|

市场调查报告书

商品编码

1683200

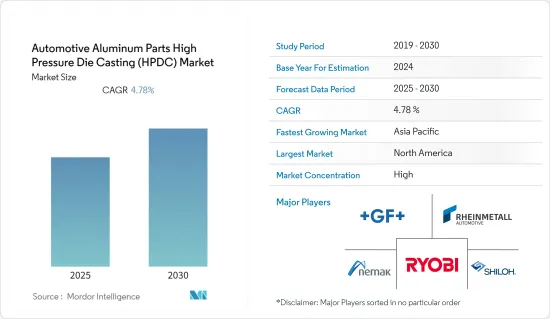

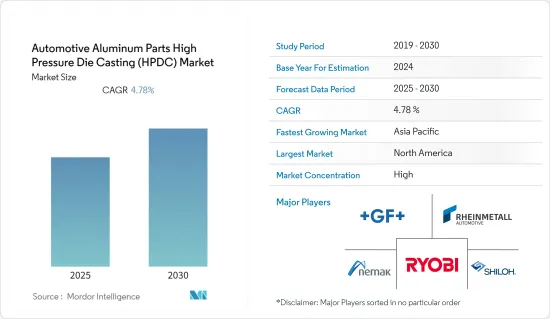

汽车铝高压铸 (HPDC) 市场 -市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Automotive Aluminum Parts High Pressure Die Casting (HPDC) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

预计预测期内汽车铝高压压铸市场复合年增长率为 4.78%。

2020 年上半年,COVID-19 疫情对市场产生了负面影响,製造工厂的关闭和封锁导致全球汽车产量下降。不过,2021年法规的逐步开放导致汽车产量回升、电动车销售更加稳定,有助于市场成长恢復。

由于透过高压铝压铸开发的汽车零件的优势,预计乘用车和商用车产量的增加将推动市场发展。推动市场成长的关键因素包括严格的排放法规和企业平均燃油经济性(CAFE)标准、欧洲对商用车及其销售的需求不断增长以及汽车行业的成长。大约75.0%的消耗铝可以重新利用,而且再生铝可以无限循环利用,使其成为汽车零件高压压铸最受欢迎的材料。

美国、德国、英国、印度和中国等主要国家的政府都透过提供补贴来支持汽车製造商并鼓励消费者采用电动车。电动车的发展趋势正在鼓励市场参与企业生产各种电动车零件,如电池外壳、传动零件等。

此外,汽车和汽车行业中铝替代钢的增长以及这些行业的资金筹措可能会为预测期内高压铝压铸市场的成长创造有利机会。

铝汽车零件高压铸市场趋势

铝价涨阻碍市场

2021 年全球汽车销量约 6,670 万辆,而 2020 年约为 6,380 万辆。全球疫情影响了世界各地的经济活动,包括汽车销售,多个国家实施了严格的封锁措施,以遏制病毒传播。因此,2020年的汽车销量与2019年相比下降了14.8%。然而,随着生活恢復正常,预计全球汽车销售将增加,有助于汽车铝高压压铸市场在预测期内实现成长。

随着对乘用车的需求不断增加以及对电动车的认识不断提高,主要企业在寻求使其现有持有实现电气化。例如:

- 2022年8月,日本汽车製造商铃木汽车宣布一项价值730亿印度卢比的战略投资,在古吉拉突邦尔普尔建立一家电动汽车电池工厂。该工厂将为印度即将推出的电动车技术生产先进的化学电池。这将是铃木继与东芝公司和电装公司合作在古吉拉突邦设立的TDS锂离子电池古吉拉突邦(TDSG)之后,在印度开展的第二项电动车电池业务。

- 2022年3月,福特汽车宣布将在2024年终在欧洲推出三款电动车,并设定了2026年在欧洲每年销售超过60万辆电动车的目标。

- 2022年1月,通用汽车宣布正考虑在密西根州的两家工厂投资超过40亿美元,以增加电动车产能。通用汽车和 LG 能源解决方案公司提案在兰辛建立一个价值 25 亿美元的电池工厂。

随着乘用车销售量的不断成长,HPDC的需求呈现出良好的成长动能。目前,乘用车需要质量轻、抗拉强度高的HPDC用于製造各种汽车零件。铝挤型企业正大力投资,以显示销售量的上升。例如,2022年8月,拉丁美洲最大的铝挤型製造商Cuprum宣布将投资1亿美元在新莱昂州建造一座新的铝挤型工厂,为汽车领域提供高压压铸技术。

考虑到这些因素和上述发展,预计乘用车领域将为汽车铝 HPDC 的需求提供同等的推动力。

北美成长速度更快

世界各地的许多压铸零件製造商都在大力投资扩大其用于汽车行业的铝高压压铸生产流程。 2020年至2021年,北美被公认为领先地区之一,Nemak、Bocar、George Fischer等主要製造商将大量投资并扩大新生产工厂,主要集中在美国和墨西哥。

该地区二氧化碳排放的增加以及相关严格的 CAFE 和 EPA 法规迫使汽车製造商在其製造过程中更广泛地采用铝高压压铸 (HPDC) 零件,从而推动了该国市场的成长。

墨西哥的汽车压铸市场正在崛起,该国是世界第七大汽车製造国,也是继德国、日本和韩国之后的第四大汽车出口国。

丰田、梅赛德斯-奔驰(与日产合资)、奥迪和宝马等主要汽车製造商均在墨西哥建立了新工厂。通用汽车、菲亚特克莱斯勒、现代和本田等其他汽车製造商正专注于扩大现有工厂。此外,美国近期宣布提高从中国进口的汽车零件的关税,也促使中国汽车製造商计划扩大在墨西哥的生产基地。

墨西哥汽车工业的成长带动了层级、层级和层级供应商数量的大幅增加。随着汽车零件轻量化和坚固化趋势的日益增长,上述供应商很可能在预测期内采用透过 HPDC 生产的铝零件。

铝製汽车零件高压压铸产业概况

汽车铝零件高压压铸市场主要由莱茵金属车、Endurance Group、Shiloh Industries、GF Casting Solutions、Ryobi Die Casting Inc. 和 Nemak 等主要企业细分。

扩大业务部门和製造工厂、在重点区域与当地製造商建立合资企业以及併购是参与企业保持和提高其市场竞争地位的主要策略。例如

- 2022 年 8 月,Minda Corporation Limited 宣布已开始收购美国、非洲和欧洲内燃机和电动车领域的多家一级供应商和OEM,以发展其高压压铸件业务,包括铝製 HPDC 零件。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场驱动因素

- 市场限制

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔

- 应用程式类型

- 白车身

- 门框

- 电池外壳

- 支柱

- 屋顶

- 其他(前端支架、加强件、横樑、仪表板支架)

- 底盘

- 传播

- 其他(悬吊、转向)

- 白车身

- 汽车模型

- 搭乘用车

- 商用车

- 地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 欧洲其他地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 其他的

- 巴西

- 南非

- 其他国家

- 北美洲

第六章 竞争格局

- 供应商市场占有率

- 公司简介

- Georg Fischer AG

- Rheinmetall Automotive AG(KSPG AG(KS Kolbenschmidt GmbH))

- Ryobi Die Casting Inc.

- Nemak

- Endurance Technologies

- Shiloh Industries Inc.

- Pace Industries

- Brabant Alucast*

第七章 市场机会与未来趋势

The Automotive Aluminum Parts High Pressure Die Casting Market is expected to register a CAGR of 4.78% during the forecast period.

The COVID-19 pandemic had a negative impact on the market as the shutdown of manufacturing facilities and lockdowns in the first half of 2020 resulted in a decline in vehicle production across the world. However, with the gradual opening of restrictions in 2021 vehicle production picked up and further stable EV sales help the market regain its growth.

An increase in the production of passenger cars and commercial vehicles is expected to drive the market for the automotive parts developed through high-pressure aluminum die casting owing to their advantages. Some of the major factors driving the growth of the market are the enactment of stringent emission regulations and Corporate Average Fuel Economy (CAFE) standards, an increase in the demand for commercial vehicles and sales in the European region, and the growth of the automotive industry. Approximately 75.0% of the aluminum consumed can be reused, and reclaimed aluminum can be recycled indefinitely, making it the most popular material for automotive parts high pressure die casting.

Government pushing automobile manufacturers and encouraging customers to adopt electric vehicles by providing subsidies across key major countries like the United States, Germany, United Kingdom, India, China, etc. This trend of growing electric mobility encourages players operating in the market to produce various electric vehicle components like battery housings, transmission parts, etc.

Furthermore, growth in the substitution of aluminum for iron and steel in the automotive and automobile sectors, as well as increased funding in these sectors, would create lucrative opportunities for the growth of the high-pressure aluminum die casting market during the forecast period.

Automotive Aluminum Parts High Pressure Die Casting Market Trends

Rising Aluminum Prices Hindering the Market

In 2021, the global car sales were around 66.7 Million, which in 2020 were 63.8 Million. The global pandemic impacted economic activities all around the world including car sales the globe, and strict lockdowns were enforced in several countries to contain the spread of the virus. Owing to this the number of cars sold in 2020 was 14.8% lower than compared in 2019. But with life returning to normalcy, the number of cars sold globally has increased which will aid the automotive aluminium parts high-pressure die casting market to grow in the forecast period.

Owing to the increase in the demand for passenger cars and the growing awareness of electric mobility, major players are looking forward to electrifying their present fleet. For instance:

- In August 2022, Japanese carmaker Suzuki Motor announced its strategic investment worth INR 7,300 crore to set up the electric vehicle battery plant at Hansalpurin Gujarat. The plant will look forward for manufacturing advanced-chemistry cell batteries for upcoming electric vehicle technology in India. This will be Suzuki's second EV battery initiative in India after TDS Lithium-Ion Battery Gujarat (TDSG), which it set up in Gujarat in collaboration with Toshiba and Denso.

- In March 2022, Ford Motors announced to include three all-electric passenger vehicles in Europe by the end of 2024 and set a target to sell more than 600,000 electric vehicles annually by 2026 in the Europe region.

- In January 2022, General Motors announced considering investing more than USD 4 billion in two Michigan factories to increase its electric car manufacturing capacity. GM and LG Energy Solution have proposed constructing a USD 2.5 billion battery facility in Lansing.

With rising sales of the passenger car segment, demand for HPDC is witnessing promising growth. Nowadays, passenger car demanding HPDC in their different car components owing to their lightweight features and higher tensile strength. Aluminium extrusion companies are investing heavily to witness elevate sales bars. For instance, in August 2022, Cuprum who is the Latin America's largest aluminium extruder announced the investment of USD 100 million to build a new plant in Nuevo Leon for extrusion of aluminium to offer high pressure die casting technology in the automotive sector.

Considering these factors and aforementioned developments, passenger car segmented is expected to provide equivalent momentum to the demand for automotive aluminium HPDC.

North America Growing at a Faster Pace

Many die casting parts manufacturers across the world have significantly invested in the expansion of the aluminum high-pressure die-casting production process for the automotive industry. During 202-2021, North America has been recognized as one of the major regions with a larger number of investments and expansions of new production plants by major manufacturers like Nemak, Bocar, and George Fischer, mainly in the United States and Mexico.

Increased CO2 emissions and subsequent stringent CAFE and EPA regulations in the region are forcing automakers to employ high-pressure die casting (HPDC) parts of aluminum more extensively in their manufacturing processes, acting as a propellant for the market's growth in the country.

The Mexican automotive die casting market is emerging, as the country is one of the largest vehicle manufacturers and seventh-largest car manufacturers in the world, as well as is the fourth-largest car exporter, behind Germany, Japan, and South Korea.

Key automakers, like Toyota, Mercedes-Benz (with Nissan), Audi, and BMW established new factories in Mexico. Other automakers, like General Motors, Fiat-Chrysler, Hyundai, and Honda are focusing on expanding their existing factories. Additionally, Chinese automobile manufacturers are planning to expand their production bases in Mexico, owing to the recent announcement of an increase in import tariff on auto parts from China to the United States.

Owing to the growing Mexican automotive industry, the presence of tier 1, tier 2, and tier 3 suppliers have been significantly increasing. With the rising trend of lightweight and robust automotive parts, the above suppliers are likely to adopt aluminum parts manufactured through HPDC, during the forecast period.

Automotive Aluminum Parts High Pressure Die Casting Industry Overview

The automotive aluminum parts high pressure die casting market is fragmented, as major players, like Rheinmetall Automotive, Endurance Group, Shiloh Industries, GF Casting Solutions, Ryobi Die Casting Inc., and Nemak.

Expansion of business segments and manufacturing plants, joint ventures with local manufacturers in key geographies, and mergers and acquisitions are the key strategies adopted by the players to maintain and improve their competitive position in the market. For instance,

- In August 2022, Minda Corporation Limited has announced that it has initiated acquisition of several Tier1 and OEMs in the internal combustion engine and electric vehicles space in United States, Africa, and Europe for developing business for high pressure die cast parts which includes aluminium HPDC parts as well.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Application Type

- 5.1.1 Body-in-white

- 5.1.1.1 Door Frames

- 5.1.1.2 Battery Housing

- 5.1.1.3 Pillar

- 5.1.1.4 Roof Components

- 5.1.1.5 Others (Front-end Carriers, Reinforcement, Cross Beams, and Instrument Panel Support)

- 5.1.2 Chassis

- 5.1.3 Transmission

- 5.1.4 Other Components (Suspension and Steering)

- 5.1.1 Body-in-white

- 5.2 Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Commercial Vehicles

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 Brazil

- 5.3.4.2 South Africa

- 5.3.4.3 Other Countries

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Georg Fischer AG

- 6.2.2 Rheinmetall Automotive AG (KSPG AG (KS Kolbenschmidt GmbH))

- 6.2.3 Ryobi Die Casting Inc.

- 6.2.4 Nemak

- 6.2.5 Endurance Technologies

- 6.2.6 Shiloh Industries Inc.

- 6.2.7 Pace Industries

- 6.2.8 Brabant Alucast*