|

市场调查报告书

商品编码

1683186

消光剂市场 -市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Matting Agents - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

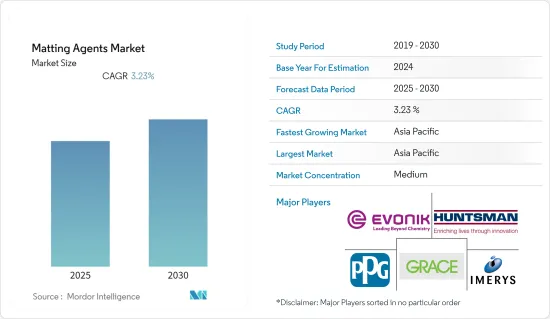

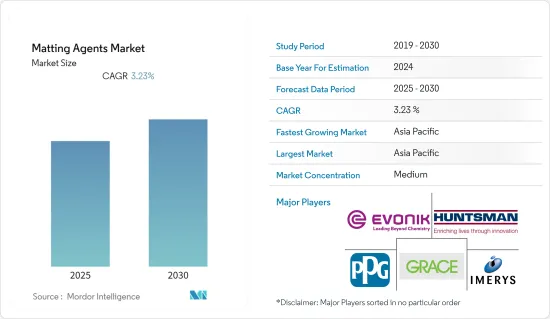

预测期内,消光剂市场预计复合年增长率为 3.23%。

COVID-19对市场产生了负面影响。由于疫情情势,全球多个国家已进入封锁状态,以遏止病毒传播。许多油漆公司和工厂关闭,扰乱了全球供应链并影响了全球的生产、交货时间和产品销售。目前,市场已经从新冠疫情中恢復,并正在经历显着的成长。

关键亮点

- 从中期来看,建筑涂料用消光剂的需求不断增加,以及其优于光泽整理加工剂的性能是推动市场发展的关键因素。

- 另一方面,有关溶剂型消光剂的规定可能会抑制市场的成长。

- 对生物基消光剂的不断增长的需求可能会在未来几年为市场带来好处。

- 亚太地区占据了最高的市场占有率,并可能在预测期内占据市场主导地位。

消光剂市场趋势

木器涂料占据市场主导地位

- 雾面剂在木材涂料中的使用日益增多,因为它们不仅能为顾客提供美感,还能提供低光泽的表面。

- 当今的水性涂料和木器涂料要求最高的性能和品质标准。目前,大多数饰面都是半光泽的,但深哑光和自然饰面正成为一种趋势。这使得配方师使用消光剂不仅是为了保护木材,也是为了增强对顾客的美感吸引力。

- 与雾面剂混合的木材漆具有高品质的性能,包括易于维护、耐刮擦、耐磨、抗紫外线和出色的表面光滑度。

- 住宅行业的成长、可支配收入的增加以及建设活动正在推动全球木材涂料市场的发展。家具领域占据木器涂料的大部分份额。据估计,2022年家具市场规模预计将达到6,943.2亿美元,2024年将达到7,660亿美元。

- 宣威公司 (Sherwin-Williams Company) 等主要公司正在大力投资这一领域。例如

- 2023 年 5 月,Gemini Coatings 签署协议,收购独立拥有的木工涂料公司 Rudd Co. Inc.。透过此次收购,现有的 Rad 和 Gritsa 客户将透过知识渊博的销售和技术团队以及使用 Gemini 现有的品牌系列获得附加价值。

- 2022 年 10 月,宣威公司宣布达成协议,收购 Industria Chimica Adriatica SpA (ICA),这是一家义大利公司,设计、製造和销售用于厨柜、家具、装饰品、建筑产品、地板材料和其他特殊应用的工业木材涂料。

- 因此,由于上述因素,木材涂料可能会占据市场主导地位,预计预测期内对消光剂的需求将会增加。

亚太地区占市场主导地位

- 在亚太地区,消光剂市场受到中国和印度等主要国家的涂料和印刷油墨产业的成长所推动。

- 中国对亚太市场的贡献庞大,占全球涂料市场的四分之一以上。中国拥有超过 1,000 家涂料企业,是该产业的主要企业。

- 2022 年 7 月,BASF欧洲公司透过其子公司BASF涂料(广东)(BCG)扩大了位于中国南方广东省江门市涂料工厂的汽车修补被覆剂生产能力。该扩建计划将使公司的生产能力增加至每年3万吨。

- 中国的油墨产业同样重要,中国是亚太地区最大的油墨用户。紫荆花油墨有限公司为叶氏化工集团有限公司的子公司,是中国最大的油墨製造商之一。随着包装产业的扩张,对油墨的需求,特别是食品包装和标籤油墨的需求也在增加。中国一些知名的包装企业包括玖龙国际(中国)投资集团、山东晨鸣纸业集团股份有限公司、太阳纸业和厦门合兴包装印刷有限公司。

- 过去二十年,印度油漆和涂料行业取得了长足的发展。该行业包括 3,000 多家涂料製造商,主要的全球市场参与企业都位于该国。

- 2023 年 1 月,亚洲涂料公司核准投资 200 亿印度卢比,在印度中央邦建立一座年产 40 万千公升的水性涂料新生产厂。该工厂预计将在三年内开始生产。

- 日本印刷油墨产业拥有几家知名製造商,包括东京印刷油墨 MG、大阪印刷油墨製造公司、联合油墨生产公司和东洋油墨 SC HOLDINGS。该倡议旨在增强食品的风味保存并提高安全标准。

- 因此,预计预测期内亚太地区被覆剂和印刷油墨产业的成长将推动亚太地区消光剂市场的发展。

消光剂产业概览

哑光剂市场已部分整合。市场的主要企业包括 Imerys SA、PPG Industrioes Inc.、Evonik Industries AG、Hunstman International LLC 和 W. R. Grace &Co.

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 建筑涂料消光剂的需求不断增加

- 比光面效果更好

- 限制因素

- 溶剂型消光剂法规

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场区隔(以金额为准的市场规模)

- 材料类型

- 二氧化硅

- 热塑性塑料

- 蜡基

- 其他材料类型

- 应用

- 涂层

- 建筑涂料

- 汽车涂料

- 工业涂料

- 木器涂料

- 其他涂料

- 印刷油墨

- 其他的

- 涂层

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作、协议

- 市场占有率(%)/排名分析

- 主要企业策略

- 公司简介

- Akzo Nobel NV

- Arkema

- Axalta Coating Systems LLC

- BASF SE

- BYK-Chemie GmbH

- CHT Germany GmbH

- Deuteron GmbH

- Evonik Industries AG

- Honeywell International Inc.

- Huber Engineered Materials

- Huntsman International LLC

- Imerys SA

- PPG Industries Inc.

- PQ Corporation

- The Lubrizol Corporation

- WR Grace & Co.

第七章 市场机会与未来趋势

- 生物基消光剂的需求不断增加

- 其他机会

The Matting Agents Market is expected to register a CAGR of 3.23% during the forecast period.

The market was negatively impacted due to COVID-19. Owing to the pandemic scenario, several countries around the world went into lockdown to curb the spread of the virus. The shutdown of numerous coatings companies and factories disrupted worldwide supply networks and harmed global production, delivery schedules, and product sales. Currently, the market has recovered from the COVID-19 pandemic and increasing at a significant rate.

Key Highlights

- In the medium term, the major factors driving the market studied are the increasing demand for matting agents for architectural coatings and superior properties to gloss finishes.

- On the flip side, regulations related to solvent-based matting agents are likely to restrain market growth.

- Growing demand for bio-based matting agents is likely to act as an opportunity for the market in the coming years.

- Asia-Pacific accounted for the highest market share, and the region is likely to dominate the market during the forecast period.

Matting Agents Market Trends

Wood Coatings to Dominate the Market

- The use of matting agents has been increasing in wood coatings as it provides a less glossy finish along with an aesthetic appeal to the customers.

- Modern waterborne and wood coatings require the highest standards in performance and quality. A majority of the finishes are currently semi-gloss, but there is a trend toward deep-matte and natural-looking coatings. This has directed the formulators toward using matting agents to enhance the aesthetic appeal to customers, as well as offer protection to the wood.

- The wood coatings mixed with matting agents offer high-quality performance characteristics, like easy-to-clean, scratch-resistance, abrasion resistance, UV resistance, and excellent surface leveling.

- The growth of the housing industry, rising disposable incomes, and construction activities drive the wood coatings market across the world. The furniture segment occupies the major share of wood coatings. According to estimates, the furniture market was valued at USD 694.32 billion in 2022, and it is estimated to reach ~USD 766 billion in 2024.

- Companies like The Sherwin-Williams Company and other major players are heavily investing in the segment. For instance,

- In May 2023, Gemini Coatings entered into an agreement to acquire substantially all the assets of Rudd Co. Inc., an independently owned wood coatings manufacturer based in Seattle. This acquisition will add value for current Rudd and Glitsa customers through knowledgeable sales and technical teams as well as access to Gemini's current family of brands,

- In October 2022, The Sherwin-Williams Company announced an agreement where it acquired Industria Chimica Adriatica SpA (ICA), an Italian designer, manufacturer, and distributor of industrial wood coatings used for kitchen cabinets, furniture, and decor, as well as building products, flooring, and other specialty applications.

- Thus, due to the abovementioned factors, wood coatings are likely to dominate the market, which, in turn, is expected to enhance the demand for matting agents during the forecast period.

Asia-Pacific Region to Dominate the Market

- In the Asia-Pacific region, the growing coatings and printing ink industries in major countries such as China and India are driving the market for matting agents.

- China's contribution to the Asia-Pacific market is substantial, accounting for over a quarter of the global coatings market. With more than 1000 coating companies in operation, China has become a major player in the industry.

- In July 2022, BASF SE, through its subsidiary BASF Coatings (Guangdong) Co. Ltd (BCG), expanded its manufacturing capabilities for automotive refinish coatings at its coatings site in Jiangmen, Guangdong Province, in South China. The company increased its production capacity to 30,000 tons annually through this expansion project.

- The ink sector in China is equally significant, with the country being the largest ink user in the Asia-Pacific region. Bauhinia Ink Company Limited, a subsidiary of Yip's Chemical Holdings Limited, is one of China's largest domestic producers of inks. The demand for inks, particularly for food packaging and labels, is experiencing growth in tandem with the expanding packaging industry. Notable Chinese packaging companies include Nine Dragons Worldwide (China) Investment Group Co. Ltd, Shandong Chenming Paper Holdings Ltd, SUN PAPER, and Xiamen Hexing Packaging and Printing Co. Ltd.

- The Indian paint and coatings industry has witnessed significant growth over the past two decades. The industry comprises more than 3,000 paint manufacturers, with the presence of major global players in the country.

- Asian Paint, in January 2023, approved an investment of INR 2,000 crore for a new waterborne paint manufacturing plant with 400,000 kiloliters per annum capacity in Madhya Pradesh, India. The facility's manufacturing is expected to be commissioned in three years.

- The Japanese printing ink industry is home to several prominent manufacturers, including TOKYO PRINTING INK MG CO. LTD, The Osaka Printing Ink Mfg. Co. Ltd, United Ink Production Co. Ltd, and TOYO INK SC HOLDINGS CO. LTD. In 2022, TOYO INK SC HOLDINGS CO. LTD announced its focus on developing water-based inks specifically designed for food packaging. This initiative aims to enhance food flavor preservation and improve safety standards.

- Therefore, the growing coatings and printing ink industries in the region are expected to drive the market for matting agents in Asia-Pacific over the forecast period.

Matting Agents Industry Overview

The matting agents market is partially consolidated in nature. Some of the major companies in the market include Imerys SA, PPG Industrioes Inc., Evonik Industries AG, Hunstman International LLC, and W. R. Grace & Co.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Matting Agents for Architectural Coatings

- 4.1.2 Superior Properties than Gloss Finishes

- 4.2 Restraints

- 4.2.1 Regulation Related to Solvent-based Matting Agents

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Material Type

- 5.1.1 Silica

- 5.1.2 Thermoplastic

- 5.1.3 Wax-based

- 5.1.4 Other Material Types

- 5.2 Application

- 5.2.1 Coatings

- 5.2.1.1 Architectural Coatings

- 5.2.1.2 Automotive Coatings

- 5.2.1.3 Industrial Coatings

- 5.2.1.4 Wood Coatings

- 5.2.1.5 Other Coatings

- 5.2.2 Printing Inks

- 5.2.3 Other Applications

- 5.2.1 Coatings

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)/ Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Akzo Nobel NV

- 6.4.2 Arkema

- 6.4.3 Axalta Coating Systems LLC

- 6.4.4 BASF SE

- 6.4.5 BYK-Chemie GmbH

- 6.4.6 CHT Germany GmbH

- 6.4.7 Deuteron GmbH

- 6.4.8 Evonik Industries AG

- 6.4.9 Honeywell International Inc.

- 6.4.10 Huber Engineered Materials

- 6.4.11 Huntsman International LLC

- 6.4.12 Imerys SA

- 6.4.13 PPG Industries Inc.

- 6.4.14 PQ Corporation

- 6.4.15 The Lubrizol Corporation

- 6.4.16 W. R. Grace & Co.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Demand for Bio-based Matting Agents

- 7.2 Other Opportunities