|

市场调查报告书

商品编码

1683225

电气和电子测试设备市场:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Electrical and Electronic Test Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

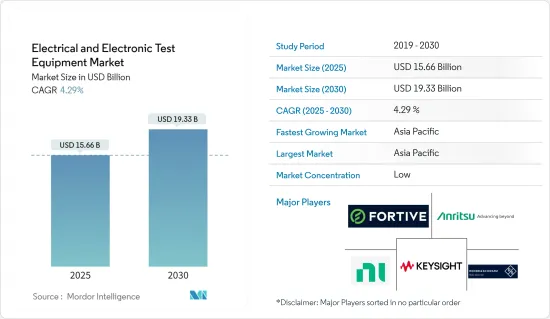

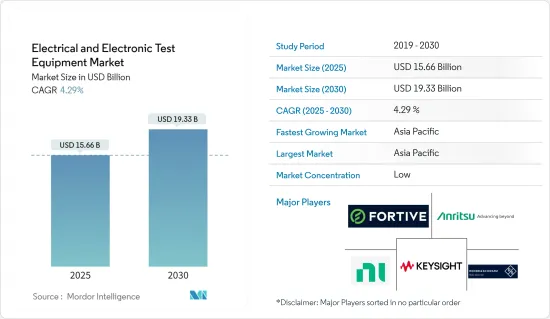

电气和电子测试设备市场规模估计到 2025 年将达到 156.6 亿美元,到 2030 年将达到 193.3 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.29%。

关键亮点

- 电气和电子测试设备是用于测量、测试、诊断和排除电气和电子系统各个方面的故障的工具。该设备有助于确保电子设备、电路和组件的正常运作、安全和性能。测试设备有助于尽可能紧密地模拟即时环境以检验被测设备(DUT)。

- 测试设备与设备本身一样重要。所有电子设备都会随着时间的推移因热量、湿度、衝击、振动等原因而磨损,从而导致性能劣化。因此,每个电子测试设施都必须具备必要的设备,无论是简单的万用电錶还是复杂的示波器。

- 电子产品设计、製造和维修对精度和速度的要求越来越高,这是推动各行业对电气和电子测试设备需求的主要因素之一。此外,新型连网电子设备和电动车、自动驾驶和 5G 等新兴先进技术的日益普及也在推动市场需求。

- 例如,电池电动车的一个风险是由于热失控而起火,电池损坏会导致不受控制的过热。此外,许多起火的电动车 (EV) 都使用了一种名为 NMC 的温度敏感电池化学物质。由于使用对温度更敏感的电池,没有采取任何设计措施来确保电池组层面的充分热冷却。严格的电气和电子测试使製造商和工程师能够优化电动车的性能和安全性。

- 此外,随着自动驾驶越来越广泛地应用,需要测试设备来确保自动驾驶系统在复杂环境下的可靠性、安全性和瞬间决策能力。这项测试过程对于确保自动驾驶汽车在道路上行驶并确保其性能和安全性至关重要。

- 与其他市场一样,电气和电子测试设备市场也面临挑战,对于OEM(目的地设备製造商)製造商而言,激烈的价格竞争是主要挑战之一。许多开发中国家(如印度)对价格非常敏感,因此检测服务的价格保持在较低水准。因此,市场上充斥着旧的、维修的和未校准的测试设备,这些设备给出的测量结果并不准确。

- 成本上升和对新产品的抵制也是问题,因为开发新产品需要大量资金。在采购方面,我们观察到客户不愿意为此类设备支付高价,有时这被视为最后的优先事项。

- COVID-19 疫情对整个半导体製造市场的需求和供应都产生了影响。全球各地半导体工厂的停工关闭,导致供不应求。这种影响也反映在市场上。然而,许多影响都是短暂的。世界各国政府为支持汽车和半导体产业采取的预防措施帮助市场復苏。

电气和电子测试设备市场趋势

半导体和计算有望成为最大的终端用户产业

- 半导体製造商采用自动测试设备 (ATE) 预计将对市场成长产生积极影响,因为它将提高半导体设备的运行速度并降低成本。

- 半导体自动测试设备 (ATE) 可以测试各种电子设备和系统,从电阻器、电容器和电感器等重要组件到复杂的积体电路 (IC)、印刷电路基板(PCB) 和完全组装的电子系统。 ATE 在电子製造领域被广泛采用,用于测试电子元件和系统的后期製造。鑑于半导体产业的兴起,ATE 的需求预计将大幅成长。

- 半导体产业正在快速扩张,半导体已成为现代技术的基本组成部分。据 SIA 称,2023 年第二季全球半导体销售额将达到 1,245 亿美元,较 2023 年第一季成长 4.7%。此外,它预测到 2030 年全球对半导体製造能力的需求将激增 56%。这些未来的发展预计将创造对电子测试设备的巨大需求。

- 随着物联网、巨量资料和人工智慧(AI)等技术的出现,市场对晶片功率性能、效率、成本、面积和上市时间的快速显着改进的需求日益增加。客户需求和偏好的这些变化预计将成为推动半导体测试设备市场成长的关键因素之一。

- 2023年6月,SIA正式批准了WSTS 2023年春季全球半导体销售预测。该预测显示,2023 年全球年销售额将为 5,151 亿美元,低于 2022 年的 5,741 亿美元。预计 2024 年全球销售额将达到 5,760 亿美元,创下业界历史最高水准。半导体设备支出的增加,加上政府的有利倡议和对半导体晶片的需求不断增长,显示人们对在世界各地建立新代工厂的兴趣日益浓厚。预计晶片产量的成长将推动电子测试设备的需求。

亚太地区可望主导市场

- 亚太地区在半导体和电子产业占据主导地位,主要得益于中国、日本、韩国和印度的广泛製造地,而且电子产业的最终组装也在迅速成熟。

- 富士康科技集团、威震亚太有限公司等大公司正在印度设立工厂。据IBEF称,印度承诺在2025-26年实现电子製造业产值3,000亿美元,出口产值1,200亿美元。此外,2023-24 年联邦预算为电子和资讯技术部拨款 1,654.9 亿印度卢比(20 亿美元),每年增加约 40%。

- 预计该地区测试活动的活性化将对电气测试设备产生巨大的需求。在此之前,大多数本地公司都在内部进行测试和认证业务。然而,中国的强制认证法规更强调严格的监管标准。这导致测试服务外包增加,以及测试服务公司对测试设备的需求不断增长。

- 除消费电子产业外,廉价航空公司在该地区占据主导地位。因此,大多数测试和服务业务都外包了。因此,新加坡已成为维护和测试服务的区域中心。新加坡的航空公司已经主导该地区二十多年。然而,印尼、越南和泰国等国家正在挑战新加坡的主导地位。

- 此外,该地区还拥有几家主要企业,如横河电机(日本)、爱德万测试公司(日本)、安立公司(日本)、普源精电科技(中国)和 ScienceTech Technologies(印度)。这些公司和该地区的其他企业一起不断致力于产品创新并为各种工业应用提供解决方案。

- 2022年8月,爱德万测试公司与罗德与施瓦茨公司高性能示波器“RTP”合作,进行高速SoC测试仪的量产演示评估。透过此次合作,该公司旨在提高产品品质以满足最新需求。预计本地公司的此类倡议将推动市场成长。

- 此外,高压线路和发电厂建设等一些基础设施计划预计将推动该地区对电气测试设备的需求。例如,2022年8月,中国国家消费电子网路宣布,计画在2022年下半年投资超过1,500亿元人民币(220亿美元)用于特高压输电线路。八个新的特高压计划的建设预计将进一步推动市场成长,将主要城市与中国西部地区连接起来,而这些地区主要位置太阳能、风能和水力发电厂。

电气电子测试设备市场概览

电气电子测试设备市场特征是高度分散,主要企业包括 Fortive Corporation、Keysight Technologies Inc. 和 Rohde & Schwarz GmbH & Co. KG。 KG、美国国家仪器公司、安立公司等。市场参与企业正在策略性地利用伙伴关係和收购来加强产品系列建立可持续的竞争地位。

2023年8月,横河电机株式会社的子公司横河测试测量株式会社发布了DLM5,000HD系列高精准度示波器。 DLM5000HD系列是DLM5000系列示波器的进化版,有频宽500MHz和350MHz的型号。这些仪器提供了更高的分辨率,可进行精确的波形分析,并具有易于使用的功能,可简化设定和操作。

2023年6月,爱德万测试公司宣布将与亚利桑那州立大学(ASU)合作,与恩智浦合作建立一个新的测试工程项目。该计画的课程由亚利桑那州立大学 Ille Tech 和 Fulton Tech 学院的教职员工製定,并将透过 Advantest 设计的实验进行丰富。这些由 Advantest 和 NXP 共同进行的实验标誌着一个重要的教育里程碑。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 产业价值链分析

- 评估主要宏观经济趋势的影响

第五章 市场动态

- 市场驱动因素

- 技术进步引发对测试和测量设备的需求

- 电动和混合动力汽车汽车的新趋势

- 市场挑战/限制

- 价格敏感度和对租赁服务的日益偏好

第六章 市场细分

- 按类型

- 半导体自动测试设备 (ATE)

- 射频(RF)测试设备

- 数位测试设备

- 电气和环境测试

- 资料采集 (DAQ)

- 按最终用户产业

- 通讯

- 半导体和计算

- 航太和国防

- 消费性电子产品

- 电动车 (EV)

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

7.供应商市场占有率分析

第八章 竞争格局

- 公司简介

- Fortive Corporation

- Keysight Technologies Inc.

- Rohde & Schwarz GmbH & Co. KG

- National Instruments Corporation

- Anritsu Corporation

- Teledyne Lecroy(Teledyne Technologies Incorporated)

- Yokogawa Test & Measurement Corporation(Yokogawa Electric Corporation)

- Teradyne Inc.

- Chauvin Arnoux Group

- Advantest Corporation

第九章投资分析

第十章 市场机会与未来趋势

The Electrical and Electronic Test Equipment Market size is estimated at USD 15.66 billion in 2025, and is expected to reach USD 19.33 billion by 2030, at a CAGR of 4.29% during the forecast period (2025-2030).

Key Highlights

- Electrical and electronic test equipment are tools used to measure, test, diagnose, and troubleshoot various aspects of electrical and electronic systems. This equipment helps ensure the proper functioning, safety, and performance of electronic devices, circuits, and components. Test equipment helps simulate the real-time environment as closely as possible to verify the device under test (DUT).

- Testing equipment is as important as the device itself. All electronic equipment tends to wear out over time due to heating, moisture, shock, or vibration. This can lead to performance degradation. Therefore, every electronic testing facility must have the required equipment, whether a simple multimeter or a complex oscilloscope.

- The increasing need for accuracy and speed in designing, manufacturing, or repairing electronic products is one of the major factors driving the demand for electric and electronic test equipment across industries. The increase in the adoption of new and connected electronic devices and emerging advanced technologies, such as electric vehicles, autonomous driving, and 5G, is also fueling the demand in the market.

- For instance, the risk associated with battery-electric vehicles is catching fire due to thermal runaway, where damage to the battery leads to uncontrollable overheating. Moreover, many electric vehicles (EVs) that caught fire used more temperature-sensitive battery chemistry called NMC. To use a more temperature-sensitive battery, no design measures were taken to ensure that it's thermally cooled properly at the battery pack level. By employing rigorous electrical and electronic testing practices, manufacturers and engineers can optimize the performance and safety of electric vehicles.

- Moreover, the increasing deployment of autonomous driving will demand the use of test equipment to ensure that autonomous driving systems are reliable, safe, and capable of making split-second decisions in complex environments. These testing processes are essential to bring autonomous vehicles to the roads with high confidence in their performance and safety.

- Like other markets, the electrical and electronics test equipment market also has some challenges to overcome, and fierce price competition has been one of the key issues for original equipment manufacturers (OEMs). Most developing nations, such as India, are very price-sensitive, which makes them keep the prices of testing services significantly low. This further leads to the presence of many old, refurbished, non-calibrated instruments operating in the market that provide inaccurate measurements.

- Resistance toward increased cost and new products is another issue, as developing a new product requires huge capital. When it comes to procurement, it has been observed that the customers are not willing to pay well for such equipment, and sometimes it is considered the last priority item.

- The COVID-19 pandemic influenced the overall semiconductor manufacturing market on both the demand and supply sides. The global lockdowns and closure of semiconductor plants led to a supply shortage. The effects were also reflected in the market. However, many of these effects were short-term. Precautions by governments worldwide to support the automotive and semiconductor sectors helped revive the market.

Electrical and Electronic Test Equipment Market Trends

Semiconductors and Computing are Expected to be the Largest End-user Industry

- The adoption of automated test equipment (ATE) by semiconductor manufacturing firms to improve performance operational speed and reduce costs of semiconductor devices is anticipated to have a favorable impact on market growth.

- Semiconductor automated test equipment (ATE) is capable of testing a diverse array of electronic devices and systems, ranging from essential components such as resistors, capacitors, and inductors to complex integrated circuits (ICs), printed circuit boards (PCBs), and fully assembled electronic systems. ATE is extensively employed in the electronic manufacturing sector to examine electronic components and systems post-fabrication. Given the rising semiconductor industry, the demand for ATE is anticipated to escalate considerably.

- The semiconductor industry is experiencing a rapid expansion, with semiconductors serving as the fundamental components of contemporary technology. According to SIA, the global sales of semiconductors amounted to USD 124.5 billion in Q2 2023, marking a 4.7% rise from Q1 2023. Additionally, it foresees a 56% surge in the worldwide demand for semiconductor manufacturing capacity by 2030. Such futuristic developments are expected to create a significant need for electronic testing equipment.

- The market is witnessing an increase in demand for rapid and significant improvements in chip power performance, efficiency, cost, area, and time to market due to the emergence of technologies such as the IoT, Big Data, and artificial intelligence (AI). This shift in customer demands and preferences is expected to be one of the critical drivers for the growth of the semiconductor testing equipment market.

- SIA officially supported the WSTS Spring 2023 worldwide semiconductor sales forecast in June 2023. The forecast estimated annual global sales to amount to USD 515.1 billion in 2023, a decrease from the 2022 sales total of USD 574.1 billion. In 2024, global sales are expected to reach USD 576.0 billion, the highest-ever total in the industry. The escalating demand for chips, coupled with favorable government initiatives and rising demand for semiconductor chips, has led to an increase in semiconductor equipment spending, indicating a growing interest in establishing new foundries worldwide. Such increasing chip production is expected to drive the demand for electronic testing equipment.

Asia-Pacific is Expected to Dominate the Market

- The Asia-Pacific region significantly dominates the semiconductor and electronics industry, primarily driven by the extensive manufacturing bases in China, Japan, South Korea, and India, which have also been rapidly maturing in the final assembly of the electronics industry.

- Large contractors, such as Foxconn Technology Group and Megatron Asia Pacific Ltd, are in the process of setting up plants in India. According to IBEF, India is committed to reaching USD 300 billion worth of electronics manufacturing and exports of USD 120 billion by 2025-26. In addition, the Union Budget 2023-24 allocated INR 16,549 crore (USD 2 billion) for the Ministry of Electronics and Information Technology, which is about 40% more elevated annually.

- The region's increasing testing and inspection activities are expected to create a considerable demand for electrical test equipment. Previously, most regional firms conducted their testing and certification operations in-house. However, due to China's Compulsory Certification regulations, greater emphasis is now placed on the need for strict regulatory standards. This has led to increased outsourcing of testing services, thereby increasing the demand for test equipment among testing services companies.

- Apart from the consumer electronics industry, low-cost carriers dominate the region. Thus, the majority of the inspection and service activities are outsourced. Due to this, Singapore has emerged as a regional hub for maintenance and inspection services. Allied players operating from Singapore have maintained dominance in the region for over two decades. However, countries like Indonesia, Vietnam, and Thailand are challenging the country's dominance.

- Additionally, the region has been a base for multiple key players, including Yokogawa (Japan), Advantest Corp (Japan), Anritsu Corporation (Japan), Rigol Technologies (China), and ScienceTech Technologies (India). These companies, along with various other companies in the region, are continuously involved in product innovations, providing solutions across various industry applications.

- In August 2022, Advantest Corp. collaborated with the Rohde & Schwarz RTP high-performance oscilloscope for mass exhibition evaluation of high-speed SoC testers. In line with this partnership, the company aims to enhance the quality of its products to meet the latest requirements. Such initiatives by the regional companies are expected to promote market growth.

- Furthermore, multiple infrastructure projects, such as executing high voltage lines and power generation plants, are anticipated to drive the region's demand for electrical testing equipment. For instance, in August 2022, China's State Grid plans to fund more than CNY 150 billion (USD 22 billion) in UHV power transmission lines in the second half of 2022. The construction of 8 new UHV projects is expected to connect China's far western regions, where solar, wind, and hydropower plants are primarily located, to its major cities, further driving market growth.

Electrical and Electronic Test Equipment Market Overview

The electrical and electronic test equipment market is characterized by a high degree of fragmentation, featuring key players like Fortive Corporation, Keysight Technologies Inc., Rohde & Schwarz GmbH & Co. KG, National Instruments Corporation, and Anritsu Corporation. Market participants are strategically leveraging partnerships and acquisitions to bolster their product portfolios and establish a sustainable competitive edge.

August 2023: Yokogawa Test & Measurement Corporation, a subsidiary of Yokogawa Electric Corporation, introduced the DLM5000HD series of precision oscilloscopes. Positioned as an advanced iteration of the DLM5000 series, the DLM5000HD series broadens Yokogawa's oscilloscope offerings, encompassing models with 500 MHz and 350 MHz frequency bandwidths. These models offer enhanced resolution for precise waveform analysis and incorporate user-friendly features that streamline setup and operation.

June 2023: Advantest Corporation unveiled its collaboration with Arizona State University (ASU) to establish a novel test engineering program in partnership with NXP. The program's curriculum, initially developed by ASU's Ira and Fulton Schools of Engineering faculty, was enriched through laboratory experiments devised by Advantest. These experiments are administered jointly by Advantest and NXP, marking a significant educational milestone.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Degree of Competition

- 4.3 Industry Value Chain Analysis

- 4.4 An Assessment of the Impact of Key Macroeconomic Trends

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Technological Advancements Leading to the need for Test and Measurement Equipment

- 5.1.2 Emerging Trend of Electric and Hybrid Vehicle

- 5.2 Market Challenge/Restraint

- 5.2.1 Price Sensitivity and Increasing Preference for Rental Services

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Semiconductor Automatic Test Equipment (ATE)

- 6.1.2 Radio Frequency (RF) Test Equipment

- 6.1.3 Digital Test Equipment

- 6.1.4 Electrical and Environmental Test

- 6.1.5 Data Acquisition (DAQ)

- 6.2 By End-user Industry

- 6.2.1 Communications

- 6.2.2 Semiconductors and Computing

- 6.2.3 Aerospace and Defense

- 6.2.4 Consumer Electronics

- 6.2.5 Electric Vehicles (EVs)

- 6.2.6 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 VENDOR MARKET SHARE ANALYSIS

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Fortive Corporation

- 8.1.2 Keysight Technologies Inc.

- 8.1.3 Rohde & Schwarz GmbH & Co. KG

- 8.1.4 National Instruments Corporation

- 8.1.5 Anritsu Corporation

- 8.1.6 Teledyne Lecroy (Teledyne Technologies Incorporated)

- 8.1.7 Yokogawa Test & Measurement Corporation (Yokogawa Electric Corporation)

- 8.1.8 Teradyne Inc.

- 8.1.9 Chauvin Arnoux Group

- 8.1.10 Advantest Corporation