|

市场调查报告书

商品编码

1683224

非洲纺织品:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Africa Textile - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

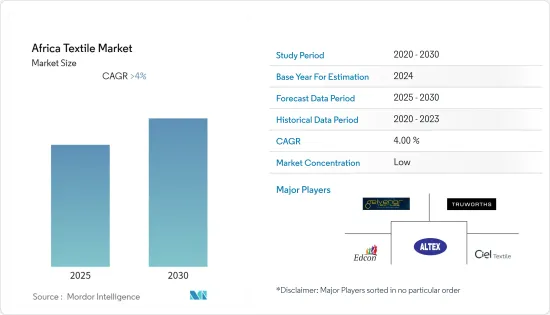

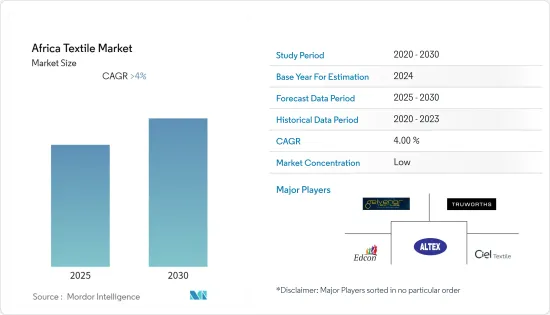

预计预测期内非洲纺织品市场的复合年增长率将超过 4%。

非洲的纺织业多种多样,但有一件事似乎保持不变,那就是棉花市场。目前非洲有许多国家种植和销售棉花。其中六个国家以「非洲棉花」为标籤种植棉花,是最大的就业创造国之一,光是棉花产业就为非洲人提供了 45 万名就业机会。然而,纺织业不仅仅是种植和销售棉花。南非也正在向技术纺织品领域扩张,向航空公司供应大麻。埃塞俄比亚等国家也开始建造更多纺织厂,僱用当地人并帮助企业摆脱中国等国家工资上涨的困境。 H&M 等公司在非洲开设工厂,因为那里的工资低,而且人口可以养活他们所需的工人。此外,非洲种植和收穫的棉花用于生产销往全球市场的纱线、线纱和其他产品。

新冠肺炎疫情对全球价值链的破坏以及对非洲企业的影响已显而易见。疫情和全球经济封锁对纺织品的生产、销售和贸易产生了直接影响。封锁导致电子商务和网路购物大幅扩张。虽然服饰是电子商务中主要且成长最快的产品类别,但纺织品是一个相当小众的线上细分市场。

非洲纺织品市场趋势

《非洲成长与机会法》对非洲纺织业的影响

为增强非洲大陆的经济实力,美国国会于2000年5月18日通过《2000年美国贸易与发展法案》签署了《非洲增长与机会法案》(AGOA),该法案颁布以来,已在肯尼亚、马拉维、莱索托、赖索托王国、加彭、辛巴威、冈比亚等目标国家取得了明显成效和巨大成功,至今至今仍持续成功,并持续成效。

透过《非洲成长与机会法》,美国向非洲产品开放了市场,其中纺织品占据了很大的市场份额。 《非洲成长与机会法案》为撒哈拉以南非洲服装出口商提供了免税进入美国市场的待遇,并对不合格的成员国(如亚洲国家)产生了重大影响。这降低了生产成本,使美国市场成为婴儿服装、坯布、棉纱、羊毛和轧棉等非洲纺织品的更好选择。与亚洲和欧洲等其他大陆市场相比,这些产品在撒哈拉以南非洲国家生产以供直接出口或用于下游服装生产并出口到美国,很可能更具竞争力。

非洲各地的纺织品生产商和出口商严重依赖2005年1月生效的新贸易规则的影响。该规则在世界贸易组织(WTO)谈判下达成,取消了已开发国家的配额,并向市场力量开放了三十多年来一直受到保护的领域。

此外,全球对非洲纺织品和服饰的需求日益增长,非洲图案被视为真正时尚和标誌性的服装。国际时装公司越来越多地将非洲影响力融入其最新系列中。

增加对埃塞俄比亚的投资

在国际贸易中心组织的产业代表团访问衣索比亚后,中国领先的纺织企业正加强在衣索比亚的采购和投资计画。

过去二十年来,中国已成为非洲经济体日益重要的融资来源,其中也包括衣索比亚年轻但快速成长的製造业。

2018年,中国纺织商会与埃塞俄比亚当地纺织合作伙伴、埃塞俄比亚纺织服饰行业协会领导以及政府高级官员签署了采购协议并探讨投资伙伴关係。

中国代表团对衣索比亚在公路、铁路、电力等基础建设方面的进展印象深刻,但表示进一步提高劳动生产力和降低物流成本将使衣索比亚成为更具吸引力的投资目的地。

在从中国出口商品变得越来越困难的当下,美国和北京之间的贸易紧张局势被认为是激励中国企业在衣索比亚投资的进一步因素。

非洲纺织业概况

本报告介绍了非洲纺织业的主要国际参与者。从市场占有率来看,目前只有少数几家大公司占据市场主导地位。然而,随着技术进步和产品创新,中小企业正在透过赢得新契约和开拓新市场来扩大其市场占有率。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察与动态

- 市场概况

- 市场驱动因素

- 市场限制

- 价值链/供应链分析

- 波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 对市场的影响

第五章 市场区隔

- 应用

- 服饰用途

- 工业/技术应用

- 适合家庭使用

- 材料类型

- 棉布

- 黄麻

- 丝绸

- 合成的

- 羊毛

- 过程

- 织物

- 不织布

第六章 竞争格局

- 市场集中度概览

- 公司简介

- CIEL Textile Ltd.

- Almeda Textile Factory Plc

- Edcon

- Truworths

- Woolworths

- Gelvenor Textiles

- Mediterranean Textile Company SAE

- Saygin-Dima Textile Sc

第七章 市场机会与未来趋势

第八章 免责声明

The Africa Textile Market is expected to register a CAGR of greater than 4% during the forecast period.

The African textile industry is a varied one, but the seeming constant is their cotton market. There are many countries in Africa that currently grow and sell cotton. Six of them grow cotton under the label ''Cotton made by Africa'', which is one of the largest job producers as well, with 450,000 Africans working in the cotton business alone. The growing and selling of cotton is not their only textile industry though. South Africa has also gotten into technical textiles as well, by providing hemp to aeronautics companies for their products. Countries like Ethiopia are also starting to gain textile mills which employ locals and help businesses trying to escape the rising wages in countries like China. Companies like H&M have opened mills in Africa, since their wages are less, and the population can support the workers needed. They also create products like thread and yarn for global markets from cotton is grown and harvested in Africa.

The disruption of the COVID-19 pandemic on global value chains and its impact on African businesses is already evident. The pandemic and global economic lockdowns have had an immediate effect on textile production, sales, and trade. There has been a significant expansion in ecommerce and online shopping because of the lockdown. Clothing is a major and rapidly growing product category for ecommerce, but textiles are a rather niche online segment.

Africa Textile Market Trends

Impact of AGOA on the African Textile Industry

To boost the economic power of the African continent, the U.S. congress signed the African Growth and Opportunity Act (AGOA) through the US Trade and Development Act of 2000 into law on May 18 2000, and since its enactment, continuous tangible results and tremendous success have been achieved till the present by the eligible members such as Kenya, Malawi, Lesotho, Equatorial Guinea, Gabon, Zimbabwe and Gambia among others.

Through AGOA, US opened up its market for African products, textiles taking the lion's share where it offers sub-Saharan exporters of apparel to the U.S. market a duty-free access which is a great leverage over non-eligible members such as Asian countries thus, reducing cost of production which gives the U.S market a better option for African textile products such as infants wear, grey fabrics, spun cotton yarn, wool, ginned cotton etc. These products have the most potential for competitive production in Sub-Saharan African countries either for direct export, or for use in downstream production of apparel for export to the United States than other continental market like Asia, and Europe among others.

Textile producers and exporters across Africa rely majorly on the impact of new trade rules that took effect in January 2005. The rules, negotiated at the World Trade Organization (WTO), opened up to market forces a sector that had been protected for more than 30 years by ending a quota system in industrial nations which resulted in a ready market for textiles and apparel from African and other developing countries.

Also, the demand for African textiles and garments is increasing globally, and African patterns are gaining recognition as truly fashionable and iconic pieces. International fashion houses are integrating more and more African influences in their latest collections.

Rising Investment in Ethiopia

Major Chinese textile companies are stepping up sourcing and investment plans in Ethiopia following a visit to the African country by a delegation of industry representatives organized by the International Trade Centre.

Over the last twenty years, China has become an increasingly important source of financing in African economies, including in Ethiopia's young but fast-growing manufacturing sector.

In 2018, China Chamber of Commerce for Textiles (CCCT) have sourcing agreements and explored investment partnerships with Ethiopia-based partners of local textile companies and leaders of Ethiopian Textile and Garment Industry Association as well as with high-level government officials.

The Chinese delegates were impressed by Ethiopia's progress on improving infrastructure, including roads, trains, and electricity, though they suggested that further enhancing labour productivity and lowering logistics costs would make the country an even more attractive destination for investment.

The current trade tensions between the United States and Beijing were cited as an additional incentive for Chinese firms to invest in Ethiopia, with increasing difficulties associated with exporting from China.

Africa Textile Industry Overview

The report covers major international players operating in the Africa Textile Industry. In terms of market share, few of the major players currently dominate the market. However, with technological advancement and product innovation, mid-size to smaller companies are increasing their market presence by securing new contracts and tapping new markets.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Porters Five Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Clothing

- 5.1.2 Industrial/Technical Applications

- 5.1.3 Household Applications

- 5.2 Material Type

- 5.2.1 Cotton

- 5.2.2 Jute

- 5.2.3 Silk

- 5.2.4 Synthetics

- 5.2.5 Wool

- 5.3 Process

- 5.3.1 Woven

- 5.3.2 Non-woven

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 CIEL Textile Ltd.

- 6.2.2 Almeda Textile Factory Plc

- 6.2.3 Edcon

- 6.2.4 Truworths

- 6.2.5 Woolworths

- 6.2.6 Gelvenor Textiles

- 6.2.7 Mediterranean Textile Company S.A.E

- 6.2.8 Saygin-Dima Textile Sc