|

市场调查报告书

商品编码

1651028

通讯云端:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Telecom Cloud - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

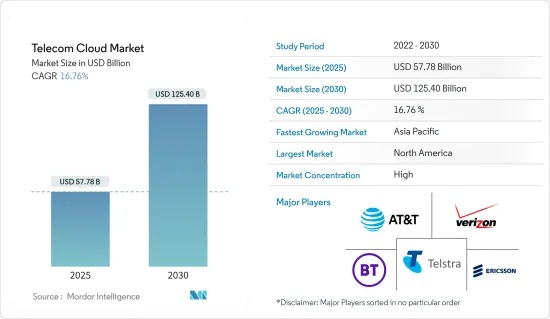

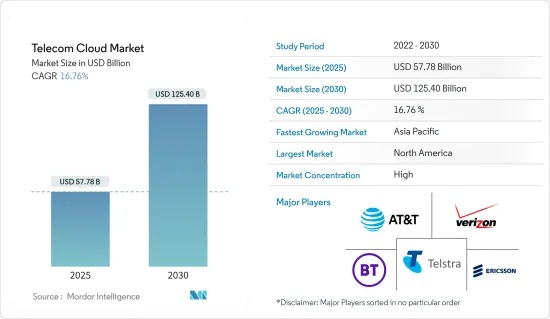

预计 2025 年通讯云端市场规模为 577.8 亿美元,到 2030 年将达到 1,254 亿美元,预测期内(2025-2030 年)的复合年增长率为 16.76%。

云端技术的最新趋势使通讯业者能够迁移到互联网,从而无需昂贵的硬体来维持与世界其他地区的连接。

主要亮点

- 云端原生技术、网路功能虚拟和软体定义网路结合所创建的分散式运算网路称为通讯云端。由于网路和运算资源分布在多个位置和云端,因此自动化和编配至关重要。这项发展是部署虚拟、可程式化和人工智慧的网路架构。采用改变网路架构的尖端云端业务策略是另一个方面。全球通讯云端趋势包括网路和行动装置的日益普及,以及各类业务的快速数位转型。

- 资讯和通讯技术的进步正在为世界各地的商业营运带来重大变化。各国政府和公共企业都依赖关键资讯基础设施服务。此外,越来越多的企业开始采用云端服务来满足其业务营运日益增长的需求。

- 预计对Over-The-Top增长、营运和管理成本降低以及企业对通讯云端认知度不断提高将推动市场成长。

- 随着对经济高效、用户友好、基于浏览器的通讯解决方案的需求不断增长,许多知名供应商都在寻求在北美推出垂直特定的 WebRTC 解决方案和服务,这有望推动市场成长。然而,网路威胁风险对市场成长构成了重大挑战,因为针对通讯业者的网路攻击可能会扰乱电话和网路消费者的服务、瘫痪企业并停止政府业务。

- 新冠疫情迫使电讯业进入变革时期期,以适应新技术和云端模式。越来越多的人在家工作、获取家庭教育资源以及观看串流影片娱乐。因此,通讯业的语音、资料和宽频服务呈现爆炸性成长也就不足为奇了。

通讯云端市场的趋势

可望主导通讯云端市场的解决方案

- 解决方案领域包括网路功能虚拟、整合通讯和协作以及内容交付网路等选项。网路和行动装置的日益普及推动了该解决方案的采用。因此,组织越来越需要利用新技术来提高业务效率和组织敏捷性。企业使用的应用程式包括语音邮件、电子邮件、IM(即时通讯)、统一通讯、语音、网路、视讯会议、文件共用、白板和社交网路。

- 市场上提供的解决方案包括整合通讯、协作和内容交付网路。这主要是由于网路和行动装置的普及率不断提高。因此,越来越多的企业意识到需要利用先进技术来提高业务敏捷性和业务效率。

- 这些企业部署了广泛的通讯和协作应用程序,包括电话、电子邮件、语音邮件、统一通讯、即时通讯(IM)、状态、音讯、网路、视讯会议、文件共用、白板、行动和社交网路。

- 此外,线上用户对媒体和丰富影片内容的需求呈指数级增长,再加上各行业终端用户组织数位化的趋势,也推动了对内容传递网路解决方案的需求。

北美将占据通讯云端市场的很大份额

- 在北美,拥有技术力员工的大公司持续提供创新技术并实现了强劲的渗透力。美国和加拿大对混合通讯云的采用正在增加,整合了公共云端领域一流的资料分析和人工智慧,以预测和满足消费者的需求和偏好。企业也使用云端来消除孤立的资料库,统一客户资料,提供引人入胜的全通路客户体验,并获得对客户的全方位视图。

- IT消费化也与行动性的蓬勃发展以及行动小工具的发展有关。此外,由于对用户友好且经济的基于浏览器的通讯解决方案的需求不断增长,一些知名製造商正在探索在北美提供特定产业的WebRTC 解决方案和服务的可能性。间接地,这有望加速市场成长。

- 此外,该地区的主导地位还可归因于近年来流动性的不断增加以及 IT 消费化导致的智慧行动装置的爆炸性增长。此外,随着对经济高效、用户友好、基于浏览器的通讯解决方案的需求不断增长,许多知名供应商都在寻求在北美推出垂直特定的 WebRTC 解决方案和服务,这有望间接促进市场成长。

- 近日,在今年MWC拉斯维加斯展会上,许多全新的通讯解决方案亮相,面向企业、云端、服务供应商甚至家庭。以下是北美最重要的连结性活动中展出的五种新鲜产品和服务。

- COVID-19 创造了一个新的转折点,要求整个地区的电信营运商大幅加快向云端的迁移,作为其数位转型的基础,以建立持续的卫生、通讯业者所需的弹性、新曲折点和产品以及结构性成本节约。

通讯云端产业概览

主要参与者包括 AT&T Inc.、BT Group PLC、Verizon Communications Inc.、Level 3 Communications Inc.、Telefonaktiebolaget LM Ericsson、Deutsche Telekom 和 NTT Communications Corporation。这些参与者越来越多地参与併购和产品推出,以开发和向市场推出新技术和新产品。因此,市场集中度可能很高。

- 2022 年 9 月-Wind River 和戴尔科技联手为通讯彻底改变云端部署。戴尔与 Wind River 共同设计的首个上市解决方案将有助于加速开放式云端原生网路技术的采用。

- 2022 年 5 月-诺基亚宣布发布其云端原生 IMS Voice Core 产品,以协助通讯服务供应商(CSP) 提高营运敏捷性、简化网路营运并降低网路管理成本。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 市场定义和范围

- 调查前提

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业相关人员分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场动态

- 市场驱动因素

- 混合云端在通讯业的采用日益增长

- 降低营运管理成本

- 市场挑战

- 安全漏洞风险

- COVID-19 对全球通讯云端市场的影响

第六章 重大技术投入

- 云端技术

- 人工智慧

- 网路安全

- 数位服务

第七章 市场区隔

- 按类型

- 解决方案

- 整合通讯与协作

- 内容传递网络

- 其他解决方案

- 服务

- 主机代管服务

- 网路服务

- 专业服务

- 託管服务

- 其他类型

- 解决方案

- 按应用

- 计费和配置

- 交通管理

- 其他应用

- 透过云端平台

- Software-as-a-Service

- Infrastructure-as-a-Service

- Platform-as-a-Service

- 按最终用户

- BFSI

- 零售

- 製造业

- 运输和配送

- 卫生保健

- 政府

- 媒体与娱乐

- 其他最终用户

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 亚太地区

- 印度

- 中国

- 日本

- 其他亚太地区

- 世界其他地区

- 北美洲

第八章 竞争格局

- 公司简介

- AT&T Inc.

- BT Group PLC

- Verizon Communications Inc.

- Telstra Corporation Ltd

- Telefonaktiebolaget LM Ericsson

- Deutsche Telekom

- NTT Communications Corporation

- CenturyLink Inc

- Singapore Telecommunications Limited

- China Telecommunications Corporation

- Telus Corporation

- Swisscom AG

第九章投资分析

第十章 市场机会与未来趋势

The Telecom Cloud Market size is estimated at USD 57.78 billion in 2025, and is expected to reach USD 125.40 billion by 2030, at a CAGR of 16.76% during the forecast period (2025-2030).

The latest trend of cloud technology has enabled telecommunication organizations to migrate to the internet, where there is no longer the need to have costly hardware for businesses to stay connected to the rest of the world.

Key Highlights

- A distributed computing network that combines cloud-native technologies, network function virtualization and software-defined networking is known as the "telecommunication cloud." Since network and computing resources are dispersed across several locations and clouds, automation and orchestration are crucial. This development is the deployment of a virtualized, programmable, and artificially intelligent network architecture. Adopting cutting-edge cloud business tactics that modify network architecture is another aspect. Some global telecom cloud trends include rising internet and mobile device adoption and the quick digital transformation of various businesses.

- The advancements in information and communications technology have brought remarkable changes in global business operations. Various government and public enterprises are dependent on critical information infrastructure services. Also, organizations are now showing more interest in cloud services to meet the growing demand from business operations.

- The increasing demand for over-the-top cloud services, lower operational and administrative costs, and growing awareness about telecom cloud among enterprises are expected to boost the market's growth.

- With the rising demand for cost-effective and user-friendly browser-based communication solutions, many notable vendors are looking to introduce vertical-specific WebRTC solutions and services in North America, which is expected to boost the market's growth. However, the risk of cyber threats poses a significant challenge to market growth, as cyber attacks on telecommunication operators can disrupt services for phone and internet consumers, cripple businesses, and shut down government operations.

- Due to the Covid-19 pandemic, the telecom industry is experiencing a transformational period of advancement to adjust to new technologies and cloud patterns. With an increasing number of people working from home, obtaining educational resources for homeschooling and streaming video entertainment is rising. Given this, the telco industry is naturally seeing spikes in voice, data, and broadband services.

Telecom Cloud Market Trends

Solution Expected To Dominate the Telecom Cloud Market

- The solution area includes options for network function virtualization, unified communication and collaboration, and content delivery networks. The growing use of the internet and mobile devices is driving the acceptance of solutions. As a result, organizations need to leverage new technology more and more to improve operational efficiency and organizational agility. Applications used by businesses include voicemail, email, IM (instant messaging), unified messaging, audio, web, and video conferencing, file sharing, whiteboarding, social networking, and more.

- The solution offerings in the market include unified communication and collaboration, a content delivery network, and other solutions. This is majorly owing to the increasing internet and mobile device penetration. With this, businesses increasingly acknowledge the need to leverage advanced technologies to improve business agility and gain operational efficiencies.

- They are deploying a broad array of communications and collaboration applications, including telephone, email, voice mail, unified messaging, instant messaging (IM) and presence, audio, web, and video conferencing, file sharing and whiteboarding, mobility, social networking, and more.

- Additionally, the exponentially rising media content and demand for rich video content among the increasing online users, along with the trend of digitization among organizations across end-user verticals, spurs the need for content delivery network solutions.

North America Holds the Major Share in the Telecom Cloud Market

- North America witnessed a huge penetration from large enterprises with technically-skilled employees, providing continuous innovative technologies. In the U.S. and Canada, there is an increase in the use of hybrid telco cloud installations, which enables the integration of best-in-class data analytics and artificial intelligence available in the public cloud sector to anticipate and meet the needs and preferences of consumers. The businesses also use the cloud to get rid of silo databases, combine customer data, offer an engaging Omni channel customer experience, and develop a 360-degree view of the customer.

- The consumerization of IT, which is also to blame for this region's dominance, may be linked to the current boom in mobility and the development of intelligent mobile gadgets. In addition, several well-known manufacturers are looking into the possibilities of providing industry-specific WebRTC solutions and services in North America in response to the growing need for browser-based communication solutions that are user-friendly and economical. Indirectly, this is anticipated to accelerate market growth.

- Further, the dominance of this region can be attributed to the recent increase in mobility and the explosion of smart mobile devices due to the consumerization of IT. Moreover, with the rising demand for cost-effective and user-friendly browser-based communication solutions, many notable vendors are looking to introduce vertical-specific WebRTC solutions and services in North America, which is indirectly expected to boost the market's growth.

- Recently, A wide range of brand-new telecommunications solutions aimed at businesses, cloud and service providers, and even homes were displayed at MWC Las Vegas this year. Here is a selection of five fresh goods and services displayed at North America's most important connectivity event.

- COVID-19 has created a new inflection point that requires every regional telecom provider to dramatically accelerate the move to the cloud as a foundation for digital transformation to build the resilience, new experiences and products, and structural cost reduction that the ongoing health, economic, and societal crisis demands.

Telecom Cloud Industry Overview

The major players include AT&T Inc., BT Group PLC, Verizon Communications Inc., Level 3 Communications Inc., Telefonaktiebolaget L.M. Ericsson, Deutsche Telekom, and NTT Communications Corporation. These players are increasingly undertaking mergers and acquisitions and product launches to develop and introduce new technologies and products in the market. Hence, the market concentration will be high.

- September 2022 - Wind River and Dell Technologies have cooperated to revolutionize telecom cloud installations. The market-first co-engineered Dell solution with Wind River will aid in accelerating the adoption of open, cloud-native network technologies.

- May 2022 - The cloud-native IMS Voice Core product, which Nokia announced the release, will aid CSPs (Communication Service Providers) in enhancing operational agility, streamlining network operations, and lowering the cost of managing their networks.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Market Definition and Scope

- 1.2 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Stakeholder Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of Hybrid Cloud in Telecom

- 5.1.2 Lower Operational and Administration Costs

- 5.2 Market Challenges

- 5.2.1 Risk of Security Breaches

- 5.3 Impact of Covid-19 in Global Telecom Cloud Market

6 KEY TECHNOLOGY INVESTMENTS

- 6.1 Cloud Technology

- 6.2 Artificial Intelligence

- 6.3 Cyber Security

- 6.4 Digital Services

7 MARKET SEGMENTATION

- 7.1 Type

- 7.1.1 Solution

- 7.1.1.1 Unified Communication and Collaboration

- 7.1.1.2 Content Delivery Network

- 7.1.1.3 Other Solutions

- 7.1.2 Service

- 7.1.2.1 Colocation Services

- 7.1.2.2 Network Services

- 7.1.2.3 Professional Services

- 7.1.2.4 Managed Services

- 7.1.3 Other Types

- 7.1.1 Solution

- 7.2 Application

- 7.2.1 Billing and Provisioning

- 7.2.2 Traffic Management

- 7.2.3 Other Applications

- 7.3 Cloud Platform

- 7.3.1 Software-as-a-Service

- 7.3.2 Infrastructure-as-a-Service

- 7.3.3 Platform-as-a-Service

- 7.4 End User

- 7.4.1 BFSI

- 7.4.2 Retail

- 7.4.3 Manufacturing

- 7.4.4 Transportation and Distribution

- 7.4.5 Healthcare

- 7.4.6 Government

- 7.4.7 Media and Entertainment

- 7.4.8 Other End Users

- 7.5 Geography

- 7.5.1 North America

- 7.5.1.1 US

- 7.5.1.2 Canada

- 7.5.2 Europe

- 7.5.2.1 Germany

- 7.5.2.2 UK

- 7.5.2.3 France

- 7.5.2.4 Italy

- 7.5.2.5 Rest of Europe

- 7.5.3 Asia Pacific

- 7.5.3.1 India

- 7.5.3.2 China

- 7.5.3.3 Japan

- 7.5.3.4 Rest of Asia-Pacific

- 7.5.4 Rest of the World

- 7.5.1 North America

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 AT&T Inc.

- 8.1.2 BT Group PLC

- 8.1.3 Verizon Communications Inc.

- 8.1.4 Telstra Corporation Ltd

- 8.1.5 Telefonaktiebolaget LM Ericsson

- 8.1.6 Deutsche Telekom

- 8.1.7 NTT Communications Corporation

- 8.1.8 CenturyLink Inc

- 8.1.9 Singapore Telecommunications Limited

- 8.1.10 China Telecommunications Corporation

- 8.1.11 Telus Corporation

- 8.1.12 Swisscom AG