|

市场调查报告书

商品编码

1683081

全球电感器市场:市场占有率分析、行业趋势和成长预测(2025-2030 年)Global Inductors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

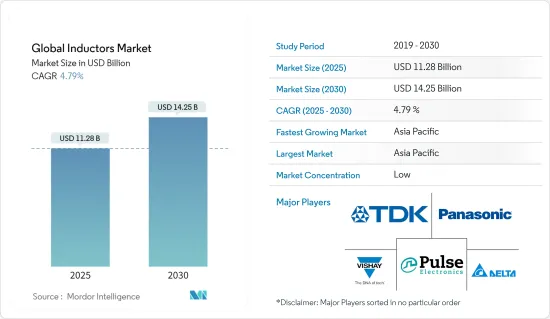

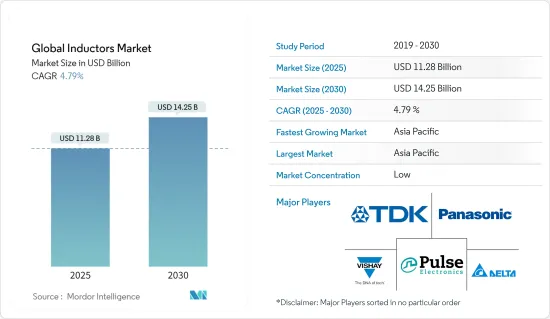

预计 2025 年全球电感器市场规模为 112.8 亿美元,到 2030 年将达到 142.5 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.79%。

关键亮点

- 随着技术的进步,电子产品和设备变得越来越复杂。例如,时尚、纤薄且具有无边框萤幕的设计。

- 智慧型手机见证了 MEMS 陀螺仪因其成本低、体积小、重量轻而取得的巨大成功。在过去几年中,语音智慧型装置等功能的采用率不断提高。到 2023年终,Amazon Echo、Google Home 和 Sonos 等智慧型装置的采用将呈现积极势头。年轻一代认为这些设备是执行日常活动的更具创新性、更快捷、更简单的方式。埃森哲最近的一项研究显示,全球超过 50% 的网路用户正在使用数位语音助理。预计这将进一步增加电子设备的复杂性,从而推动电感器的需求。

- 电感器在医疗及医疗设备产业也扮演重要角色。医疗保健领域的各种进步,例如大型医院设备、医疗穿戴式装置和改进的照护现场设备,预计将增加需求。医疗产业持续推动电子产品的需求。随着技术的进步,基板变得更小、更密集、更可靠,被动电子元件将在医疗保健领域发挥越来越重要的作用。

- 电感器磁芯和线圈由铜、铁和其他铁氧体材料等金属製成,因此电感器的生产依赖原料价格。供应链和原材料成本的波动可能会增加前置作业时间并影响市场供应商的利润率,从而阻碍市场成长。

- 通膨和利率上升进一步减少了消费者支出,限制了2022年和2023年的市场成长。俄罗斯和乌克兰之间的战争为欧洲国家带来了严重的通膨打击,德国、瑞典、法国和英国的通膨率与2022年1月相比大幅上升。英国2023年8月的通膨率为6.7%,而2022年1月为5.5%。这些因素阻碍了2023年的市场成长。美国劳工统计局的数据显示,2023年第三季美国製造业产出下降了0.1%。这可能会导致製造业对电感器的需求下降。

电感器市场趋势

频率电感器可望实现高成长

- 频率电感器,也称为 RF(射频)电感器,专门设计用于无线通讯、无线电技术、雷达系统等中使用的高频电路。需要 RF 电感器是因为用于低频应用的常规电感器可能无法正常工作或在高频率因寄生电容和趋肤效应而发生故障。频率电感器经过最佳化,可以最大限度地减少这些问题,使它们能够在很宽的频率范围内保持理想的电感和性能。

- RF电感器的主要特性是额定电流低、电阻高。但频率越高,线路电阻越大。此外,由于如此高的谐振频率的频率很高,因此会出现一些效应。这些包括趋肤效应、邻近效应和寄生电容。

- RF电感器可以用多种方法製造。例如,知名的电感器供应商村田製作所 (Murata Manufacturing) 采用线绕、薄膜和多层製造方法。每种製造方法都有不同的特性。

- RF电感器应用于智慧型手机、行动通讯模组、蓝牙模组等小型通讯产品,因此小型化趋势较强。因此,新兴市场的供应商正致力于开发体积小但功能强大的射频电感器,以满足行动通讯的发展。

- 由于家用电子电器是电感器需求的主要驱动力,5G 技术的日益普及预计活性化全球对各种家用电子电器和通讯设备的需求,进而影响市场成长。全球 5G 的推出增加了物联网和传统智慧型手机对射频电感器的需求。根据2023年5月发布的5G美洲组织报告,预计2023年5G行动用户数将超过19亿,到2027年将达到59亿。

- 2023 年 2 月,GSMA 报告称,预计未来两年内 5G 连线数将翻倍。 GSMA 还报告称,成长将来自亚太和拉丁美洲地区的关键市场,包括最近推出 5G 网路的巴西和印度。 2023 年 Airtel 和 Jio 服务的扩展对于印度的持续渗透至关重要。此外,GSMA预计2025年终,印度的5G用户数将达到1.45亿人。

亚太地区将经历大幅成长

- 亚太电感器市场受到中国、韩国、日本和印度等工业经济体和技术先进国家的需求所推动。中国由于半导体产业和工业自动化的快速成长,已成为电感元件最大的需求国家之一。

- 智慧型手机成长迅速,过去几年亚太国家智慧型手机用户数量不断增加。根据GSMA的《移动经济报告》,到2025年,亚太地区将成为全球最大的5G地区,以中国、日本、韩国和澳洲为首,预计商用5G网路部署将达到6.75亿个5G连接,占2025年全球计画5G连接总数的一半以上。

- 车载资讯娱乐系统提供音乐、影片和其他多媒体内容、导航、车载网路连线以及与外部系统的通讯。供应商正在提供新技术,旨在减轻组成各种通讯总线的电缆线束的重量。例如,2024年1月,TDK株式会社宣布推出最新电感器KLZ2012-A系列(长2.0 mm x 宽1.25 mm x 高1.25 mm),具有宽工作范围、高耐用性和出色的电感公差,适用于汽车音频总线(A2B)应用。

- 由于铁氧体磁芯电感器在汽车使用的功率转换模型中实现了高效率,预计其应用将随着汽车市场的成长而增加。它们还可用于汽车和电子设备应用的变压器和电感器。工业4.0推动了製造和生产过程的自动化,导致电感器在许多电子组件中使用。

- 总体而言,随着汽车产业的快速成长和电感需求的增加,中国、日本和韩国等国家正在主导各种智慧城市倡议。该地区的这些创新努力为电感器在汽车、交通、能源和公共产业领域的使用创造了机会。此外,该地区的通讯也取得了长足的进步,村田製造等公司推出了专门用于 NFC 电路的电感器。这些新兴市场的发展有望促进该地区的市场成长。

电感器产业概况

由于全球性和中小型公司的存在,电感器市场高度细分。市场的主要企业包括 TDK 公司、Vishay Intertechnology 公司、松下公司、台达电子公司和 Pulse Electronics(国巨公司)。市场参与企业正在采取联盟和收购等策略来加强其产品供应并获得可持续的竞争优势。

- 2024 年 3 月 - 台达集团旗下的台达电子(泰国)PCL 最近在泰国 Bangpoo工业开设了最新的Delta工厂 8 和研发中心。新的 30,400平方公尺工厂旨在支持台达扩大生产和加强为全球客户提供电动车 (EV) 电力电子产品开发的努力。该工厂和研究中心的建立是Delta满足电动车市场日益增长的需求的策略的一部分。

- 2024 年 2 月 - TDK 公司宣布推出最新系列专为汽车高频电路设计的感测器:MHQ1005075HA。 MHQ1005075HA采用与传统产品相同的材料和施工方法。此外,也利用TDK独特的设计技术来加强内部结构,并专注于故障安全设计。该系列采用 1005 尺寸(1.0 x 0.5 x 0.7 毫米,长 x 宽 x 高),电感范围从 1.0 nH 到 56 nH。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 产业价值链分析

- 宏观经济趋势对市场的影响

第五章 市场动态

- 市场驱动因素

- 消费性电子产品技术创新不断提升

- 对节能电气和电子系统的需求不断增加

- 市场限制

- 原料成本上涨,尤其是铜

第六章 市场细分

- 按类型

- 力量

- 按频率

- 按核心

- 空气/陶瓷芯

- 铁氧体磁芯

- 其他核心

- 按行业

- 车

- 航太和国防

- 通讯

- 家用电子电器与计算机

- 其他行业

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- TDK Corporation

- Vishay Intertechnology Inc.

- Panasonic Corporation

- Delta Electronics Inc.

- Pulse Electronics(Yageo Corporation)

- Sagami Elec Co. Ltd

- Taiyo Yuden Co. Ltd

- TE Connectivity Ltd

- Murata Manufacturing Co. Ltd

- Sumida Corporation

- Coilcraft Inc.

第八章投资分析

第九章:市场的未来

The Global Inductors Market size is estimated at USD 11.28 billion in 2025, and is expected to reach USD 14.25 billion by 2030, at a CAGR of 4.79% during the forecast period (2025-2030).

Key Highlights

- With the advent of technological advancements, electronics and electronic devices are getting more complex, primarily due to the increasing consumer demand for small or slim devices. Customers have a specific standard for these devices nowadays, for instance, sleek, thin design, with the screen going from edge to edge.

- Smartphones have witnessed the great success of MEMS gyroscopes owing to their low cost, miniature size, and lightweightness. Features like voice-enabled smart devices have increased adoption over the past few years. The adoption of smart devices, such as the Amazon Echo, Google Home, and Sonos, was aggressive by the end of 2023. The younger generation views these devices as the more innovative, faster, and easier way to perform everyday activities. A recent survey conducted by Accenture revealed that more than 50% of internet users use digital voice assistants globally. This is further expected to add to the complexity of electronics, thereby augmenting the demand for inductors.

- Inductors also play an essential role in the healthcare and medical devices industry. Various advancements in the healthcare sector, including improving macro-sized hospital equipment, medical wearables, and point-of-care devices, are expected to increase the demand. The medical industry is continually driving the need for electronics. As technology enhances and smaller, denser, more reliable boards become possible, passive electronic components will play an increasingly important role in healthcare.

- The use of metals, including coppers, iron, and other ferrite substances, for the core and coil of inductors creates the production dependency of inductors on the raw material price. Fluctuations in the supply chain and raw material costs can increase the lead time and impact the profit margin of the market vendors, hindering market growth.

- The increasing inflation and interest rates further decreased consumer spending, which restricted the market's growth in 2022 and 2023. Due to the war in Russia and Ukraine, European countries experienced inflation, and compared to January 2022, inflation in Germany, Sweden, France, and the United Kingdom increased significantly. In August 2023, the United Kingdom's inflation rate was 6.7% compared to 5.5% in January 2022. These factors hampered the market's growth in 2023. According to the Bureau of Labor Statistics, the US manufacturing sector's output reduced by 0.1% in the third quarter of 2023. This may lead to decreased demand for inductors from the manufacturing sector.

Inductor Market Trends

Frequency Inductor Expected to Witness Significant Growth

- Frequency inductors, called RF (radio frequency) inductors, are specifically designed for applications in high-frequency circuits, such as those used in radio communication, wireless technology, and radar systems. They are necessary because regular inductors, intended for low-frequency applications, may not perform well or even malfunction at higher frequencies due to parasitic capacitance and skin effects. Frequency inductors are optimized to minimize these issues, allowing them to maintain their desired inductance and performance across a wide range of frequencies.

- RF inductors are mainly characterized by low current rating and high electrical resistance. However, the wire resistance increases as the high frequencies are used here. In addition, a few effects come into the picture because of these high-resonant radio frequencies. These include skin effect, proximity effect, and parasitic capacitance.

- RF inductors can be manufactured in different ways. For instance, Murata, one of the prominent vendors of inductors, uses wire wound manufacturing methods, film manufacturing methods, and multi-layer manufacturing methods. Each method has different characteristics.

- There has been a prevailing trend of miniaturization of RF inductors due to their usage in small communication products such as smartphones, wireless modules, Bluetooth modules, etc. Hence, the vendors in the market are focusing on developing small yet powerful RF inductors to contribute to the growth of mobile communication.

- As consumer electronics is the prominent driver for inductor demand, the growing push to adopt 5G technology is expected to drive the demand for various consumer electronics and communication devices worldwide, impacting market growth. The 5G deployments worldwide are increasing the need for RF inductors for IoTs and conventional smartphones. According to the 5G Americas Organization Report released in May 2023, 5G mobile subscriptions were expected to exceed 1.9 billion in 2023 and reach 5.9 billion by 2027.

- In February 2023, GSMA reported that 5G connections are anticipated to double over the upcoming two years. In addition, GSMA also reported that the growth would come from key markets within APAC and LATAM, like Brazil and India, which have recently launched 5G networks. The expansion of services from Airtel and Jio in 2023 was pivotal to India's ongoing adoption. Moreover, GSMA 5G is expected to account for 145 million in India by the end of 2025.

Asia-Pacific to Register Major Growth

- The Asia-Pacific inductor market is driven by demand from industrial economies and technologically advanced countries, such as China, Korea, Japan, and India. China is one of the largest sources of demand for inductor components, owing to the rapidly growing semiconductor industry and industrial automation.

- The growth of smartphones has been exponential, and the number of smartphone users in the Asian-Pacific countries has increased in the past few years. According to GSMA's Mobile Economy report, Asia-Pacific is on its way to becoming the world's largest 5G region by 2025, led by China, Japan, South Korea, and Australia, as well as commercial 5G network launches that are expected to reach 675 million 5G connections, more than half of the global 5G total scheduled by 2025.

- Automotive infotainment systems provide music, videos, other multimedia content, navigation, internet connectivity inside vehicles, and communication with outside systems. Vendors are offering new technology designed to reduce the weight of cable harnesses comprising various telecommunication buses. For instance, in January 2024, TDK Corporation introduced its latest inductor KLZ2012-A series (2.0 mm (L) x 1.25 mm (W) x 1.25 mm (H)) for automotive audio bus (A2B) applications with a wide operation range, high durability, and superior inductance tolerance.

- Ferrite core inductors are expected to witness a rise in adoption owing to the growth in the automotive sector to achieve high efficiency in power conversion models used in automotive. They are also helpful for transformers and inductors in automotive and electronic applications. Industry 4.0 has increased the automation of manufacturing and production processes, thus leading to an increased use of inductors, owing to their presence in many electronic assemblies.

- Overall, along with the rapidly growing automotive sector and increasing demand for inductors, countries such as China, Japan, and South Korea are leading various Smart city initiatives. These innovative initiatives in the region create the potential for using inductors across automotive, transportation, energy, and utilities. Furthermore, communication in the area has also witnessed considerable progress, with companies like Murata deploying specialized inductors for NFC circuits. Such developments are likely to propel the region's market growth.

Inductor Industry Overview

The inductor market is highly fragmented due to the presence of both global players and small- and medium-sized enterprises. Some of the major players in the market are TDK Corporation, Vishay Intertechnology Inc., Panasonic Corporation, Delta Electronics Inc., and Pulse Electronics (Yageo Corporation). Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- March 2024 - Delta Electronics (Thailand) PCL, a branch of Delta Group, recently opened its latest Delta Plant 8 and R&D Center at Bangpoo Industrial Estate in Thailand. This new facility, spanning 30,400 sq. m, is designed to support Delta's efforts in expanding production and enhancing the development of electric vehicle (EV) power electronics for customers worldwide. Establishing this factory and research center is part of Delta's strategy to meet the increasing demand in the EV market.

- February 2024 - TDK Corporation unveiled its latest MHQ1005075HA line of inductors designed for automotive high-frequency circuits. This new product maintains the same materials and construction techniques as its predecessor. Still, it incorporates TDK's unique design knowledge to enhance the internal structure, focusing on fail-safe design. The series comes in a 1005 size (1.0 X 0.5 X 0.7 mm - L x W x H) and offers inductance ranging from 1.0 nH to 56 nH.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Degree of Competition

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of Macroeconomic Trends in the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rise In Innovations in Consumer Electronics Products

- 5.1.2 Growing Demand for Energy-efficient Electrical and Electronic Systems

- 5.2 Market Restraints

- 5.2.1 Rising Cost of Raw Materials, Especially Copper

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Power

- 6.1.2 Frequency

- 6.2 By Core

- 6.2.1 Air/Ceramic Core

- 6.2.2 Ferrite Core

- 6.2.3 Other Cores

- 6.3 By End-user Vertical

- 6.3.1 Automotive

- 6.3.2 Aerospace and Defense

- 6.3.3 Communications

- 6.3.4 Consumer Electronics and Computing

- 6.3.5 Other End-user Verticals

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 TDK Corporation

- 7.1.2 Vishay Intertechnology Inc.

- 7.1.3 Panasonic Corporation

- 7.1.4 Delta Electronics Inc.

- 7.1.5 Pulse Electronics (Yageo Corporation)

- 7.1.6 Sagami Elec Co. Ltd

- 7.1.7 Taiyo Yuden Co. Ltd

- 7.1.8 TE Connectivity Ltd

- 7.1.9 Murata Manufacturing Co. Ltd

- 7.1.10 Sumida Corporation

- 7.1.11 Coilcraft Inc.