经历显着的成长。

- 2021年各国肥料出口总额总合约832亿美元。这一金额反映出,2020 年所有化肥出口商的平均增幅为 50.7%,当年化肥出口总额为 552 亿美元5。

- 2021年俄罗斯出口额为124亿美元,较2020年(69.9亿美元)成长约78%。此外,中国出口大幅成长近74.6%。 2021年中国化肥出口总额为114.7亿美元。

- 此外,农业用地减少和病虫害造成的作物损失也是推动农药市场发展的主要因素。

- 因此,预计所有这些有利趋势将在预测期内推动农业化学品市场的需求。预计这将推动对特种化学品的需求。

亚太地区占市场主导地位

- 亚太地区主导特种化学品市场。由于建筑业的强劲增长、化妆品需求的增加、电气和电子行业的投资和生产的增加、包装行业对粘合剂和塑料的需求的增加以及该地区工业对水处理系统的安装增加,预计该行业在预测期内仍将保持其地位。

- 该地区人口不断增长,特别是中国和印度等国家,导致粮食需求增加。预计这将推动农业化学品市场的发展,进而促进预测期内专门食品聚合物市场的成长。

- 亚太地区建筑业的成长主要由于服务业扩张导致的办公空间需求上升、住宅建筑计划增加以及跨国公司流入该地区建设工业基础的投资。预计这些因素将在预测期内推动该地区对油漆和被覆剂、黏合剂和密封剂、建筑化学品和特殊聚合物的需求。

- 根据中国国家统计局数据,2021年中国建筑业企增加价值额81380亿元(约11516.1亿美元) ,年增2.15%。

- 预计未来七年印度的住宅投资也将达到约 1.3 兆美元。预计该国将建造 6,000 万套新住宅。预计到 2025 年,印度经济适用住宅数量将增加 70% 左右。此外,印度政府「2022年实现全民住宅」的目标对该行业来说也是一个重大变化。

- 黏合剂已成为汽车应用中的关键技术部件,并不断取代传统的黏合和黏附方法。该地区的黏合剂和密封剂产量正在增加,从而导致对化妆品化学品的需求增加。

- 根据日本汽车工业协会(JAMA)的数据,2021年日本生产了7,846,955辆乘用车和轻型车。

- 黏合剂在电子工业中有多种用途,包括三防胶、端子电极保护和表面黏着型元件的黏合。电子业是印度成长最快的行业之一。据电子和资讯技术部称,2021年该行业的市场规模预计在4.95兆卢比至5.0兆卢比之间(约合669.5亿至676.2亿美元)。

- 因此,预计所有这些有利趋势将在预测期内推动该地区特种化学品市场的成长。

特种化学品产业概况

特种化学品市场高度细分,众多参与企业占据了相当大的市场占有率。市场的主要参与企业(不分先后顺序)包括BASF SE、Dow、Corteva、Sika AG 和 Solvay。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 亚太地区、中东和非洲建设活动强劲成长

- 人口成长推动全球粮食需求

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 原料分析

第 5 章 市场区隔(以金额为准的市场规模)

- 油漆和涂料

- 动态

- 应用

- 建筑学

- 车

- 工业的

- 木头

- 其他的

- 催化剂

- 动态

- 催化功能

- 化学合成催化剂

- 精製催化剂

- 聚合催化剂

- 建筑化学品

- 动态

- 应用

- 商务用

- 工业的

- 基础设施

- 住宅

- 公共空间

- 化妆品

- 动态

- 应用

- 头髮护理

- 护肤

- 口腔护理

- 个人卫生

- 其他的

- 染料、油墨、颜料

- 动态

- 类型

- 墨水

- 染料

- 有机颜料

- 无机颜料

- 电子化学品

- 动态

- 应用

- 半导体和积体电路

- 印刷基板

- 水处理化学品

- 动态

- 功能

- 凝聚剂

- 凝聚剂

- 除生物剂和杀菌剂

- 消泡剂和消泡剂

- pH 调节剂和软化剂

- 其他的

- 食品添加物

- 动态

- 类型

- 天然添加物

- 合成添加剂

- 农药

- 动态

- 类型

- 肥料

- 除草剂

- 杀菌剂

- 杀虫剂

- 杀线虫剂

- 灭螺剂

- 其他作物保护化学品

- 工业和公共设施清洁工

- 动态

- 应用

- 一般清洁剂

- 杀菌剂和消毒剂

- 衣物洗护产品

- 洗车用品

- 润滑油添加剂

- 动态

- 产品类型

- 分散剂和乳化剂

- 清洗剂

- 抗氧化剂

- 极压抗磨添加剂

- 黏度指数改进剂

- 摩擦改进剂

- 腐蚀抑制剂

- 其他的

- 矿业化学品

- 动态

- 功能

- 浮选化学品

- 萃取化学品

- 研磨助剂

- 油田化学品

- 动态

- 应用

- 除生物剂

- 腐蚀和水垢抑制剂

- 破乳剂

- 聚合物

- 界面活性剂

- 其他化学品

- 黏合剂和密封剂

- 动态

- 科技

- 水性胶黏剂

- 溶剂型胶黏剂

- 热熔胶

- 反应性黏合剂

- 其他胶黏剂

- 密封剂

- 塑胶添加剂

- 动态

- 塑胶类型

- 聚乙烯 (PE)

- 聚苯乙烯(PS)

- 聚丙烯(PP)

- 聚酰胺(PA)

- 聚对苯二甲酸乙二醇酯(PET)

- 聚氯乙烯(PVC)

- 聚碳酸酯(PC)

- 其他塑料

- 橡胶加工化学品

- 动态

- 应用

- 胎

- 无轮胎

- 特种聚合物

- 动态

- 纺织化学品

- 动态

- 应用

- 涂料和施胶化学品

- 着色剂和助剂

- 整理加工剂

- 退浆剂

- 其他的

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 东南亚国协

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 西班牙

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 市场占有率分析

- 黏合剂和密封剂

- 农药

- 建筑化学品

- 润滑油和石油添加剂

- 矿业化学品

- 油田化学品

- 油漆和被覆剂

- 特种聚合物

- 水处理化学品

- 主要企业策略

- 公司简介

- 3M

- AECI

- Afton Chemical

- Akzo Nobel NV

- Albemarle Corporation

- ALTANA

- Archroma

- Arkema Group

- Ashland

- Asian Paints

- Axalta Coating Systems

- Baker Hughes Company

- BASF SE

- Berger Paints India Limited

- Buckman

- Chevron Corporation

- Clariant

- Corteva

- Covestro AG

- DIC Corporation

- Dow

- DSM

- DuPont

- Eastman Chemical Company

- Ecolab

- Evonik Industries AG

- Exxon Mobil Corporation

- Ferro Corporation

- Flint Group

- FMC Corporation

- GCP Applied Technologies Inc.

- HB Fuller Company

- Halliburton

- Henkel AG & Co. KGaA

- Hexcel Corporation

- Huntsman International LLC

- Infineum International Limited

- Kemira

- KRONOS Worldwide Inc.

- Kurita Water Industries Ltd

- Holcim

- LANXESS

- Lonza

- MAPEI SpA

- Merck KGaA

- NIPSEA GROUP

- Nouryon

- Nutrien Ltd

- Pidilite Industries Ltd

- PPG Industries Inc.

- Procter & Gamble

- RPM International Inc.

- SABIC

- Schlumberger Limited

- Sika AG

- Solenis

- Solvay

- Syngenta

- The Chemours Company

- The Lubrizol Corporation

- The Sherwin-Williams Company

- Venator Materials PLC

- Veolia

- WR Grace & Co.

- Wacker Chemie AG

- Yara

第七章 市场机会与未来趋势

The Specialty Chemicals Market size is estimated at USD 1.11 trillion in 2025, and is expected to reach USD 1.30 trillion by 2030, at a CAGR of 3.31% during the forecast period (2025-2030).

The market was negatively impacted by the COVID-19 outbreak in 2020. Owing to the pandemic scenario, several countries went into lockdown, which led to supply chain disruptions, work stoppages, and labor shortages. However, the sector is recovering well since restrictions were lifted. An increase in house sales and new project launches have led to a rise in the demand for paints, coatings, and construction chemicals. The increasing demand for semiconductors, integrated circuits, and agrochemicals led to the market recovery over the last two years.

Key Highlights

- The major factors driving the market's growth are the robust growth of construction activities, especially in Asia-Pacific and the Middle East & Africa. Furthermore, the growing population is propelling the demand for food worldwide.

- On the flip side, increasing environmental regulations and decreasing fossil fuel reserves are the restraints hampering the market's growth.

- Growing research and development for creating novel products will likely provide an opportunity for the market studied over the forecast period.

- Asia-Pacific dominated the global market, owing to the vast customer base, leading to high demand for specialty chemicals, increasing industrial production, and robust growth of the construction sector in the region.

Speciality Chemicals Market Trends

Agrochemicals Segment to Dominate the Market Demand

- The agrochemicals segment dominated the share in the specialty chemicals market. The segment's growth is extensively driven by the decreasing per capita arable land and increasing demand for food worldwide.

- The global population is increasing rapidly. This growing population is adding to the food demand. Supplying food to this ever-increasing population is becoming a threat. On the other hand, arable land is declining due to industrialization and urbanization. Fertilizers have been used for a long time to increase crop productivity, thus, enhancing agrochemicals demand over the forecast period.

- With the increasing per capita income and growing population, food and cash crops demand is estimated to increase globally. For instance, as per the FAO, the food demand in the United States is expected to increase by 50-90% by 2050.

- The Food and Agriculture Organization of the United Nations (FAO) and the International Food Policy Research Institute (IFPRI) have published projections of an increase in global food demand by 2050. The FAO projections indicate that world food demand may increase by 70% by 2050, with much of the projected increase in global food demand expected to come from rising consumer incomes in Asia-Pacific, Eastern Europe, and Latin America.

- Furthermore, owing to the growing concerns about nutrient efficiency uptake by plants and the growing regulatory health and environmental concerns, micronutrient fertilizers, bio-based fertilizers, and specialty fertilizers (like liquid fertilizers) are gaining popularity.

- Bio-herbicides that use microbes as biological weed control agents are also gaining popularity in integrated pest management techniques, along with synthetic herbicides. Although the segment constitutes only a tiny part of the industry, it is expected to grow significantly.

- Fertilizers exported by all countries totaled around USD 83.2 billion in 2021. That dollar amount reflects an average 50.7%5 increase for all shippers of fertilizers in 2020 when overall fertilizer exports were worth USD 55.2 billion.

- Russia exported USD 12.4 billion in 2021, an increase of around 78% compared to 2020 (USD 6.99 billion), with India being one of the largest importers from the Federation. Additionally, China experienced a significant increase in exports of almost 74.6%. Fertilizer exports from China totaled 11.47 billion USD in 2021.

- Moreover, contracting agricultural land and losing crops owing to pests and diseases are the significant factors driving the insecticide market.

- Hence, all such favorable trends are expected to drive the demand for the agrochemicals market during the forecast period. It is expected to drive the need for specialty chemicals.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region dominated the specialty chemicals market. It is likely to retain its position during the forecast period due to robust growth of the construction sector, increasing cosmetic products demand, growing investment and production in the increasing electrical and electronics industry output, increasing demand for adhesives and plastics from the packaging industry, and increasing installations of water treatment systems from the industries in the region.

- The growing population in the region, especially in countries such as China and India, is increasing the demand for food. It is expected to drive the agrochemical market and consequently help the specialty polymers market grow over the forecast period.

- The growth of the Asia-Pacific construction sector is majorly driven by the service sector expansion, leading to an increase in the demand for office spaces, an increase in residential construction projects, and an inflow of investments from multinational companies to set up an industrial base in the region. Such factors will likely increase the demand for paints and coatings, adhesives and sealants, construction chemicals, and specialty polymers in the area during the forecast period.

- According to the National Bureau of Statistics of China, in 2021, the value added of construction enterprises in China was CNY 8,013.8 billion (~USD 1151.61 billion), up by 2.15% over the previous year.

- India will also likely witness an investment of around USD 1.3 trillion in housing over the next seven years. The country is expected to see the construction of 60 million new homes. The availability of affordable housing is likely to rise by around 70% by 2025 in India. Besides, the Indian government's 'Housing for All by 2022' is also a significant game-changer for the industry.

- Adhesives have become a prime technology component in automotive applications, continuously replacing traditional bonding or adhesion methods. It is increasing adhesives and sealants production in the region, leading to a rise in demand for cosmetic chemicals.

- According to Japan Automobile Manufacturers Association (JAMA), the country produced 7,846,955 units of passenger cars and light vehicles in 2021.

- The electronics industry uses adhesives for various applications, including conformal coatings, protecting terminal electrodes, and bonding of surface mount devices, among many others. The electronics industry is one of the fastest-growing industries in India. According to the Ministry of Electronics and IT, the industry's market size is INR 4,950-5,000 billion (~ USD 66.95-67.62 billion) as of fiscal 2021.

- Hence, all such favorable trends are collectively likely to drive the growth of the specialty chemicals market in the region during the forecast period.

Speciality Chemicals Industry Overview

The specialty chemicals market is highly fragmented, with numerous players holding a significant market share. Some of the major players in the market (in no particular order) include BASF SE, Dow, Corteva, Sika AG, and Solvay, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Robust Growth of Construction Activities in Asia-Pacific, and Middle East and Africa

- 4.1.2 Growing Population is Propelling the Demand for Food Worldwide

- 4.2 Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products and Services

- 4.2.5 Degree of Competition

- 4.3 Raw Material Analysis

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Paints and Coatings

- 5.1.1 Dynamics

- 5.1.2 Application

- 5.1.2.1 Architectural

- 5.1.2.2 Automotive

- 5.1.2.3 Industrial

- 5.1.2.4 Wood

- 5.1.2.5 Other Applications

- 5.2 Catalysts

- 5.2.1 Dynamics

- 5.2.2 Function

- 5.2.2.1 Chemical Synthesis Catalysts

- 5.2.2.2 Petroleum Refining Catalysts

- 5.2.2.3 Polymerization Catalysts

- 5.3 Construction Chemicals

- 5.3.1 Dynamics

- 5.3.2 Application

- 5.3.2.1 Commercial

- 5.3.2.2 Industrial

- 5.3.2.3 Infrastructure

- 5.3.2.4 Residential

- 5.3.2.5 Public Space

- 5.4 Cosmetic Chemicals

- 5.4.1 Dynamics

- 5.4.2 Application

- 5.4.2.1 Hair Care

- 5.4.2.2 Skin Care

- 5.4.2.3 Oral Care

- 5.4.2.4 Personal Hygiene

- 5.4.2.5 Other Applications

- 5.5 Dyes, Inks, and Pigments

- 5.5.1 Dynamics

- 5.5.2 Type

- 5.5.2.1 Inks

- 5.5.2.2 Dyes

- 5.5.2.3 Organic Pigments

- 5.5.2.4 Inorganic Pigments

- 5.6 Electronic Chemicals

- 5.6.1 Dynamics

- 5.6.2 Application

- 5.6.2.1 Semiconductors and Integrated Circuits

- 5.6.2.2 Printed Circuit Boards

- 5.7 Water Treatment Chemicals

- 5.7.1 Dynamics

- 5.7.2 Function

- 5.7.2.1 Flocculants

- 5.7.2.2 Coagulants

- 5.7.2.3 Biocides and Disinfectants

- 5.7.2.4 Defoamers and Defoaming Agents

- 5.7.2.5 pH Adjusters and Softeners

- 5.7.2.6 Other Functions

- 5.8 Food Additives

- 5.8.1 Dynamics

- 5.8.2 Type

- 5.8.2.1 Natural Additives

- 5.8.2.2 Synthetic Additives

- 5.9 Agrochemicals

- 5.9.1 Dynamics

- 5.9.2 Type

- 5.9.2.1 Fertilizers

- 5.9.2.2 Herbicide

- 5.9.2.3 Fungicide

- 5.9.2.4 Insecticide

- 5.9.2.5 Nematicide

- 5.9.2.6 Molluscicide

- 5.9.2.7 Other Crop Protection Chemicals

- 5.10 Industrial and Institutional Cleaners

- 5.10.1 Dynamics

- 5.10.2 Application

- 5.10.2.1 General Purpose Cleaners

- 5.10.2.2 Disinfectants and Sanitizers

- 5.10.2.3 Laundry Care Products

- 5.10.2.4 Vehicle Wash Products

- 5.11 Lubricant Additives

- 5.11.1 Dynamics

- 5.11.2 Product Type

- 5.11.2.1 Dispersants and Emulsifiers

- 5.11.2.2 Detergents

- 5.11.2.3 Oxidation Inhibitors

- 5.11.2.4 Extreme-pressure Additives and Anti-wear Additives

- 5.11.2.5 Viscosity Index Modifiers

- 5.11.2.6 Friction Modifiers

- 5.11.2.7 Corrosion Inhibitors

- 5.11.2.8 Other Product Types

- 5.12 Mining Chemicals

- 5.12.1 Dynamics

- 5.12.2 Function

- 5.12.2.1 Flotation Chemicals

- 5.12.2.2 Extraction Chemicals

- 5.12.2.3 Grinding Aids

- 5.13 Oilfield Chemicals

- 5.13.1 Dynamics

- 5.13.2 Application

- 5.13.2.1 Biocide

- 5.13.2.2 Corrosion and Scale Inhibitor

- 5.13.2.3 Demulsifier

- 5.13.2.4 Polymer

- 5.13.2.5 Surfactant

- 5.13.2.6 Other Chemical Types

- 5.14 Adhesives and Sealants

- 5.14.1 Dynamics

- 5.14.2 Technology

- 5.14.2.1 Water-borne Adhesives

- 5.14.2.2 Solvent-borne Adhesives

- 5.14.2.3 Hot-melt Adhesives

- 5.14.2.4 Reactive Adhesives

- 5.14.2.5 Other Adhesives

- 5.14.2.6 Sealants

- 5.15 Plastic Additives

- 5.15.1 Dynamics

- 5.15.2 Plastic Type

- 5.15.2.1 Polyethylene (PE)

- 5.15.2.2 Polystyrene (PS)

- 5.15.2.3 Polypropylene (PP)

- 5.15.2.4 Polyamide (PA)

- 5.15.2.5 Polyethylene Terephthalate (PET)

- 5.15.2.6 Polyvinyl Chloride (PVC)

- 5.15.2.7 Polycarbonate (PC)

- 5.15.2.8 Other Plastic Types

- 5.16 Rubber Processing Chemicals

- 5.16.1 Dynamics

- 5.16.2 Application

- 5.16.2.1 Tire

- 5.16.2.2 Non-tire

- 5.17 Specialty Polymers

- 5.17.1 Dynamics

- 5.18 Textile Chemicals

- 5.18.1 Dynamics

- 5.18.2 Application

- 5.18.2.1 Coating and Sizing Chemicals

- 5.18.2.2 Colorants and Auxiliaries

- 5.18.2.3 Finishing Agents

- 5.18.2.4 Desizing Agents

- 5.18.2.5 Other Application

- 5.19 Geography

- 5.19.1 Asia-Pacific

- 5.19.1.1 China

- 5.19.1.2 India

- 5.19.1.3 Japan

- 5.19.1.4 South Korea

- 5.19.1.5 ASEAN Countries

- 5.19.1.6 Rest of Asia-Pacific

- 5.19.2 North America

- 5.19.2.1 United States

- 5.19.2.2 Canada

- 5.19.2.3 Mexico

- 5.19.2.4 Rest of North America

- 5.19.3 Europe

- 5.19.3.1 Germany

- 5.19.3.2 United Kingdom

- 5.19.3.3 Italy

- 5.19.3.4 France

- 5.19.3.5 Spain

- 5.19.3.6 Rest of Europe

- 5.19.4 South America

- 5.19.4.1 Brazil

- 5.19.4.2 Argentina

- 5.19.4.3 Rest of South America

- 5.19.5 Middle-East and Africa

- 5.19.5.1 Saudi Arabia

- 5.19.5.2 South Africa

- 5.19.5.3 Rest of Middle-East and Africa

- 5.19.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis

- 6.2.1 Adhesives and Sealants

- 6.2.2 Agrochemicals

- 6.2.3 Construction Chemicals

- 6.2.4 Lubricants and Oil Additives

- 6.2.5 Mining Chemicals

- 6.2.6 Oilfield Chemicals

- 6.2.7 Paints and Coatings

- 6.2.8 Specialty Polymers

- 6.2.9 Water Treatment Chemicals

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 AECI

- 6.4.3 Afton Chemical

- 6.4.4 Akzo Nobel NV

- 6.4.5 Albemarle Corporation

- 6.4.6 ALTANA

- 6.4.7 Archroma

- 6.4.8 Arkema Group

- 6.4.9 Ashland

- 6.4.10 Asian Paints

- 6.4.11 Axalta Coating Systems

- 6.4.12 Baker Hughes Company

- 6.4.13 BASF SE

- 6.4.14 Berger Paints India Limited

- 6.4.15 Buckman

- 6.4.16 Chevron Corporation

- 6.4.17 Clariant

- 6.4.18 Corteva

- 6.4.19 Covestro AG

- 6.4.20 DIC Corporation

- 6.4.21 Dow

- 6.4.22 DSM

- 6.4.23 DuPont

- 6.4.24 Eastman Chemical Company

- 6.4.25 Ecolab

- 6.4.26 Evonik Industries AG

- 6.4.27 Exxon Mobil Corporation

- 6.4.28 Ferro Corporation

- 6.4.29 Flint Group

- 6.4.30 FMC Corporation

- 6.4.31 GCP Applied Technologies Inc.

- 6.4.32 H.B. Fuller Company

- 6.4.33 Halliburton

- 6.4.34 Henkel AG & Co. KGaA

- 6.4.35 Hexcel Corporation

- 6.4.36 Huntsman International LLC

- 6.4.37 Infineum International Limited

- 6.4.38 Kemira

- 6.4.39 KRONOS Worldwide Inc.

- 6.4.40 Kurita Water Industries Ltd

- 6.4.41 Holcim

- 6.4.42 LANXESS

- 6.4.43 Lonza

- 6.4.44 MAPEI SpA

- 6.4.45 Merck KGaA

- 6.4.46 NIPSEA GROUP

- 6.4.47 Nouryon

- 6.4.48 Nutrien Ltd

- 6.4.49 Pidilite Industries Ltd

- 6.4.50 PPG Industries Inc.

- 6.4.51 Procter & Gamble

- 6.4.52 RPM International Inc.

- 6.4.53 SABIC

- 6.4.54 Schlumberger Limited

- 6.4.55 Sika AG

- 6.4.56 Solenis

- 6.4.57 Solvay

- 6.4.58 Syngenta

- 6.4.59 The Chemours Company

- 6.4.60 The Lubrizol Corporation

- 6.4.61 The Sherwin-Williams Company

- 6.4.62 Venator Materials PLC

- 6.4.63 Veolia

- 6.4.64 W. R. Grace & Co.

- 6.4.65 Wacker Chemie AG

- 6.4.66 Yara