|

市场调查报告书

商品编码

1683111

汽车传动轴市场:市场占有率分析、行业趋势和成长预测(2025-2030 年)Automotive Drive Shaft - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

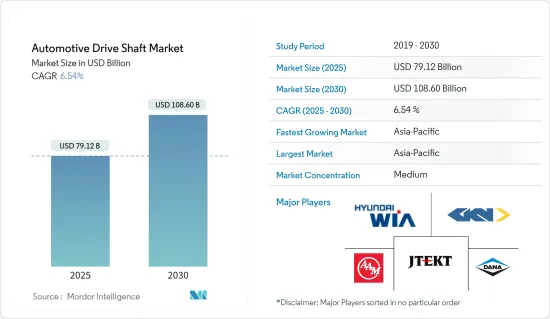

预计 2025 年汽车传动轴市场规模为 791.2 亿美元,预计到 2030 年将达到 1,086 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.54%。

从中期来看,随着人口和可支配收入的增加,全球对汽车(包括乘用车和商用车)的需求预计将扩大。汽车产量和製造量的不断增长推动了全球对传动轴的需求。

预测期内,商用车和巴士的需求不断增长可能会推动全球汽车的生产和销售,有助于市场保持专注。这一趋势主要受电动车需求不断增长的推动。此外,汽车製造商正专注于生产最节能的电动车以满足日益增长的需求。传动轴製造商不断更新其产品线以满足不断变化的OEM需求并增加市场占有率。

考虑到电动车,大众和通用汽车等主要OEM正在对新技术进行大量投资,建立供应链并提高电动车及其零件(如电池组和马达)的生产能力。例如

关键亮点

- 2023 年 6 月,梅赛德斯-奔驰宣布将向其欧洲组装厂投资数十亿美元,以实现在本世纪末向电动车的转变。此举将包括生产基于新电动平台及其零件的汽车,预计将于 2025 年推出。

受轻量化零件需求增加和全轮驱动车销售上升等趋势的推动,汽车传动轴市场预计未来几年将实现成长。预计未来几年影响整体汽车传动轴市场成长的显着因素之一是全球多功能车销售的激增。亚太地区以新兴经济体为主,约占全球汽车销售量的一半。

预计未来几年亚太汽车传动轴市场将占据最大份额并实现最高成长率。亚太地区的特征是新兴经济体的存在,占全球汽车销售的大部分份额,这种趋势在预测期内可能会持续下去。

中国、美国和挪威等国家对电动车的需求持续成长。汽车製造商计划在未来几年内推出更多电动车车型。大多数现有和即将推出的电动车车型都是全轮驱动 (AWD) 或后轮驱动 (FR),这可能会在预测期内产生对轻型传动轴的需求。

汽车传动轴的发展趋势

乘用车占最大市场份额

在汽车市场上,乘用车由于其设计时尚、尺寸大、经济性好等特点,销量很高。对高性能豪华 SUV 的高需求推动了这一成长。因此,许多公司都专注于推出各种新型乘用车。例如:

- 2023 年 5 月,路虎公布了有史以来最强大、最快的量产 SUV 的细节。新款 Range 探测车 Sport SV 配备一台 5.0 升 V8 增压发动机,可输出 635 匹马力。

电动车已成为汽车产业不可或缺的一部分,并为实现能源效率以及减少污染物和其他温室气体的排放提供了一条途径。不断增强的环保意识和积极主动的政府倡议是推动这一增长的关键因素。

根据国际能源总署(IEA)的数据,2024年第一季的电动车销量将比2023年第一季成长约25%,其中中国占比最大,为45%,其次是欧洲,为25%。

政府和地方的排放法规是整体电动车产业发展的主要驱动力之一。道路运输普遍被认为是欧洲最大的空气污染源。为了防治空气污染,欧盟理事会通过了关于环境空气品质评估和控制的第96/62/EC号指令,该指令设定了空气中各种有害化合物的排放目标。车辆排放的最重要污染物是氮氧化物(NOx)和细尘(粒状物 - PM),目前的上限均为每年 40g/m3。

欧洲已设定了 2050 年实现气候中和的雄心勃勃的目标。为实现这一目标,欧盟委员会预计将在未来几年内出台几项新法案,其中许多法案旨在提高流动性。到本世纪末,欧盟委员会的目标是让道路上至少有 3,000 万辆电动车。为了实现这一目标,我们需要一套政策和目标,引导国家、企业和消费者走上正确的道路。

乘用车的需求也可能增加对复杂传动轴的需求。传动轴製造商正在研究新材料和製造方法来生产能够满足这些车辆需求的传动轴。例如,一些製造商使用碳纤维代替钢材来减轻重量,而一些製造商则使用能够承受高扭矩的创新复合材料。例如

- 2023 年 1 月,传动系统零件製造商 Kalyani Mobility Drivelines (KMD) 推出了一系列适用于电动车和其他专用车辆的等速 (CV) 传动轴。

由于这些因素以及电动和混合动力汽车市场的扩大,汽车传动轴市场预计将继续成长和发展。

预计亚太地区将占据主要市场份额

中国和印度是亚太地区汽车製造业突出的国家。这些国家拥有大量汽车製造商,这可能在预测期内为市场创造有利可图的机会。

该地区的政府已经推出了一系列奖励计划来促进汽车销售。它还提供购买电动车的补贴,以鼓励该地区汽车产业的扩张。例如:

- 随着乘用车销售量和产量的增加,印度汽车业逐年呈指数级增长。例如,与上年度相比,预计 2022-23 年乘用车销量将从 1,467,039 辆增至 1,747,376 辆,而多功能车销量将从 1,489,219 辆增至 2,003,718 辆,可从 1,489,219 辆增至 2,003,718 辆,可从 1,489,219 辆增至 2,003,718 辆,可从 1,489,219 辆增至 2,003,718 辆,为 2,6100 厢式销售量为 2,13100 2,001600 厢型车。

受中产阶级可支配收入不断增加的推动,印度经济正在扩张。这对汽车需求产生了正面影响。由于印度的生产成本低廉,过去五年汽车产量激增。随着汽车製造业的崛起,汽车感测器市场也日益受到关注。

印度城市的车辆持有比欧盟国家和美国的车辆数量年轻得多,后两国的平均车龄分别为 8 年和 11 年。

主要汽车零件製造商正在全部区域扩大生产设施并推出新产品。预计这些汽车零件製造商将在预测期内见证市场的显着成长。例如,KYB Corporation(KYB)宣布计划在2023年3月之前开发用于电动车(EV)中eAxle驱动马达系统的电动油泵。该公司还宣布计划製造用于eAxles润滑和冷却的油泵,并将其作为电气化时代的新业务进行开发。

因此,考虑到所有这些市场发展和趋势,预计亚太汽车传动轴市场在预测期内将显着成长。

汽车传动轴产业概况

汽车传动轴市场由全球性和地区性企业整合和主导。这些公司正在采取新产品发布、联盟和合併等策略来保持其在市场中的地位。例如

- 2023 年 9 月,JTEKT North America 以 JTEKT Automotive Systems、Koyo Bearings 和 Toyoda Machine Tools 品牌生产了广泛的产品。透过增加七条新机器生产线、两条新组装和一条内部加工零件的附加工序,JTEKT 北美公司扩大了其前驱动轴的生产能力。

市场的主要企业包括 GKN PLC(Melrose Industries PLC)、Yamada Manufacturing、American Axle & Manufacturing Inc.、JTEKT Corporation 和 Dana Incorporated。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场驱动因素

- 政府加大力度促销

- 市场限制

- 传动轴维护成本高

- 波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

5. 市场区隔(市场规模-美元)

- 依设计类型

- 中空轴

- 实心轴

- 按职位类型

- 后轴

- 前轴

- 按车型

- 搭乘用车

- 商用车

- 按分销管道

- OEM

- 售后市场

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 欧洲其他地区

- 亚太地区

- 印度

- 中国

- 日本

- 韩国

- 其他亚太地区

- 其他的

- 南美洲

- 中东和非洲

- 北美洲

第六章 竞争格局

- 供应商市场占有率

- 公司简介

- GKN PLC(Melrose Industries PLC)

- JTEKT Corporation

- Dana Holding Corporation

- Hyundai Wia Corporation

- Nexteer Automotive Group Ltd

- Showa Corporation

- Yamada Manufacturing Co. Ltd

- American Axle & Manufacturing Co. Ltd

- Wanxiang Qianchao Co. Ltd

- NTN Corporation

第七章 市场机会与未来趋势

The Automotive Drive Shaft Market size is estimated at USD 79.12 billion in 2025, and is expected to reach USD 108.60 billion by 2030, at a CAGR of 6.54% during the forecast period (2025-2030).

Over the medium term, with the rising population and disposable income, the demand for automobiles, such as passenger cars and commercial vehicles, is expected to grow worldwide. The increasing production and manufacturing of automobiles are fueling the demand for drive shafts globally.

The market will likely be the focus of attention during the forecast period, driven by the growing demand for commercial vehicles and buses, both of which are expected to drive global vehicle production and sales. This trend is primarily due to the growing demand for electric vehicles. In addition, automakers are putting all their efforts into making the most energy-efficient electric vehicles as their demand grows. Driveshaft manufacturers are updating their product lines to meet the constantly shifting needs of OEMs and expand their market share.

Considering the future of electric vehicles, the major OEM companies, including Volkswagen and General Motors, are investing majorly in new technology, establishing supply chains, and increasing the production capacity of EVs and their components, such as battery packs and motors. For instance:

Key Highlights

- In June 2023, Mercedes-Benz announced an investment of billions in its European assembly plants to equip them for the shift to electric cars by the end of the decade. This move involves the production of vehicles on the new electric platforms and their components to be introduced in 2025.

The automotive drive shaft market is anticipated to grow in the coming years, driven by trends such as the rising demand for lightweight components and the increasing sales of all-wheel-drive vehicles. One notable factor that is anticipated to impact the overall growth of the automotive drive shaft market in the coming years is the sharp increase in utility vehicle sales worldwide. Asia-Pacific is distinguished by the presence of emerging economies and accounts for about half of global vehicle sales.

The Asia-Pacific automotive drive shaft market is expected to hold the largest share and register the highest growth rate in the coming years. Asia-Pacific is characterized by the presence of emerging economies and accounts for a major share of global vehicle sales, which may continue over the forecast period.

Countries such as China, the United States, and Norway are continuing to see stronger demand for electric vehicles. Automakers are planning to launch more EV models in the coming years. The majority of the present and upcoming EV models are all-wheel drives (AWD) or rear-wheel drives (RWD), which may generate the demand for lightweight drive shafts during the forecast period.

Automotive Drive Shaft Market Trends

Passenger Cars Hold the Highest Share in the Market

Passenger car sales are high in the automotive market due to features such as stylish design, size, and economic value. High demand for luxury SUVs with high performance propels this growth. Therefore, many companies are focusing on the launch of various new passenger car models. For instance:

- In May 2023, Land Rover released details about its most powerful and fastest production SUV yet. The new Range Rover Sport SV packs 635 hp with a supercharged 5-liter V8 engine.

Electric vehicles have become an integral part of the automotive industry, and they represent a pathway toward achieving energy efficiency, along with reduced emissions of pollutants and other greenhouse gases. The growing environmental concerns and favorable government initiatives are the major factors driving this growth.

According to the International Energy Agency, in Q1 2024, electric car sales grew by around 25% compared to Q1 2023, with China holding the largest share of 45%, followed by Europe with 25%.

Emission laws at the governmental and regional levels have been one of the key causes propelling the EV industry in general. Road transport is commonly acknowledged as the single-largest source of air pollution in Europe. To combat air pollution, the EU Council adopted "Directive 96/62/EC on ambient air quality assessment and management," which establishes emission targets for various harmful compounds in the atmosphere. The most important pollutants produced by cars are nitrogen oxides (NOx) and fine dust (particulate matter - PM), both of which are now capped at 40 g/ m3 per year.

Europe has set a lofty target of being climate-neutral by 2050. The European Commission plans to publish several new legislative proposals over the next few years to meet this goal, many of which are aimed at improving mobility. By the end of this decade, the European Commission aims to have at least 30 million electric vehicles on the road, a tremendous increase from the current 1.4 million EVs on European roads. To achieve this aim, a set of policies and targets must be in place to guide states, businesses, and consumers on the correct path.

The demand for passenger cars may also boost the demand for sophisticated drive shafts. Manufacturers of drive shafts are researching novel materials and manufacturing procedures to build drive shafts that can handle the requirements of these vehicles. Some producers, for example, use carbon fiber instead of steel to minimize weight, while others use innovative composite materials that can withstand high torque levels. For instance:

- In January 2023, Kalyani Mobility Drivelines (KMD), a manufacturer of driveline components, introduced a lineup of constant-velocity (CV) driveshafts for EVs and other specialty vehicles.

Owing to such factors and the expansion of the electric and hybrid vehicle market, the automotive drive shaft market will likely continue to grow and evolve.

Asia-Pacific is Expected to Hold a Significant Share in the Market

China and India are the prominent countries in terms of vehicle manufacturing in Asia-Pacific. The countries have a major presence of automotive manufacturers, which may create lucrative opportunities for the market during the forecast period.

The governments in the region have introduced many incentive plans to bolster auto sales. They are also offering subsidies on the purchase of electric vehicles to encourage the expansion of the region's automotive industry. For instance:

- With the growing sales and production of passenger cars, the Indian automotive industry has been witnessing exponential growth Y-o-Y. For instance, sales of passenger cars increased from 14,67,039 to 17,47,376 units, utility vehicles from 14,89,219 to 20,03,718 units, and vans from 1,13,265 to 1,39,020 units in FY 2022-23 compared to the previous financial year.

The Indian economy is expanding as there is a rise in the disposable income of middle-income consumers. This factor, in turn, has a favorable impact on the demand for automobiles. Vehicle manufacturing has increased rapidly over the last five years due to the country's cheap production costs. The automotive sensor market is gaining traction as vehicle manufacturing increases.

The vehicular fleet in Indian cities is much younger than in EU nations and the United States, where the average age of cars is eight years and 11 years, respectively.

Major automotive component manufacturers are expanding their manufacturing facilities and introducing new products across the region. They are expected to witness major growth in the market during the forecast period. For example, KYB Corporation (KYB) announced plans to develop electric oil pumps for eAxle drive motor systems in electric vehicles (EVs) by March 2023. The company also announced plans to build oil pumps for lubricating and cooling eAxles and develop them as a new business for the era of electrification.

Thus, considering such developments and trends in the market, the Asia-Pacific automotive drive shaft market is expected to have significant growth during the forecast period.

Automotive Drive Shaft Industry Overview

The automotive drive shaft market is consolidated and led by global and regionally established players. These companies adopt strategies such as new product launches, collaborations, and mergers to sustain their market positions. For instance:

- In September 2023, JTEKT North America manufactured a broad range of products under the JTEKT Automotive Systems, Koyo Bearings, and Toyoda Machine Tools brands. By adding seven new machine lines, two new assembly lines, and additional processes to machine components internally, JTEKT North America expanded its capability to produce front drive shafts.

Some of the major players in the market include GKN PLC (Melrose Industries PLC), Yamada Manufacturing Co. Ltd, American Axle & Manufacturing Inc., JTEKT Corporation, and Dana Incorporated.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing Government Policies to Promote EV Sales

- 4.2 Market Restraints

- 4.2.1 High Cost of Maintenance Related to Drive Shafts

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value - USD)

- 5.1 By Design Type

- 5.1.1 Hollow Shaft

- 5.1.2 Solid Shaft

- 5.2 By Position Type

- 5.2.1 Rear Axle

- 5.2.2 Front Axle

- 5.3 By Vehicle Type

- 5.3.1 Passenger Cars

- 5.3.2 Commercial Vehicles

- 5.4 By Sales Channel

- 5.4.1 OEM

- 5.4.2 Aftermarket

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 India

- 5.5.3.2 China

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Rest of the World

- 5.5.4.1 South America

- 5.5.4.2 Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 GKN PLC (Melrose Industries PLC)

- 6.2.2 JTEKT Corporation

- 6.2.3 Dana Holding Corporation

- 6.2.4 Hyundai Wia Corporation

- 6.2.5 Nexteer Automotive Group Ltd

- 6.2.6 Showa Corporation

- 6.2.7 Yamada Manufacturing Co. Ltd

- 6.2.8 American Axle & Manufacturing Co. Ltd

- 6.2.9 Wanxiang Qianchao Co. Ltd

- 6.2.10 NTN Corporation

![汽车传动轴市场 - [传动轴类型:单件式、多件式;驱动系统:两轮驱动(全轴、半轴)、四轮驱动] - 全球产业分析、规模、份额、成长、趋势及预测,2025-2035 年](/sample/img/cover/42/default_cover_6.png)