|

市场调查报告书

商品编码

1683123

本质安全设备 (IS 设备) 市场 -市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Intrinsically Safe Equipment (IS Equipment) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

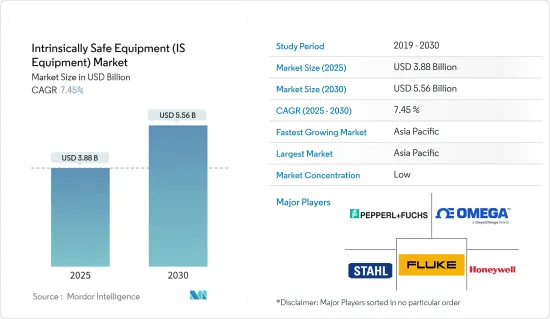

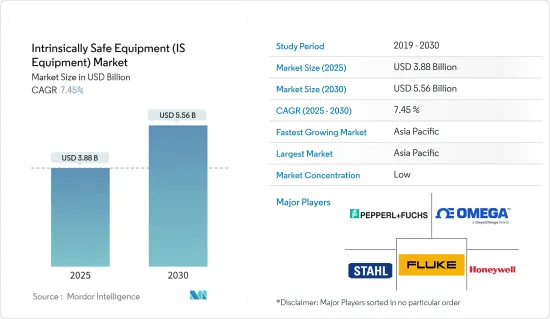

本质安全设备市场规模预计在 2025 年为 38.8 亿美元,预计到 2030 年将达到 55.6 亿美元,预测期内(2025-2030 年)的复合年增长率为 7.45%。

本质安全设备是指在正常或异常条件下,不会释放足够的电能或热能来引起特定危险大气混合物的最高可燃浓度的点燃的设备和线路。这是透过将危险区域内电气设备可用的电量限制在点燃气体的水平以下来实现的。要发生火灾或爆炸,必须有燃料、氧气和点火源。

本质安全系统假设大气中存在燃料和氧气。儘管如此,该系统的设计确保任何特定仪器迴路中的电能或热能不会大到引起火灾。本质安全 (IS) 是一种进入危险区域的设备设计方法。其目的是将可用能量降低到不足以引起点火的水平。这意味着防止火花并保持低温。

关键亮点

- 工业化进程的加速是推动本质安全设备成长的关键因素。随着人口的成长,未来几年及以后流程製造业的前景整体光明。根据工业统计,2022年第三季工业经济年增3.6%,而第二季的增幅仅2.5%。其他工业化经济体2022年第三季年增4.9%,表现优于工业化经济体集团。

- 石油和天然气探勘活动的增加对研究市场的成长产生了积极影响。由于石油和天然气工业存在高度爆炸性的环境和可燃性气体,本质安全设备被广泛使用。这个行业极易发生危险情况,紧急管理系统至关重要。国际能源总署 (IEA) 预测,2023 年全球上游石油和天然气投资将成长约 11%,达到 5,280 亿美元,为 2015 年以来的最高水准。在壳牌和英国石油公司放缓了从传统业务转向投资可再生作为能源转型一部分的计划后,对石油和天然气蕴藏量和产量的兴趣再次高涨,尤其是欧洲主要公司。

- 这导致危险区域的安全标准提高,预计在预测期内对本质安全设备的需求将增加。在2022年的本质安全防爆设备市场中,石油和天然气领域占有30.91%以上的份额。石油和天然气产业包含许多对员工和所用设备都具有危险性的领域。此外,石油和天然气产业还包括主管道、泵浦和压缩机站以及其他需要现代化、可靠的控制和安全系统的设施。

- 职业健康与安全 (OHS) 法规对于保护任何行业工人的健康和安全至关重要。然而,这些规定在北美、欧洲、亚洲、澳洲和纽西兰等不同地区存在很大差异。因此,遵守各国的法规可能是一个挑战,尤其是对于跨国经营的公司而言。一个关键的挑战是文化差异,它会影响法律的解释和实施方式。

- 此外,在世界不同地区营运的跨国公司必须客製化其产品以满足不同国家的需求,从而使生产过程变得复杂,并最大限度地降低了规模经济率。相反,国际电工委员会(IEC)等组织制定的一些国际联合标准有助于减少这种抑制剂对全球市场的影响。

- 俄罗斯与乌克兰的衝突对全球经济产生了巨大影响。依赖进口石油和天然气的国家由于依赖能源进口而受到的影响尤其严重。乌克兰衝突可能导致非洲国家石油和天然气需求激增。非洲国家持有满足日益增长的石油和天然气需求所需的蕴藏量和基础设施。包括日本和欧盟国家在内的其他国家正在积极投资非洲的石油和天然气产业,以减少对俄罗斯的依赖。此外,非洲和欧洲已经开始在石油和天然气计划上进行合作,预计将进一步扩大市场机会。

本质安全防爆设备(IS设备)市场趋势

石油和天然气终端用户领域预计将占据主要市场占有率

- 预计各个地区对安全问题的日益关注和整个行业的探勘活动的活性化将推动市场成长。在石油和天然气工业等危险场所,本质安全是一种防止电气设备和电线爆炸的设计技术。在主要的终端用户市场之一,石油和天然气行业对本质安全设备的需求很高。这个产业经常发生事故和爆炸,迫使世界各国政府实施严格的安全法规。此外,不断增长的能源需求以及海上和陆上油田探勘活动的活性化为市场在这一领域站稳脚跟提供了巨大的机会。

- 在石油和天然气工业中,现代电气设备经过专门设计,可以承受石油和天然气工业内各种过程的恶劣条件,包括马达控制和支援。随着各行业对电气设备的使用不断增加,对本质安全设备的需求也日益增加,以降低爆炸风险。在石油和天然气领域,本质安全设备被广泛用于精製、钻井平台和石化厂,以确保工人的安全并防止潜在的爆炸。

- 同样,在石油和天然气工业中,本质安全正成为确保安全保护的常用方法。该技术涉及使用低压或电力设备,包括电子设备、控制设备、人机介面 (HMI) 以及工业监视器和显示器。由于存在高度爆炸性的环境和可燃性气体,这些设备在该行业中被广泛使用。鑑于该行业的风险敏感性,实施紧急管理系统已成为强制性要求,从而增加了对各种安全标准的需求。

- 不断扩大的工业投资和全球石油需求的成长预计将为各国创造就业机会。因此,市场预计将成长,工人安全措施将成为优先事项。国际能源总署(IEA)预测,2023 年全球原油需求量将达到 1.019 亿桶/日,比 2022 年的预测高出 200 万桶/日。国际能源总署也预测,到年终,全球需求量将增加约 800 万桶/天,从而导致对海上活动的需求增加。

- 此外,根据石油输出国组织发布的报告,包括生质燃料在内的全球原油消费量将在2022年达到每天9,957万桶。预计这一数字将在2023年上升到每天1.0189亿桶,到2045年最终达到每天1.098亿桶。此外,预计到2045年柴油和轻油的需求将成长到每天3,010万桶,而2021年为每天2,760万桶。这些因素有助于提高人们的安全意识和实施更严格的安全法规,从而更加重视职场的安全,因此对一系列本质安全设备的需求也随之增加。

- 例如,业界越来越多地采用本质安全感测器来有效检测和应对环境变化。这些感测器广泛应用于石油和天然气设施,用于各种目的,包括检查泵浦、过滤器、井口和管道中其他零件的状况。此外,它在评估地上泵的效率方面也发挥着重要作用。此外,这些感测器对于监控存量基准和在潜在问题成为重大工业问题之前主动识别潜在问题具有重要价值。

亚太地区:可望大幅成长

- 中国是亚太地区最大的国家之一,主要产业包括采矿业、化学品、石油和天然气以及製程製造。过去几年,随着中国各州政府提倡更严格的职场安全法规,该地区的这些行业的本质安全设备领域发生了重大变化。此外,由于该地区工业爆炸事故和人员伤亡不断增加,人们对安全问题的担忧日益加剧,预计将加强安全设备的应用。

- 日本对本质安全设备的需求受到政府监管日益加强以及对职场安全日益关注(尤其是爆炸事故增多)的推动。其中一个例子是 2023 年 6 月新舄县一家化工厂发生的爆炸,造成一名承包商死亡,两人受伤。预计各行业将采用一系列安全设备,包括感测器、侦测器等,以便对潜在危险进行早期预警。

- 同样,日本各行各业也持续在各个领域采用本质安全设备,包括烟雾侦测器、感测器、发射器和其他设备。尤其在电力、製造和采矿等可燃性气体和液体常见的行业中尤其如此。预计这些领域的投资不断增加将带来针对防止潜在爆炸的安全设备的投资机会增加。例如,日本持续投资核能,严重依赖核能发电厂的电力。该地区核能发电活动的活性化预计将推动市场向前发展。

- 由于投资不断增长以及政府鼓励外国直接投资 (FDI) 的倡议,预计印度的需求将激增。由于存在高度爆炸性的环境和可燃性气体,因此使用这些产品是必要的,特别是在石油和天然气工业中。随着印度石油和天然气产业的扩张,政府也加强安全法规,预计将进一步推动市场发展。特别是石油工业安全局(OISD)等组织在製定和协调实施自我规范措施方面发挥关键作用,以加强印度石油和天然气产业的安全,从而增强市场潜力。

- 印尼和韩国等地区对石油天然气和采矿业的本质安全设备的需求很高。这些行业的伤亡和爆炸事故不断增加,迫使这些地区的政府实施严格的安全法规。此外,这些领域的探勘活动的活性化也推动了市场的发展。

本质安全防爆设备(IS设备)市场概况

本质安全设备市场分散,主要参与者包括 Pepperl+Fuchs、Fluke Corporation(Fortive Corporation)、OMEGA Engineering、R. Stahl AG 和 Honeywell International Inc.。市场参与企业正在采用联盟和收购等策略来增强其产品供应并获得可持续的竞争优势。

- 2023 年 10 月-Omega Engineering 宣布对其整个系列 HANITM 温度感测器进行升级。在创新且屡获殊荣的 HANI 温度感测技术的基础上进行了改进,所有 HANI 产品均达到 IP67 等级。

- 2023 年 12 月 - R. STAHL 推出用于 Ex e 开关和配电盘的新型 8530 和 8550 Ex de 防爆组件。新款 8530 和 8550 系列的亮点在于其设计,工作电流从先前的 40A 增加到 8530 系列的 63A 和 8550 系列的 125A。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- 产业价值链分析

- COVID-19 的副作用和其他宏观经济因素将如何影响市场

第五章 市场动态

- 市场驱动因素

- 加强政府监管

- 能源需求不断成长,推动新矿场和油气资源探勘需求

- 市场问题

- 各地区安全法规各有不同

- 成本和设计复杂性

第六章 市场细分

- 按区域

- 0 区

- 20 区

- 1 区

- 21 区

- 2 区

- 22 区

- 班级

- 1 类

- 2 级

- 第 3 类

- 按产品

- 感应器

- 检测器

- 转变

- 发射机

- 隔离器

- LED 指示灯

- 其他产品

- 按最终用户

- 石油和天然气

- 矿业

- 力量

- 化工和石化

- 加工

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 欧洲其他地区

- 亚太地区

- 中国

- 日本

- 印度

- 其他亚太地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 其他拉丁美洲国家

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 其他中东和非洲地区

- 北美洲

第七章 竞争格局

- 公司简介

- Pepperl+Fuchs

- Fluke Corporation(Fortive Corporation)

- OMEGA Engineering(Spectris PLC)

- R. Stahl AG

- Honeywell International Inc.

- Eaton Corporation PLC

- CorDEX Instruments Ltd

- Bayco Products Inc.

- Kyland Technology Co. Ltd

- Banner Engineering Corp.

- Georgin

第八章投资分析

第九章:市场的未来

The Intrinsically Safe Equipment Market size is estimated at USD 3.88 billion in 2025, and is expected to reach USD 5.56 billion by 2030, at a CAGR of 7.45% during the forecast period (2025-2030).

Intrinsically safe equipment is equipment and wiring that cannot release sufficient electrical or thermal energy under normal or abnormal conditions to cause the ignition of a specific hazardous atmospheric mixture in its most easily ignited concentration. This is achieved by limiting the amount of power available to the electrical equipment in the dangerous area to a level below that which will ignite the gases. Fuel, oxygen, and an ignition source must be present to have a fire or explosion.

An intrinsically safe system assumes that fuel and oxygen are present in the atmosphere. Still, the system is designed in a way that the electrical energy or thermal energy of a particular instrument loop can never be significant enough to cause ignition. Intrinsic safety (IS) is an approach to the design of equipment going into hazardous areas. The idea is to reduce the available energy to a level too low to cause ignition. That means preventing sparks and keeping temperatures down.

Key Highlights

- Flourishing industrialization is a significant factor driving the growth of intrinsically safe equipment. With the growing population, the outlook for process manufacturing is generally positive over the next year or so. According to United Nations Industrial Organizations, industrial economies ticked from a limited 2.5% Y-o-Y increase in the second quarter of 2022 to a 3.6% expansion in the third quarter. Other industrializing economies registered a Y-o-Y output increase of 4.9% in the third quarter of 2022, higher than the group of industrial economies.

- The rising oil and gas exploration activities have positively impacted the growth of the market studied, as intrinsically safe equipment is widely used in the oil and gas industry because of the highly explosive atmosphere and flammable gasses. The industry is highly prone to risks, and emergency management systems are crucial. The International Energy Agency forecasts global upstream oil and gas investments to increase by about 11% to USD 528 billion in 2023, the highest level since 2015. The renewed appetite for oil and gas reserves and production - among European majors in particular - comes after Shell and BP slowed down plans to shift away from their legacy business and invest in renewables as part of the energy transition.

- Thus, the demand for intrinsically safe equipment is expected to increase during the forecast period because of the increased safety standards for hazardous areas. The oil and gas segment held over a 30.91% share in the intrinsically safe equipment market in 2022. The oil and gas industry broadly includes areas that are hazardous to the employees and the equipment used. Moreover, the oil and gas industry includes trunk pipelines, pumping and compressor stations, and other facilities requiring modern and reliable control and safety systems.

- Occupational health and safety (OHS) regulations are essential for protecting the health and safety of workers in any industry. However, these regulations can vary significantly from region to region, including North America, Europe, Asia, Australia, and New Zealand. Thus, complying with regulations in different countries can be challenging for companies, especially those that operate across borders. One significant challenge is the cultural differences that may affect how laws are interpreted or implemented.

- Furthermore, multinational companies working in global regions have to work toward customizing their products per the varying country requirements, making their production process more complex and minimizing the rate of economies of scale. On the contrary, some of the joint international standards set by organizations such as the International Electrotechnical Commission reduce the impact of this restraint in the global market.

- The conflict between Russia and Ukraine has dramatically affected the global economy. Countries that rely on importing oil and natural gas have been particularly impacted due to their dependence on energy imports. The ongoing conflict in Ukraine could potentially result in a surge in the demand for oil and gas from African nations, as they possess the necessary reserves and infrastructure to meet this growing need. Various countries, including Japan, EU nations, and others, actively invest in Africa's oil and gas sector to reduce their reliance on Russia. Furthermore, Africans and Europeans have already begun collaborating on oil and gas projects, which are expected to further enhance the market's opportunities.

Intrinsically Safe Equipment (IS Equipment) Market Trends

Oil and Gas End User Segment is Expected to Hold a Significant Market Share

- The growing safety concerns and increasing exploration activities across the industry in various regions are expected to drive market growth. In hazardous locations, such as those found in the oil and gas industry, intrinsic safety serves as a design technique to prevent explosions in electrical equipment and wiring. The intrinsically safe equipment finds significant demand in the oil and gas sector, which is one of its primary end-user markets. Governments worldwide are compelled to enforce strict safety regulations due to the industry's rising number of accidents and explosions. Furthermore, the expanding energy requirements and the growing exploration activities in offshore and onshore oil fields present a substantial opportunity for the market to establish a foothold in this sector.

- In the O&G industry, modern electrical equipment is specifically engineered to withstand the demanding conditions of various processes within the oil and gas industry, including motor controls and supports. As the utilization of electrical equipment continues to rise across the industry, there is a growing requirement for intrinsically safe equipment to mitigate the risk of explosions. In the oil and gas sector, intrinsically safe equipment is extensively employed in oil refineries, drilling rigs, and petrochemical plants to safeguard workers and prevent potential explosions.

- Similarly, in the oil and gas industry, intrinsic safety has emerged as a prevalent method for ensuring safety protection. This technique involves the use of lower voltage or power equipment, including electronics, controls, HMIs, and industrial monitors and displays. These devices are extensively utilized in this industry due to the presence of highly explosive atmospheres and flammable gases. Given the industry's susceptibility to risks, the implementation of emergency management systems has become imperative, leading to a growing demand for diverse safety standards.

- The industry's increasing investments and the rising global oil demand are projected to create employment opportunities in various countries. As a result, the market is expected to grow and prioritize safety measures for workers. According to the International Energy Agency (IEA), the global demand for crude oil was estimated to reach 101.9 million barrels per day (bpd) in 2023, surpassing the 2022 forecast by 2 million bpd. Additionally, the IEA predicts that by the end of the decade, global demand will increase by approximately eight million bpd, leading to a greater demand for offshore activities.

- Moreover, according to the report released by OPEC, the global consumption of crude oil, including biofuels, reached 99.57 million barrels per day in 2022. This figure is projected to climb to 101.89 million barrels per day in 2023 and eventually reach 109.8 million barrels per day by 2045. Additionally, the demand for diesel and gasoil is expected to rise to 30.1 million barrels per day in 2045, compared to 27.6 million barrels in 2021. These factors will contribute to increased awareness and the implementation of stricter safety regulations, placing a greater emphasis on workplace safety, thereby driving the need for various intrinsically safe equipment.

- For instance, in the industry, there is a growing trend of embracing intrinsically safe sensors to detect and react to environmental changes effectively. These sensors are extensively utilized in gas and oil facilities for various purposes, such as examining the state of pumps, filters, wellheads, and other components of pipelines. Additionally, they play a crucial role in evaluating the efficiency of above-ground pumps. Furthermore, these sensors are of great importance in monitoring inventory levels and proactively identifying potential issues before they become major concerns in the industry.

Asia-Pacific Expected to Register Major Growth

- China is one of the biggest countries in APAC, having major industries like mining, chemicals, oil and gas, process manufacturing, and others. Over the past few years, there have been significant changes in the field of intrinsically safe equipment across these industries in the region, as governments across the Chinese states have been advocating for more stringent workplace safety regulations. Moreover, increasing safety concerns owing to the increasing explosions and causalities across the industries in the region are expected to enhance the safety equipment applications.

- The demand for intrinsically safe equipment in Japan is being driven by the growing number of government regulations and increasing concerns about safety and security in the workplace, particularly due to the rise in explosion activities. An example of this is the explosion that occurred at a chemical plant in Niigata Prefecture in June 2023, resulting in the death of a contractor and injuries to two others. The industry is expected to adopt a range of safety equipment, including sensors, detectors, and others, to provide early warning of potential hazards.

- Similarly, various industries in Japan are continuously incorporating intrinsically safe equipment, including smoke detectors, sensors, transmitters, and other devices, across different sectors. This is particularly evident in industries such as power, manufacturing, mining, and others, where the utilization of flammable gases or liquids is prevalent. The growing investments in these sectors are anticipated to create more opportunities for safety equipment, aiming to prevent potential explosions. For example, Japan is consistently investing in nuclear power energy and heavily relies on electricity generated from nuclear plants. The escalating activities in nuclear power generation within the region are projected to drive the market forward.

- The market studied in India is anticipated to experience a surge in demand due to the growing investments and government initiatives aimed at promoting foreign direct investments (FDIs). This is particularly relevant in the oil and gas industry, where highly explosive atmospheres and flammable gases necessitate the use of these products. As the Indian oil and gas industry expands, the government is also intensifying safety regulations, which are expected to drive the market further. Notably, organizations such as the Oil Industry Safety Directorate (OISD) play a crucial role in formulating and coordinating the implementation of self-regulatory measures to enhance safety in the Indian oil and gas industry, thereby bolstering the market's potential.

- The regions of Indonesia, Korea, and others have a significant demand for intrinsically safe equipment in the oil and gas and mining sectors. These industries are witnessing a rise in casualties and explosions, which have compelled governments in these regions to implement strict safety regulations. Additionally, the market is being driven by the growing exploration activities in these sectors.

Intrinsically Safe Equipment (IS Equipment) Market Overview

The intrinsically safe equipment market is fragmented with the presence of major players like Pepperl + Fuchs, Fluke Corporation (Fortive Corporation), OMEGA Engineering, R. Stahl AG, and Honeywell International Inc. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- October 2023 - Omega Engineering announced the upgrade of its entire family of HANITM Temperature Sensors, a series of sensors. These improvements to the innovative, award-winning HANI temperature sensing technology include an IP67 rating for all HANI products.

- December 2023 - R. STAHL introduced new 8530 and 8550 Ex d e explosion-protected components for Ex e switching and power distribution boards. The highlight of both the new 8530 and 8550 series is the design, and the operating current - previously 40A - is increased to 63A for the 8530 series and even to 125A for the 8550 series.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Number of Government Regulations

- 5.1.2 Growing Energy Requirements, Driving the Demand for Exploration of New Mines and Oil and Gas Resources

- 5.2 Market Challenges

- 5.2.1 Varying Safety Regulations Across Different Regions

- 5.2.2 Cost and Design Complexity

6 MARKET SEGMENTATION

- 6.1 By Zone

- 6.1.1 Zone 0

- 6.1.2 Zone 20

- 6.1.3 Zone 1

- 6.1.4 Zone 21

- 6.1.5 Zone 2

- 6.1.6 Zone 22

- 6.2 By Class

- 6.2.1 Class 1

- 6.2.2 Class 2

- 6.2.3 Class 3

- 6.3 By Products

- 6.3.1 Sensors

- 6.3.2 Detectors

- 6.3.3 Switches

- 6.3.4 Transmitters

- 6.3.5 Isolators

- 6.3.6 LED Indicators

- 6.3.7 Others Products

- 6.4 By End User

- 6.4.1 Oil and Gas

- 6.4.2 Mining

- 6.4.3 Power

- 6.4.4 Chemical and Petrochemical

- 6.4.5 Processing

- 6.4.6 Other End Users

- 6.5 By Geography

- 6.5.1 North America

- 6.5.1.1 United States

- 6.5.1.2 Canada

- 6.5.2 Europe

- 6.5.2.1 Germany

- 6.5.2.2 United Kingdom

- 6.5.2.3 France

- 6.5.2.4 Rest of Europe

- 6.5.3 Asia-Pacific

- 6.5.3.1 China

- 6.5.3.2 Japan

- 6.5.3.3 India

- 6.5.3.4 Rest of Asia-Pacific

- 6.5.4 Latin America

- 6.5.4.1 Brazil

- 6.5.4.2 Mexico

- 6.5.4.3 Argentina

- 6.5.4.4 Rest of Latin America

- 6.5.5 Middle East & Africa

- 6.5.5.1 Saudi Arabia

- 6.5.5.2 United Arab Emirates

- 6.5.5.3 Rest of Middle East & Africa

- 6.5.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Pepperl + Fuchs

- 7.1.2 Fluke Corporation (Fortive Corporation)

- 7.1.3 OMEGA Engineering (Spectris PLC)

- 7.1.4 R. Stahl AG

- 7.1.5 Honeywell International Inc.

- 7.1.6 Eaton Corporation PLC

- 7.1.7 CorDEX Instruments Ltd

- 7.1.8 Bayco Products Inc.

- 7.1.9 Kyland Technology Co. Ltd

- 7.1.10 Banner Engineering Corp.

- 7.1.11 Georgin