|

市场调查报告书

商品编码

1683197

垂直共振腔面射型雷射市场:市场占有率分析、产业趋势和成长预测(2025-2030 年)Vertical Cavity Surface Emitting Laser - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

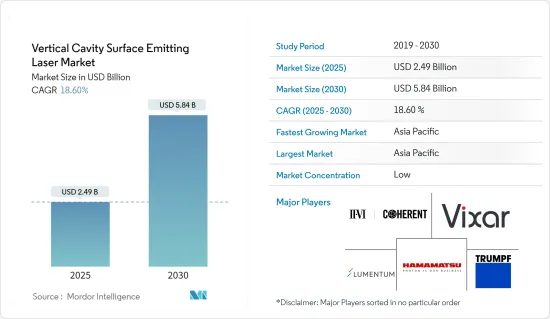

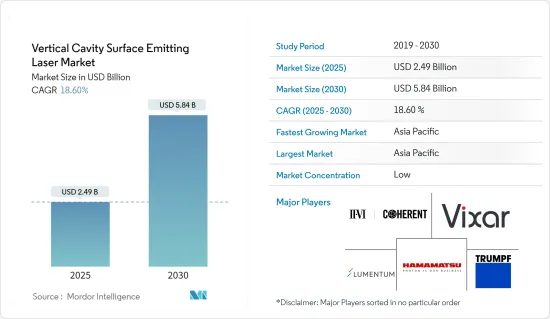

垂直共振腔面射型雷射市场规模预计在 2025 年为 24.9 亿美元,预计到 2030 年将达到 58.4 亿美元,预测期内(2025-2030 年)的复合年增长率为 18.6%。

就出货量而言,市场预计将从 2025 年的 51.4 亿台成长到 2030 年的 160.6 亿台,预测期间(2025-2030 年)的复合年增长率为 25.60%。

垂直共振腔面射型雷射(VCSEL) 是一种雷射垂直发射于其顶面的半导体。这与从边射型雷射不同。 VCSEL 以经济高效的解决方案提供高精度、高效率、高可靠性和高速度,是雷射物理学领域最有前途的新发展。 VCSEL 具有多种优势,包括低功耗、光束品质、调变速度和製造成本。

关键亮点

- 由于对高速、高效和远距资料传输的需求不断增加,汽车雷射雷达应用和工业应用对 VCSEL 雷射的需求不断增加等多种因素,预计 VCSEL 市场将在预测期内实现强劲增长。 2023 年 8 月,Innoviz Technologies 与BMW集团将扩大合作,启动新一代 LiDAR 的 B 样开发阶段。

- 在过去的几年中,资料中心的光互连基础设施已经从 100Gbit/s 发展到下一代资料速率 400Gbit/s。这主要归因于AI、VR/AR、物联网(IoT)等新兴技术市场的快速成长,以及5G行动网路系统的引入导致资料中心内资料流量的持续增加。

- 智慧型手机製造商越来越多地在智慧型手机中采用 VCSEL 进行 3D 感应和接近感应应用,这是推动市场成长的主要因素之一。 3D 感应的成长是由 iPhone 中 Face ID 模组的引入所推动的。自那时起,3D感测领域取得了巨大进步。渐渐地,3D感测已经从前置的脸部认证模组转移到后置的拍照功能。

- 由于 InP 基 VCSEL 具有低色散和低光纤损耗的特点,因此通常适用于光纤通讯等应用。然而,由于反射率高、穿透深度低,基于 InP 的 VSCEL 无法提供大屈光对比的 DBR 镜。有效共振器长限制了调谐范围和限制因子。

- COVID-19 疫情对所研究的市场产生了重大影响,部署 VCSEL 的几个终端用户产业面临多重挑战。受全国范围的停工影响,工业陷入停滞,但自2020年第二季起已逐步恢復营运。由于原材料从中国购买,因此受到美国征收关税的影响。

- 世界各地的地缘政治紧张和衝突正在推动军事需求。根据斯德哥尔摩国际和平实验室(SIPRI)统计,2022年美国军费开支高达8,770亿美元,位居世界最高国家之头。这占当年世界军费开支总额2.2兆美元的近40%。这占美国国内生产总值的3.5%。

垂直共振腔面射型雷射市场趋势

ADAS 和 LiDAR 是快速成长的应用

- 汽车产业是 VCSEL 製造商的主要新兴市场之一,受到自动驾驶汽车和汽车高端内装功能等趋势的推动。儘管近年来汽车产业受到衰退的打击,但每辆汽车感测器数量的增加是推动供应商发展的主要动力。大多数市场供应商正在扩大其在汽车市场(内部和外部应用)的影响力。

- LiDAR 是 ADAS 的关键组件,高效的 VCSEL 因其占用空间小、价格诱人、可靠性和性能卓越而非常适合 ADAS LiDAR。 VCSEL 用于 LiDAR 系统中的物体侦测和距离测绘、ADAS 和自动驾驶的外部感测技术以及用于汽车内部和外部的 3D 感测。

- 为了实现 LEVEL 4 级自动驾驶,大多数已开发地区和新兴地区都已强製或计划强制在新车中安装 ADAS,这预计将为市场供应商创造巨大的成长机会。例如,在美国,80-90%的新车都配备至少一项ADAS功能。

- 根据国家安全委员会的数据,到 2026 年,大约 71% 的註册车辆将配备后视摄影机,60% 的註册车辆将配备后部停车感测器。 ADAS 的普及可能会推动市场的成长。

- 自动驾驶和自动驾驶汽车的日益普及是 ADAS 市场的主要成长要素。例如,根据英特尔预测,2030 年全球汽车销售将达到 1.014 亿辆以上,自动驾驶汽车预计将占 2030 年汽车註册量的 12% 左右。

由于中国占据市场主导地位,预计亚太地区将显着成长

- 在亚太地区,由于汽车、医疗和消费电子产业对 VCSEL 的应用日益广泛,预计中国将显着成长。

- 中国是世界领先的家用电子电器製造国之一。该地区的製造业正在快速成长,并引进了一系列製造和通讯技术。

- 随着来自世界各地的各种电子设备不断涌入中国,中国的半导体消费成长速度快于其他国家。全球五大知名行动电话公司中有三家总部位于韩国,这为半导体应用提供了绝佳的机会。

- 中国政府也致力于创建一个动力来源的科技权威国家,以追踪和监控其公民。预计此类项目将提振该国研究市场的需求。中国政府的「中国製造2025」计画旨在2030年将半导体产业产值提升至3,050亿美元,满足80%的国内需求。预计这些发展将促进该国市场的成长。

- 领先的公司正专注于开发创新产品以巩固其市场地位。例如,VCSEL 半导体研发先驱、高速光纤通讯和 3D 深度摄影机用 VCSEL 製造商 Berxel Photonics 于 2023 年 9 月在中国深圳举行的中国国际光电博览会上宣布现场演示搭载 106Gbps VCSEL 的 800G 收发器。

- 推动 VCSEL 成长的另一个因素是电动车的日益普及。例如,该技术有望应用于汽车行业,用于手势识别、驾驶员监控和自动驾驶感测器等应用。该地区的汽车工业正在以惊人的速度成长。该地区对自订半导体和感测器的需求正在增加。因此,VCSEL 技术有望在该领域发挥关键作用。根据中汽协的数据,2023年8月中国纯电动车产量为58.9万辆,其中搭乘用55.1万辆,商用车3.8万辆。同月,中国生产了25.4万辆PHEV,其中搭乘用PHEV 25.3万辆,商用车PHEV 1000辆。

- 中国政府把汽车产业,包括零件产业定位为重点产业之一。政府预计到 2025 年中国汽车产量将达到 3,500 万辆。这些案例表明,预计在预测期内市场将会成长。

垂直共振腔面射型雷射产业概况

VCSEL 市场比较分散,主要参与者包括 Coherent Corporation、Lumentum Operations LLC、Vixar Inc(OSRAM AG)、Hamamatsu Photonics KK 和 TRUMPF Group。市场参与企业正在采取联盟和收购等策略来加强其产品供应并获得可持续的竞争优势。

- 2023 年 10 月 -资料通讯用高速 VCSEL 和光电二极体解决方案的全球参与企业通快光子元件公司 (Trumpf Photonic Components) 和西班牙高速光纤网路连结解决方案专家 KDPOF 在格拉斯哥举行的欧洲光纤通讯会议 (ECOC) 上展示了首个用于车载系统的 980nm 多Gigabit互载系统。

- 2023 年 6 月 - 全球领先的光学解决方案供应商 AMS Osram 宣布推出 TARA2,000-AUT-SAFE 系列垂直共振腔面射型雷射(VCSEL)。该公司加强了用于汽车内部感测的红外线雷射模组产品组合,并增加了更可靠、更强大的眼部安全功能。新型 TARA2,000-AUT-SAFE 可产生严格控制的红外线光束,峰值波长为 940nm。它支援与现有TARA2,000-AUT系列相同的应用场景,包括驾驶员监控、手势感应和车内监控。此紧凑模组包含一个欧司朗 VCSEL 晶片和一个 ams 微透镜阵列 (MLA)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 购买者和消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 专利状况

- COVID-19 的副作用和其他宏观经济因素将如何影响市场

第四章 市场动态

- 市场驱动因素

- 资料中心越来越多地采用 VCSEL

- 智慧型手机对 3D 感测应用的需求不断增加

- 市场限制

- InP基VCSEL渗透率低,资料传输范围有限

第五章:材料趋势分析

- 氮化镓

- 砷化镓

- 其他材料类型

第六章 市场细分

- 按波长

- 红色 (650-750 奈米)

- 近红外线(750-1,400 nm)

- 短波红外线(1,400 至 3,000 nm)

- 按晶粒尺寸

- 0.02~0.06 mm2

- 0.06~0.4 mm2

- 0.4~1.3 mm2

- 10~75 mm2

- 按最终用户产业

- 电信

- 行动和消费电子

- 车

- 医疗

- 产业

- 航太和国防

- 按应用

- 资料通讯

- 光电滑鼠

- 脸部辨识和深度相机

- 手势姿态辨识

- 雷射自动对焦

- 接近感测器

- 虹膜扫描

- 医疗的

- ADAS LiDAR

- 工业应用

- 其他的

- 按地区

- 北美洲

- 欧洲

- 台湾

- 中国

- 韩国

- 日本

- 其他的

第七章 竞争格局

- 公司简介

- Coherent Corporation

- Lumentum Operations LLC

- Vixar Inc(OSRAM AG)

- Hamamatsu Photonics KK

- TRUMPF Group

- ams OSRAM AG

- HLJ Technology Co. Ltd

- Teledyne FLIR Systems Inc.

- Vertilite Inc.

- Leanardo Electronics US(Lasertel)

- Broadcom Inc.

- Santec Corporation

第八章投资分析

第九章 市场机会与未来趋势

The Vertical Cavity Surface Emitting Laser Market size is estimated at USD 2.49 billion in 2025, and is expected to reach USD 5.84 billion by 2030, at a CAGR of 18.6% during the forecast period (2025-2030). In terms of shipment volume, the market is expected to grow from 5.14 billion units in 2025 to 16.06 billion units by 2030, at a CAGR of 25.60% during the forecast period (2025-2030).

The vertical-cavity surface-emitting laser (VCSEL) is a semiconductor whose laser is emitted perpendicular to the top surface. It differs from an edge-fired laser, which emits the laser from the edge. VCSELs offer precision, high efficiency, reliability, and high speed with a cost-effective solution, and these are the most promising new technological developments in laser physics. VCSELs offer various advantages, such as lower power consumption, beam quality, modulation speeds, and manufacturing costs.

Key Highlights

- The VCSEL market is anticipated to witness robust growth during the forecast period owing to several factors like increasing requirements for transmitting data over long distances with high speed and efficiency, rising demand for these lasers in automotive LiDAR applications, and industrial applications. In August 2023, Innoviz Technologies and the BMW Group are expanding their collaboration by starting a B-sample development phase on a new generation of LiDAR.

- Over the past few years, optical interconnect infrastructures in the data centers have advanced to the next-generation 400 Gbit/s data rate from 100 Gbit/s. This is primarily driven by the ever-increasing data traffic in data centers due to the rapid market growth of emerging technologies, such as AI, VR/AR, and the Internet of Things (IoT), and the introduction of 5G mobile network systems.

- The increasing adoption of VCSELs in smartphones by smartphone manufacturers for 3D sensing or proximity sensing applications is one of the primary factors driving the market growth. The growth of 3D sensing was propelled by the introduction of face ID modules in iPhones. Since then, there have been significant developments in 3D sensing. Slowly, there was a transition of 3D sensing from front-side face ID modules to the rear side for photography applications.

- InP-based VCSELs are typically preferred for applications such as optical communication due to their low dispersion and low fiber loss. However, InP-based VSCELs cannot provide large refractive index contrast DBR mirrors, owing to the high reflectivity and low penetration depth. The effective cavity length limits the tuning range and the confinement factor.

- The COVID-19 pandemic had a remarkable impact on the market studied, with several end-user industries that deploy VCSEL facing several difficulties. The industries were stuck with nationwide lockdowns, which brought them to a standstill, but after Q2 of 2020, they gradually started their operation. Since the raw materials are bought in China, the sourcing has been affected by the tariffs imposed by the United States.

- Geopolitical tensions and conflicts worldwide drive the demand for military spending. According to the Stockholm International Peace Research Institute (SIPRI), the United States led the ranking of countries with the highest military expenditure in 2022, with USD 877 billion dedicated to the military. That constituted nearly 40 percent of the total military spending worldwide that year, which amounted to USD 2.2 trillion. This amounted to 3.5 percent of the US gross domestic product.

Vertical Cavity Surface Emitting Laser Market Trends

ADAS and LiDAR to be the Fastest-growing Application

- The automotive industry is one of the major emerging markets for the VCSEL manufacturers, owing to trends like autonomous vehicles and high-end interior features in vehicles. Although the automotive industry has been witnessing a recession in recent years, the growing number of sensors per vehicle is mainly motivating the market vendors. Most of the market vendors are expanding their scope for the automotive market (interior and exterior applications).

- LiDAR is a critical component of ADAS, and highly efficient VCSELs, with their tiny footprint, attractive pricing, and remarkable reliability and performance, are making them suitable for ADAS LIDAR. VCSELs are used in LiDAR systems for object detection and mapping distances, exterior sensing technologies for ADAS and autonomous driving, and automotive 3D sensing for in-cabin and outside the vehicle, among others.

- In order to achieve LEVEL 4 autonomy, most of the developed and developing regions have mandated or are planning to mandate ADAS in new vehicles, which is expected to create massive growth opportunities for the market vendors. For instance, 80-90% of new vehicles in the United States have at least one ADAS feature.

- According to the National Safety Council, by 2026, approximately 71% of registered vehicles will be equipped with rear cameras, while 60% will have rear parking sensors. Such increasing adoption of ADAS would aid the growth of the market studied.

- The increasing adoption of self-driving or autonomous vehicles is a primary growth factor for the ADAS market. For instance, according to Intel, global car sales are expected to reach over 101.4 million units in 2030, and autonomous vehicles are expected to account for about 12% of car registrations by 2030.

Asia-Pacific Expected to Witness Significant Growth with China Dominating the Market

- China is expected to grow substantially in the Asia-Pacific region due to the increasing adoption of VCSEL in the automotive, healthcare, and consumer electronics industries.

- China is one of the prominent consumer electronics producers across the world. The manufacturing industry is rapidly growing in the region and is witnessing the deployment of various manufacturing and telecommunications technologies, which is expected to aid in the market's growth.

- Due to the continued flow of global, diversified electronics equipment into China, the consumption of semiconductors in China is growing faster than in others. Three of the world's top five most prominent mobile phone companies are based in this country, which presents enormous opportunities for adopting semiconductors.

- The Chinese government is also working to create a techno-authoritarian state powered by artificial intelligence and sensors to track and monitor its citizens. The demand for market studied in the country is expected to grow with such programs. The Chinese government's "Made in China 2025" initiative aims to make its semiconductor industry reach USD 305 billion in output by 2030 and meet 80% of domestic demand. Such instances are estimated to boost the market's growth in the country.

- Major players focus on developing innovative products to strengthen their market positions. For instance, in September 2023, Berxel Photonics, a pioneer in VCSEL semiconductor R&D and manufacturer of high-speed optical communications VCSELs and 3D depth cameras, announced a live demo of its 106 Gbps VCSEL-powered 800G transceiver in China International Optoelectronic Exposition in Shenzhen, China.

- Another factor contributing to the growth of VCSEL is the growing adoption of electric vehicles. For example, this technology is anticipated to be used in the vehicle industry for applications like recognition of gestures, driver monitoring, and autonomous driving sensors. In this region, the auto industry is growing at an excellent rate. The demand for custom semiconductors and sensors is increasing in the area. Therefore, VCSEL technology is expected to play a significant role in the region. As per CAAM, 589,000 battery-electric vehicles were made in China in August 2023, with 551,000 passenger BEVs and 38,000 business BEVs. In the same month, 254,000 PHEVs were produced in China, of which 253,000 were passenger PHEVs, and 1,000 were commercial PHEVs.

- The Chinese government views its automotive industry, including the auto parts sector, as one of its pillar industries. The government expects China's automobile output to reach 35 million units by 2025. Such instances show that the market is anticipated to grow over the forecast period.

Vertical Cavity Surface Emitting Laser Industry Overview

The VCSEL market is fragmented with the presence of major players like Coherent Corporation, Lumentum Operations LLC, Vixar Inc (OSRAM AG), Hamamatsu Photonics KK, and TRUMPF Group. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- October 2023 - TRUMPF Photonic Components, a global player in high-speed VCSEL and photodiode solutions for data communication, and KDPOF, an expert in high-speed optical networking solutions based in Spain, showcased its first 980nm multi-gigabit interconnect system for automotive systems at the European Conference for Optical Communication (ECOC), held in Glasgow.

- June 2023 - AMS Osram, the world's significant supplier of optical solutions, announced the launch of the TARA2000-AUT-SAFE family of vertical cavity surface emitting lasers (VCSELs), Reliable and more robust eye safety features while enhancing the portfolio of infrared laser modules for automotive in-cabin sensing. The new TARA2000-AUT-SAFE generates a tightly controlled beam of infrared light at a peak wavelength of 940nm. It suits the same application scenarios as the existing TARA2000-AUT series: driver monitoring, gesture sensing, and in-cabin monitoring. The compact module contains an ams Osram VCSEL chip and a microlens array (MLA).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

- 3.1 Market Overview

- 3.2 Industry Attractiveness - Porter's Five Forces Analysis

- 3.2.1 Bargaining Power of Suppliers

- 3.2.2 Bargaining Power of Buyers/Consumers

- 3.2.3 Threat of New Entrants

- 3.2.4 Threat of Substitute Products and Services

- 3.2.5 Intensity of Competitive Rivalry

- 3.3 Patent Landscape

- 3.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing Adoption of VCSEL in Data Centers

- 4.1.2 Growing Demand for 3D Sensing Applications in Smartphones

- 4.2 Market Restraints

- 4.2.1 Low Penetration of InP-based VCSELs and Limited Data Transmission Range

5 MATERIAL TREND ANALYSIS

- 5.1 Gallium Nitride

- 5.2 Gallium Arsenide

- 5.3 Other Material Types

6 MARKET SEGMENTATION

- 6.1 By Wavelength

- 6.1.1 Red (650-750 nm)

- 6.1.2 Near-infrared (750-1400 nm)

- 6.1.3 Shortwave-infrared (1400-3000 nm)

- 6.2 By Die-size

- 6.2.1 0.02 - 0.06 mm2

- 6.2.2 0.06 - 0.4 mm2

- 6.2.3 0.4 - 1.3 mm2

- 6.2.4 10 - 75 mm2

- 6.3 By End-user Industry

- 6.3.1 Telecom

- 6.3.2 Mobile and Consumer

- 6.3.3 Automotive

- 6.3.4 Medical

- 6.3.5 Industrial

- 6.3.6 Aerospace and Defense

- 6.4 By Application

- 6.4.1 Datacom

- 6.4.2 Optical Mouse

- 6.4.3 Facial Recognition and Depth Camera

- 6.4.4 Gesture Recognition

- 6.4.5 Laser Autofocus

- 6.4.6 Proximity sensing

- 6.4.7 Iris Scan

- 6.4.8 Medical

- 6.4.9 ADAS LiDAR

- 6.4.10 Industrial Applications

- 6.4.11 Other Applications

- 6.5 By Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Taiwan

- 6.5.4 China

- 6.5.5 South Korea

- 6.5.6 Japan

- 6.5.7 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Coherent Corporation

- 7.1.2 Lumentum Operations LLC

- 7.1.3 Vixar Inc (OSRAM AG)

- 7.1.4 Hamamatsu Photonics KK

- 7.1.5 TRUMPF Group

- 7.1.6 ams OSRAM AG

- 7.1.7 HLJ Technology Co. Ltd

- 7.1.8 Teledyne FLIR Systems Inc.

- 7.1.9 Vertilite Inc.

- 7.1.10 Leanardo Electronics US (Lasertel)

- 7.1.11 Broadcom Inc.

- 7.1.12 Santec Corporation