|

市场调查报告书

商品编码

1683160

汽车自我调整照明系统:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Automotive Adaptive Lighting System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

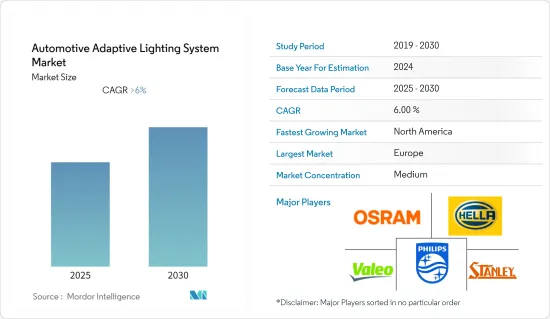

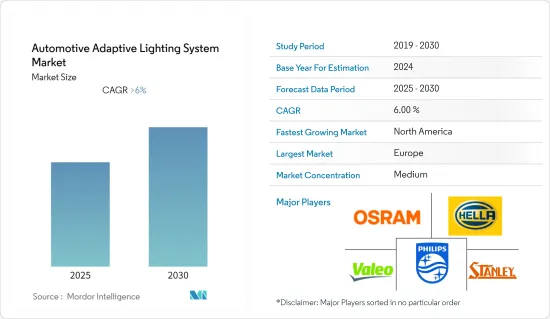

预计预测期内汽车自我调整照明系统市场复合年增长率将超过 6%。

由于製造工厂关闭和汽车产量减少,COVID-19 疫情对市场产生了负面影响。不过,疫情过后需求已开始復苏,汽车及相关零件产业的成长支撑了市场成长。

推动汽车主动式转向头灯市场成长的主要因素之一是全球范围内自动驾驶汽车、商用汽车等各种车辆的日益普及以及汽车行业的电气化。这影响了包括自我调整前照明系统在内的产品的需求。此外,LED 头灯可提高安全性并减少车辆碰撞的总次数。因此,该行业正在以更快的速度扩张。

此外,政府以法规形式不断推出的措施促进主动式转向头灯的使用以及驾驶辅助系统的高采用率也在推动汽车主动式转向头灯业务的发展。此外,预计汽车主动式转向头灯的技术进步将在预测期内推动市场需求。

由于该地区汽车工业的不断发展,预计欧洲和北美以及亚太地区将在预测期内占据重要的市场占有率。推动这些地区市场成长的关键因素是对乘客安全和生产力的先进技术功能的需求不断增长,以及增加製造活动的奖励。中国、印度和日本等新兴市场的崛起、购买力的提高、电动车生产的大量投资以及政府措施越来越多地采用主动式转向头灯的倡议,正在推动该市场的成长。

汽车自我调整照明系统市场趋势

预测期内,头灯市场可能会出现显着的市场成长

自我调整头灯是主动式安全系统的一部分,旨在透过提高弯道和山坡上的可视度,使夜间和照度下的驾驶更加安全。高级头灯 (AFL) 系统可优化前照灯光线分布,以适应不断变化的驾驶和道路条件。由于导致严重伤亡的夜间交通事故不断增加,AFLS 在汽车中的应用也日益广泛。例如,欧洲立法试图透过鼓励汽车配备更多的安全系统来减少致命事故。

根据车速和转向输入,该系统将近光灯转向驾驶者行驶的方向。这使得驾驶员能够专心驾驶,节省时间和精力。此系统可调整头灯角度和光输出,使驾驶者即使在夜间或其他能见度较差的条件下也能获得最佳可视度。例如

- 博世的智慧头灯控制使用摄影机自动调整近光或远光范围。自我调整照明系统不仅可以控制灯光的范围和分割,还可以根据交通状况控制光束的宽度。

- 同时,BMW主动式转向头灯作为选配配置提供,配备无眩光远光辅助系统,可智慧控制主头灯光束。在该系统中,前视镜中的影像感测器可监测前方 400 公尺内的照明条件和交通状况。

除了这些因素之外,物流和运输业对具有主动式转向头灯和交通感测器等先进安全功能的重型商用车的需求也在增加。此外,卡车驾驶人和车主对道路安全的日益关注,导致了对自我调整前照明技术解决方案的需求,从而推动了市场成长。

预计预测期内欧洲将占据主要市场占有率

欧洲汽车市场受政府规范和法规驱动。这些法规正在推动OEM开发先进的汽车照明系统。 ADAS(高级驾驶辅助系统)的重大进步正在推动该地区汽车采用自我调整照明。

虽然豪华汽车製造商和高端品牌提供高端车辆,但许多汽车製造商现在正在将 ADAS 和自我调整照明技术引入其入门级车辆中。对配备先进安全功能的中小型车辆的需求持续成长,最终将推动该地区自我调整照明市场的成长。欧洲汽车製造商正在设计、製作原型并测试外部照明的可能性。例如

- Polestar 透过 Polestar 2 Fastback 将先进的照明技术引入紧凑型高端电动车领域。这款汽车在斯堪地那维亚开发,非常适合在最黑暗的夜晚和白天行驶。

- 大众汽车公司正在研发一种技术,当汽车转弯时,它会在道路上投射出一对红色警示线,让行人知道哪里是危险区域,或许还能消除汽车从高围栏车道倒车时挡住人行道上骑车人的问题。

- 同样,海拉的主动式转向头灯系统将该公司的 VarioX® 模组与旋转模组结合在一起。光源和透镜组合有一个可沿其纵轴旋转的圆柱体。圆柱体的外表面在道路上产生不同的光分布,步进马达在几毫秒内将圆柱体旋转到所需位置。

由于上述因素,预测期内欧洲预计将占据汽车自我调整照明系统市场的主导份额。

汽车自我调整照明系统产业概况

汽车自我调整照明系统市场由各种国际和区域参与者主导,例如:Osram Licht AG、Valeo Group、HELLA KGaAHueck& Co. 和 Stanley Electric。这些公司专注于策略合作计划,以扩大其市场份额和盈利能力。相比之下,主要汽车製造商都在其即将推出的车型中提供自适应头灯。例如,

- 2021 年 4 月,福特欧洲研究与先进工程中心的工程师正在测试预测智慧照明系统技术,该技术利用即时位置资料有效地引导车辆行驶。原型车的先进照明系统利用 GPS 定位、先进技术和高度精确的道路几何资讯来准确识别前方道路的转弯。

- 2019年,海拉有限公司和位于索斯特的弗劳恩霍夫无机磷光体应用中心完成了基于雷射技术的照明系统原型。高解析度头灯模组原型由头灯内部的雷射光源组成。

- 雷诺宣布,2020 年雷诺 Talisman 将配备带有 LED MATRIX 技术的主动式转向头灯和动态 LED 转向灯。雷诺还更新了其 Espace 小型货车的 2020 年车型。该车型是第一款采用自我调整矩阵光束大灯的汽车。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场驱动因素

- 市场限制

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔

- 按车型

- 中端乘用车

- 跑车

- 高级轿车

- 按类型

- 正面

- 后部

- 依组件类型

- 控制器

- 感应器/摄影机

- 灯组件

- 其他的

- 按销售管道

- OEM

- 售后市场

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 其他欧洲国家

- 亚太地区

- 印度

- 中国

- 日本

- 韩国

- 其他亚太地区

- 世界其他地区

- 南美洲

- 中东和非洲

- 北美洲

第六章 竞争格局

- 供应商市场占有率

- 公司简介

- HELLA KGaA Hueck & Co.

- Hyundai Mobis

- Valeo Group

- Magneti Marelli SpA

- Koito Manufacturing Co. Ltd

- Koninklijke Philips NV

- Texas Instruments

- Stanley Electric Co. Ltd

- OsRam Licht AG

- ZKW Group

- General Electric Company

第七章 市场机会与未来趋势

The Automotive Adaptive Lighting System Market is expected to register a CAGR of greater than 6% during the forecast period.

The COVID-19 pandemic had a negative impact on the market owing to the shutdown of manufacturing facilities and decreased vehicle production. However, post-pandemic demand started restoring as the market growth was supported by the growing automotive and its associated components industry.

One of the major factors driving the growth of the Automotive Adaptive Headlights market is the increasing adoption of various vehicles, such as autonomous vehicles, commercial vehicles, and others, combined with the electrification of the automotive industry around the world. This is affecting the demand for this product, including adaptive front lighting systems. Furthermore, LED headlights to improve safety, lowering the overall number of vehicle collisions. As a result, the industry's expansion is accelerated.

Furthermore, the government's rising measures in the form of rules and regulations to promote the use of adaptive headlights, as well as the high adoption rate of driver assistance systems, propel the Automotive Adaptive Headlights business forward. In addition, technological advancement in automotive adaptive lighting is expected to stimulate demand in the market during the forecast period.

Europe and North America, followed by Asia-Pacific expected to capture significant market shares during the forecast period owing to the growth rate of the automotive industry in this region. The key factors driving the growth of the market in these regions are an increasing need for technologically advanced features for passenger safety and productivity coupled with the incentive to increase manufacturing activities. The emergence of developing countries such as China, India, Japan, and other, increase in purchasing power, high investment in electric vehicle production, and increasing government initiatives for the adoption of adaptive headlights drives the growth of this market.

Automotive Adaptive Lighting System Market Trends

Front Lighting Segment of Market Likely to Grow Significantly During the Forecast period

Adaptive front lights are a part of the active safety systems designed to make driving at night or in low-light conditions safer by increasing visibility around curves and over hills. Advanced Front-lighting (AFL) system optimizes light distribution from the headlights according to the changing driving and road circumstances. The adoption of the automotive AFLS is increasing due to the growing number of road accidents at night, resulting in severe injuries and fatalities. For instance, European legislation is trying to reduce fatalities by encouraging the inclusion of an increased number of safety systems in vehicles.

Depending on vehicle speed and steering input, the system projects the low-beam headlights in the direction the driver intends to travel. Thereby, it saves time and effort for the driver helping him to concentrate on driving. The system provides an optimized vision to the driver during the night and other poor-sight conditions of the road by adapting the headlight angle and light intensity. For instance:

- Bosch intelligent headlight control utilizes a video camera to automatically adjust the low beam or high beam lights range. The adaptive lighting system not only controls the range or segmentation of the light but can also manipulate the width of the beam according to traffic conditions.

- Whereas BMW Adaptive Headlights come with optional glare-free High Beam Assist, which controls the headlights' main beam for proper illumination. In this system, an image sensor inside the front mirror looks after the lighting conditions and the traffic ahead of 400 meters.

Apart from all these factors, demand for heavy commercial vehicles with advanced safety features, such as adaptive headlights and traffic sensors, in the logistics and transportation industries is also increasing. Moreover, rising road safety concerns among truck drivers and fleet owners are resulting in the demand for adaptive front-lighting technology solutions, which, in turn, is driving the market growth.

Europe is Expected to Hold Major Market Share During the Forecast Period

Government norms and regulations drive the automotive market in Europe. These regulations have prompted OEMs to develop advanced automotive lighting systems. There has been a significant advancement in the safety and driver assistance systems, driving the adoption of automotive adaptive lighting significantly in the region.

Luxury car manufacturers and premium brands offer high-end cars, but now many automakers implement ADAS and adaptive lighting technology in entry-level cars. A consistent increase in the demand for compact and mid-sized cars equipped with advanced safety features will ultimately propel the growth of the region's adaptive lighting market. Vehicle manufacturers in Europe are designing, prototyping, and testing the possibilities for external lighting. For example,

- Polestar has introduced advanced lighting technology to the compact premium electric vehicle segment on its Polestar 2 fastback. Developed in Scandinavia, the car is well adapted to even the darkest of nights and days.

- Volkswagen is working on a technology that projects a pair of red warning lines on the road when a car is turning around, thereby letting pedestrians know where the danger zone is and presumably eliminating the problem of backing out of a high-fenced driveway into the path of a cyclist on the footpath.

- Similarly, in Hella adaptive headlight systems, the company's VarioX(R) module is combined with a swiveling module. There is a cylinder that can be rotated in its longitudinal axis in the combination of the light source and the lens. The cylinder's outer surface generates different light distributions on the road, and the stepper motor turns the cylinder to the required position within milliseconds.

On the basis of the aforementioned factors, Europe is expected to hold a dominant share in Automotive Adaptive Lighting System Market during the forecast period.

Automotive Adaptive Lighting System Industry Overview

The Automotive Adaptive Lighting System Market is dominated by various international and regional players such as Osram Licht AG, Valeo Group, HELLA KGaAHueck& Co., and Stanley Electric Co. Ltd. These companies are focusing on strategic collaborative initiatives to expand their market shares and profitability. In contrast, major automakers are offering adaptive headlights in their upcoming models. For instance,

- In April 2021, Engineers at Ford research and advanced engineering Europe were testing predictive smart light system technology that uses real-time location data to effectively show the car the way to go. The prototype advanced lighting system uses GPS location data, advanced technologies, and highly accurate street geometry information to accurately identify turns in the road ahead.

- In 2019, HELLA GmbH & Co. KGaA, and the Fraunhofer Application Center for Inorganic Phosphors in Soest, completed a prototype lighting system based on laser technology. The prototype for a high-resolution headlamp module consists of a laser light source in the headlamp.

- Renault announced that the 2020 Renault Talisman would be offered adaptive headlights with LED MATRIX technology and dynamic LED indicators. Renault also updated its minivan Espace for the 2020 model year. The model of the French brand is the first car that included adaptive matrix beam headlamps.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Vehicle Type

- 5.1.1 Mid-Segment Passenger Cars

- 5.1.2 Sports Cars

- 5.1.3 Premium Vehicles

- 5.2 By Type

- 5.2.1 Front

- 5.2.2 Rear

- 5.3 By Component Type

- 5.3.1 Controller

- 5.3.2 Sensors/ Camera

- 5.3.3 Lamp Assembly

- 5.3.4 Others

- 5.4 By Sales Channel Type

- 5.4.1 OEM

- 5.4.2 Aftermarket

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 India

- 5.5.3.2 China

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Rest of the World

- 5.5.4.1 South America

- 5.5.4.2 Middle-East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 HELLA KGaA Hueck & Co.

- 6.2.2 Hyundai Mobis

- 6.2.3 Valeo Group

- 6.2.4 Magneti Marelli SpA

- 6.2.5 Koito Manufacturing Co. Ltd

- 6.2.6 Koninklijke Philips N.V.

- 6.2.7 Texas Instruments

- 6.2.8 Stanley Electric Co. Ltd

- 6.2.9 OsRam Licht AG

- 6.2.10 ZKW Group

- 6.2.11 General Electric Company