|

市场调查报告书

商品编码

1651042

海上管道 -市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Offshore Pipeline - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

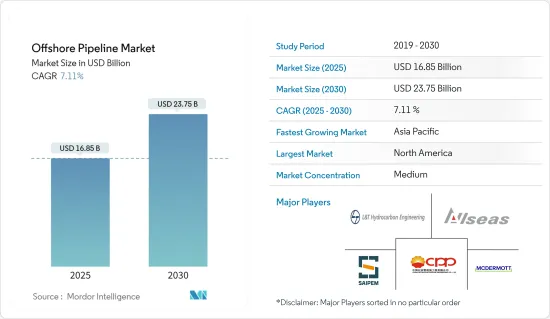

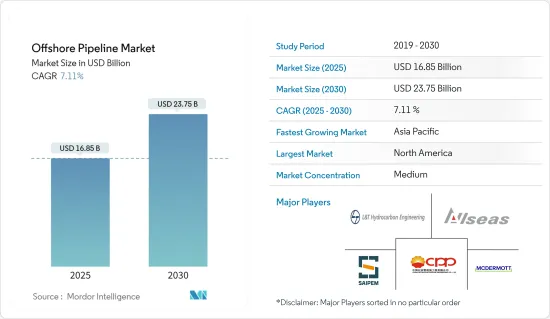

预计 2025 年海上管道市场规模为 168.5 亿美元,到 2030 年预计将达到 237.5 亿美元,预测期内(2025-2030 年)的复合年增长率为 7.11%。

从长远来看,预测期内预计推动市场发展的因素包括:原油和天然气需求不断增加(尤其是亚太地区的需求),以及对石油和天然气探勘的安全性、经济性和可靠连通性的日益重视。

另一方面,预计建筑、深水挑战和高昂建筑成本等技术挑战将抑制市场成长。

预计在预测期内,透过欧洲和亚太地区的海底(海上)管道进口的石油和天然气将增加为海上管道市场创造庞大的商机。

由于海上探勘活动的活性化,以美国和加拿大为首的北美很可能在预测期内主导海上管道市场。

海上管道市场趋势

天然气产业可望强劲成长

- 天然气需求的不断增长推动了新天然气田的发现和使用海底管线进行简单、低成本的天然气出口运输的采用,预计这将推动海上管道市场的发展。

- 2022年全球天然气产量为40,438亿立方公尺。北美地区天然气产量居世界首位,约12,039亿立方米,其次是中东和非洲,产量为9,703亿立方米。预计这将在预测期内推动海上管道市场的发展。

- 2022年9月,德国EUROPIPE公司订单北美公司TC Energy(TCE)的墨西哥湾酵母门户管线计划的管线供应合约。 TCE 正在与墨西哥国有电力公司联邦电力委员会 (CFE) 合作建造一条价值 45 亿美元的海上天然气管道,以确保墨西哥东南部的电力供应。该计划于八月底被订单了 Salzgitter Mannesmann 与 Aktien-Gesellschaft der Dillinger Huttenwerke 的合资企业 EUROPIPE。计划范围为供应265,000吨(365公里)防腐涂层管道。

- 此外,2023 年 1 月,埃尼报告称,在位于埃及近海东地中海纳尔吉斯油田的纳尔吉斯 1 号勘探井发现了新的重大天然气。 Nargis-1 井的钻探水深为 1,014 英尺(309 公尺),并遇到了约 200 英尺(61 公尺)厚的中新世和渐新世含气砂岩。可以利用埃尼现有的设施来开发这项发现。

- 此外,最近一波成本削减和重大技术突破使得许多石油和天然气探勘和生产公司能够向永续深水和超深水开发领域拓展。

- 因此,预计不久的将来海上管道市场将迅速扩张。鑑于上述情况,预计预测期内天然气产业将快速成长。

北美可望主导市场

- 预计预测期内北美将主导全球海上管道市场。该地区的几个国家正在寻求投资海上石油和天然气探勘。预计预测期内美国和加拿大等国家的石油和天然气管道基础设施将保持运作。

- 由于墨西哥湾活动增多,美国海上管道市场预计将大幅扩张。计划中的新天然气生产计划预计将大幅扩大该地区的海底管线网路。

- 例如,2023 年 1 月,总部位于休士顿的 Talos Energy 在美国墨西哥湾的两个深水发现中发现了商业数量的石油和天然气,并计划将其开发为 Ram Powell张力脚平臺(TLP) 的海底回接装置。据美国称,在 Lime Rock 和 Venice 主要目标区分别发现了 78 英尺和 72 英尺的产油层。

- 截至 2021 年 12 月,TC Energy Corp. 和墨西哥国有电力公司 Comision Federal de Electricidad (CFE) 正在就建设一条新的海上天然气管道进行谈判,以向尤卡坦半岛供应天然气,该半岛因国内生产停滞而面临长期天然气短缺。此外,Sempra 每年 325 万吨的 Energia Costa Azul (ECA) 液化天然气 (LNG) 第一期终端于 2021 年做出了最终投资决定。预计该线将于 2024 年投入营运。

- 此外,预计未来几年技术进步将为加拿大的管道业务带来稳定强劲的成长。加拿大石油和天然气产业认为管道是满足高价值终端用户市场能源需求最安全、最可靠、最具成本效益的方式。

- 因此,由于对石油和天然气计划的投资增加,预计预测期内北美将成为海上管道市场的领先地区。

海上管道产业概况

海上管道市场适度细分。市场的主要企业(不分先后顺序)包括 Saipem SpA、L&T Hydrocarbon Engineering Limited、McDermott International Ltd.、Allseas Group SA 和中国石油管道工程公司。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第 2 章执行摘要

第三章调查方法

第四章 市场概况

- 介绍

- 至2029年的市场规模及需求预测(单位:美元)

- 截至2029年全球原油历史趋势及产量预测(单位:百万桶/日)

- 布兰特原油与亨利港现货价格(截至 2023 年)

- 至 2029 年世界天然气产量的历史趋势和预测(单位:十亿立方英尺/天)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 石油和天然气需求不断增加

- 越来越重视石油和天然气探勘的安全性、经济性和可靠的连接性

- 限制因素

- 建设技术难题、深水难题、建造成本高

- 驱动程式

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔

- 产品类型

- 油

- 气体

- 2029 年市场规模与需求预测(按地区)

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 挪威

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 韩国

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 伊朗

- 卡达

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 其他中东和非洲地区

- 北美洲

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- Saipem SpA

- L&T Hydrocarbon Engineering Limited

- McDermott International Ltd.

- Allseas Group SA

- Bourbon Corporation SA

- Enbridge Inc.

- Subsea 7 SA

- Genesis Energy LP

- China Petroleum Pipeline Engineering Co. Ltd.

- Atteris LLC

- 市场排名/份额分析

第七章 市场机会与未来趋势

- 透过海底(近海)管道增加欧洲-亚太地区石油和天然气进口

The Offshore Pipeline Market size is estimated at USD 16.85 billion in 2025, and is expected to reach USD 23.75 billion by 2030, at a CAGR of 7.11% during the forecast period (2025-2030).

Over the long term, factors such as increasing demand for crude oil and natural gas, especially from the Asia-Pacific region, and growing emphasis on safe, economic, and reliable connectivity for oil and gas exploration are expected to drive the market during the forecast period.

On the other hand, technical challenges like construction, deep-water challenges, and high construction costs are expected to restrain market growth.

Nevertheless, increasing oil and gas imports in the European and Asia-Pacific regions through subsea (offshore) pipelines are expected to create huge opportunities for the offshore pipeline market during the forecast period.

North America, led by the United States and Canada, would likely dominate the offshore pipeline market during the forecast period due to the increased offshore exploration activities.

Offshore Pipeline Market Trends

The Gas Segment is Expected to Witness Significant Growth

- The rising demand for natural gas has resulted in the discovery of new gas fields as well as the adoption of simple and low-cost transportation of natural gas exports via subsea (offshore) pipelines, which are anticipated to drive the offshore pipeline market.

- Global natural gas production was recorded at 4043.8 billion cubic meters in 2022. North America is the leading natural gas producer, accounting for about 1203.9 billion cubic meters, followed by the Middle East and Africa with 970.3 billion cubic meters. This is expected to drive the offshore pipeline market during the forecast period.

- In September 2022, EUROPIPE, located in Germany, was awarded by North American TC Energy (TCE) a contract to supply pipe for the Southeast Gateway Pipeline project in the Gulf of Mexico. TCE is constructing the USD 4.5 billion offshore gas pipeline in collaboration with the Mexican state-owned power utility Comision Federal de Electricidad (CFE) to ensure southeastern Mexico's electricity supply. The project was awarded to EUROPIPE, a joint company of Salzgitter Mannesmann and Aktien-Gesellschaft der Dillinger Huttenwerke, at the end of August. The project's scope involves supplying 265,000 metric tons of pipe (365 kilometers) with anti-corrosion coating.

- Additionally, in January 2023, Eni reported a significant new gas discovery at the Nargis-1 exploration well in the Nargis Offshore Area Concession off the coast of Egypt in the Eastern Mediterranean Sea. The Nargis-1 well was drilled in 1,014 feet (309 m) of water and encountered roughly 200 net feet (61 m) of Miocene and Oligocene gas-bearing sandstones. The discovery can be developed by taking advantage of Eni's current facilities.

- Furthermore, recent waves of cost reductions and key technological breakthroughs have allowed many oil and gas exploration and production companies to diversify into sustainable deepwater and ultra-deepwater developments.

- As a result, the offshore pipeline market is anticipated to expand rapidly in the near future. As a result of the preceding, the gas segment is anticipated to grow at a rapid pace during the forecast period.

North America is Expected to Dominate the Market

- During the forecast period, North America is anticipated to dominate the global offshore pipeline market. Several countries in the area are attempting to invest in offshore oil and gas exploration. During the forecast period, oil and gas pipeline infrastructure in countries such as the United States and Canada is anticipated to remain fully operational.

- With increased activity in the Gulf of Mexico, the offshore pipeline market in the United States is anticipated to expand significantly. The forthcoming new gas production projects are expected to significantly expand the region's subsea pipeline network.

- For instance, in January 2023, Talos Energy, headquartered in Houston, discovered commercial quantities of oil and natural gas in two deepwater discoveries in the United States Gulf of Mexico, which it intends to develop as subsea tie-backs to its Ram Powell tension-leg platform (TLP). According to the US player, 78 feet and 72 feet of net pay zone thickness were discovered in the main targets at Lime Rock and Venice, respectively, with excellent geologic qualities.

- As of December 2021, TC Energy Corp. and Mexican state power utility Comision Federal de Electricidad (CFE) were in talks to build a new offshore gas pipeline to supply the Yucatan Peninsula, which has faced chronic gas shortages due to stagnant domestic production. Also, Sempra's 3.25 million metric tons/year (mmty) Energia Costa Azul (ECA) liquefied natural gas (LNG) Phase 1 terminal reached a final investment decision in 2021. It is expected to start operation by 2024.

- Furthermore, technological advancements are anticipated to drive stable and robust growth in the Canadian pipeline business over the next several years. Pipelines are regarded as the safest, most dependable, and most cost-effective way of meeting the energy needs of high-value end-user markets in the Canadian oil and gas sector.

- As a result, North America is anticipated to be the major region in the offshore pipeline market during the forecast period, owing to increased investment in oil and gas projects.

Offshore Pipeline Industry Overview

The offshore pipeline market is moderately fragmented. Some of the major players in the market (in no particular order) include Saipem SpA, L&T Hydrocarbon Engineering Limited, McDermott International Ltd., Allseas Group SA, and China Petroleum Pipeline Engineering Co. Ltd., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Crude Oil Historic Trend and Production Forecast in million barrels per day, Global, until 2029

- 4.4 Brent Crude Oil and Henry Hub Spot Prices, until 2023

- 4.5 Natural Gas Historic Trend and Production Forecast in billion cubic feet per day (bcf/d), Global, until 2029

- 4.6 Recent Trends and Developments

- 4.7 Government Policies and Regulations

- 4.8 Market Dynamics

- 4.8.1 Drivers

- 4.8.1.1 Increasing Demand for Crude Oil and Natural Gas

- 4.8.1.2 Growing Emphasis on Safe, Economic, and Reliable Connectivity for Oil and Gas Exploration

- 4.8.2 Restraints

- 4.8.2.1 Technical Challenges Like Construction, Deep-Water Challenges, and High Construction Costs

- 4.8.1 Drivers

- 4.9 Supply Chain Analysis

- 4.10 Porter's Five Forces Analysis

- 4.10.1 Bargaining Power of Suppliers

- 4.10.2 Bargaining Power of Consumers

- 4.10.3 Threat of New Entrants

- 4.10.4 Threat of Substitute Products and Services

- 4.10.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Product Type

- 5.1.1 Oil

- 5.1.2 Gas

- 5.2 Geography (Regional Market Analysis {Market Size and Demand Forecast till 2029 (for regions only)})

- 5.2.1 North America

- 5.2.1.1 United States of America

- 5.2.1.2 Canada

- 5.2.1.3 Rest of the North America

- 5.2.2 Europe

- 5.2.2.1 United Kingdom

- 5.2.2.2 Germany

- 5.2.2.3 France

- 5.2.2.4 Italy

- 5.2.2.5 Norway

- 5.2.2.6 Rest of the Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 India

- 5.2.3.3 South Korea

- 5.2.3.4 Rest of the Asia-Pacific

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of the South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Iran

- 5.2.5.2 Qatar

- 5.2.5.3 Saudi Arabia

- 5.2.5.4 United Arab Emirates

- 5.2.5.5 Rest of the Middle-East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Saipem SpA

- 6.3.2 L&T Hydrocarbon Engineering Limited

- 6.3.3 McDermott International Ltd.

- 6.3.4 Allseas Group SA

- 6.3.5 Bourbon Corporation SA

- 6.3.6 Enbridge Inc.

- 6.3.7 Subsea 7 SA

- 6.3.8 Genesis Energy LP

- 6.3.9 China Petroleum Pipeline Engineering Co. Ltd.

- 6.3.10 Atteris LLC

- 6.4 Market Ranking/Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Oil and Gas Imports in the European and Asia-Pacific Regions Through Subsea (offshore) Pipelines