|

市场调查报告书

商品编码

1683405

扭矩感测器:市场占有率分析、行业趋势和统计、成长预测(2025-2030)Torque Sensor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

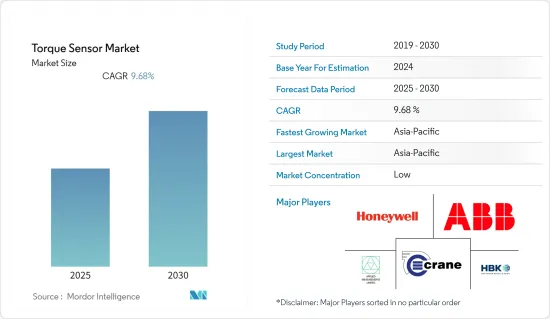

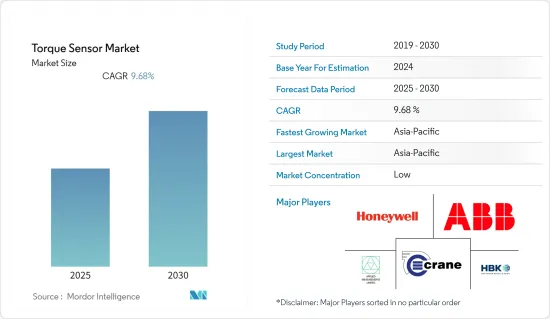

预计预测期内扭矩感测器市场复合年增长率为 9.68%。

主要亮点

- 扭矩感测器以多种方式测量扭矩。基本原理是测量用于旋转(或试图旋转)元素的“力”的机械过程。此外,当对轴施加“扭矩”力时,轴会扭曲(仅扭曲很小的量)。

- 此外,技术的改进以及无线和数位组件与扭矩感测器的整合有望帮助维持市场成长。此外,工业 4.0、工业自动化、机器人和智慧工厂的概念正在增加扭矩感测器的市场机会。航太、汽车和医疗领域的趋势正在推动市场需求。

- 此外,由于对提高安全性、控制和飞行员操作的需求不断增加,预计各航太公司将采用扭力感测器。这些感测器用于测量飞行过程中的扭矩控制、驱动系统和煞车系统。此外,为了保持市场竞争力,扭力感测器供应商正在推出适合特定应用的新产品。

- 市场供应商正在整合新技术并将新产品引入市场。大多数扭力感测器需要滑环将扭力读数从旋转轴传输到静态读数设备。通常,这些系统在使用时噪音很大、设定时间较长,而且其磨损部件并不总是可靠的。为了克服这些挑战,一些公司将表面声波(SAW)检测与无线技术结合。

- 例如,2020 年 12 月,英国感测器製造商 Sensor Technology 宣布推出基于四元件应变计桥的新一代非接触式扭力感测器,该感测器是对使用表面声波 (SAW) 检测的现有非接触式感测器的补充,同时以相同的价格提供更高的精度。

- 市场面临的关键挑战之一是由于扭矩感测器应用的多样性而带来的技术挑战。不同环境中的不同应用会影响这些感测器的准确性和可靠性。此外,电动车的转速明显更高,这对扭力感测器提出了挑战。

- 此外,医疗行业的外科医生需要能够进行精确控制和可重复运动的仪器,通常需要体积小巧。扭矩感测器与先进的电子设备相结合有助于提供这种功能。这些感测器的开发人员将面临工程挑战,特别是将它们整合到手术机器人设备中。例如,测量扭矩对于确保机器人工具能够执行精确和无缝的运动至关重要,但将感测器整合到这些复杂的医疗系统中对开发人员来说是一个挑战。

扭力感测器市场趋势

汽车应用占据最大市场占有率

- 旋转扭力感知器用于变速箱测试、应变测量、离合器、煞车、悬吊系统、动力传动系统和引擎的动态扭力测试。

- 随着汽车产量的增加,市场正面临潜在的成长。受新冠疫情影响,2020年全球轻型车产量将降至7,000万辆左右。预计汽车市场将在2023年左右反弹并恢復疫情前的产量。预计2025年全球轻型汽车产量将达到约9,300万辆(资料来源:舍弗勒集团)。

- 此外,电动车不需要变速箱或离合器。儘管如此,引擎仍会产生扭力来驱动窄范围的引擎转速和檔位,并且相同的扭力也用于加速。这就是为什么需要扭矩感测器。

- 扭力也负责转动方向盘,而强化方向盘的各种发展正在为公司创造多种商机。例如,2020年9月,舍弗勒与博世汽车转向系统合作,推出并扩展其智慧机电整合后轮转向系统产品组合。该技术依靠方向盘中的扭矩感测器来收集资料。控制单元已经整合到电子控制器中,可以计算并协助骑士进行转向。计算驾驶员施加的扭矩时也会考虑车辆的其他几个参数。因此,这些参数正在推动市场的成长。

- 此外,随着对汽车的需求不断增加,汽车产业製造业正在利用先进机器人的自动化流程。例如,具有高有效载荷能力和长距离的大型机器人用于焊接车身面板,而小型机器人用于焊接支架和座椅等子组件。在机器人 MIG 和 TIG电弧焊接中,焊枪每个週期都定位在相同的方向。可重复的速度和电弧间隙确保每项焊接工作都符合相同的高标准。诸如此类的应用正在推动汽车领域对扭矩感测器的需求。

- 此外,在汽车领域,北美和欧洲对自动驾驶汽车的需求庞大,这也推动了扭力感测器的发展。例如,特斯拉在方向盘中使用扭矩感测器来确定驾驶员是否注意转向。根据公开记录,该地区许多司机为了解放双手而侵入系统。这些发展将使汽车供应商能够确保道路安全。

亚太地区预计将占据主要市场占有率

- 日本、韩国、中国和印度等国家正利用自动化设备迅速改造其製造业,以提高生产效率并满足产业需求。此外,工业自动化和机器人产业对旋转扭矩感测器的采用越来越多,正在推动市场的发展。

- 汽车产业占印度扭力感测器的大部分需求。根据 Catapult Organisations 2021 年的报告,电动车 (EV) 目前占印度汽车总销量的不到 1%,但该市场正在成长,预计到 2025 年价值将至少达到 48 亿英镑(4,750 亿印度卢比)。然而,两轮车占据了该市场的最大份额,为 62%,其次是三轮车,为 37%。此外,政府的优惠政策和汽车製造商的大量投资预计将推动印度汽车产业对扭矩感测器的需求。

- 同时,轩尼诗基金的数据显示,日本在机器人和工厂自动化系统的生产方面处于世界领先地位,占全球市场占有率的 30%。此外,全球对工业机器人的需求以每年 46% 的速度成长,预计到 2025 年全球机器人市场规模将达到 2,485 亿美元。这些数字反映了工业自动化领域对扭矩解决方案的需求不断增长,而日本是该市场的主要聚集者。

- 2020年,中国工业机器人市场成长9.5%,进一步显示对扭矩感测器的需求增加。此外,中国政府还计划在 2025 年将国内企业的市场占有率从 30-40% 提高一倍至 70%,这符合该国 2021 年初核准的五年计划。

- 此外,中国领先的工业机器人製造商Yuibot在5月由Softbank Corporation创投公司主导的最新一轮资金筹措中筹集了1,550万美元。这家总部位于深圳的新兴企业在 2020 年也取得了成功,完成了多轮资金筹措,并凭藉其独创性赢得了许多奖项。

- 此外,对扭矩解决方案的不断增长的需求促使一些公司采取策略措施。例如,2020年7月,NSK株式会社开发出了一种非接触式扭力感测器,可即时测量汽车驱动轴的扭力。这是世界上第一个此类感测器。这项新技术开启了超越 CASE 的新可能性,例如提高燃油效率(降低功耗)以及提高乘坐舒适度和安全性。

扭力感测器产业概况

扭力感测器市场分散且竞争激烈,有多家供应商,包括 ABB Ltd.、Crane Electronics Ltd.、Applied Measurements Ltd.、Crane Electronics Ltd.、Honeywell International 等。大多数公司都专注于开发用于多种应用的扭矩感测器。

- 2021 年 4 月 - Datum Electronics Ltd 与 Nautils Labs 合作,为船东、营运商、技术经理和租船人提供全面的船舶数位化和预测决策支援解决方案。

- 2020 年 1 月 - 为了满足製造业对安全协作机器人日益增长的需求,TE Connectivity (TE) 设计了一种安全扭矩感测器,该感测器透过预先实现人机协作并提高准确性和速度来整合和提高功能安全性。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响评估

- 产业价值链分析

- 技术简介

- 磁弹性

- 应变计

第五章 市场动态

- 市场驱动因素

- 机器人中扭矩感测器的使用日益增多

- 电动方向盘(EPS) 系统对扭力感测器的需求

- 市场挑战

- 扭力感测器在某些应用中不可靠

第六章 市场细分

- 依产品类型

- 反作用扭矩

- 旋转扭矩

- 按应用

- 车

- 航太

- 製造业

- 医疗

- 其他用途

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

第七章 竞争格局

- 公司简介

- ABB Ltd

- Crane Electronics Ltd

- HBK Benelux(Spectris PLC)

- Applied Measurements Ltd.

- Honeywell International

- Norbar Torque Tools Ltd

- Infineon Technologies AG

- Teledyne Technologies, Inc.

- TE Connectivity Ltd

- Datum Electronics Ltd(Indutrade AB)

- PCB Piezotronics, Inc.

- Kistler Instrumente AG

- MagCanica, Inc.

第八章投资分析

第九章:市场的未来

简介目录

Product Code: 68023

The Torque Sensor Market is expected to register a CAGR of 9.68% during the forecast period.

Key Highlights

- Torque sensors measure torque through various methods. The basic principle is a mechanical process, which measures the "force" being used (or attempting) to turn an element. Also, when a force of "torque" is applied to a shaft, the shaft twists (by a minimal amount).

- Further, improvements in technology and integration of wireless and digital components into torque sensors are expected to help sustain the market's growth. Moreover, Industry 4.0, industrial automation, robotics, and smart factory concepts are increasing the market opportunities for torque sensors. The upward trend in the aerospace, automotive, and medical sectors is driving demand in the market.

- Moreover, with demand increasing for improving safety, control, and pilot operations, various aerospace companies are expected to adopt torque sensors because these sensors measure in-flight torque controls, actuation systems, and braking systems. Also, to remain competitive in the market, torque sensor vendors are coming up with new products suitable for specific applications.

- Market vendors are integrating new technologies to launch new products in the market. Most torque sensors need slip rings to transfer torque readings from the rotating shaft to the static readout. Generally, this system is noisy to use, slow to set up, and wearing parts are not always reliable. Some companies have integrated wireless technologies with surface acoustic wave (SAW) detection to overcome these challenges.

- For instance, in December 2020, UK sensor manufacturer, Sensor Technology, announced a new generation of non-contact torque sensors based on four-element strain gauge bridges that complement its existing non-contact sensors, which use surface acoustic waves (SAW) detection, but offer improved accuracy for the same price.

- One of the significant challenges the market faces is the challenge posed by the technology due to the diversity of applications of torque sensors. Due to diverse applications in different environments, the accuracy and reliability of these sensors get compromised. Moreover, electric vehicle drives run at significantly higher rotational speeds, creating challenges for torque sensors.

- Furthermore, surgeons demand devices in the medical industry to allow precise control and repeatable movement, usually in a compact footprint. Torque sensors coupled with advanced electronics can help provide such capabilities. These sensor developers encounter engineering challenges integrating them into the devices, particularly for surgical robotics. For instance, measuring the torque moment is critical to ensure that robotic tools can perform precise and seamless movements, but incorporating sensors into these complex medical systems creates challenges for the developers.

Torque Sensor Market Trends

Automotive Applications Accounts For the Largest Market Share

- Torque sensors have been used in the automotive industry for quite a long time as rotary torque sensors are used for testing gearbox, strain measurement, testing clutch, brake, suspension system, powertrain, and dynamic torque within the engine.

- With the increasing production of the automobile, the market caters a potential growth. Amid the Covid-19 pandemic, the global light vehicle production dropped to around 70 million units in 2020. The automotive market is anticipated to bounce off, reaching the pre-pandemic production volumes around the year 2023. In 2025, it is projected that some 93 million light vehicles might be produced worldwide (source: Schaeffler Gruppe).

- Further, electric vehicles do not require a gearbox or clutch. Still, the engines generate torque used to power a narrow band of engine speed or gears, and also the same torque is also used for acceleration. Thus, drives the need for torques sensors in the market.

- Torque is also involved in the steering wheel rotation, and various developments to enhance the steering wheel are driving multiple opportunities for the company. For instance, in September 2020, Schaeffler partners with Bosch Automotive Steering to introduce and expand the Intelligent mechatronic Rear Wheel Steering system portfolio. The technology will involve collecting data based on the steering wheel torque sensor. The control units are already integrated with the electronic controller calculates to assist in steering for the rider. Also, the torque applied by the driver is calculated as it accounts for several other vehicle parameters. Therefore, such parameters are driving the market growth.

- Moreover, with the increasing demand for automobiles, the manufacturing sectors in the automotive industry is leveraging automation process with advanced robotics. For example, large robots with high payload capabilities and long reach are being used to weld car body panels, while smaller robots are being used to weld subassemblies such as brackets and mounts. Robotic MIG and TIG arc welding positions the torch in the same orientation every cycle. With its repeatable speed and arc gap, ensure every fabrication is welded with the same high standard. Such applications are driving the need for torque sensors in the automotive sector.

- Further, the automotive sector is witnessing huge demand for autonomous vehicles in North America and Europe and driving torque sensors. For instance, Tesla uses a torque sensor for the steering wheel to determine if drivers are paying attention to the steering. Many drivers in the region have been publicly documented for hacking the systems to stay hands-free. Such developments enable the automotive vendors to ensure safety on the roads.

Asia Pacific is Expected to Account For Significant Market Share

- Countries such as Japan, South Korea, China, and India are rapidly transforming their manufacturing sector with automated equipment to increase production efficiency and meet the industry needs. Moreover, the industrial automation and robotic industry are witnessing the growing adoption of rotary torque sensors, which is, in turn, driving the market.

- Its automotive sector majorly dominates the demand for torque sensors in India. According to Catapult Organizations report 2021, electric vehicles (EVs) currently account for less than 1% of total vehicle sales in India; the market is increasing and is expected to be worth around at least GBP 4.8 billion (INR 475 billion) by 2025. However, two-wheelers account for the largest share of this market at 62%, followed by three-wheelers at 37%. Further, the favoring government policies and heavy investments from automakers are expected to spike the demand for torque sensors for the automotive industry in India.

- On the other hand, according to Hennessy Funds, Japan is the global leader in producing robots and factory automation systems and holds 30% of the worldwide market share. Further, the global demand for industrial robots is growing at 46% annually, and the global robotics market is estimated to reach USD 248.5 billion by 2025. Such figures depict the rising demand for torque solutions in the industrial automation sector, with Japan being the primary aggregator in the market.

- In 2020, China's industrial robotics market grew by 9.5%, further indicating increased demand for torque sensors. Moreover, the Chinese government aims to double domestic companies' market share from 30-40% to 70% by 2025, according to the country's five-year plan approved earlier in the year 2021.

- Moreover, Leading Chinese industrial robot maker Youibot generated USD 15.5 million in its latest funding round led by SoftBank Ventures in May. The Shenzhen-based startup also had a full year in 2020, completing multiple financing rounds and winning several awards for its ingenuity.

- Further, several companies are taking strategic measures to tap into the rising demand for torque solutions in the market. For instance, In July 2020, NSK Ltd. has developed a non-contact torque sensor capable of measuring the torque of drive shafts in vehicles in real-time. This is the first sensor in the world of this type and capability. This new technology can increase fuel economy (reduce power consumption), improve ride comfort and safety, and open up a world of new possibilities across CASE.

Torque Sensor Industry Overview

The torque sensors market is fragmented and highly competitive due to several vendors, including ABB Ltd., Crane Electronics Ltd, Applied Measurements Ltd, Crane Electronics Ltd, and Honeywell International. Most of the companies concentrate their efforts on the development of torque sensors for multiple applications.

- April 2021 - Datum Electronics Ltd has partnered with Nautils Labs to provide shipowners, operators, technical managers, and charterers with a comprehensive vessel digitalization and predictive decision support solution.

- January 2020 - TE Connectivity (TE) designed a safety torque sensor with integrated and improved functional safety, including increased accuracy and speed, in advance human-robot collaboration to address the growing demand for safe and collaborative robots in manufacturing.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the COVID-19 Impact on the Market

- 4.4 Industry Value Chain Analysis

- 4.5 Technology Snapshot

- 4.5.1 Magnetoelastic

- 4.5.2 Strain Gauge

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increase in Use of Torque Sensors in Robotics

- 5.1.2 Demand for Torque Sensors For Electric Power Steering (EPS) Systems

- 5.2 Market Challenges

- 5.2.1 Less Reliability of Torque Sensors in Certain Applications

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Reaction Torque

- 6.1.2 Rotational Torque

- 6.2 By Application

- 6.2.1 Automotive

- 6.2.2 Aerospace

- 6.2.3 Manufacturing

- 6.2.4 Medical

- 6.2.5 Other Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Ltd

- 7.1.2 Crane Electronics Ltd

- 7.1.3 HBK Benelux (Spectris PLC)

- 7.1.4 Applied Measurements Ltd.

- 7.1.5 Honeywell International

- 7.1.6 Norbar Torque Tools Ltd

- 7.1.7 Infineon Technologies AG

- 7.1.8 Teledyne Technologies, Inc.

- 7.1.9 TE Connectivity Ltd

- 7.1.10 Datum Electronics Ltd (Indutrade AB)

- 7.1.11 PCB Piezotronics, Inc.

- 7.1.12 Kistler Instrumente AG

- 7.1.13 MagCanica, Inc.

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219