|

市场调查报告书

商品编码

1651052

欧洲停车场:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Europe Car Parking - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

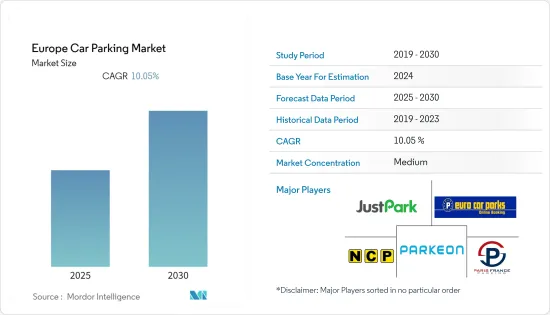

预测期内,欧洲停车市场预计将以 10.05% 的复合年增长率成长。

主要亮点

- 预计整个欧洲的停车费将大幅上涨。驾驶者支付停车费的意愿大幅提升,但同时,平均停车时间却减少了。从历史上看,停车费的上涨速度远高于通货膨胀率。例如,在德国,短期停车场的停车费在五年内平均上涨了2.9%。英国成长了 3.6%,挪威成长了 4.6%。

- 该市场还受益于技术改进以及地方政府和技术供应商之间的合作。例如,2019年9月,P2P汽车租赁公司、机场汽车共享经济的先驱Car & Away透露,它已从英国私人投资者那里筹集了350万英镑的资金。这项投资预计将有助于该公司扩大在英国的业务,并进一步实现打造全球最聪明的P2P(P2P) 汽车共享社群的目标。

- 由于新冠疫情导致停车场关闭,欧洲停车场业务受到严重打击。需求下降是由于交通拥堵缓解和汽车销售下降等因素造成的。不过,一旦解除封锁,需求预计会增加,而且由于对公共交通安全的担忧,汽车销售预计也会上升。疫情过后,停车管理可能会进一步发展,并更加重视人身安全、资讯安全和人们的福祉。

欧洲停车市场的趋势

技术进步推动市场成长

- 车辆、基础设施和公共交通正在迅速与智慧技术结合,以提高机动性和安全性。道路上安装了感测器,可以追踪沿路汽车和行动电话的资料,从而了解交通流模式、道路封闭、道路工程、道路状况等。

- 物联网 (IoT)、停车感测器和电子付款方式等技术进步也支持了市场的成长。公司希望透过提供更好的客户体验和便利的停车服务来获得竞争优势。利用即时资料和分析,企业可以分配停车位、控制存取权限并减少管理停车开销。

- 此外,停车管理让顾客感到安心,因为路边停车并不是最安全的选择。然而,停车场管理仍然可以增加顾客数量和顾客的停留时间。

- 此外,透过优化可用的停车位,停车管理技术有助于提高整体收益。同时,其在降低整体营运支出(OPEX)和资本支出(CAPEX)方面发挥关键作用。世界各国政府都在努力为其民众提供充足的停车位,以缓解交通拥挤。

汽车购买量增加

- 儘管过去几个月欧洲新车註册量整体成长率持续下降,但新车购买量仍然相当强劲。根据JATO Dynamics对欧洲27个市场的统计,2021年3月欧洲(包括欧盟、欧洲自由贸易联盟国家和英国)新车註册量为1,116,419辆,较去年同期下降19%。儘管 2020 年 3 月至 2019 年 3 月期间註册量增加了 33%,但市场仍未能恢復到疫情前的水平,比 2019 年 3 月低了 37%。

- 2022年3月,欧洲新乘用车註册量下降了五分之一,而2022年第一季近期汽车销量下降了11%,至1985年以来的最低水准。 2022年3月,电动车在欧洲的市占率增加,再次超过柴油车。 2022年3月,特斯拉Model 3是欧洲最畅销的轿车和最畅销的电池电动车,标緻208是第一季欧洲最受欢迎的汽车。

欧洲停车产业概况

欧洲停车市场相当分散,许多参与者占据相当大的市场份额。停车市场的知名参与者包括 JustPark、Parkeon SA、Park Rite 和 Urbiotica。

- 2021 年 9 月-JustPark 和 Octopus Energy 建立充电伙伴关係。目的是为缺乏家庭停车场或充电设施的英国车队驾驶提供更好的都市区充电机会——这是电动车普及的一大障碍。

- 2020 年 6 月,Urbiotica 宣布收购 Worldsensing 的停车管理解决方案 Fastprk。 Fastprk 的加入完善了 Urbiotica 的智慧停车解决方案产品组合,巩固了其在该领域的领导地位,并藉助 Fastprk 技术提供的互补双重检测和 LoRa通讯协定开闢了新的市场机会。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业相关人员分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 购买者和消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 国内付款环境的演变

- 与日本无现金交易扩张相关的主要市场趋势

- COVID-19 对该国付款市场的影响

第五章 市场动态

- 市场驱动因素

- 汽车数量的稳定增长引发了人们对停车位安全的担忧

- 技术进步以及理事会和技术提供者之间的持续合作

- 市场挑战

- 成本和基础设施问题

- 欧洲停车产业的主要法规和标准

- 关键用案例和使用案例分析

- 欧洲停车产业主要人口趋势与模式分析

- 欧洲现金替代与汽车购买量成长分析

第六章 市场细分

- 按应用领域

- 停车场营运商/停车场管理公司

- 基础设施提供者(硬体和软体)

- P2P 停车应用程式提供者

- 按国家

- 英国

- 德国

- 法国

- 义大利

- 其他欧洲国家

第七章 竞争格局

- 公司简介

- JustPark

- Euro Car Parks Limited

- National Car Parks Limited(NCP)

- NSL Limited, a Marston Holdings Company

- ParkingEye Ltd

- Parkeon SA

- Indigo Group

- Paris France Parking

- Park Rite

- RFC

- IPairc

- Munster Car Park Services Ltd

- Nationwide Controlled Parking Systems

- Tazbell

- Urbiotica

第八章投资分析

第九章:未来市场展望

简介目录

Product Code: 91163

The Europe Car Parking Market is expected to register a CAGR of 10.05% during the forecast period.

Key Highlights

- It is expected to see significant growth in prices/parking charges across all European countries. The willingness of car users to pay for parking is increasing significantly - while the average duration of use is decreasing. In the past, parking charges have increased at a rate well above the inflation rate. For example, in Germany, parking charges for short-stay car parks increased by an average of 2.9 % in five years. In the UK, they increased by 3.6 %, and in Norway by 4.6%.

- The market also benefits from technological improvements and collaborations between local governments and technology suppliers. For example, in September 2019, Car & Away, the peer-to-peer car rental company and pioneer of the airport-based car-sharing economy, revealed that it had raised GBP 3.5 million in capital from private investors in the United Kingdom. This investment is expected to help the company expand in the United Kingdom and, further, it's objective to build the world's smartest peer-to-peer (P2P) car-sharing community.

- The European car parking business has been harmed as a result of the lockdown imposed due to the spread of the coronavirus. Reduced demand is due to a sharp reduction in traffic congestion and a decrease in car sales, among other factors. However, after the lockdown is lifted, demand is projected to rise, and vehicle sales are expected to increase due to concerns about public transportation safety. Post-pandemic car parking management will likely grow, focusing more on physical safety, information security, and people's perceived well-being.

Europe Car Parking Market Trends

Technological Advancements to Boost the Market Growth

- Vehicles, infrastructure, and public transportation are rapidly linked with smart technology to improve mobility and safety. Streets are equipped with sensors that track data on the roads and through cars and mobile phones to acquire insight into traffic flow patterns, roadblocks, roadwork, and road conditions, among other things.

- Technological advancements such as the Internet of Things (IoT), parking sensors, and electronic payment methods also support the market's growth. Firms are trying to deliver an enhanced customer experience and offer hassle-free parking that can help them gain a competitive advantage over others. With the help of real-time data and analytics, organizations can allocate spaces, provide access control, and reduce administrative overhead spent on parking.

- Additionally, car parking management gives customers a sense of security as parking on the street is not considered the safest option. Still, with the car parking management, there can be an increase in the number of customers and the time they spend at any outlet.

- Furthermore, by optimizing vacant parking spaces, parking management technologies assist in raising overall revenue. Simultaneously, they play a critical role in lowering overall operational and capital expenditures (OPEX and CAPEX) (CAPEX). All governments worldwide attempt to reduce traffic congestion by providing enough parking spots for their population.

Increase in purchase of Cars

- Though the overall growth rate of new car registrations has kept declining over the past few months in Europe, there is a significant number of new purchases. Total new passenger vehicle registrations in Europe (including the EU, EFTA, and the UK) were down 19% in March 2021, according to JATO Dynamics statistics for 27 European markets, with 1,116,419 new passenger cars registered. While registrations grew by 33% from March 2020 to March 2019, the market has failed to return to pre-pandemic levels, falling 37% short of March 2019.

- In March 2022, new passenger vehicle registrations in Europe fell by a fifth, with recent automobile sales falling 11% in the first quarter of 2022 to the lowest levels since 1985. EVs increased market share in Europe in March 2022, outselling diesel vehicles once more. In March 2022, the Tesla Model 3 was Europe's best-selling car model and best-selling battery-electric vehicle, but the Peugeot 208 was Europe's favorite automobile during the first quarter.

Europe Car Parking Industry Overview

The Europe Car Parking Market is moderately fragmented, with many players accounting for significant amounts of shares in the market. Some of the prominent companies in the car parking market are JustPark, Parkeon S.A, Park Rite, Urbiotica, and others.

- September 2021 - JustPark and Octopus Energy launch charging cooperation. They aim to help provide better urban charging opportunities for fleet drivers in the UK who do not have access to their parking and charging opportunities at home, which is suspected to be a large hurdle for EV adoption.

- In June 2020, Urbiotica announced the acquisition of Fastprk, a parking management solution from Worldsensing. The addition of Fastprk completes Urbiotica's portfolio of smart parking solutions, strengthening its leadership position in the sector and opening up new opportunities to penetrate new markets due to the complementarity that Fastprk's technology offers with its dual detection and LoRa communication protocol.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Stakeholder Analysis

- 4.3 Industry Attractiveness-Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Evolution of the payments landscape in the country

- 4.5 Key market trends pertaining to the growth of cashless transaction in the country

- 4.6 Impact of COVID-19 on the payments market in the country

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Steady rise in vehicles leading to concerns over availability of parking space

- 5.1.2 Technological advancements and ongoing collaborations between local councils and technology providers

- 5.2 Market Challenges

- 5.2.1 Cost & Infrastructural Concerns

- 5.3 Key Regulations and Standards in the Europe Car Parking Industry

- 5.4 Analysis of major case studies and use-cases

- 5.5 Analysis of key demographic trends and patterns related to car parking industry in Europe

- 5.6 Analysis of cash displacement and rise of purchase of vehicles in Europe

6 Market Segmentation

- 6.1 By Application Area

- 6.1.1 Parking Operators/Parking Management Companies

- 6.1.2 Infrastructure Providers (Hardware & Software)

- 6.1.3 P2P Parking Apps Provider

- 6.2 By Country

- 6.2.1 UK

- 6.2.2 Germany

- 6.2.3 France

- 6.2.4 Italy

- 6.2.5 Rest of Europe

7 Competitive Landscape

- 7.1 Company Profiles

- 7.1.1 JustPark

- 7.1.2 Euro Car Parks Limited

- 7.1.3 National Car Parks Limited (NCP)

- 7.1.4 NSL Limited, a Marston Holdings Company

- 7.1.5 ParkingEye Ltd

- 7.1.6 Parkeon S.A

- 7.1.7 Indigo Group

- 7.1.8 Paris France Parking

- 7.1.9 Park Rite

- 7.1.10 RFC

- 7.1.11 IPairc

- 7.1.12 Munster Car Park Services Ltd

- 7.1.13 Nationwide Controlled Parking Systems

- 7.1.14 Tazbell

- 7.1.15 Urbiotica

8 Investment Analysis

9 Future Outlook of the Market

02-2729-4219

+886-2-2729-4219