|

市场调查报告书

商品编码

1683216

电源模组封装:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Power Module Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

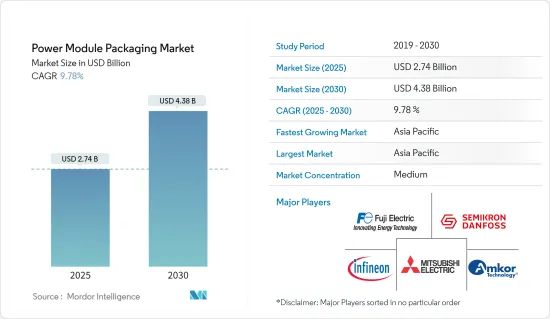

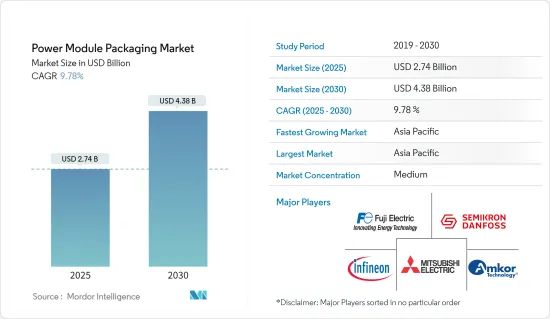

预计 2025 年功率模组封装市场规模为 27.4 亿美元,到 2030 年将达到 43.8 亿美元,预测期内(2025-2030 年)的复合年增长率为 9.78%。

电力电子模组或电源模组可作为容纳多个电力元件(通常是电力半导体元件)的实体容器。封装在向更高功率密度转变的过程中发挥关键作用,可实现更有效率的电源、更快的转换、电力传输和更高的可靠性。随着世界转向更快的开关频率和更高的功率密度,我们看到用于引线接合法、晶粒黏接、基板和系统冷却的封装材料也发生了相应的变化。

主要亮点

- 功率模组是电源逆变器和转换器的关键元件。电源模组常用于电动车和其他马达控制器、家用电器、电源、电镀机、医疗设备、电池充电器、交直流逆变器和转换器、电源开关、焊接设备等。功率模组封装市场的成长得益于减少能源浪费、采用高效的分散式冷却方法、缩小占地面积以及随之而来的功率密度的提高。此外,工业和家用电子电器领域对电源模组的需求不断增长,正在推动电源模组封装市场的发展。

- 家用电子电器产业正在经历重大转型,推动力在于对更智慧、更先进设备的需求不断增长。电子产业的另一个重要趋势是物联网(IoT)的兴起。随着对智慧型设备的需求不断增长,物联网已成为我们日常生活中不可或缺的一部分。因此,企业主要使用这项技术来开发新产品和服务。例如,根据 GSMA 的数据,中国以 15 亿个连线数领先,其次是北美和欧洲,各有 3 亿个连线数。

- 不断电系统(UPS)、伺服器电源、电源转换器和马达驱动器等工业设备消耗了世界上很大一部分电力。因此,提高工业电源的效率可以大幅降低企业营运成本。不断增加的功率密度和改善的热性能推动了对高效电源的需求呈指数级增长。

- 由于电源模组製造商面临日益增加的复杂性、摩尔定律变得越来越难以维持且成本越来越高而导致的未来设计蓝图的丢失,以及标准不断发展且规则各异的大量新市场的涌入,整合可能会持续下去。

- 俄乌战争推高了铝价和镍价,而能源价格上涨则影响了金属,尤其是铜价。铜是功率模组封装市场的重要材料,用于底板和电气互连。铜价的波动对功率模组封装市场有直接的影响。根据 ukraineinvest.gov 报导,预计金属价格在 2022 年将上涨 16%,然后在 2023 年有所回落。俄罗斯和乌克兰之间持续的战争、中国更严格的排放法规以及高昂的能源成本是造成铜短缺的主要因素。

电源模组封装市场趋势

互联互通将占据主导地位

- 功率模组是电源逆变器和转换器的关键元件。电源模组常用于电动车和其他马达控制器、家用电器、电源、电镀机、医疗设备、电池充电器、交直流逆变器和转换器、电源开关、焊接设备等。功率模组封装市场的成长得益于减少能源浪费、采用高效的分散式冷却方法、缩小占地面积以及随之而来的功率密度的提高。

- 互连器用于建立管理系统的电子组件中不同主动元件和被动元件之间的连接。连接器在智慧型手机、笔记型电脑、电脑和电视等通讯和消费性电子应用中很常见,推动了对创新和先进的电源模组封装解决方案的需求。例如,根据GSMA的预测,2023年亚太地区的智慧型手机普及率将达到78%。到 2030 年,亚太地区的智慧型手机普及率预计将达到 90% 以上,这将推动市场成长。

- 值得注意的是,互连技术是封装的关键且必要部分。晶片之间透过封装相互连接,接收电能、交换讯号并最终运作。随着互连方法改变半导体产品的速度、密度和功能,它们也在不断发展和演变。

- 通常,电源模组内的功率元件使用引线键合进行电气连接,并使用硅胶填充绝缘层进行互连。大直径铜线键合、银烧结、无线键结互连、基于平面柔性的封装等技术均被不同程度地引入,以改善新型综合带隙功率模组的寄生电感和电阻、耐温性、可靠性和热性能。

- 互连主要可以透过受有效功率循环限制的晶片连接的寿命来描述。焊料夹在晶片和基板之间,在主动加热过程中仅在 Z 方向膨胀。这会导致焊料体疲劳。银烧结技术可将鬆散的金属粉末转变成紧密结合的多孔结构,从而延长动力循环能力。此外,互连是透过烧结低温活化的最小球形颗粒形成的。

亚太地区可望强劲成长

- 由于中国等国家越来越多地采用可再生能源以及电动/混合动力汽车的数量不断增加,该地区预计将占据最高份额。中国已成为可再生能源领域的主导力量。中国政府已经开始了摆脱煤炭的历史性倡议,并且取得了巨大进展。根据中国国家统计局的数据,过去十年来,煤炭在能源消耗中的比例从68.5%下降到56%。

- 政府正在推动减少排放并改善空气品质。根据世界能源监测的数据,中国的太阳能发电量达到 228 吉瓦(GW),风电发电量更是高达 310 吉瓦,超过世界其他国家的总和。中国计划在2030年实现1,200吉瓦的目标,另外还有750吉瓦的新计画正在筹备中。

- 印度雄心勃勃的可再生能源目标正在改变电力产业。印度可再生电力的成长正在加速,预计2026年新增发电能力将翻倍。随着更有效率的电池用于储存电力,且太阳能成本较现在进一步下降 66%,预计到 2040 年可再生能源将占总发电量的 49% 左右。

- 印度政府在COP26高峰会上承诺2070年实现净零排放,到2030年将可再生能源目标提高到500吉瓦,这对该产业的发展做出了重大贡献。印度政府已采取多项倡议推动可再生能源产业的发展。

功率模组封装产业概况

功率模组封装市场已基本固体,主要参与者如下:富士电机、英飞凌科技股份公司、三菱电机株式会社 (Powerex Inc.)、赛米控和安靠科技公司。

由于整合不断加强、技术进步和地缘政治情势的变化,所研究的市场正在经历波动。此外,随着代工厂和IDM之间的垂直整合不断加强,考虑到参与者的收益驱动型投资能力,受调查市场的竞争态势预计将继续加剧。

在透过创新获得永续竞争优势至关重要的市场中,随着汽车等终端用户产业的需求预计将激增,竞争只会加剧。

在这种情况下,考虑到最终用户对播放器的包装品质的期望,品牌标识起着重要作用。由于富士电机、三菱电机、AMKOR、ONSemi 和 Semikron 等现有主要市场参与者的存在,市场渗透率也很高。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 评估新冠肺炎疫情和宏观经济趋势对产业的影响

- 技术简介

第五章 市场动态

- 市场驱动因素

- 工业和消费性电子领域的需求不断增长

- 节能设备的需求不断增加

- 市场限制

- 市场整合影响整体盈利

第六章 市场细分

- 依技术分类

- 基板

- 底板

- 晶粒黏接

- 基板安装

- 封装

- 互连

- 其他技术

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- Fuji Electric Co. Ltd

- Infineon Technologies AG

- Mitsubishi Electric Corporation(Powerex Inc.)

- Semikron

- Amkor Technology Inc.

- Hitachi Ltd

- STMicroelectronics NV

- MacMic Science & Technology Co. Ltd

- Texas Instruments Inc.

- Starpower Semiconductor Ltd

- Toshiba Corporation

第八章投资分析

第九章:市场的未来

The Power Module Packaging Market size is estimated at USD 2.74 billion in 2025, and is expected to reach USD 4.38 billion by 2030, at a CAGR of 9.78% during the forecast period (2025-2030).

A power electronic module or power module acts as a physical container for storing several power components, usually power semiconductor devices. Packaging plays a crucial role in the shift toward higher power densities, which enables more efficient power supplies, faster conversion, power delivery, and improved reliability. As the world is shifting toward faster-switching frequencies and higher power densities, there is a related shift in packaging materials used for wire bonding, die-attach, substrates, and system cooling.

Key Highlights

- The power modules are the key elements in the power inverters and converters. Power modules are commonly used in electric cars and other electric motor controllers, appliances, power supplies, electroplating machinery, medical equipment, battery chargers, AC to DC inverters and converters, power switches, and welding equipment. The power module packaging market's growth is driven by a reduction in the wastage of energy, the use of efficient distributed cooling schemes, a reduction in footprint, and a consequent increase in power density. Moreover, the growing demand for power modules in the industrial and consumer electronics sector is set to drive the power module packaging market.

- The consumer electronics industry has experienced a significant transformation driven by the rising demand for smarter and more advanced devices. Another important trend in the electronics industry is the increase of the Internet of Things (IoT). With the rise in demand for smart devices, IoT has become essential to everyday life. Thus, businesses primarily use this technology to develop new products and services. For instance, according to GSMA, greater China leads significantly with 1.5 billion connections, surpassing other regions, and is followed by North America and Europe with 0.3 billion connections each.

- Industrial appliances such as uninterruptible power supplies (UPS), server power supplies, power converters, and motor drives consume a significant portion of the world's power. Therefore, any increase in efficiency in industrial power supplies will substantially reduce a company's operating costs. With greater power density and better thermal performance, the demand for high-efficiency power supplies is increasing exponentially.

- The consolidation will increase as power module manufacturers grapple with the increasing complexity, the loss of a roadmap for future designs as Moore's Law is becoming more difficult and expensive to sustain, and a flood of new markets with evolving standards and different sets of rules.

- The Russia and Ukraine War is driving the aluminum and nickel prices upward, while high energy prices have affected metals, specifically copper. Copper is a crucial material in the power module packaging market, and it is used in baseplate and electrical interconnections. Copper price fluctuations will directly impact the power module packaging market. Metal prices were expected to increase 16% in 2022 and ease somewhat in 2023, according to ukraineinvest.gov. The ongoing war between Russia and Ukraine, stricter emissions standards in China, and high energy costs are the main factors in the increasing shortage of copper.

Power Module Packaging Market Trends

Interconnections Holds Major Share

- The power modules are the key elements in the power inverters and converters. Power modules are commonly used in electric cars and other electric motor controllers, appliances, power supplies, electroplating machinery, medical equipment, battery chargers, AC to DC inverters and converters, power switches, and welding equipment. The power module packaging market's growth is driven by a reduction in the wastage of energy, the use of efficient distributed cooling schemes, a reduction in footprint, and a consequent increase in power density.

- Interconnects are used to establish connections between different active and passive components within an electronic assembly that manages a system. Connectors are commonly utilized in telecommunications and consumer electronics applications, such as smartphones, laptops, computers, and TVs, and are driving the demand for innovative and advanced power module packaging solutions. For instance, as per GSMA, in 2023, the smartphone adoption rate across the Asia-Pacific region reached 78%. By 2030, smartphone adoption in APAC is projected to reach over 90%, which would drive the market growth.

- It is important to note that interconnection technology is a critical and necessary part of packaging. Chips are interconnected through packaging to receive power, exchange signals, and, ultimately, operate. As a semiconductor product's speed, density, and functions change depending on how the interconnection is made, interconnection methods constantly evolve and develop.

- Typically, power devices in a power module are interconnected using wire bonds for electrical connection and filled with silicone gel for insulation. Technologies such as large-diameter copper wire bonds, silver sintering, wirebondless interconnects, and planar flex-based packaging to improve the parasitic inductance and resistance, temperature capability, reliability, and thermal performance of new comprehensive band gap power modules have been implemented to varying degrees of success.

- Interconnections can be explained by the lifetime of a chip connection, which is mainly limited by active power cycles. The solder is sandwiched between the chip and substrate and can expand only in the Z-direction during active heating. This leads to fatigue of the solder body. Silver sintering, which is the transformation of a loose metal powder into a firmly bonded porous structure, has been introduced to extend the power cycling capability. Further, the interconnect is formed by sintering the smallest sphere-like particles, activated at low temperatures.

Asia-Pacific is Expected to Witness Major Growth

- The region is expected to occupy the highest share, owing to the increasing adoption of renewable energy and the rising number of electric/hybrid vehicles in countries like China. China has emerged as a dominant force in the renewable energy stage. The Chinese government has made significant strides in beginning a historic shift away from coal. Over the last decade, according to China's National Bureau of Statistics, coal's share of energy consumption decreased from 68.5% to 56%.

- The government is pushing for emissions reductions and improved air quality. According to Global Energy Monitor, China's solar capacity is 228 gigawatts (GW), with wind capacity at a whopping 310 GW more than the rest of the world combined. China aims to hit its 2030 target of 1,200 GW, with another 750 GW of new wind and solar projects in the pipeline.

- India's ambitious renewable energy goals are transforming its power sector. Renewable electricity is growing faster in India, and the new capacity additions are expected to double by 2026. As more efficient batteries will be used to store electricity, which will further reduce the cost of solar energy by 66% compared to the current price, renewable energy is expected to make up around 49% of total electricity generation by 2040.

- The Indian government's commitment to achieving net zero emissions by 2070 and increasing its renewable energy target to 500 GW by 2030 at the COP26 Summit has significantly contributed to industry growth. The government is taking several initiatives to boost India's renewable energy sector.

Power Module Packaging Industry Overview

The power module packaging market is semi-consolidated, with the presence of major players such as Fuji Electric Co. Ltd, Infineon Technologies AG, Mitsubishi Electric Corporation (Powerex Inc.), Semikron, and Amkor Technology Inc. These players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

With the growing consolidation, technological advancement, and geopolitical scenarios, the market studied has been witnessing fluctuation. In addition, with the increasing vertical integration of foundries and IDMs, the intensity of competition in the market studied is expected to continue to rise, considering players' ability to invest, which results from their revenues.

In a market where the sustainable competitive advantage through innovation is significant, competition will only increase, given the anticipated surge in demand from end-user industries such as automotive.

In such a scenario, the brand identity plays a major role, considering the importance of packaging quality that the end users expect from the player. With the presence of large market incumbents, such as Fuji Electric, Mitsubishi, AMKOR, Onsemi, and Semikron, the market penetration levels are also high.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products and Services

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 and Macroeconomic Trends on the Industry

- 4.4 Technology Snapshot

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand from the Industrial and Consumer Electronics Segment

- 5.1.2 Rising Demand for Energy-efficient Devices

- 5.2 Market Restraints

- 5.2.1 Market Consolidation Affecting Overall Profitability

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 Substrate

- 6.1.2 Baseplate

- 6.1.3 Die Attach

- 6.1.4 Substrate Attach

- 6.1.5 Encapsulations

- 6.1.6 Interconnections

- 6.1.7 Other Technologies

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia

- 6.2.4 Australia and New Zealand

- 6.2.5 Latin America

- 6.2.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Fuji Electric Co. Ltd

- 7.1.2 Infineon Technologies AG

- 7.1.3 Mitsubishi Electric Corporation (Powerex Inc.)

- 7.1.4 Semikron

- 7.1.5 Amkor Technology Inc.

- 7.1.6 Hitachi Ltd

- 7.1.7 STMicroelectronics NV

- 7.1.8 MacMic Science & Technology Co. Ltd

- 7.1.9 Texas Instruments Inc.

- 7.1.10 Starpower Semiconductor Ltd

- 7.1.11 Toshiba Corporation