|

市场调查报告书

商品编码

1651031

北美塑胶包装:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)NA Plastic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

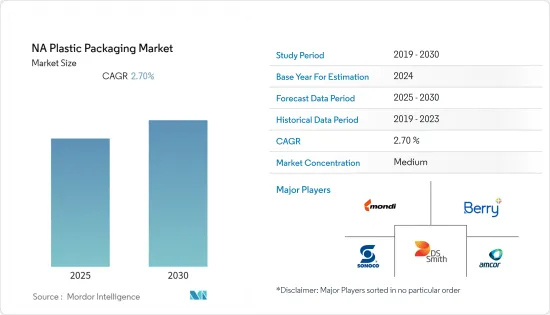

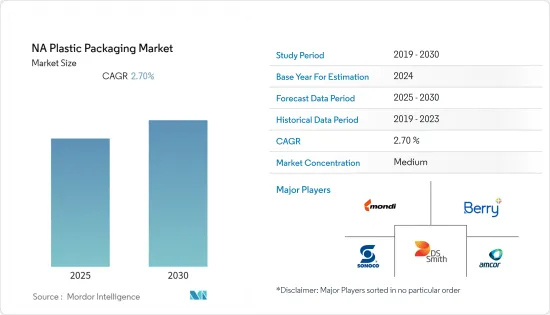

预计预测期内北美塑胶包装市场的复合年增长率为 2.7%。

主要亮点

- 近年来,北美包装产业发生了巨大变化,电子商务的成长、数位印刷的创新和永续性推动了市场的发展。这推动了对永续包装的需求。例如,根据软包装协会的调查,超过 60% 的北美消费者愿意为有形的功能性包装优势(如产品保护、运输便利性和供应链效率)支付更多费用。

- 软包装主要用于食品,占整个市场的60%以上。美国软包装产业正在经历健康成长,这得益于该行业面临的许多包装挑战的创新解决方案的实施。据软包装协会称,品牌所有者正在采用薄膜、小袋和袋子作为包装解决方案,部分原因是它们在美国消费者中被广泛接受。

- 国内铝需求的增加,导致从中国进口的铝箔数量激增。过去10年,中国对美国的铝箔出货量增加了近10倍,达到约2.65亿磅。目前,软包装主要用于食品,其中成长最快的领域是咖啡、零嘴零食、生鲜食品、已调理食品和宠物食品。

- 由于许多行业越来越多地采用创新包装技术,预计加拿大将经历更高的成长。此外,该地区零售业蓬勃发展,并且在零售领域处于全球领先地位,因此严重依赖灵活的包装方法。

- 在加拿大,能够延长成品食品保质期的包装介质越来越受欢迎,这推动了加拿大食品和饮料行业的硬质包装发展。此外,对方便食品的需求不断增长以及核心家庭的数量不断增加预计将进一步推动食品和饮料硬包装市场的采用。

北美塑胶包装市场趋势

来自终端用户的食品——预计在预测期内,软质塑胶包装将占据落后份额

- 由于外出用餐的需求不断增加以及食品零售业务的成长,食品业在市场研究中占据着突出的份额。该地区的消费者越来越注重维持健康的饮食习惯,新鲜、健康食品送到他们手中所需的时间也正在改变。

- FDA 对国家的食品业进行严格监管。 FDA 负责监管该国销售的大多数包装食品,并对包装必须包含的物质、身份、净含量、营养成分、成分等有具体要求。该政府机构根据有关食品接触物质、食品和包装辐照以及环境的决定制定具体的包装法规。

- FDA 正在开发用于食品接触通知 (FCN) 的包装因素 (PF) 的更新资料库,其中可能包括 550 种食品的 PF。这项发展与该国各非政府组织的游说一致,要求 FDA 撤销食品包装中使用 PFAS 的核准。

- 包装食品出口的增加推动了对软包装的需求。加拿大加工食品出口到190个国家。我们的产品大部分出口到美国、中国、日本、墨西哥、俄罗斯和韩国。据加拿大统计局称,加拿大加工食品出口额达 280 亿加元。

- 加拿大的零售和食品服务业的销售额也在成长。对即食消费、速食等的需求推动了加工食品的成长,从而促进了软包装市场的发展。根据美国农业部外国农业服务局 2019 年的研究,2017 年至 2022 年期间加拿大包装食品销售额预计增长的可能是甜饼干、点心棒和水果零食,增长 19.8%,其次是涂抹酱、食用油和乳製品,分别增长 15.8%、13.8% 和 12.3%。研究进一步发现,2018 年包装食品进口总额达 248 亿加币。

- 近日,美国食品药物管理局(FDA)与加拿大食品检验局(CFIA)和加拿大卫生署达成协议。该协议旨在核准食品安全系统和检查。因此,遵守 FDA 包装产品品质标准的需求促使加拿大製造商为其产品采用增强的包装材料和系统。

- 此外,美国和加拿大的主要铝箔容器製造商已经成立了一个协会,即铝箔容器製造商协会(AFCMA),其使命是生产最高品质的产品并向公众宣传铝箔容器的好处。

加拿大可望成为最大市场

- 许多加拿大消费者越来越倾向使用更环保的包装。由于塑胶和塑胶製品的使用会对环境产生有害影响,这些国家的政府对该行业实施了非常严格的规章制度,与其他材料相比,该行业增长相对缓慢。

- 同时,安大略省管理部门在各个市政当局开展的「塑胶在行」宣传活动正在刺激路边蓝色垃圾箱的硬质塑胶容器的供应。安大略省瓶装水製造商 Ice River Springs 的回收部门正在将宝特瓶与超级市场瓶壳混合,以製造 100% 再生瓶。该工作小组汇集了包装和废弃物管理产业、政府、大学、产业协会和沃尔玛供应商合作伙伴的代表,是首批专注于减少包装和废弃物转移的工作小组之一。

- 沃尔玛加拿大包装 SVN推出了永续包装记分卡,根据材料类型和重量、产品与包装的永续性以及立方体利用率等多项标准来评估产品包装的可持续性。 SVN 也与其他几个组织的代表合作成立了一个材料优化委员会,其目标是探索提高掩埋回收率和增加从垃圾掩埋场转移的废弃物量的方法。

- 随着对永续性的关注度日益提高,公司正致力于采用环保和可回收的产品。每年,加拿大塑胶产业积极参与并支持加拿大各地市政当局的项目,以增加收集的塑胶数量和种类。 Recycle BC 是一家非营利组织,负责整个不列颠哥伦比亚省的住宅包装和纸製品回收。

- 小森株式会社和 Komcan Inc. 正在透过向软包装公司提供机械和设备来扩大其在加拿大包装市场的份额。例如,Produlith Packaging 公司用一台配备涂布机(GLX640C)和 H-UV 油墨固化系统的六色小森 Lithrone GX40 印刷机取代了两台竞争对手的印刷机,同时还采用了小森的 KP-Connect 技术,这云端基础的资料驱动操作技术,可以即时控制所有印刷过程。

- 据安大略省回收委员会称,加拿大约有 9% 的塑胶被回收利用,其余的则被送入垃圾掩埋场或被当作垃圾丢弃。加拿大消费者越来越倾向于使用可回收的食品包装,并且更倾向于对包装负责的品牌。

- 2020年2月,加拿大领先的食品和饮料包装公司联手在该国发展塑胶循环经济。该地区的公司也在创新和开发灵活的食品包装产品。例如,2019 年 7 月,ProAmpac 凭藉其新的儿童零食包装设计获得了 PAC 加拿大领导力银奖,并凭藉顶级护髮产品软质包装图形创新获得了第二名。

北美塑胶包装产业概况

北美塑胶包装市场竞争激烈,有几个主要参与者。少数参与者享有更好的市场信誉,并扩大了地理知名度和影响力。拥有较大市场份额的大型企业正致力于扩大其在终端用户行业的基本客群。

- 2020 年 6 月 - Amcor 与 Espoma Organic 合作创新更具永续的包装并推出新型生物基聚合物包装。聚乙烯(PE)薄膜含有25%源自甘蔗的生物基材料。

- 2020 年 9 月 – 安姆科 (Amcor) 将与雀巢合作,推出用于湿猫粮的可回收柔性杀菌袋,可将消费包装的环境足迹改善多达 60%。新款包装袋符合 CEFLEX 联盟最近发布的《循环经济包装指南》。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

- 产业价值链分析

第五章 市场动态

- 市场驱动因素

- 便捷包装需求不断成长

- 人口和生活方式的变化

- 市场限制

- 对製造商在环境恶化方面的严格规定

- 评估新冠肺炎对市场的影响

第六章 按类型细分市场

- 硬质塑胶包装

- 按材质

- PE

- PP

- PET

- PS 和 EPS

- 其他材料

- 按产品

- 瓶子和罐子

- 托盘和容器

- 盖子与封口装置

- 其他产品

- 按最终用户

- 食物

- 饮料

- 个人护理

- 药品

- 其他最终用户

- 按材质

- 软质塑胶包装

- 按材质

- PE

- BOPP

- CPP

- 其他材料

- 按产品

- 袋子和包包

- 薄膜包装

- 更多产品

- 按最终用户

- 食物

- 饮料

- 个人护理

- 其他最终用户

- 按材质

- 按国家

- 美国

- 加拿大

第七章 竞争格局

- 公司简介

- Berry Global Inc.

- Anchor Packaging

- Amcor PLC

- Mondi PLC

- American Packaging Corporation

- Tetra Pak International SA

- US Packaging & Prapping LLC

- Crown Holdings Inc.

- Packaging Corporation of America

- Owens Illinois Inc.

- Transcontinental Inc.

- Emmerson Packaging

- DS Smith PLC

- Winpak Ltd

- ES Plastic

- Guycan Plastics Limited

- Sonoco Products Company

- St. Johns Packaging

- Flair Flexible Packaging Corporation

第八章投资分析

第九章:市场的未来

简介目录

Product Code: 55176

The NA Plastic Packaging Market is expected to register a CAGR of 2.7% during the forecast period.

Key Highlights

- The packaging industry in the North American region has undergone a drastic change in recent years, and the growth of e-commerce, along with innovations in digital printing, and sustainability are driving the market. Due to this, there has been an increased demand for sustainable, flexible packaging. For instance, according to the Flexible Packaging Association, more than 60% of consumers in North America are keen to pay more for tangible and functional packaging benefits, such as product protection, shipping friendly, and supply chain efficacy, among others.

- Flexible packaging is mainly used for food, which contributes to more than 60% of the total market. The US flexible packaging industry is witnessing healthy growth, as the industry was able to implement innovative solutions for the many packaging challenges it faced. According to the Flexible Packaging Association, brand owners are taking on films, pouches, and bags as a go-to packaging solution, acknowledgments in part to extensive acceptance by American consumers.

- The increased domestic demand for aluminum has led to an upsurge in aluminum foil imports from China, whose foil shipments to the United States increased almost 10-fold, valued at around 265 million pounds, in the last decade. Today, flexible packaging is mostly used for food, with the fastest areas of expansion being coffee, snack foods, fresh produce, ready-to-eat meals, and pet food.

- Canada is anticipated to witness a higher growth rate due to the growing adoption of innovative packaging techniques across numerous industries. Furthermore, the region has a flourishing retail industry that banks heavily on flexible packaging methods, being a global leader in the retail industry.

- The increasing popularity of packaging media in Canada, which provides long shelf life to finished food products, is driving the rigid packaging in the food and beverage industry in Canada. Moreover, the rising demand for convenience food and an increasing number of nuclear families is expected to further enhance the adoption of the rigid packaging market for food and beverages.

North America Plastic Packaging Market Trends

Food from end-user - flexible plastic packaging is expected to hold lagest share during the forecast period

- The food segment holds a prominent share of the market studied due to the rising demand for food services and the growing retail food business. The consumers in the region are increasingly becoming cautious about maintaining a healthy diet, which is transforming the time of fresh, healthy food being delivered to them, which, in turn, is expected to augment the demand for flexible food packaging.

- The FDA highly regulates the food industry in the country. The FDA regulates most packaged foods sold in the country and has specific requirements, such as what elements a package must contain, identity statement, net quantity, nutrition facts, and ingredients. The government body has a particular set of packaging rules based on food contact substances, irradiation of food and packaging, and environmental decisions.

- The FDA is developing an updated database of packaging factors (PFs) for food contact substance notifications (FCNs) that may include PFs for 550 food items. The development is in line with the push from various NGOs in the country to pull the FDA's approval of PFASs in food packaging.

- The demand for flexible packaging is rising due to the increase in exports of packaged foods. Processed food products from Canada are exported to 190 countries. A significant share of the products is exported to the United States, China, Japan, Mexico, Russia, and South Korea. According to StatCan, the export value of processed food products from Canada was CAD 28 billion.

- The country is also witnessing an increasing growth in its retail and food services sales. The demand for on-the-go consumption, and fast food, among others, is driving the growth of processed food, which, in turn, is boosting the flexible packaging market. According to the USDA Foreign, Agricultural Service studies 2019, the expected sales growth of packaged food in Canada between 2017 and 2022 may be driven by sweet biscuits, snack bars, and fruit snacks with 19.8% growth followed by spreads, edible oil, dairy with 15.8%, 13.8%, and 12.3% respectively. Additionally, according to the same study, the import of packaged food in 2018 was CAD 24.8 billion.

- In the recent past, US Food and Drug Administration (FDA) signed an arrangement with the Canadian Food Inspection Agency (CFIA) and the Department of Health Canada (Health Canada). The agreement is aimed at recognizing food safety systems and inspections. Thus, with the need to comply with packaging product quality standards of the FDA, Canadian manufacturers have sought to adopt enhanced packaging materials and systems for their products.

- Moreover, leading manufacturers of aluminium foil containers in the United States and Canada have formed an association, the Aluminium Foil Container Manufacturers Association (AFCMA), dedicated to producing top quality products and educating the public of the advantages of aluminium foil containers.

Canada is expected to hold the largest market

- Many consumers in Canada are increasingly moving toward eco-friendly packaging materials. As the usage of plastic and plastic products has potentially hazardous implications on the environment, governments in these countries have imposed very stringent rules and regulations in the industry, making it a relatively slower-growing industry compared to other materials.

- At the same time, Stewardship Ontario's "Plastic Is In" campaigns in municipalities are stimulating the supply of rigid plastic containers in curbside Blue Boxes. Ontario bottled water manufacturer Ice River Springs' Recycling Division uses a mix of PET bottles and supermarket shells to create 100% recycled bottles. It is one of the first working groups focused on packaging reduction and waste diversion, bringing together representatives from the packaging and waste management industries, government, universities, industry associations, and Walmart vendor partners.

- The Walmart Canada Packaging SVN launched the Sustainable Packaging Scorecard, which evaluates the sustainability of product packaging based on several criteria, such as material type and weight, product-to-package ratio, and cube utilization. They also collaborated with representatives of several other organizations to form the Material Optimization Committee, aimed at exploring how to improve recycling rates for packaging and increase the volume of waste diverted from landfills.

- With the increased focus on sustainability, companies are focusing on adopting eco-friendly and recyclable products. Each year, the Canadian plastics industry undertakes proactive outreach and program support to municipalities across Canada in order to increase the amount and types of plastics collected for recycling. Recycle BC is a not-for-profit organization responsible for residential packaging and paper product recycling throughout British Columbia.

- Komori and Komcan Inc. extended their presence in the Canadian packaging market by providing flexible packaging companies with machinery and equipment. For instance, Produlith Packaging replaced two competitive presses with the purchase of a six-color Komori Lithrone GX40 with coater (GLX640C) and H-UV ink curing system along with Komori's KP-Connect, a cloud-based technology for data-driven operations that offers real-time control of all printing processes.

- According to the recycling council of Ontario, Canada recycles about 9% of its plastics, with the rest dumped in landfills or tossed away as litter. Consumers in the country are increasingly moving toward recyclable food packaging materials and prefer brands that are responsible for their packaging that pushes the market for flexible packaging.

- In February 2020, major Canadian food and beverage packaging companies collaborated to develop a circular economy for plastic in the country. The companies are also innovating and developing flexible food packaging products in the region. For instance, in July 2019, ProAmpac achieved silver PAC Canadian leadership awards for designing the packaging for new children's snacks and the second for graphics innovation in flexible packaging for premier hair care products.

North America Plastic Packaging Industry Overview

The North America Plastic Packaging Market is highly competitive and has several major players. A few of the players enjoy better market goodwill and extended geographical recognition and presence. The major players, who have a relatively prominent share in the market, are focusing on expanding their customer base across the end-user industries.

- JUN 2020- Amcor partnered with Espoma Organic to innovate more sustainable packaging and launch a new bio-based polymer package. The polyethylene (PE) film contains 25% bio-based material derived, in this case, from sugarcane.

- SEP 2020- Amcor collaborated with Nestle to launch recyclable flexible retort pouches that will improve the environmental footprint of consumer packaging by up to 60%, starting with wet cat food. The new pouch meets the packaging guidelines for a circular economy recently published by the CEFLEX Consortium.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 The Increased Demand for Convenient Packaging

- 5.1.2 Changing Demographic and Lifestyle Factors

- 5.2 Market Restraints

- 5.2.1 Stringent Regulation on Manufacturers Pertaining to Environmental Degradation

- 5.3 Assessment of the Impact of COVID 19 on the market

6 MARKET SEGMENTATION - BY TYPE

- 6.1 Rigid Plastic Packaging

- 6.1.1 By Material

- 6.1.1.1 PE

- 6.1.1.2 PP

- 6.1.1.3 PET

- 6.1.1.4 PS and EPS

- 6.1.1.5 Other Materials

- 6.1.2 By Product

- 6.1.2.1 Bottles and Jars

- 6.1.2.2 Trays and Containers

- 6.1.2.3 Caps and Closures

- 6.1.2.4 Other Products

- 6.1.3 By End User

- 6.1.3.1 Food

- 6.1.3.2 Beverage

- 6.1.3.3 Personal Care

- 6.1.3.4 Pharmaceuticals

- 6.1.3.5 Other End Users

- 6.1.1 By Material

- 6.2 Flexible Plastic Packaging

- 6.2.1 By Material

- 6.2.1.1 PE

- 6.2.1.2 BOPP

- 6.2.1.3 CPP

- 6.2.1.4 Other Materials

- 6.2.2 By Product

- 6.2.2.1 Pouches and Bags

- 6.2.2.2 Films and Wraps

- 6.2.2.3 Other Products

- 6.2.3 By End User

- 6.2.3.1 Food

- 6.2.3.2 Beverage

- 6.2.3.3 Personal Care

- 6.2.3.4 Other End Users

- 6.2.1 By Material

- 6.3 By Country

- 6.3.1 US

- 6.3.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Berry Global Inc.

- 7.1.2 Anchor Packaging

- 7.1.3 Amcor PLC

- 7.1.4 Mondi PLC

- 7.1.5 American Packaging Corporation

- 7.1.6 Tetra Pak International SA

- 7.1.7 U.S. Packaging & Prapping LLC

- 7.1.8 Crown Holdings Inc.

- 7.1.9 Packaging Corporation of America

- 7.1.10 Owens Illinois Inc.

- 7.1.11 Transcontinental Inc.

- 7.1.12 Emmerson Packaging

- 7.1.13 DS Smith PLC

- 7.1.14 Winpak Ltd

- 7.1.15 ES Plastic

- 7.1.16 Guycan Plastics Limited

- 7.1.17 Sonoco Products Company

- 7.1.18 St. Johns Packaging

- 7.1.19 Flair Flexible Packaging Corporation

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219