|

市场调查报告书

商品编码

1651048

北美街道照明:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)North America Street Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

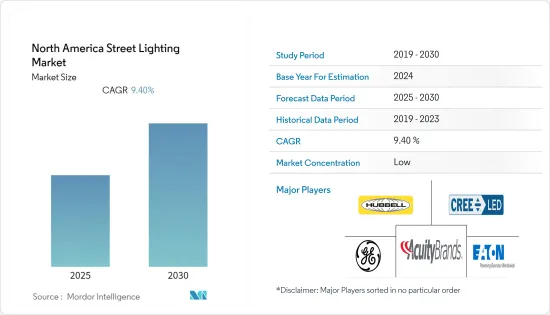

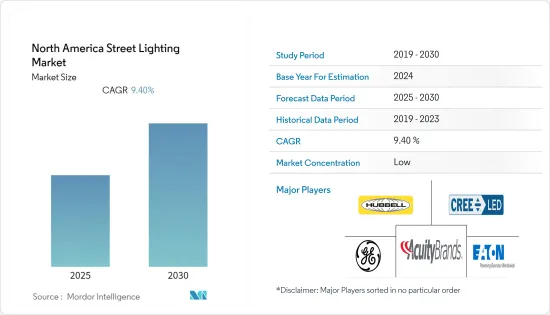

预计预测期内北美街道照明市场的复合年增长率将达到 9.4%。

过去几年,北美街道照明市场正从传统照明快速转型为智慧照明。这种转变的主要驱动力是智慧照明相对于传统照明的多重优势。智慧路灯可以帮助城市监控环境、增强公共和交通安全、升级 WiFi 热点的连接性,并提供智慧停车和智慧导航等基于位置的服务。

此外,快速的都市化和智慧城市等基础设施发展、节能街道照明系统的需求以及 LED 灯和灯具在街道照明应用中的日益普及,主导了街道照明的需求。

政府正在采取各种倡议,在智慧城市中引入创新的街道照明解决方案,从而推动该地区对街道照明的需求。例如,巴塞隆纳、洛杉矶和圣荷西最近透过实施飞利浦的 SmartPole 试点,在其互联智慧城市发展方面迈出了一步。透过部署 SmartPole,圣荷西市节省了能源,降低了能源和维护成本,在黑暗的街道上引入了 LED 照明,并改善了居民的宽频体验。

此外,主要街道照明市场参与者正关注低能耗、可预测的长寿命和光污染等问题。此外,领先的公司正在与政府合作,在全部区域引入节能街道照明,以节能取代传统照明。这些倡议进一步推动了北美街道照明市场的成长。

然而,智慧照明实施成本高是市场发展的一大限制因素。智慧路灯包括安装前和安装后服务,包括安装、设计、维护、支援和监控服务。

新冠疫情导致北美多个国家实施严格封锁,造成许多街道照明计划暂停、供应链中断、原料可得性困难等,阻碍了该地区对街道照明的需求。

北美街道照明市场趋势

LED 市场可望占据最大份额

随着时间的推移,LED照明技术在该区域取得了长足的发展,促使该地区政府推出各种倡议,以节能照明取代传统照明。北美地区的一些城市正在采用 LED 路灯,因为 LED 灯的寿命更长、消费量更低。

此外,全部区域智慧城市的发展正在推动对 LED 路灯的需求。多个政府在各类智慧城市计划中安装的LED路灯正推动老化城市基础设施的广泛改造。此外,智慧互联繫统中添加LED光源正导致能源消耗急剧下降,并增加了街道照明对LED灯的需求。

此外,加拿大政府也实施了要求註册能源标籤产品的法规。各国政府已推出各种倡议来减少照明能源消耗,例如加拿大的能源之星。此外,许多地方政府正在考虑安装更节能的路灯以降低成本。

例如,2021年3月,加拿大拉瓦尔市批准了计划,将约37,000个灯具转换为智慧控制LED照明灯具。转换为 LED 照明预计每年可节省 275 万美元,主要用于能源消耗和维护成本。转向 LED 照明也符合 Urban by Nature 的策略愿景,旨在将这座城市打造为永续城市復兴的典范。

此外,根据美国能源局报告的资料,2017年美国LED照明采用率为39%,预计2035年将增加到99%。预计上述所有因素将进一步推动北美街道照明市场对 LED 照明的需求。

美国占北美路灯市场最大份额

美国市场占据主导地位,预计在预测期内仍将保持领先地位。 Cree Lighting、Acuity Brands Inc. 和 GE Lighting 等主要街道照明市场参与者的存在促进了该地区街道照明产品的普及。

美国许多城市都在大力投资大规模街道照明现代化计划,以降低成本并提供更节能的街道照明,从而导緻美国对街道照明的需求增加。

例如,2022年2月,芝加哥市完成了路灯现代化专案「芝加哥智慧照明计划」,用高效的LED照明替换了28万多盏老化路灯。这将提高整个城市的夜间能见度,预计未来十年将为芝加哥纳税人节省 1 亿美元的电费。

此外,智慧路灯还可以具备许多支援智慧城市的功能,成为智慧城市的平台。智慧设计的街道照明可以减少城市的电力使用并提高公共安全和福祉。智慧城市的发展主要受物联网(IoT)等技术的推动。物联网(IoT)正在美国各地的各个智慧城市中实施。预计整个全部区域对物联网街道照明的需求将会成长。

此外,美国高速公路和街道数量的不断增加也推动了街道照明的需求。根据美国人口普查局报告的资料,2017年美国高速公路和道路建设的平均月价值为894亿美元,到2021年将增加至999亿美元。预计上述因素将推动美国对街道照明的需求。

北美街道照明产业概况

北美街道照明市场的竞争似乎很激烈,而且由于该地区有许多市场参与者,市场似乎比较分散。这些主要企业提供创新的街道照明技术,并透过併购来抢占市场占有率。欧洲街道照明市场的主要企业包括 Acuity Brands, Inc.、Cree Lighting、通用电气公司等。

2022 年 5 月 - Ubicquia 是一家专门从事易于部署和易于监控的智慧街道基础设施的公司,而 RealTerm Energy 是向市政当局提供承包节能 LED 路灯转换的领导者之一,他们宣布他们已经完成 25 个智慧路灯计划,并且正处于完成美国和加拿大其他五个城市任务的最后阶段。 RealTerm Energy 正在部署其他 Ubicquia 街道照明平台,用于空气品质监测、公共 Wi-Fi 和视讯分析,以提高公共安全。

2021 年 7 月-Cree Lighting 宣布已完成奥勒冈州桑迪市的重大计划。该公司将全市所有路灯从低效率的高压钠灯更换为寿命更长、更高效的LED灯。改造完成后,该市预计将减少路灯能耗 58%,每年节省约 68,000 美元。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 对北美路灯市场的影响评估

第五章 市场动态

- 市场驱动因素

- 街道照明系统中对智慧解决方案(如智慧路灯)的需求不断增加

- 政府支持LED路灯

- 智慧城市基础设施的不断普及将推动街道照明市场的发展

- 市场限制

- LED 驱动器故障和高成本带来的挑战

第六章 市场细分

- 依照明类型

- 传统照明

- 智慧照明

- 按光源

- LED 照明

- 萤光

- HID 灯

- 按产品

- 硬体

- 照明和灯泡

- 照明灯具

- 控制系统

- 软体和服务

- 硬体

- 按国家

- 美国

- 加拿大

第七章 竞争格局

- 公司简介

- Acuity Brands, Inc.

- Cree Inc.

- General Electric Company

- Hubbell Incorporated

- Eaton Corporation PLC

- OSRAM Gmbh

- Signify Holding

- Bridgelux, Inc.

- Liveable Cities(LED Roadway Lighting Ltd.)

- Leotek Electronics USA, LLC

第八章投资分析

第九章 市场机会与未来趋势

The North America Street Lighting Market is expected to register a CAGR of 9.4% during the forecast period.

Over the past few years, the North America Street market has rapidly moved from conventional to smart lighting. The main drivers for this shift are various benefits of smart lighting over conventional lighting. Smart street lighting can help cities monitor the environment, increase public and traffic safety, upgrade connectivity as WiFi hotspots, and deliver location-based services like smart parking and smart navigation.

Furthermore, the demand for street lighting is governed by the rapid urbanization and development of infrastructure such as smart cities, the need for energy-efficient street lighting systems, increasing penetration of LED lights and luminaires in street lighting applications.

The government takes various initiatives to implement innovative street light solutions in smart cities, growing the demand for street lighting in the region. For instance, Barcelona, Los Angeles, and San Jose have recently stepped into evolving the connected smart city by implementing Philips SmartPole pilots. The SmartPole initiative provides the City of San Jose with more energy conservation, reduced expenditures on energy and maintenance, implementation of LED lighting on dark city streets, and an enhanced broadband experience for the residents in the city.

Moreover, major street lighting market players focus on issues such as low energy consumption, long predictable lifetime, and light pollution. Further, the major players are collaborating with the government to implement energy-efficient street lights across the region by replacing conventional lights with energy-efficient ones. Such initiative further boosts the growth of the North American street lighting market.

However, the high installation cost of implementing smart lighting is a significant restraint for the market. Smart street lighting comprises pre-installation and post-installation services such as installation, design, maintenance, support, and monitoring services.

The COVID-19 pandemic led to strict lockdowns across several nations in the North American region resulting in a temporary halt in numerous street lighting projects, supply chain disruptions, and challenges regarding raw material availability, thereby hampering the demand for street lighting in the region.

North America Street Lighting Market Trends

LED Segment is Expected to Hold the Largest Share

The LED light technology has evolved significantly over time in the region, which has led to various government initiatives to replace conventional lighting with energy-efficient lights in the region. Multiple cities across North America have adopted LED streetlights because of the longer lifespan and lower energy consumption of LED lights.

Furthermore, the development of smart cities across the region propels the demand for LED streetlights. The installation of connected LED street lighting in various smart city projects by multiple governments contributes to the broader innovation of aging city infrastructure. Further, the addition of LED sources in smart and connected systems has resulted in a steep reduction in energy consumption, thus increasing the demand for LED lights in street lighting.

Furthermore, the Canadian government has implemented a rule that mandates the registration of products with energy labeling. The government has introduced various initiatives for reducing light energy consumption, such as ENERGY STAR in Canada. Moreover, many regional governments are looking to implement energy-efficient street lights to save costs.

For instance, in March 2021, the City of Laval in Canada gave the green light for a project to convert approximately 37,000 fixtures to LED luminaires with smart controls. This conversion to LED lights is expected to result in annual savings of USD 2.75 million, primarily in energy consumption and maintenance costs. The move toward adopting LEDs is also in line with the strategic vision of 'Urban by Nature,' which aims to make the City a model city in sustainable urban redevelopment.

Additionally, as per data reported by the US Department of Energy, the adoption rate of LED lights in the United States was 39% in 2017, which is expected to increase to 99% in 2035. All of the factors mentioned above are further expected to propel the demand for LED lights in the street lighting market in North America.

The United States Holds the Largest Share in North America Street Lighting Market

The United States market is expected to hold the dominant share and continue its lead over the forecast period. The presence of major street light market players such as Cree Lighting, Acuity Brands Inc., and GE Lighting has contributed to widespread product adoption for the street lights in the region.

Many cities across the United States are heavily investing in massive streetlight modernization projects for cost savings and energy-efficient street lighting, thus growing the demand for street lighting in the United States.

For instance, in February 2022, the City of Chicago completed the Chicago Smart Lighting Program, a streetlight modernization project to replace more than 280,000 outdated streetlights with high-efficiency LED lights that have improved the quality of night-time visibility across the city and are projected to save Chicago taxpayers USD 100 million in electricity costs over the next ten years.

Furthermore, smart street lights are the platform of a smart city as they can have many features to support a smart city. Intelligently designed streetlights can reduce electricity usage in the city and enhance public safety and well-being. Smart Cities development is primarily driven by technologies such as the Internet of Things (IoT); this Internet of Things (IoT) has been implemented in various smart cities in the United States. The demand for street lighting coupled with IoT across the region is expected to grow.

Moreover, the increasing number of highways and streets across the United States is also growing the demand for street lighting. As data reported by US Census Bureau, the average monthly value of public highway and street construction in the United States was USD 89.4 billion in 2017, which increased to USD 99.9 billion in 2021. The abovementioned factors are expected to propel the demand for street lighting in the United States.

North America Street Lighting Industry Overview

The competition in the North American street lighting market appears to be high, and the market seems fragmented due to the presence of many market players in the region. These major players offer innovative street lighting technologies and indulge in mergers and acquisitions to gain market share. Major players in the Europe street lighting market include Acuity Brands, Inc., Cree Lighting, and General Electric Company., among others.

May 2022 - Ubicquia, a company dedicated to making intelligent street infrastructure that is easy to deploy and monitor, and RealTerm Energy, one of the leaders in providing energy-efficient turnkey LED street-lighting conversions for municipalities, announced that they have completed 25 smart street lighting projects and are in the final stages of completing tasks in 5 other cities across the United States and Canada. RealTerm Energy has deployed other Ubicquia streetlight platforms for air quality monitoring, public WIFI, and video analytics to enhance public safety.

July 2021 - Cree Lighting announced that it had completed an extensive project in the City of Sandy, Oregon. The company converted all of the city's street lights from inefficient high-pressure sodium lamps to long-lasting, highly efficient LED lamps. With the conversion complete, the city expects a 58% reduction in street light energy consumption and an annual savings of approximately USD 68,000.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Defination

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of COVID-19 Impact on the North America Street Lighting Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Demand for Intelligent Solutions, such as Smart Street Lighting in Street Lighting Systems

- 5.1.2 Government Support in Implementation of LED Lights in Street Lighting

- 5.1.3 Increasing Adoption of Smart City Infrastructure to Drive the Street Lighting Market

- 5.2 Market Restraints

- 5.2.1 Challenges Associated With LED Driver Failure and High Cost Associated With Installation

6 MARKET SEGMENTATION

- 6.1 By Lighting Type

- 6.1.1 Conventional Lighting

- 6.1.2 Smart Lighting

- 6.2 By Light Source

- 6.2.1 LEDs

- 6.2.2 Fluorescent Lights

- 6.2.3 HID Lamps

- 6.3 By Offering

- 6.3.1 Hardware

- 6.3.1.1 Lights and Bulbs

- 6.3.1.2 Luminaries

- 6.3.1.3 Control Systems

- 6.3.2 Software and Services

- 6.3.1 Hardware

- 6.4 By Country

- 6.4.1 US

- 6.4.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Acuity Brands, Inc.

- 7.1.2 Cree Inc.

- 7.1.3 General Electric Company

- 7.1.4 Hubbell Incorporated

- 7.1.5 Eaton Corporation PLC

- 7.1.6 OSRAM Gmbh

- 7.1.7 Signify Holding

- 7.1.8 Bridgelux, Inc.

- 7.1.9 Liveable Cities (LED Roadway Lighting Ltd.)

- 7.1.10 Leotek Electronics USA, LLC