|

市场调查报告书

商品编码

1683396

电动汽车增程器:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Electric Vehicle Range Extender - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

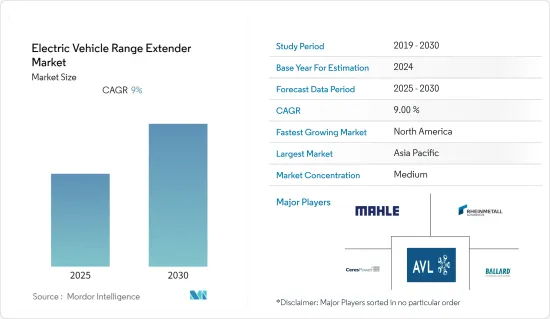

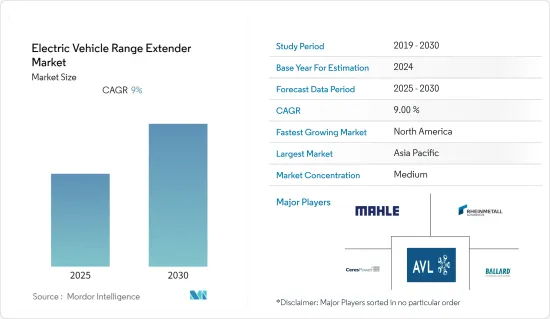

预计预测期内电动车增程器市场复合年增长率将达 9%。

由于製造工厂的停工和封锁,COVID-19 疫情对电动增程器市场的影响是不可避免的。然而,随着全球电动车普及率与前一年同期比较大幅成长,预计市场将恢復成长动能。

对电动车延长行驶里程的需求不断增加以及引擎尺寸缩小等因素将推动电动增程器市场的成长。此外,延长纯电动车行驶里程的发展和OEM对降低电池价格的日益关注预计将阻碍全球市场的成长。此外,预计在预测期内,牵引发电机和电池等新技术的持续采用将增加对增程器的需求。

预计亚太地区将占据最大的市场份额,而北美预计将在预测期内呈现最快的成长。这一增长是由该地区混合动力汽车和纯电动汽车的大力普及以及充电基础设施的缺乏所推动的。由于英国、德国、挪威和法国等主要国家的电动车销量增加,欧洲也预计将出现正成长。

电动车增程器市场趋势

预测期内燃料电池增程器将呈现更快的成长率

由于一些新兴国家正在向燃料电池增程器市场持续发展,预计燃料电池增程器器将在预测期内占据相当大的市场份额。燃料电池增程器的需求不断增长以及创新增程器的发展为该行业创造了新的机会。例如

- 2019 年 2 月,Power Cell Sweden AB 从全球汽车一级供应商收到两套 MS-30 燃料电池系统的订单,预计将于 2019 年交付。该系统围绕PowerCell S2燃料电池组构建,有效容量为30kW。这些系统将作为增程器(REX)安装在中国的测试车辆上。

- 2019年9月,蓝色世界科技宣布在丹麦奥尔堡港开始建造全球最大的甲醇燃料电池工厂。甲醇燃料电池可作为增程器,实现远距、快速添加液体燃料,同时解决环境污染问题。该厂预计年产能为750kW,相当于5万台燃料电池单元。

因此,新型增程器的开发支持了燃料电池增程器日益增长的需求,从而促进了整体市场的成长。

预测期内,亚太地区将占据主要市场份额

预计预测期内亚太地区将占据主要市场占有率。越来越多的OEM(主要来自中国和日本)正在见证对增程器的需求激增,这为专注于为电动车配备增程器的参与者提供了有利可图的机会。此外,政府对电动车扩展器和电动车购买的激励措施也可能促进该地区的市场成长。例如,

- 2020 年 8 月,中国宣布将免征新车购置税至 2022 年 12 月,以支持新能源车 (NEV) 产业(电动车、插电式混合动力汽车和燃料电池车)。政府正致力于提高车辆的行驶里程和动力效率要求,以获得补贴。

此外,由于市场技术创新的不断增加,预计北美在预测期内也将以更快的速度成长。电动车充电设施的短缺推动了对提供可靠续航里程的增程器的需求。电源的改进、电池和牵引发电机等新兴技术的使用增加以及政府支持零排放汽车的倡议将有助于开拓该地区的市场。

电动汽车增程器产业概况

由于主要参与者占据主要市场占有率份额,电动车增程器市场适度整合。此外,一些公司正专注于产品发布、併购等内部成长策略,以加强其在市场上的地位。例如

- 2019 年 3 月,MAHLE 收购了德国变速箱专家 ZG-Zahnrader und Getriebe GmbH,为欧洲领先的高效推进系统独立专家之一 MAHLE 动力传动系统增添了重要的变速箱专业知识。此次收购致力于加强整个动力传动系统的全面开发,以优化性能、效率、封装和NVH的平衡。

市场的主要企业包括 Mahle International、Rheinmetall Automotive、Ceres Power Holdings 和 Ballard Power Systems。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场驱动因素

- 市场挑战

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔

- 按类型

- ICE增程器

- 燃料电池增程器

- 其他的

- 按组件

- 电池组

- 马达

- 发电机

- 电源转换器

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 世界其他地区

- 南美洲

- 中东和非洲

- 北美洲

第六章 竞争格局

- 供应商市场占有率

- 公司简介

- MAHLE International GmbH

- Rheinmetall Automotive

- Ceres Power Holdings plc

- Ballard Power Systems Inc

- AVL Group

- Magna International Inc.

- Emoss Mobile Systems

- Horizon Fuel Cell Technologies

- Plug Power

第七章 市场机会与未来趋势

The Electric Vehicle Range Extender Market is expected to register a CAGR of 9% during the forecast period.

The Impact of the COVID-19 pandemic on the EV range extender market is inevitable due to shut down of manufacturing units and lock downs. However, market is expected to regain its momentum owing to the swiftly escalating year-on-year adoption rate of electric vehicles across the world.

Factors such as rise in demand for driving range extension of the electric vehicles and engine downsizing to augment the growth of the EV range extender market. Moreover, developments for the extension of driving range of BEVs and enhanced focus of OEMs toward reducing the price of the battery are expected to hinder the growth of the market across the globe. Moreover, growing adoption of new technologies such as towable generators and batteries expected to increase demand for range extenders over the forecast period.

Asia Pacific expected to hold significant share in the market and North America to exhibit fastest growth during the forecast period. This growth can be attributed to significant adoption of hybrid and pure EVs, along with a lack of charging infrastructure across the region. Europe also to witness positive growth owing to rising sales of EV in key countries such as the U.K., Germany, Norway, and France.

Electric Vehicle Range Extender Market Trends

Fuel Cell Range Extender to Witness Faster Growth Rate During Forecast Period

Fuel cell range extenders are expected to capture a significant share in the market during the forecast period, owing to the several on-going developments towards fuel cell range extender market. Rise in demand for fuel cell range extender along with development of innovative range extenders create new opportunities in the industry. For instance,

- In February 2019, Power Cell Sweden AB had received an order for two MS-30 fuel cell systems from a global automotive tier 1 supplier for delivery in 2019. The system built around PowerCell's fuel cell stack S2 and with an effect of 30 kW. These systems will be installed as range extenders, REX, in the vehicles for tests in China.

- In September 2019, Blue World Technologies announced that it has started construction of its world's largest methanol fuel cell factory at the Port of Aalborg, Denmark. The methanol fuel cell acts a range extender delivering long range, fast refueling with a liquid fuel as well as addressing environmental pollution. The factory anticipates its annual production capacity of 750 kW, which is equivalent to 50,000 fuel cell units.

Thus, rising demand for fuel cell range extenders to be supported by development of new type of range extenders supplementing the growth of overall market.

Asia-Pacific to Hold Significant Share in the Market During Forecast Period

Asia-Pacific anticipated to hold significant market share during forecast period. Owing to increasing number of OEMs, majorly in China and Japan, and surging demand for range extenders to offer lucrative opportunities to players as they are focusing on providing EVs with range extenders. In addition, government incentives on the purchase of EV extenders and EVs likely to fuel the growth of the market in this region. For instance,

- In August 2020, China announced that authorities will exempt New vehicles from purchase tax till December 2022 to support the new energy vehicle (NEV) industry - electric vehicles, plug-in hybrid vehicles, and fuel cell vehicles. The government is focusing on raising the requirements for the driving range and power efficiency of cars to qualify for the subsidies.

Besides, this North America also expected to grow at fasterpace over the forecast period owing to growing innovations in market. Lack of charging facilites for EVs to provoke demand for range extenders in market due to its long range reliability. Improved power supplies, increasing use of emerging technologies such as batteries and towable generators and government efforts to support zero emission cars to contribute for overall development of market in region.

Electric Vehicle Range Extender Industry Overview

The Electric Vehicle range extender market is moderately consolidated one due to the presence of major players in the market holding majorty market shares. Moreover, several companies are focusing on organic growth strategies such as product launches, mergers and acquisitions to strengthen their presence in the market. For instance,

- In March 2019, MAHLE's acquisition of the German transmission specialist ZG-Zahnrader und Getriebe GmbH adds significant extra transmission expertise to MAHLE Powertrain, one of the leading independent specialists in high-efficiency propulsion systems in Europe. This acquisition focuses on enhancing integrated development of entire powertrain, optimizing balance of performance, efficiency, packaging and NVH.

Some of the major players in the market include Mahle International GmbH, Rheinmetall Automotive, Ceres Power Holdings plc, Ballard Power Systems Inc and among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Challenges

- 4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 ICE Range Extender

- 5.1.2 Fuel Cell Range Extender

- 5.1.3 Others

- 5.2 Component

- 5.2.1 Battery Pack

- 5.2.2 Electric Motor

- 5.2.3 Generator

- 5.2.4 Power Converter

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 MAHLE International GmbH

- 6.2.2 Rheinmetall Automotive

- 6.2.3 Ceres Power Holdings plc

- 6.2.4 Ballard Power Systems Inc

- 6.2.5 AVL Group

- 6.2.6 Magna International Inc.

- 6.2.7 Emoss Mobile Systems

- 6.2.8 Horizon Fuel Cell Technologies

- 6.2.9 Plug Power