|

市场调查报告书

商品编码

1651051

欧洲赌场管理:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Europe Casino Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

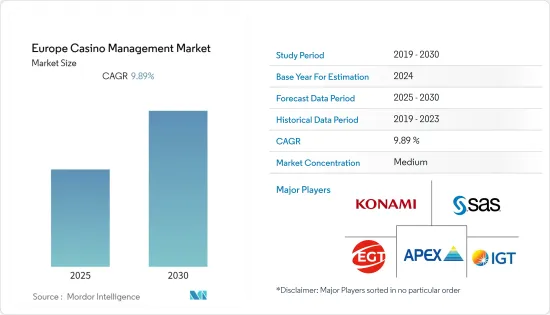

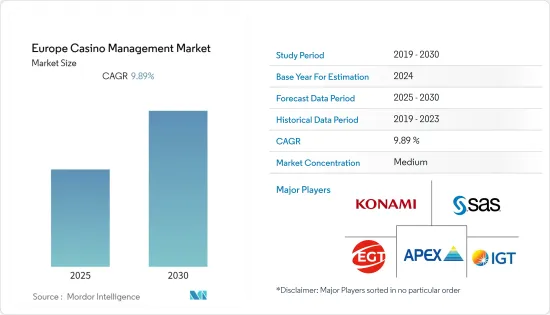

预计预测期内欧洲赌场管理市场的复合年增长率将达到 9.89%。

主要亮点

- 由于对业务自动化和分析的需求不断增加、安全性和风险管理不断提高以及对诈欺相关活动的担忧日益增加,欧洲赌场管理系统市场在不久的将来可能会大幅增长。

- 来自欧洲国家的玩家喜欢在实体赌场玩。例如,线下赌博是2019年义大利最受欢迎的赌博形式。资料显示,调查期间,线下赌客占所有受访者的18.3%。然而,在选定的年份,只有 2% 的赌徒表示自己完全在线上。

- 此外,世界各地蓬勃发展的赌场俱乐部文化和日益放鬆的博彩监管可能会推动对赌场管理系统的需求。游戏分析可以收集、分析和预测客户行为,其应用越来越广泛,并创造了丰厚的成长潜力。

- COVID-19 疫情爆发对赌博业/赌场业务产生了负面影响。许多国家纷纷颁布政府禁令,关闭赌场、彩票网点和其他赌博场所。关闭导致赌场数週甚至数月没有收益,即使重新开业,也受到入场顾客数量的限制,无法满载运作。然而,未来几个月,该国的赌博市场预计将在疫情期间承受损失并大幅成长。

欧洲赌场管理市场趋势

分析领域预计将占据最大的市场占有率

- 赌场经营者持有Terabyte的资料,其中包括客户资讯。分析帮助赌场经营者维护他们的客户资料库。如今,分析技术已不再仅仅记录客户资料库,还可以根据盈利对客户进行细分、预测盈利、利用特定的促销优惠操纵客户行为以及针对特定客户群的市场宣传活动。

- 赌场经营者拥有包含消费者资讯的数 GB 的资料。赌场经营者可以使用分析技术来追踪他们的消费者资料库。如今,分析已经发展到包括基于盈利的客户细分、盈利预测、透过特殊促销优惠操纵客户行为、针对特定客户群进行行销宣传活动等等。

- 透过预测分析,赌场现在可以绘製客户价值图表并预测他们的行为。随着资料库仓储技术的投资不断增加以及会员卡的普及,现在大多数客户交易都已被记录下来。

- 随着住房选择的增加和竞争的加剧,赌场更加重视分析,以保持竞争力并吸引更多客户。全国有数百家赌场,竞争非常激烈,留住客户非常困难,因此赌场必须妥善利用所获得的资料。

赌场的接受度越来越高

- 世界各地赌场的不断扩张和社会的日益认可正在推动赌场业务的发展。世界各国政府都允许开设赌博俱乐部,以促进经济成长并吸引更多外国游客。

- 在过去几年中,该行业在技术和为消费者提供的游戏体验方面取得了长足的进步。赌场严重依赖客户保留,并努力提高服务品质以提供更个人化的体验。游戏俱乐部使用各种技术来收集有关其顾客和场地运营的资讯。

- 根据游戏俱乐部的需求,赌场管理系统可能包含各种模组,而这些模组无法透过单一供应商的解决方案来解决。因此,供应商越来越多地创建开放系统,允许俱乐部所有者纳入第三方解决方案和硬件,以实现对其游戏运营的最佳控制。

欧洲赌场管理行业概况

欧洲赌场管理市场集中度较低,区域 CMS 供应商的出现和灵活的定价方案也加剧了竞争对手之间的竞争。市场的主要企业包括 International Game Technology PLC、Novomatic AG、Konami Gaming Inc. 和 SAS Institute Inc.

- 2021 年 2 月——国际游戏技术有限公司 (International Game Technology PLC) 与肯塔基州彩票公司签署一份为期四年的协议,继续提供 iLottery 平台和移动应用程序,并在彩票现有的数字游戏组合中添加令人兴奋的新 IGT PlayLottery 内容。

- 2021 年 2 月 - NOVOMATIC 继续重组其销售和生产部门。所有销售职能均直接置于 Jakob Rothwangl 的控制之下,而整个生产职能则集中在 Walter Eschbacher 的管理之下。重点是提高效率和扩大协同效应。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 购买者/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 主要市场趋势和电子商务在零售总额中的份额

- COVID-19 对电子商务销售的影响

第五章 市场动态

- 市场驱动因素

- 广泛推动赌场相关活动合法化

- 要求改进赌场安全和监控业务的管理

- 市场挑战

- 线上赌场/赌博日益流行

- 欧洲赌场管理产业主要人口趋势和模式分析

- 欧洲赌场管理产业各国现状

第六章 市场细分

- 依目的

- 会计和处理(拉霸机和赌桌管理、现金处理)

- 安全和监控(模拟和 IP 监控系统、生物识别)

- 酒店管理(酒店及其他房地产)

- 分析

- 玩家追踪

- 媒体管理

- 行销与推广

- 按最终用户

- 中小型赌场

- 大型赌场

- 按国家

- 英国

- 德国

- 法国

- 义大利

- 其他欧洲国家

第七章 竞争格局

- 公司简介

- International Game Technology PLC

- Novomatic AG

- Apex Gaming Technology

- Amatic Industries GmbH

- Decart Ltd

- Euro Games Technology Ltd.

- Ensico CMS doo

- Advansys doo

- Synectics plc.

- Dallmeier electronic GmbH & Co.KG

- Konami Gaming, Inc.

- SAS Institute Inc.

- Konami Gaming, Inc.

第八章投资分析

第九章:未来市场展望

简介目录

Product Code: 91158

The Europe Casino Management Market is expected to register a CAGR of 9.89% during the forecast period.

Key Highlights

- The Europe casino management system market will likely grow significantly in the near future, owing to an increased need for business automation and analytics, improved security and risk management, and increased worry about fraud-related activities.

- Players in European countries prefer to play at brick-and-mortar casinos. For example, offline gambling was the most popular form of gambling in Italy in 2019. According to the data, offline gamblers made up 18.3% of all respondents during the study period. In the chosen year, however, only 2% of gamblers reported being completely online.

- Furthermore, booming the casino club culture and weak gaming regulations across the globe will fuel demand for casino management systems. Gaming analytics, which collects, analyses, and forecasts customer behavior, is becoming more widely used, creating lucrative growth potential.

- The COVID-19 outbreak has had a negative impact on the gambling/casino business. Government-imposed stay-at-home prohibitions in many nations resulted in the shutdown of casinos, lottery outlets, and other gambling facilities. Closures left casinos without revenue for weeks or months, and even when they reopened, limits were imposed to limit the number of guests, preventing them from operating at full capacity. However, it is expected that in the coming months, the gambling market across nations will retain the loss during the pandemic and grow significantly.

Europe Casino Management Market Trends

Analytics Segment is Expected to hold the Largest Market Share

- Casino operators have terabytes of data with them, which includes customer information. Analytics help the casino operators to maintain the customer database. Analytics today not only record customer databases but have also evolved to segment customers based on profitability, predict profitability, manipulate customer behavior with specific promotional offers, and market campaigns targeted at a specific segment of customers.

- Casino operators have gigabytes of data, which includes consumer information. The casino operators can use analytics to keep track of their consumer database. Today, analytics has grown to include segmenting customers based on profitability, predicting profitability, manipulating customer behavior with specialized promotional offers, and marketing campaigns targeted at a certain segment of customers, among other things.

- Through predictive analytics, casinos can now graph a customer's value and anticipate their behavior. Most customer transactions are recorded, thanks to increased investments in database warehousing technologies and the widespread use of loyalty cards.

- With more housing options and higher competition, casinos are putting a greater emphasis on analytics to stay competitive and attract more customers. With hundreds of casinos across the country, it is critical for casinos to properly utilize the data they acquire, as competition is stiff and client retention is difficult.

Increase in the Acceptance of Casinos

- The expanding worldwide casino presence and rising social acceptability of casinos are driving the business. Governments are allowing gambling clubs to open in order to encourage economic growth and increase foreign tourism.

- Over the last few years, the sector has seen considerable advances in technology and the gaming experience provided to consumers. Casinos rely significantly on client retention and strive to improve service quality in order to provide a more personalized experience. Gaming clubs use a number of different technologies to collect information on their clients and floor operations.

- Depending on the needs of the gaming club, casino management systems can comprise various modules that a single vendor solution cannot meet. As a result, vendors are more likely to create open systems that allow club owners to incorporate third-party solutions and hardware to get optimal control over gaming operations.

Europe Casino Management Industry Overview

The Europe casino management market is mildly concentrated, and the emergence of regional CMS vendors and the deployment of flexible pricing schemes have also intensified the competitive rivalry. The major players in the market are International Game Technology PLC, Novomatic AG, Konami Gaming Inc., and SAS Institute Inc., among others.

- February 2021 - International Game Technology PLC has signed a four-year contract with the Kentucy lottery Corporation to continue providing its iLotteryplatform and mobile app and add engaging new IGT PlayLotterycontent to the Lottery's existing digital game portfolio.

- February 2021 - NOVOMATIC continues restructuring the Sales and Production Departments. All sales units are, effective immediately, bundled under Jakob Rothwangl's management, and the entire Production Department is now centrally managed by Walter Eschbacher. The focus is on increasing efficiency and amplifying synergy potential.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness-Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Key market trends and share of e-commerce of total Retail sector

- 4.4 Impact of COVID-19 on the e-commerce sales

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Broader move towards legalization of casino-related activities

- 5.1.2 Demand for better management of security and surveillance operations in casinos

- 5.2 Market Challenges

- 5.2.1 Growing popularity of online casinos/gambling

- 5.3 Analysis of key demographic trends and patterns related to Casino Management industry in Europe

- 5.4 Current positioning of countries in the Casino Management industry in region Europe

6 Market Segmentation

- 6.1 By Purpose

- 6.1.1 Accounting and Handling (slot machine and table management, cash handling)

- 6.1.2 Security and Surveillance (Analog and IP Surveillance Systems, biometrics)

- 6.1.3 Hotel Management (Hotel and other property)

- 6.1.4 Analytics

- 6.1.5 Player Tracking

- 6.1.6 Media Management

- 6.1.7 Marketing and Promotions

- 6.2 By End User

- 6.2.1 Small and Medium Casinos

- 6.2.2 Large Casinos

- 6.3 By Country

- 6.3.1 UK

- 6.3.2 Germany

- 6.3.3 France

- 6.3.4 Italy

- 6.3.5 Rest of Europe

7 Competitive Landscape

- 7.1 Company Profiles

- 7.1.1 International Game Technology PLC

- 7.1.2 Novomatic AG

- 7.1.3 Apex Gaming Technology

- 7.1.4 Amatic Industries GmbH

- 7.1.5 Decart Ltd

- 7.1.6 Euro Games Technology Ltd.

- 7.1.7 Ensico CMS d.o.o.

- 7.1.8 Advansys d.o.o.

- 7.1.9 Synectics plc.

- 7.1.10 Dallmeier electronic GmbH & Co.KG

- 7.1.11 Konami Gaming, Inc.

- 7.1.12 SAS Institute Inc.

- 7.1.13 Konami Gaming, Inc.

8 Investment Analysis

9 Future Outlook of the Market

02-2729-4219

+886-2-2729-4219