|

市场调查报告书

商品编码

1683127

生物乙酸市场 -市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Bio-Acetic Acid - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

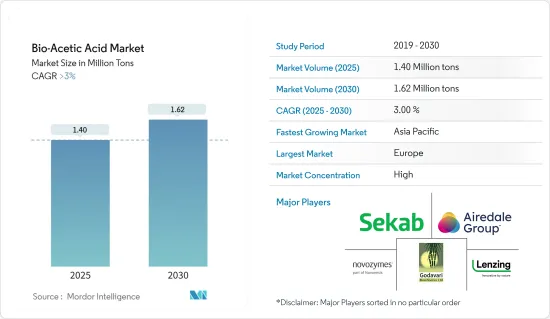

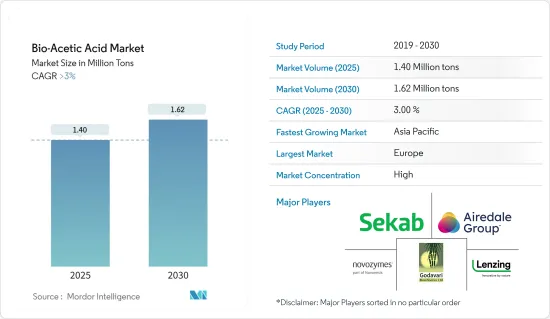

生物乙酸市场规模预计在 2025 年为 140 万吨,预计在 2030 年达到 162 万吨,预测期内(2025-2030 年)的复合年增长率将超过 3%。

2020 年,生物乙酸市场受到 COVID-19 的不利影响。受疫情影响,建设活动和汽车製造活动暂停,导致对用于配製黏合剂、油漆、被覆剂、塑胶、复合材料等终端用户工业产品的醋酸乙烯单体的需求减少,从而对生物乙酸的市场需求产生负面影响。不过,随着各产业恢復生产,市场仍维持了成长轨迹。

预计预测期内对生物基和可再生化学品以及醋酸乙烯单体(VAM) 的需求不断增加将推动市场需求。

另一方面,替代原材料的可用性和原材料价格的波动预计会阻碍市场成长。

在预测期内,开发新的分离技术以提高生产效率很可能成为市场发展的机会。

亚太地区贡献了最高的市场占有率,预计将在预测期内占据市场主导地位。

生物乙酸市场趋势

醋酸乙烯单体(VAM) 占据市场主导地位

- 乙酸主要用于生产醋酸乙烯单体(VAM)。乙酸的伯酯,例如乙酸乙酯和醋酸丁酯,通常用作油漆和涂料的溶剂。

- 醋酸乙烯单体(VAM) 用于製造水性涂料、黏合剂、防水被覆剂以及纸和纸板被覆剂,并用于各种终端行业,包括建筑、油漆和涂料、塑胶、溶剂、黏合剂和纺织品。

- 从全球来看,醋酸乙烯单体消费量的成长受到中国和美国的需求所推动。

- 在印度,亚洲涂料有限公司 (Asian Paints Ltd) 的完全子公司亚洲涂料 (聚合物) 私人有限公司 (APPPL) 宣布,将于 2023 年在古吉拉突邦赫吉建立醋酸乙烯酯-乙烯乳液 (VAE) 和醋酸乙烯单体(VAM) 製造工厂。建立该製造工厂的预计成本为 210 亿印度卢比(2.5124 亿美元)。

- 据 Motilal Oswal Financial Services(MOFSL)称,醋酸乙烯单体(VAM)是最大的醋酸衍生物,占全球需求的 40%。

- 2023年10月,美国跨国承包商KBR及其日本乙酰技术合作伙伴昭和电工被亚洲涂料公司选中,为印度的一家基层醋酸乙烯单体(VAM) 工厂提供服务。根据协议条款,KBR将为该年产10万吨的工厂提供技术许可、基础工程和专有设施。另一方面,昭和电工列出了催化剂和操作技术。

- 因此,预计 VAM 市场中的所有这些趋势将在预测期内推动生物乙酸市场的需求。

亚太地区占市场主导地位

- 亚太地区是全球最大的生物乙酸消费地区和成长最快的市场。

- 乙酸是一种重要的化学试剂和工业化学品,用于製造塑胶软饮料瓶、照相胶片、油漆和被覆剂。建设活动的增加增加了对所用油漆和被覆剂的需求,从而增加了对乙酸的需求。

- 亚太地区对醋酸乙烯单体(VAM) 的需求正在增长,其中中国发挥关键作用。中国和印度人口众多,全球市场消费潜力大。

- 在印度,国内VAM需求100%依赖进口。最大的衍生物醋酸乙烯单体(VAM)占醋酸消费量的34%。新加坡是印度VAM主要进口国,占印度VAM进口总量的一半以上。

- 2023年12月,中国江苏苏宝化工宣布在镇江新区投资醋酸乙烯酯和EVA综合计划。该雄心勃勃的计划将分两个阶段进行,首先建造一座年产能为 33 万吨的 VAM 生产工厂。

- 2023年初,INEOS与乐天株式会社宣布,计画在韩国蔚山兴建第三家VAM厂,将VAM产能从45万吨扩大至70万吨。

- 上述因素导致亚太地区对生物乙酸消费的需求不断增加。

生物乙酸产业概况

生物乙酸市场正在整合。主要参与企业(不分先后顺序)包括 LENZING AG、Godavari Biorefineries Ltd、Airedale Group、Novozymes A/S(Novonesis 集团的一部分)和 Sekab。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 对生物基和可再生化学品的需求不断增加

- 醋酸乙烯单体(VAM)需求增加

- 限制因素

- 替代产品的可用性

- 原物料供应和价格的波动;

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场区隔(市场规模(基于数量))

- 原料

- 生物质

- 玉米

- 玉米

- 糖

- 其他成分

- 应用

- 醋酸乙烯单体(VAM)

- 醋酸酯

- 精对苯二甲酸(PTA)

- 乙酸酐

- 其他的

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 西班牙

- 北欧国家

- 土耳其

- 俄罗斯

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东和非洲

- 卡达

- 阿拉伯聯合大公国

- 奈及利亚

- 埃及

- 南非

- 其他中东和非洲地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- AFYREN SA

- Airedale Group

- btgbioliquids

- GODAVARI BIOREFINERIES LTD

- Jubilant Ingrevia Limited

- LanzaTech

- LENZING AG

- Novozymes A/S(Novonesis Group)

- Sekab

- SUCROAL SA

第七章 市场机会与未来趋势

- 开发新型分离技术以提高生产效率

The Bio-Acetic Acid Market size is estimated at 1.40 million tons in 2025, and is expected to reach 1.62 million tons by 2030, at a CAGR of greater than 3% during the forecast period (2025-2030).

The bio-acetic acid market was negatively impacted by COVID-19 in 2020. Construction activities and automotive manufacturing activities were on a temporary halt owing to the pandemic scenario, which had minimized the demand for vinyl acetate monomer used in the formulation of these end-user industry products such as adhesives, paints, coatings, plastics, and composites, in turn, negatively impacted the market demand for bio-acetic acid. However, the market retained its growth trajectory due to all the industries' resumed production processes.

Increasing demand for bio-based and renewable chemicals and vinyl acetate monomers (VAM) is expected to drive market demand during the forecast period.

On the flip side, the availability of alternatives and volatility in the feedstock availability and prices are expected to hinder the growth of the market.

Developing new separation technologies to increase production efficiency is likely to act as an opportunity for the market studied over the forecast period.

Asia-Pacific accounts for the highest market share and is expected to dominate the market during the forecast period.

Bio-Acetic Acid Market Trends

The Vinyl Acetate Monomer (VAM) Segment to Dominate the Market

- Acetic acid is mainly used to manufacture vinyl acetate monomer (VAM). The major esters of acetic acid, such as ethyl acetate and butyl acetate, are commonly used as solvents for paints and coatings.

- Vinyl acetate monomer (VAM) is used to produce water-based paints, adhesives, waterproofing coatings, and paper and paperboard coatings that can be used in various end-use industries such as construction, paints and coatings, plastic, solvents, adhesives, and textiles.

- On the Global front, growth in vinyl acetate monomer consumption is driven by demand in China and the United States.

- In India, in 2023, Asian Paints (Polymers) Private Limited (APPPL), a wholly-owned subsidiary of Asian Paints Ltd, announced the setting up of a manufacturing facility of vinyl acetate-ethylene emulsion (VAE) and vinyl acetate monomer (VAM) at Dahej, Gujarat. The approximate cost of setting up the manufacturing facility would be INR 2,100 crore (USD 251.24 million).

- According to the Motilal Oswal Financial Services (MOFSL), vinyl acetate monomer (VAM) is the largest acetic acid derivative, accounting for 40% of its global demand.

- In October 2023, US-based multinational contractor KBR and its Japanese acetyls technology partner, Showa Denko, were selected by Asian Paints to provide services for a grassroots vinyl acetate monomer (VAM) plant in India. Under the contract terms, KBR will provide a technology license, basic engineering, and proprietary equipment for a 100,000 t/y plant. In contrast, Showa Denko will provide the catalysts, along with its technical operating know-how.

- Thus, all such trends in the VAM market are expected to drive the demand for the bio-acetic acid market during the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific is the largest consumer of bio-acetic acid globally and is the fastest-growing market.

- Acetic acid is an important chemical reagent and industrial chemical used in producing plastic soft drink bottles, photographic films, paints, and coatings. The increasing construction activities boost the demand for paints and coatings to be used, boosting the demand for acetic acid.

- Asia-Pacific accounts for the growing demand for vinyl acetate monomer (VAM), a crucial role that China is playing. Due to the huge population in China and India, they pose a huge consumption potential for the global market.

- In India, 100% of domestic VAM demand is met through imports. The largest derivative, vinyl acetate monomer (VAM), accounts for 34% of acetic acid consumption. Singapore is a major importer, with more than half the share of the total quantity of VAM imported by India.

- In December 2023, Jiangsu Sopo Chemical in China announced investing in a vinyl acetate and EVA-integrated project in the Zhenjiang New District. This ambitious project will unfold in two stages, beginning with the construction of a VAM production plant with a substantial capacity of 330 thousand tons per year.

- In early 2023, INEOS and LOTTE Corporation announced plans to expand VAM production capacity from 450 kilotons to 700 kilotons by adding a third VAM plant in Ulsan, South Korea, with expectations for completion by the end of 2025.

- The factors above contribute to the increasing demand for bio-acetic acid consumption in Asia-Pacific.

Bio-Acetic Acid Industry Overview

The bio-acetic acid market is consolidated. Some major players (not in any particular order) include LENZING AG, Godavari Biorefineries Ltd, Airedale Group, Novozymes A/S (Novonesis Group), and Sekab.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Bio-based and Renewable Chemicals

- 4.1.2 Increasing Demand for Vinyl Acetate Monomers (VAM)

- 4.2 Restraints

- 4.2.1 Availability of Alternatives

- 4.2.2 Volatility in the Feedstock Availability and Prices

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Raw Material

- 5.1.1 Biomass

- 5.1.2 Corn

- 5.1.3 Maize

- 5.1.4 Sugar

- 5.1.5 Other Raw Materials

- 5.2 Application

- 5.2.1 Vinyl Acetate Monomer (VAM)

- 5.2.2 Acetate Esters

- 5.2.3 Purified Terephthalic Acid (PTA)

- 5.2.4 Acetic Anhydride

- 5.2.5 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Spain

- 5.3.3.6 NORDIC Countries

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Qatar

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Nigeria

- 5.3.5.4 Egypt

- 5.3.5.5 South Africa

- 5.3.5.6 Rest of Middle East and Africa

- 5.3.6 Middle East and Africa

- 5.3.6.1 Saudi Arabia

- 5.3.6.2 South Africa

- 5.3.6.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AFYREN SA

- 6.4.2 Airedale Group

- 6.4.3 btgbioliquids

- 6.4.4 GODAVARI BIOREFINERIES LTD

- 6.4.5 Jubilant Ingrevia Limited

- 6.4.6 LanzaTech

- 6.4.7 LENZING AG

- 6.4.8 Novozymes A/S (Novonesis Group)

- 6.4.9 Sekab

- 6.4.10 SUCROAL SA

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of New Separation Technologies to Increase Production Efficiency