|

市场调查报告书

商品编码

1850970

卫星天线:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Satellite Antenna - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

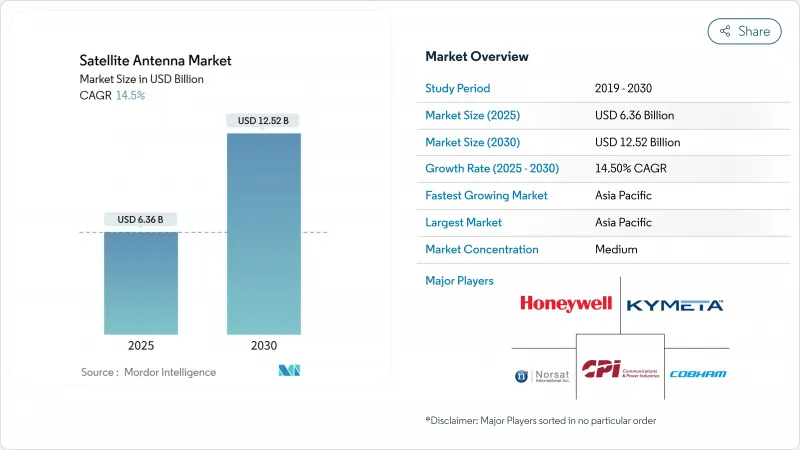

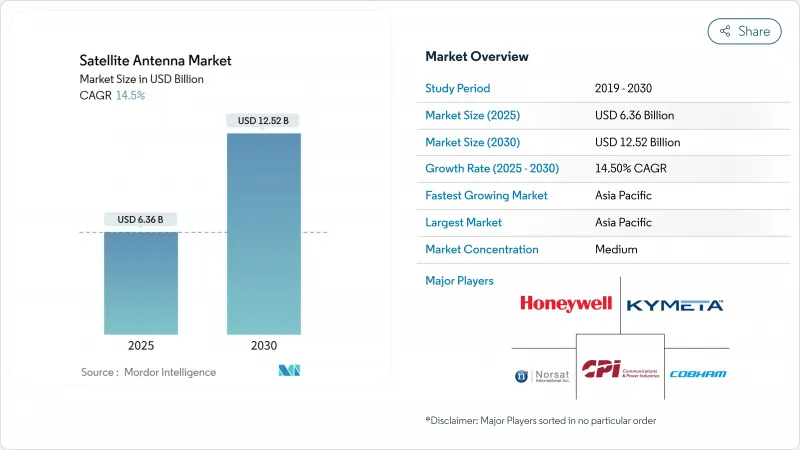

预计到 2025 年,卫星天线市场规模将达到 63.6 亿美元,到 2030 年将达到 125.2 亿美元,复合年增长率将达到 14.5%。

对高吞吐量连接的强劲需求、多轨道卫星群的部署以及天线製造成本的下降,正在加速卫星天线在商业和国防领域的应用。软体定义的波束控制、轻质复合材料和高度整合的晶片组在提升性能的同时,也降低了营运商的生命週期拥有成本。战略併购拓展了产品系列,各国政府将太空基础设施视为其数位主权的重要支柱,这些因素也推动了卫星天线市场的成长。儘管供应商需要应对监管和轨道碎片等复杂问题,但这些因素共同推动了卫星天线市场持续两位数的成长。

全球卫星天线市场趋势与洞察

低地球轨道宽频卫星星座的激增

星链(Starlink)和OneWeb等低地球轨道计划正在重新定义链路预算,促使营运商部署能够每分钟追踪数十颗高速移动卫星的电子控制阵列。截至2024年9月,已註册的卫星群达到411个,但仅有5%完成发射,这为天线供应商留下了巨大的发展空间。紧凑相位阵列将GNSS接收器与边缘运算集成,使终端能够在低地球轨道(LEO)、中地球轨道(MEO)和地球同步轨道(GEO)层之间自动切换波束。偏远社区、海上航道和灾害应变团队已初步受益。相控相位阵列无需机械零件,降低了全生命週期维护成本,并增强了大规模部署的经济效益。随着卫星天线市场规模扩大到类似手机的水平,能够以家用电子电器价格分布大规模生产双轨道终端的供应商将获得巨大的市场价值。

太空快速军事化(MilSATCOM)

国防部官员将可靠且抗干扰的连结视为任务关键。美国2025财年预算拨款252亿美元用于天基系统,将推动采购能够在复杂电磁环境下运作的多频段定向天线。经实战验证的要求包括旁瓣抑制、抗欺骗和动态波束跳变以减轻干扰。欧洲和亚太地区的平行计画进一步扩大了需求。军方也在推动研发更轻的终端,以便小型无人机和士兵使用,促进了氮化镓功率放大器和共形复合材料技术的突破。虽然从长远来看,安全的光纤交联将与射频技术形成互补,但近期支出重点在于先进的相位阵列射频复合材料,以保持卫星天线市场的良好发展势头。

赤道Ku/ Ka波段雨衰

强降雨会使Ku波段和Ka波段讯号衰减高达20dB,迫使业者增加链路余裕或切换到较低频率。印尼和巴西的热带微暴流会导致不可预测的讯号衰落,从而影响企业和回程传输客户的服务等级协定(SLA)。缓解措施包括自我调整编码、站点分集和在暴风雨期间回落至C波段的双频终端,但这些措施会增加服务提供者的资本支出和营运支出(OPEX)。儘管Ka波段网路具有容量优势,但由于对未来气候变迁的不确定性,通讯业者仍不愿部署以Ka波段为中心的网路。因此,赤道地区的Ka波段网路采用趋势可能落后于全球卫星天线市场。

细分市场分析

凭藉成熟的地面基础设施和均衡的抗雨致衰减能力, Ku波段将在2024年占据卫星天线市场29%的份额。该波段仍将是广播和VSAT服务的核心,尤其是在已获得监管批准的地区。相较之下,Ka频宽正以15.2%的复合年增长率快速成长,吸引寻求更低每位元成本和灵活点波束架构的宽频营运商。这一成长趋势,加上NASA为地球观测卫星群提出的每日26Tb的路由需求,将推动配备Ka终端的卫星天线市场规模的扩大。 C波段在易受飓风影响的地区仍将发挥重要作用,而X波段由于其抗干扰能力,将继续在国防领域占据一席之地。新兴的多波段天线打破了传统的频段壁垒,实现了即时频率切换。这种能力提高了系统的整体可用性,并拓宽了卫星天线市场供应商的潜在收入来源。

多波束平板天线设计可同时支援Ku波段和Ka波段的连接,并可在雨衰期间反转通讯方向。整合可程式射频前端的供应商能够根据需要动态分配功率,从而提高频谱效率。这些进步显着提升了行动VSAT、邮轮、油气平台等提案的价值。因此,预计到2030年,高频率终端卫星天线市场规模将翻倍,供应商必须融入天气自适应智慧技术,才能充分满足热带地区的需求。

2024年,抛物面天线将占卫星天线市场规模的38%,由于其高性价比,常用于固定式卫星闸道。机械万向节对于大型邮轮和卫星地面站而言仍然经济高效。然而,以18.4%的复合年增长率快速成长的平板电子控制阵列正在重新定义行动应用场景。采用Anokiwave技术的面板现已完成工厂校准,缩短了安装时间,并支援安装在窄体飞机的保形机身上。一种原型充气式碟形天线有望实现20:1的封装效率,以适应对发射品质敏感的小型卫星。

混合架构将紧凑型抛物面天线段与变速器子阵列结合,兼具碟形天线的高增益优势和ESA天线的灵活性。研发柔性介电材料的供应商使天线能够弯曲贴合车辆车顶,从而消除空气阻力带来的不利影响。因此,可寻址卫星天线市场扩展到私家车、火车和城市无人计程车等领域,这些应用都需要超薄终端。反射器厂商将透过整合自动指向和健康监测韧体来保护已安装的设备,这表明到2030年,双方将采取共存而非彻底替换的策略。

卫星天线市场报告按频段(C 波段、 X波段、 Ku波段、其他)、天线类型(碟形天线、喇叭天线、FRP 天线罩天线、其他)、应用(星载、机载、其他)、最终用户(民用和政府、国防)和地区进行细分。

区域分析

亚太地区将以14.6%的复合年增长率实现最快成长,直至2030年,这主要得益于中国、印度、日本和韩国扩大多轨道系统规模和提升国内製造业水准。中国第五个南极卫星站将于2024年2月启用,届时将展示用于科学和国防领域的卫星天线。印度「印度製造」政策下的与生产连结奖励计画将鼓励馈源喇叭、雷达罩和射频积体电路子系统的在地化生产,从而降低该地区营运商的成本。日本汽车产业正准备利用非地面电波回程传输实现联网汽车服务,这促使供应商将天线小型化,以便整合到车顶上。

由于深厚的航太供应链、巨额国防开支和蓬勃发展的太空企业,北美仍然是最大的卫星天线市场。美国太空军维护一个卫星控製网络,目前运作19个天线,运转率75%,并计画从2025年开始部署12个新的高容量天线。加拿大的极地通讯专案也增加了对耐低温天线的需求。墨西哥和其他拉丁美洲国家正在利用地球同步轨道(GEO)网关提供网路社群Wi-Fi服务,但资本支出压力将限制其短期内的规模。

欧洲保持着强劲的市场份额,这得益于欧洲太空总署(ESA)的技术演示,例如AMPER计划用于支援军事和气候监测任务的异形网状反射器。德国和英国正在资助建造主权卫星地面站,以确保资料自主性;行动网路营运商正在苏格兰和巴伐利亚的乡村地区测试基于卫星的回程传输。东欧通讯业者正在采用租赁购买模式来应对外汇波动,这种策略有助于天线供应商平稳订单。在中东,海湾合作委员会(GCC)的主权财富基金正在支持地球同步轨道甚高通量卫星(GEO VHTS)计划,沙乌地阿拉伯的蓝图要求到2030年将该国的航太收入提高两倍。南美洲发展落后,但巴西出现了成长迹象,该国强制要求海上油气连接使用双冗余天线。总而言之,这些动态维持了卫星天线市场的区域需求多元化,从而保护了全球收入免受宏观衝击的影响。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概览

- 市场驱动因素

- 低地球轨道宽频卫星星座的扩展

- 太空快速军事化(MilSATCOM)

- 高通量卫星(HTS)有效载荷采用

- 商用机上互联(IFC)的蓬勃发展

- 基于ESA的平板成本曲线通货紧缩(未公开)

- 月球和近月任务的通讯需求(UNDER-RADAR)

- 市场限制

- 赤道地区 Ku/ Ka波段降雨衰减

- 相位阵列晶片组的出口管製瓶颈

- 轨道碎片保险成本不断上涨(未公开通报)

- 新兴市场通讯业者资本支出危机(不受重视)

- 价值链分析

- 监管环境

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 供应商的议价能力

- 买方的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按频宽

- C波段

- X波段

- Ku波段

- Ka波段

- L/S波段

- VHF/UHF频段

- 依天线类型

- 抛物面反射器

- 平面显示器(ESA/RSA)

- 喇叭

- 介质共振器

- 玻璃纤维雷达罩

- 金属印章

- 透过使用

- 太空船

- 空中

- 海上

- 陆地(移动和固定)

- 最终用户

- 商业的

- 政府和国防部

- 按地区

- 北美洲

- 美国

- 加拿大

- 南美洲

- 巴西

- 阿根廷

- 欧洲

- 德国

- 英国

- 法国

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 亚太其他地区

- 中东和非洲

- 海湾合作委员会国家

- 土耳其

- 南非

- 其他中东和非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Honeywell International Inc.

- CPI International Inc.

- Kymeta Corp.

- Norsat International Inc.

- Cobham SATCOM

- L3Harris Technologies Inc.

- Viasat Inc.

- Airbus Defence and Space

- Gilat Satellite Networks Ltd.

- Maxar Technologies

- Ball Aerospace

- Intellian Technologies

- Isotropic Systems(All.Space)

- Hanwha Phasor

- SES SA(O3b mPOWER User Terminals)

- Thales Alenia Space

- MT Mechatronics

- SatixFy Ltd.

- General Dynamics Mission Systems

- LEOcloud Inc.

- Hughes Network Systems

第七章 市场机会与未来展望

The satellite antenna market size stands at USD 6.36 billion in 2025 and is projected to reach USD 12.52 billion by 2030, reflecting a robust 14.5% CAGR.

Strong demand for high-throughput connectivity, the roll-out of multi-orbit constellations, and falling antenna production costs are accelerating adoption across commercial and defense domains. Software-defined beam steering, lighter composites, and highly integrated chipsets are improving performance while lowering lifetime ownership costs for operators. Growth is also being reinforced by strategic mergers that broaden product portfolios and by governments treating space infrastructure as a pillar of digital sovereignty. These converging factors keep the satellite antenna market on a double-digit growth path even as suppliers navigate regulatory and orbital-debris complexities.

Global Satellite Antenna Market Trends and Insights

Proliferation of LEO broadband constellations

Low Earth Orbit projects such as Starlink and OneWeb are rewriting link-budget assumptions, pushing operators to deploy electronically steered arrays that can track dozens of fast-moving satellites per minute. In September 2024, 411 constellations were registered, yet only 5% were fully launched, leaving extensive runway for antenna suppliers. Compact phased arrays now include integrated GNSS receivers and edge computing, letting terminals auto-switch beams across LEO, MEO, and GEO layers. Remote communities, maritime routes, and disaster-response teams are early beneficiaries. Because phased arrays eliminate mechanical parts, lifetime maintenance costs fall, reinforcing the economic case for large-scale roll-outs. Vendors able to mass-produce dual-orbit terminals at consumer-electronics price points will capture outsized value as the satellite antenna market broadens to handset-like volumes.

Rapid militarization of space (MilSATCOM)

Defense authorities see assured, jam-resistant links as mission-critical. The U.S. FY 2025 budget allocates USD 25.2 billion to space-based systems, triggering procurement of multi-band, directive antennas that operate in contested electromagnetic environments. Battle-proven requirements include side-lobe suppression, anti-spoofing, and dynamic beam hopping to mitigate interference. Parallel programs in Europe and Asia-Pacific further widen demand. Militaries also push for lighter terminals to fit small UAVs and dismounted soldiers, encouraging breakthroughs in GaN power amplifiers and conformal composites. Over the long term, secure optical cross-links will complement RF, but near-term spending remains anchored in advanced phased-array RF architectures, sustaining momentum for the satellite antenna market.

Ku/Ka-band rain fade in equatorial regions

Heavy rainfall events attenuate Ku and Ka signals by up to 20 dB, forcing operators to oversize link margins or revert to lower frequencies. Tropical micro-bursts in Indonesia and Brazil create unpredictable fades that undermine SLAs for enterprise and backhaul customers. Mitigation tactics include adaptive coding, site diversity, and dual-band terminals that fall back to C band during storms, yet these solutions raise capex and opex for service providers. Future climate variability adds uncertainty, making some telcos reluctant to commit to Ka-centric networks despite their capacity advantages. Consequently, adoption curves in equatorial belts may lag the global satellite antenna market trend.

Other drivers and restraints analyzed in the detailed report include:

- High-throughput satellite (HTS) payload adoption

- Commercial in-flight connectivity (IFC) boom

- Export-control bottlenecks on phased-array chipsets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Ku Band accounted for 29% of the satellite antenna market in 2024, capitalizing on mature ground infrastructure and balanced rain-fade resilience. The segment continues to anchor broadcast and VSAT services, especially where regulatory clearances already exist. In contrast, Ka Band is scaling rapidly at a 15.2% CAGR, attracting broadband operators that seek lower cost per bit and flexible spot-beam architectures. This growth trajectory translates to an expanding satellite antenna market size for Ka terminals, underpinned by NASA's requirement to route 26 Tb/day on its upcoming Earth-observation constellation. C Band maintains relevance in cyclone-prone zones, while X Band remains a defense niche thanks to interference immunity. Emerging multi-band antennas blur traditional silos, permitting real-time frequency switching, a capability that uplifts overall system availability and widens supplier addressable revenue streams within the satellite antenna market.

Multi-beam flat-panel designs now facilitate simultaneous Ku and Ka connectivity, enabling operators to reverse traffic when rain fade hits. Suppliers integrating programmable RF front-ends can dynamically allocate power where needed, lifting spectral efficiency. These advances transform value propositions for mobile VSAT, cruise, and oil-and-gas platforms. As such, the satellite antenna market size for high-frequency terminals is forecast to double by 2030, though suppliers must embed weather-adaptive intelligence to unlock full demand across tropical geographies.

Parabolic reflectors held 38% share of the satellite antenna market size in 2024, favored for static gateways that prize high gain per dollar. Mechanical gimbals remain cost-effective for large cruise ships and teleport hubs. Yet flat-panel electronically steered arrays, expanding at an 18.4% CAGR, are redefining mobility use cases. Anokiwave-powered panels are now factory-calibrated, slashing installation time and supporting conformal fuselage mounting on narrow-body aircraft. Inflatable dishes under prototyping promise 20:1 packing efficiency, catering to launch-mass-sensitive small satellites.

Hybrid architectures blend small parabolic segments with phase-shifter sub-arrays, extracting the high-gain benefits of dishes and the agility of ESAs. Vendors exploring flexible dielectric materials can bend antennas around vehicle roofs, erasing aerodynamic drag penalties. Consequently, the addressable satellite antenna market widens to include personal vehicles, trains, and urban drone taxis, all of which require ultra-low-profile terminals. Reflector incumbents respond by embedding auto-pointing and health-monitoring firmware to protect installed bases, signaling a coexistence rather than outright displacement scenario through 2030.

The Satellite Antenna Market Report is Segmented by Frequency Band (C Band, X Band, Ku Band, and More), Antenna Type (Parabolic Reflector, Horn, FRP-Radome, and More), Application (Spaceborne, Airborne, and More), End-User (Commercial and Government and Defense), and Geography.

Geography Analysis

Asia Pacific records the quickest expansion, charting a 14.6% CAGR to 2030 as China, India, Japan, and South Korea scale multi-orbit systems and indigenous manufacturing. China's fifth Antarctic outpost, opened in February 2024, showcases dual-use satellite dishes that serve science and defense agendas. India's production-linked incentives, aligned with its "Make in India" drive, catalyze local fabrication of feed horns, radomes, and RFIC subsystems, lowering costs for regional operators. Japan's auto sector readies connected-car services using non-terrestrial backhaul, prompting suppliers to miniaturize antennas for rooftop integration.

North America remains the largest satellite antenna market thanks to deep aerospace supply chains, heavy defense spending, and entrepreneurial space ventures. The U.S. Space Force maintains the Satellite Control Network, operating 19 dishes at 75% utilization, with plans for 12 new high-capacity antennas starting 2025. Canada's Polar communications programs add demand for low-temperature-tolerant antennas. Mexico and other Latin peers leverage GEO gateways for internet-community Wi-Fi, although capex pressures curb near-term scale.

Europe holds robust share, reinforced by ESA technology demonstrators such as the shaped mesh reflector from the AMPER project that supports military and climate-monitoring missions. Germany and the UK fund sovereign teleports to secure data autonomy, while mobile network operators test backhaul-over-satellite in rural Scotland and Bavaria. Eastern European telcos adopt lease-to-own models to overcome currency volatility, a tactic that smooths order pipelines for antenna suppliers. The Middle East, buoyed by GCC sovereign wealth funds, backs GEO VHTS projects, and Saudi Arabia's roadmap foresees a trebling of national space revenues by 2030. South America trails but shows pockets of growth in Brazil, where oil-and-gas offshore connectivity mandates dual-redundant antennas. Collectively, these dynamics keep regional demand diversified within the satellite antenna market, insulating global revenue from macro shocks.

- Honeywell International Inc.

- CPI International Inc.

- Kymeta Corp.

- Norsat International Inc.

- Cobham SATCOM

- L3Harris Technologies Inc.

- Viasat Inc.

- Airbus Defence and Space

- Gilat Satellite Networks Ltd.

- Maxar Technologies

- Ball Aerospace

- Intellian Technologies

- Isotropic Systems (All.Space)

- Hanwha Phasor

- SES S.A. (O3b mPOWER User Terminals)

- Thales Alenia Space

- MT Mechatronics

- SatixFy Ltd.

- General Dynamics Mission Systems

- LEOcloud Inc.

- Hughes Network Systems

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Proliferation of LEO broadband constellations

- 4.2.2 Rapid militarization of space (MilSATCOM)

- 4.2.3 High?throughput satellite (HTS) payload adoption

- 4.2.4 Commercial in-flight connectivity (IFC) boom

- 4.2.5 ESA-based flat-panel cost curve deflation (UNDER-RADAR)

- 4.2.6 Lunar and cislunar mission communications demand (UNDER-RADAR)

- 4.3 Market Restraints

- 4.3.1 Ku-/Ka-band rain fade in equatorial regions

- 4.3.2 Export-control bottlenecks on phased-array chipsets

- 4.3.3 Mounting orbital-debris insurance premiums (UNDER-RADAR)

- 4.3.4 CAPEX crunch at emerging-market telcos (UNDER-RADAR)

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Frequency Band

- 5.1.1 C Band

- 5.1.2 X Band

- 5.1.3 Ku Band

- 5.1.4 Ka Band

- 5.1.5 L/S Band

- 5.1.6 VHF/UHF Band

- 5.2 By Antenna Type

- 5.2.1 Parabolic Reflector

- 5.2.2 Flat-Panel (ESA/RSA)

- 5.2.3 Horn

- 5.2.4 Dielectric-Resonator

- 5.2.5 FRP-Radome

- 5.2.6 Metal-Stamp

- 5.3 By Application

- 5.3.1 Spaceborne

- 5.3.2 Airborne

- 5.3.3 Maritime

- 5.3.4 Land (Mobile and Fixed)

- 5.4 By End-User

- 5.4.1 Commercial

- 5.4.2 Government and Defense

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Russia

- 5.5.3.5 Rest of Europe

- 5.5.4 APAC

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Rest of APAC

- 5.5.5 Middle East and Africa

- 5.5.5.1 GCC Countries

- 5.5.5.2 Turkey

- 5.5.5.3 South Africa

- 5.5.5.4 Rest of MEA

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Overview, Core Segments, Financials, Strategy, Market Rank)

- 6.4.1 Honeywell International Inc.

- 6.4.2 CPI International Inc.

- 6.4.3 Kymeta Corp.

- 6.4.4 Norsat International Inc.

- 6.4.5 Cobham SATCOM

- 6.4.6 L3Harris Technologies Inc.

- 6.4.7 Viasat Inc.

- 6.4.8 Airbus Defence and Space

- 6.4.9 Gilat Satellite Networks Ltd.

- 6.4.10 Maxar Technologies

- 6.4.11 Ball Aerospace

- 6.4.12 Intellian Technologies

- 6.4.13 Isotropic Systems (All.Space)

- 6.4.14 Hanwha Phasor

- 6.4.15 SES S.A. (O3b mPOWER User Terminals)

- 6.4.16 Thales Alenia Space

- 6.4.17 MT Mechatronics

- 6.4.18 SatixFy Ltd.

- 6.4.19 General Dynamics Mission Systems

- 6.4.20 LEOcloud Inc.

- 6.4.21 Hughes Network Systems

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment