|

市场调查报告书

商品编码

1651044

碱性电池:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Alkaline Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

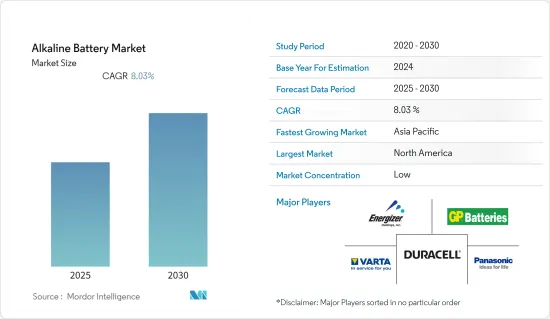

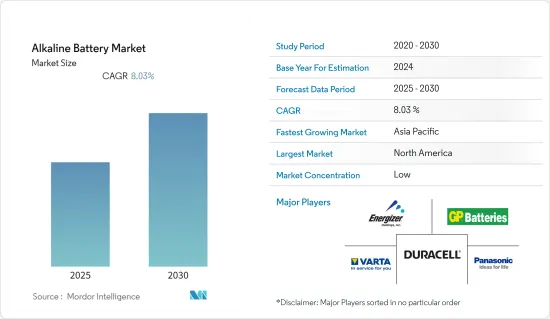

预测期内,碱性电池市场预计将实现 8.03% 的复合年增长率

关键亮点

- 从中期来看,与其他电池相比,碱性电池的能量密度高、保质期长、能够在高温下运作以及易于回收,预计将推动碱性电池市场的发展。

- 另一方面,能量密度更高的锂离子电池的竞争加剧预计将抑制碱性电池市场。

- 碱性电池价格实惠、麦克风、烟雾侦测器、手电筒、遥控器等家用电子电器产品的成长、对碱性电池的需求以及一次性使用正在推动碱性电池市场的成长机会。

- 由于日常家用电子电器产品的需求不断增加,预计预测期内亚太地区将成为碱性电池成长最快的市场。

碱性电池市场趋势

家用电子电器可望主导市场

- 碱性一次电池又称为一次性消费电池。全球对碱性一次电池的需求仍然很高,因为一次电池具有许多优点,包括成本低,并且广泛用于手电筒、计算器、手錶和烟雾探测器等家用电子电器。

- 在强劲的需求、政策措施和优质化情境的推动下,家用电子电器和电器产品领域预计将在 2023 年成长。这可能会导致碱性电池的需求增加。

- 2023年,作为行销策略的一部分,为了提升市场地位,Canon宣布很快就会推出功能更完善的数位相机,以满足数位产业的需求。数位相机销量和使用量的增加可能会增加未来对碱性电池的需求。

- 2022年全球军费开支约21,819.2亿美元,较2021年成长3.7%。军事应用对一次电池的需求不断增长以及对家用电子电器的需求不断增加预计将推动一次碱性电池市场的成长。

- 此外,许多国家都在为其军队增添手电筒、夜视仪等电子设备。此类设备很可能使用一次性碱性电池来实现其正常功能,从而推动碱性电池市场的发展。

- 因此,鑑于上述情况,在预测期内,一次电池部分很可能成为碱性电池市场中最大的部分。

亚太地区可望成为成长最快的市场

- 亚太地区正处于从碳锌电池过渡到碱性电池的时期。大多数人使用的日常家用电子电器产品(如手錶和遥控器)主要使用碱性电池,因为它们成本低且处理安全。预计此类趋势将增加该地区碱性电池的使用量。

- 此外,碱性电池製造商正致力于扩大其在开发中国家的业务。他们瞄准不断增长的市场机会,包括在该地区推出新的低成本产品。这些产品预计将推动碱性电池市场的发展。

- 碱性电池环保且易于回收。有指出,各大厂商生产的电池大多不含汞,因此弃置时不会对环境造成污染或危害。由于其他可充电电池必须妥善收集和回收,亚太地区对这些电池的需求日益增长。

- 中国、韩国、日本等该地区的国家正逐渐占据全球碱性电池製造和供应的更大份额。相较之下,印度和印尼等国家是该地区碱性电池的主要用户。此外,2023年,通膨下降预计将影响印度、印尼和马来西亚等国家的消费性电子市场成长,预计将促进碱性电池市场的发展。

- 总体而言,预计亚太地区将成为预测期内碱性电池成长最快的市场。

碱性电池产业概况

碱性电池市场适度细分。该市场的主要参与企业(不分先后顺序)包括松下公司、金霸王公司、瓦尔塔消费电池有限公司、金山电池国际有限公司和劲量控股公司。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第 2 章执行摘要

第三章调查方法

第四章 市场概况

- 介绍

- 至2028年市场规模及需求预测(单位:美元)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 可再生能源和能源储存计划增加

- 全球消费性电子产品成长

- 限制因素

- 锂离子电池的高性能特性

- 驱动程式

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔

- 市场类型

- 基本的

- 次要

- 应用

- 家用电子电器产品

- 玩具

- 其他的

- 地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 德国

- 法国

- 欧洲其他地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 伊朗

- 卡达

- 南非

- 奈及利亚

- 其他中东和非洲地区

- 北美洲

第六章 竞争格局

- 合併、收购、合作及合资

- 主要企业策略

- 公司简介

- Duracell Inc

- Panasonic Corporation

- Energizer Holdings Inc

- GP Batteries International Limited

- Nanfu Battery Company Limited

- Euroforce Battery Co.

- KoninklijkePhilips NV

- VARTA Consumer Batteries GmbH & Co. KGaA

第七章 市场机会与未来趋势

- 电池部件回收的便利性

简介目录

Product Code: 71252

The Alkaline Battery Market is expected to register a CAGR of 8.03% during the forecast period.

Key Highlights

- Over the medium term, high energy density, the more significant shelf life of alkaline batteries, their ability to operate at high temperatures, and their ease of recycling than other batteries are likely to drive the alkaline battery market.

- On the other hand, the increasing competition from lithium-ion batteries having more energy density is expected to restrain the alkaline battery market.

- Nevertheless, due to their affordability, the growth of consumer electronics such as microphones, smoke alarms, flashlights, remote control, etc., demand for alkaline batteries, and single-usage entails an opportunity for its market to grow.

- Because of its increasing demand for day-to-day consumer electronics, Asia-Pacific is expected to be the fastest-growing market for alkaline batteries during the forecast period.

Alkaline Battery Market Trends

Consumer Electronics Expected to Dominate the Market

- The primary alkaline battery also is known as disposable consumer batteries; owing to the numerous advantages of primary batteries, such as low cost, and wide applications across consumer electronics such as flashlights, calculators, clocks, and smoke alarms, the demand for primary alkaline batteries remains high, worldwide.

- Due to pent-up demand, policy initiatives, and premiumization scenarios, the consumer electronics & appliances segment is expected to surge in 2023 as firms plan to expand their capacities after combating the pandemic and introduce smart-age products. This could generate the requirement for alkaline batteries in the market.

- In 2023, Canon, as a part of the company's marketing strategy and to improve its market standing, the company declared to roll out the digital camera with improved functionalities soon in a bid to cater to the demand in the digital industry. This increase in the sales and utilization of digital cameras might increase the demand for alkaline batteries in the future.

- In 2022, the global military expenditure was approximately USD 2181.92 billion, which was higher than what countries spent in 2021, and increased by 3.7%. The rising demand for primary batteries in military applications and increased demand for consumer electronics are expected to drive the growth of the primary alkaline batteries segment.

- Moreover, many countries add electronic gear to their armies, such as torch lights, night visions, etc. This equipment will likely use primary alkaline batteries for their proper functioning, thus driving the market for alkaline batteries.

- Hence, the primary segment will likely be the largest in the alkaline battery market during the forecast period due to the above points.

Asia-Pacific Expected to be the Fastest-Growing Market

- The Asia-Pacific region is in a transitional phase of moving away from carbon-zinc batteries to alkaline batteries. Many of the population that use day-to-day household appliances such as clocks, remote, etc., mainly uses alkaline batteries because of their low costs and safe disposal. Such trends are expected to increase the utilization of alkaline batteries in the region.

- Moreover, the manufacturers of alkaline batteries are focusing on expanding their business in developing countries. They are looking for growing market opportunities, which include the launch of new, low-cost products in the regions. These products are likely to drive the alkaline battery segment.

- Alkaline batteries are quite environment-friendly and can be easily recycled. It has been noted that almost all the batteries made by the major manufacturers are mercury-free and hence, do not pose any environmental pollution or hazard on disposal. This creates a buoyant demand for these batteries in Asia-Pacific since other rechargeable consumer batteries must be appropriately collected and recycled.

- The countries in the region, such as China, South Korea, and Japan, are slowly holding a significant share in the manufacturers and supplying alkaline batteries globally. In comparison, countries such as India and Indonesia are substantial users of alkaline batteries in the region. Also, in 2023, the reduction in inflation is expected to impact the growth of consumer electronic goods markets in countries such as India, Indonesia, and Malaysia, which is anticipated to increase the development of the Alkaline battery market.

- Hence, owing to the above points, Asia-Pacific is expected to be the fastest-growing market for alkaline batteries during the forecast period.

Alkaline Battery Industry Overview

The alkaline battery market is moderately fragmented. Some of the key players in this market (in no particular order) include Panasonic Corporation, Duracell Inc, VARTA Consumer Batteries GmbH & Co. KGaA, GP Batteries International Limited, and Energizer Holdings Inc., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increase in deployment of Renewable Energy with Energy Storage Projects

- 4.5.1.2 Growth of Consumer Electronics across the world

- 4.5.2 Restraints

- 4.5.2.1 Higher performance characteristics possess by Lithium-Ion Batteries

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Primary

- 5.1.2 Secondary

- 5.2 Application

- 5.2.1 Consumer Electronics

- 5.2.2 Toys

- 5.2.3 Other Applications

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States of America

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 Iran

- 5.3.5.3 Qatar

- 5.3.5.4 South Africa

- 5.3.5.5 Nigeria

- 5.3.5.6 Rest of Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Collaboration and Joint Ventures

- 6.2 Strategies Adopted by Key Players

- 6.3 Company Profiles

- 6.3.1 Duracell Inc

- 6.3.2 Panasonic Corporation

- 6.3.3 Energizer Holdings Inc

- 6.3.4 GP Batteries International Limited

- 6.3.5 Nanfu Battery Company Limited

- 6.3.6 Euroforce Battery Co.

- 6.3.7 KoninklijkePhilips NV

- 6.3.8 VARTA Consumer Batteries GmbH & Co. KGaA

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Ease of Recycling Battery Components

02-2729-4219

+886-2-2729-4219