|

市场调查报告书

商品编码

1683229

MEMS能源采集设备:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)MEMS Energy Harvesting Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

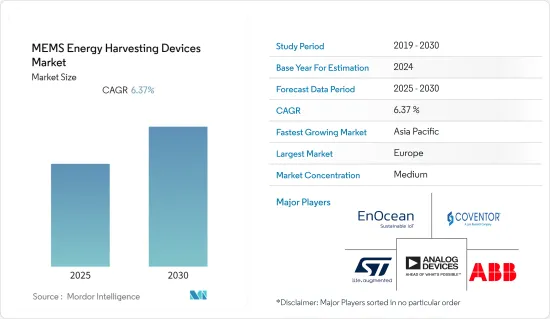

预计预测期内 MEMS能源采集设备市场复合年增长率为 6.37%。

主要亮点

- 能源采集已经存在了几十年,主要用于自行车发电机和太阳能电池板。然而,这项技术是一场革命,具有令人难以置信的应用,包括建筑和工业自动化、汽车、智慧城市和安全系统。能源采集是满足日益增长的能源需求和节省能源的重要工具。此外,巨量资料和物联网技术催生了自主能源采集设备的出现,与电池相比,这些设备的维护需求更少,安装也更简单。

- 此外,商业建筑自动化市场也正在蓬勃发展,预计随着智慧城市计画的兴起将大幅成长。由于具有节省安装和维护成本的潜力,能源采集无线解决方案在建筑和家庭自动化领域正在迅速发展。与铜线和电池相比,能源采集无线技术是连接数千台建筑设备并寻找新的监控和控制应用的理想通讯标准。

- 电子机械系统(MEMS)被认为是实现物联网感测节点的首选技术。 MEMS 有助于将感测器/致动器、用于资讯处理和射频通讯的电子电路、天线和能源采集整合在单一晶片或封装上。这些设备可能与生物、化学和热现象相互作用,包括与流体的相互作用。同时,这些设备通常与非电磁场和力相互作用,例如机械力、压电力和热力。 MEMS 技术是实现能源采集小型化的绝佳工具。

- 最近的趋势是,从机械振动、热梯度、电磁辐射和太阳辐射中能源采集方面取得了许多进展。这项进步旨在为便携式和个人设备提供替代传统电池的电源。因此,製造超低功率电子设备已成为限制基于 MEMS 的收集设备采用率的主要挑战之一。

- COVID-19 加速了以患者为中心的医疗方法的步伐,增加了对远端患者监护的需求,包括远端医疗、照护现场设备和可穿戴设备。追踪人体的体温和血压的能力正在推动对能源采集穿戴式装置的需求。这一趋势为穿戴式装置市场以及压力、惯性、麦克风和热电堆等整合式 MEMS 感测器创造了新的机会。

MEMS能源采集设备市场趋势

楼宇和家居自动化占主要份额

- MEMS能源采集设备市场中的楼宇和家庭自动化终端应用是指使用基于 MEMS 的能源采集设备。该设备为住宅和商业建筑内的各种自动化系统和设备提供动力并增强其功能。

- MEMS能源采集设备市场在楼宇和家庭自动化领域的最终用户应用涵盖许多应用。这包括无线感测器网络,用于监测温度、湿度、空气品质、居住和照明水平等参数。 MEMS能源采集设备还为节能 LED 照明系统、智慧恆温器、基于区域的 HVAC 控制以及安全和监控系统供电。还包括无线保全摄影机和门禁系统。此外,它还允许您控制智慧家庭设备,例如智慧锁、家用电器、语音助理和娱乐系统。

- 此外,正如美国Hippo Holdings 最近的一项研究强调的那样,人们越来越注重便利性,从而推动了建筑和家庭自动化的发展趋势。根据同一项研究,便利性占智慧家庭设备使用率的46%。 MEMS能源采集设备可以成为楼宇和智慧家居系统中满足此需求的潜在解决方案。透过为照明控制、暖通空调系统、安全系统和智慧家庭设备等自动化系统供电,MEMS能源采集设备可提供无缝、个人化的体验,提升居住者的舒适度和便利性。

- 此外,在北美,智慧家庭技术预计将在美国和加拿大等国家迅速普及。精通技术的消费者、对能源效率的重视以及积极的政府倡议等因素可能是市场成长的潜在驱动力。

- 由于越来越重视智慧型设备的能源效率、永续性和最佳化,楼宇和家庭自动化市场正呈现出整合 MEMS能源采集设备的趋势。总体而言,随着 MEMS能源采集技术的进步,楼宇和家庭自动化的成长轨迹预计将进一步扩大。

亚太地区发展迅速

- 亚洲国家,尤其是中国、日本、韩国和台湾,在 MEMS 技术的开发和製造方面取得了长足的进步。这些国家拥有先进的研发设施,正在推动创新并突破MEMS收集设备功能的界限。

- 亚洲是大型消费性电子市场的製造地,对智慧型手机、穿戴式装置和物联网设备等行动装置的需求很高。 MEMS 收集设备提供了一个有吸引力的解决方案,可以利用环境能量为这些设备供电,减少对传统电池的依赖。

- 由于MEMS感测器能够减少排放气体和燃料消耗、提高稳定性和安全性、改善乘客的舒适度和便利性,因此已成为汽车中最关键的部件之一。 MEMS 感测器的成本效益促进了多种用于汽车应用的感测器的开发。这些包括加速计、陀螺仪、辐射和温度感测器、压力和振动感测器等。

- 这些设备对于提高汽车安全性发挥关键作用。这一因素正成为市场成长的催化剂。 2022 年 9 月,SiTime 公司宣布推出基于先进 MEMS 技术的全新汽车振盪器系列。这款全新差分振盪器具有10倍的容错能力,即使在极端路况和温度下也能确保ADAS可靠运作。

- 此外,亚洲各国政府也推出了政策和倡议,推广清洁能源技术,减少对石化燃料的依赖。例如,首届印度-日本环境週于2023年1月举行。印度製定了到 2070 年实现净零排放的雄心勃勃的目标。日本已订定了2050年实现净零排放的目标。这些措施通常包括财政激励、研究津贴以及与产业相关人员的合作以创造有利环境。这些政府针对清洁能源的倡议预计将推动 MEMS能源采集设备市场的成长。

MEMS能源采集设备产业概况

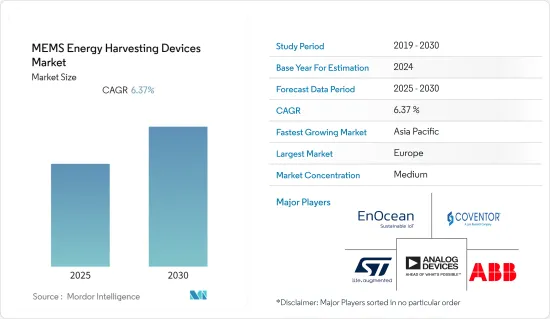

MEMS能源采集设备市场由许多大型供应商组成,它们拥有后向和向前整合能力,从而产生收入。市场相对集中,供应商不断增加研发支出,以获得技术力和相对于其他公司的竞争优势。市场上的供应商竞争的是技术和质量,而不是价格。该市场的特点是产品差异化程度中等至高度、产品渗透率不断提高、竞争激烈。一般来说,提供的产品包括客户客製化。主要市场参与者包括 EnOcean Gmbh、STMicroelectronics NV、Coventor Inc.(Lam Research Corporation)、Analog Devices Inc. 和 ABB Ltd.

- 2023 年 5 月-义法半导体针对工业市场推出首款 MEMS 防水/防液体绝对压力感测器,并宣布具有 10 年长寿命计画。

- 2023 年 4 月-EnOcean 的创新能源采集无线技术显着减少二氧化碳排放。截至2023年4月底,设备销售量将超过1,900万台,使公司减少二氧化碳排放量1,403,302吨。这主要归功于自供电解决方案,它不再需要电池和电缆,从而使建筑物更加节能。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 产业价值链分析

- COVID-19 市场影响

第五章 市场动态

- 市场驱动因素

- 智慧城市的发展

- 商业应用缓慢进入工业和家庭自动化设备市场

- 市场限制

- 超低功耗电子产品

- 无线资料传输速度和标准

第六章 市场细分

- 依技术分类

- 振动能源采集

- 能源采集

- 射频能源采集

- 其他能源采集

- 按最终用户应用

- 车

- 产业

- 军事和航太

- 楼宇和家居自动化

- 消费性电子产品

- 其他最终用户应用程式

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

第七章 竞争格局

- 公司简介

- EnOcean Gmbh

- STMicroelectronics NV

- Coventor Inc.(Lam Research Corporation)

- Analog Devices Inc

- ABB Ltd

- Cymbet Corp

- Micropelt(EH4 GmbH)

第八章投资分析

第九章 市场机会与未来趋势

The MEMS Energy Harvesting Devices Market is expected to register a CAGR of 6.37% during the forecast period.

Key Highlights

- Energy harvesting is used for decades for bicycle dynamos or solar panels. However, this technology is a revolution with staggering applications in building and industry automation, automotive vehicles, smart cities, and security systems. Notably, governments and favorable public initiatives are the major drivers for energy harvesting demand growth as public actors consider energy harvesting a crucial tool for meeting the increasing energy demand and saving energy. In addition, Big Data and IoT technologies led to autonomous energy-harvesting devices that require less maintenance and are easier to install than batteries.

- Moreover, the market for commercial building automation is also booming and is expected to experience significant growth with rising smart city initiatives. Energy harvesting wireless solutions find surging applications in building and home automation owing to their high cost-saving potential in installation and maintenance. Compared to copper wiring or batteries, energy-harvesting wireless technology is the ideal communication standard to interconnect thousands of building devices and find new monitoring and control applications.

- Microelectromechanical systems (MEMS) are considered the most suitable technology to realize IoT-sensing nodes. It facilitates the integrated fabrication of sensors/actuators, electronic circuits for information processing and radio frequency communication, antennas, and energy harvesters on a single chip or package. They may interact with biological, chemical, and thermal phenomena, including fluid interaction. At the same time, these devices usually interact with non-electromagnetic fields and forces, such as mechanical forces, piezoelectric and thermoelectric forces, among others. It promoted MEMS technology as an excellent tool for miniaturizing energy harvesters.

- In recent years, much development is made in energy harvesting from mechanical vibrations, thermal gradients, electromagnetic radiations, and solar radiations. This progress is made to provide alternative power sources to operate portable and personal gadgets instead of traditional batteries. As a result, the creation of ultra-low-power electronic devices became one of the main challenges likely to limit the adoption rate of MEMS-based harvesting devices.

- COVID-19 accelerated the pace towards a more patient-centric approach and increased the need for remote patient monitoring, including telehealth, point-of-care devices, and wearables. There is a growing demand for energy harvesters' wearables owing to their ability to track peoples' temperature and blood pressure. This trend created new opportunities in the wearables market, as well as for integrated MEMS sensors, such as pressure, inertial, microphones, thermopiles, etc.

MEMS Energy Harvesting Devices Market Trends

Building and Home Automation to Hold Major Share

- Building and home automation end-user application in the MEMS energy harvesting devices market refers to using MEMS-based energy harvesting devices. The devices power and enhance various automated systems and devices within residential and commercial buildings.

- The building and home automation end-user application in the MEMS energy harvesting devices market encompasses many applications. These include wireless sensor networks for monitoring parameters such as temperature, humidity, air quality, occupancy, and lighting levels. MEMS energy harvesting devices also power energy-efficient LED lighting systems, smart thermostats, zone-based HVAC controls, and security and surveillance systems. It also includes wireless security cameras and access control systems. Additionally, they enable the operation of smart home devices such as smart locks, appliances, voice-activated assistants, and entertainment systems.

- Further, the trend of building and home automation is driven by the increasing emphasis on convenience, as highlighted by Hippo Holdings' recent survey in the United States. It stated that convenience accounts for 46% of the utilization of smart home devices across all demographics. MEMS energy harvesting devices could be a potential solution to be adopted in building and home automation systems to meet this demand. By powering automated systems such as lighting controls, HVAC systems, security systems, and smart home devices, MEMS energy harvesting devices provide seamless and personalized experiences, enhancing occupants' comfort and convenience.

- Moreover, in North America, countries such as the United States and Canada are expected to witness rapid adoption growth of smart home technologies. Factors such as the presence of tech-savvy consumers, a strong emphasis on energy efficiency, and favorable government initiatives might be potential factors responsible for the market's growth.

- The building and home automation market is witnessing a growing trend towards integrating MEMS energy harvesting devices, owing to the rising emphasis on energy efficiency, sustainability, and the optimization of smart devices. Overall, the growth trajectory of building and home automation, coupled with advancements in MEMS energy harvesting technology, is expected to witness further expansion.

Asia-Pacific to Witness Fastest Growth

- Asian countries, particularly China, Japan, South Korea, and Taiwan, made significant strides in developing and manufacturing MEMS technologies. These countries include advanced research and development facilities, fostering innovation and pushing the boundaries of MEMS harvesting device capabilities.

- Asia is a manufacturing hub for a large consumer electronics market, with a high demand for portable devices such as smartphones, wearables, and IoT devices. MEMS harvesting devices provide an attractive solution for powering these devices by harnessing ambient energy, reducing the dependence on traditional batteries.

- Also, MEMS sensors became one of the most important components in automobiles due to their ability to reduce emissions and fuel consumption, increase stability and safety, and improve the comfort and convenience of passengers. The cost-effective capability of MEMS sensors led to the development of several sensors for automotive applications. It includes accelerometers, gyroscopes, radiation and temperature sensors, and pressure and vibration sensors.

- These devices play a critical role in improving the safety of vehicles. This factor acts as the catalyst for the growth of the market. In September 2022, SiTime Corporation introduced a new automotive oscillator family based on its advanced MEMS technology. The new differential oscillators are 10x more resilient and ensure reliable operation of ADAS across extreme road conditions and temperatures.

- Moreover, governments across Asia implemented policies and initiatives to promote clean energy technologies and reduce reliance on fossil fuels. For instance, in January 2023, the first India-Japan environment week took place during the event. India set an ambitious target of achieving net zero by 2070. Japan initiated a goal of becoming net zero by 2050. These measures often include financial incentives, research grants, and collaborations with industry players, creating a conducive environment. These initiatives by the government for clean energy will increase the growth of the MEMS harvesting device market.

MEMS Energy Harvesting Devices Industry Overview

The MEMS energy harvesting device market comprises many large-scale vendors capable of backward and forward integration and commands significant revenue generation capabilities. The market is relatively consolidated, and vendors increasingly spend on R&D to gain technological capabilities and a competitive edge over other enterprises. The vendors in the market are competing on technology and quality rather than on price. This market is characterized by moderate-to-high product differentiation, growing levels of product penetration, and high levels of competition. Generally, the products offered include customer customizations. Some of the major market players are EnOcean Gmbh, STMicroelectronics NV, Coventor Inc. (Lam Research Corporation), Analog Devices Inc., and ABB Ltd.

- May 2023- STMicroelectronics introduced the first MEMS water/liquid-proof absolute pressure sensor with a declared 10-year longevity program for the industrial market.

- April 2023- EnOcean's innovative energy-harvesting wireless technology significantly reduces carbon emissions. As of the end of April 2023, with over 19,000,000 devices sold, the company could save a remarkable 1,403,302 tons of CO2. It is primarily because of its self-powered solutions that eliminate the need for batteries or cables and helps make buildings more energy efficient.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth of Smart Cities

- 5.1.2 Commercial Applications are Slowly Getting into the Market for Industrial Applications and Home Automation Appliances

- 5.2 Market Restraints

- 5.2.1 Ultra Low Power Electronics

- 5.2.2 Wireless Data Transmissions Rates and Standards

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 Vibration Energy Harvesting

- 6.1.2 Thermal Energy Harvesting

- 6.1.3 RF Energy Harvesting

- 6.1.4 Other Types of Energy Harvesting

- 6.2 By End-user Applications

- 6.2.1 Automotive

- 6.2.2 Industrial

- 6.2.3 Military and Aerospace

- 6.2.4 Building and Home Automation

- 6.2.5 Consumer Electronics

- 6.2.6 Other End-user Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 EnOcean Gmbh

- 7.1.2 STMicroelectronics NV

- 7.1.3 Coventor Inc. (Lam Research Corporation)

- 7.1.4 Analog Devices Inc

- 7.1.5 ABB Ltd

- 7.1.6 Cymbet Corp

- 7.1.7 Micropelt (EH4 GmbH)