|

市场调查报告书

商品编码

1683412

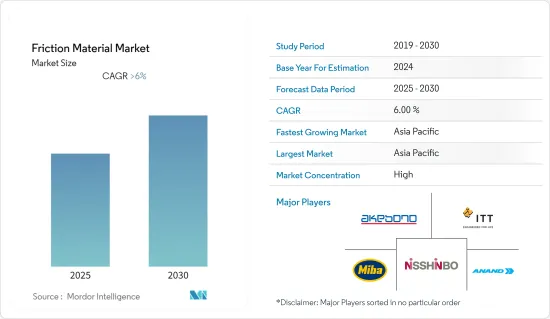

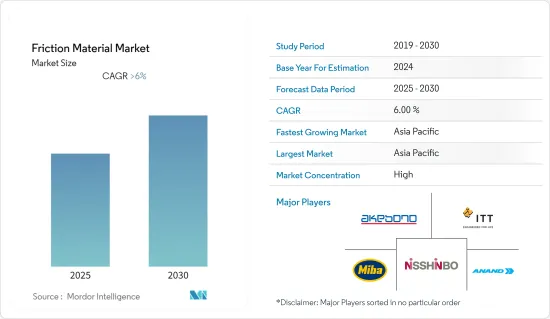

摩擦材料市场:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Friction Material - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

预计预测期内摩擦材料市场复合年增长率将超过 6%。

2020 年,市场受到了 COVID-19 的负面影响。在疫情期间,由于封锁期间汽车製造活动暂时停止,汽车离合器、齿轮、煞车系统等中使用的摩擦材料的消耗量下降。此外,疫情期间,客运列车和航空运输设施长期关闭,减少了列车煞车系统以及飞机离合器、煞车和齿轮中使用的摩擦材料的消费量。然而,货运列车仍满载运作。例如,截至2020年8月19日,印度铁路的负载容量总量达到约5,747万吨,较2019年同期成长6.6%,从而增加了对货运列车煞车系统中使用的摩擦材料的需求。

短期内,各种工业机械对摩擦材料产品的需求不断增长预计将推动市场成长。

另一方面,摩擦材料和维护的高成本预计会阻碍市场的成长。

由于中国、印度和日本等国家消费量庞大,预计亚太地区将在预测期内占据市场主导地位。

摩擦材料市场趋势

汽车产业占市场主导地位

摩擦材料在小型和大型车辆的应用越来越多。在汽车中,摩擦材料用于离合器、煞车、齿轮等。

摩擦煞车透过摩擦将车辆的动能转化为热能,然后将热量散发到周围环境中,从而降低车辆速度。

在所使用的材料中,烧结金属材料非常适合采矿车辆运输车等重型应用。

陶瓷离合器可以承受相当大的热量,并且可以在高达 550°C 的温度下运行,而不会因离合器反覆接合和分离而褪色。这些耐热特性使其成为赛车应用和各种最终用途的汽车煞车技术的理想选择。

过去三年来,汽车产业发展放缓。根据国际汽车工业组织(OICA)的数据,汽车产量从2019年的92,175,805辆下降到2020年的77,621,582辆,下降了15.8%。此外,汽车销量也从2019年的9,042万辆下降到2020年的7,797万辆。

造成这一下降的主要原因是美国、中国、日本和德国等主要汽车中心的产量下降。 2020年,这些国家的降幅与2019年相比分别达到19%、2%、17%和24%。

因此,预计上述因素将在未来几年对市场产生重大影响。

亚太地区可望主导市场

由于中国和印度拥有庞大的工业和汽车行业,并且该地区正在持续投资发展建筑业,因此亚太地区预计将主导全球市场。

在中国和印度,对卡车、巴士、火车、工业机械和机器人的需求不断增长,推动了各种应用对摩擦材料的需求。

中国是世界上最大的汽车製造业国家。 2018年,产业成长放缓,产销量均出现下滑。类似的趋势持续,2019年产量下降了7.5%。此外,2020年的产量达到2,523万辆,比2019年下降了约2%。

随着疫情蔓延,许多汽车公司因全国的停工而停产。除了湖北汽车公司外,特斯拉还关闭了位于上海的新工厂,并推迟了其 Model 3 的生产。此外,大众也推迟了与上汽有合作的所有中国工厂的生产。

此外,印度2019年产量约452万台,而2020年产量约339万台,下降了约25%。

摩擦材料也用于铁路。根据IBEF统计,印度铁路营运着世界上最大的铁路网络之一,轨道长度为123,236公里,拥有13,523列客运列车和9,146列货运列车,载客量达2,300万人次。

此外,印度和中国的航太製造业正在快速成长,预计将刺激市场需求。根据波音公司《2020-2039年民用飞机市场展望》,2020年至2039年期间,亚太地区将交付约17,485架新飞机。因此,预计到2039年该地区的飞机持有量将达到约18,770架,这将增加对摩擦材料的需求。

因此,预计上述因素将在未来几年对市场产生重大影响。

摩擦材料产业概况

摩擦材料市场在本质上是部分整合的,少数主要企业控制很大一部分市场。主要参与企业包括日清纺控股公司、曙光煞车工业公司、ITT公司、米巴股份公司和ANAND集团。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 工业机械需求不断成长

- 其他驱动因素

- 限制因素

- 摩擦材料的维护成本高

- 新冠肺炎疫情的影响

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场区隔

- 类型

- 磁碟

- 垫片

- 堵塞

- 衬垫

- 其他的

- 材料

- 陶瓷製品

- 石棉

- 半金属

- 烧结金属

- 酰胺纤维

- 其他的

- 应用

- 离合器和煞车系统

- 轮齿系统

- 其他的

- 最终用户产业

- 车

- 铁路

- 航太

- 矿业

- 其他的

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作、协议

- 市场占有率分析**/排名分析

- 主要企业策略

- 公司简介

- ABS Friction

- ANAND Group

- Akebono Brake Industry Co. Ltd

- Brembo SpA

- ITT Inc.

- Japan Brake Industrial Co. Ltd

- Miba AG

- Nisshinbo Holdings Inc.

- Tenneco Inc.

- Yantai Haina Brake Technology Co. Ltd

第七章 市场机会与未来趋势

- 耐热摩擦材料需求不断增加

- 其他机会

The Friction Material Market is expected to register a CAGR of greater than 6% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. During the pandemic scenario, automotive manufacturing activities were stopped temporarily during the lockdown, thereby decreasing the consumption of friction materials used in vehicles' clutches, gears, braking systems, and others. Furthermore, the passenger train and air transport facilities were halted during the pandemic for a long duration of time, which decreased the consumption of friction materials used in the braking systems of trains and clutches, brakes, and gears of aircraft. However, freight trains were running at full pace. For instance, the total freight loading through Indian railways amounted to about 57.47 million ton till August 19, 2020, with a growth rate of 6.6% compared to the same period of 2019, which has enhanced the demand for friction materials used in the braking systems of freight trains.

Over the short term, the growing need for friction material products for various industrial machinery is expected to drive the market's growth.

On the flip side, the high cost and maintenance of friction materials are expected to hinder the market growth.

The Asia-Pacific region is expected to dominate the market during the forecast period due to the huge consumption from countries such as China, India, and Japan.

Friction Materials Market Trends

The Automotive Industry Dominates the Market

Friction materials have been increasingly used in both light- and heavy-duty vehicles. In vehicles, friction materials find their applications in clutches, brakes, and gears, among others.

Friction brakes are used to decelerate a vehicle by transforming the kinetic energy of the vehicle to heat via friction and dissipating that heat to the surroundings.

Among all the materials used, sintered metal materials are well-suited for heavy-duty applications, such as mining vehicle transporters.

Ceramic material clutches can withstand considerable heat, and they can operate without fading at temperatures up to 550°C due to repeated engagement and disengagement of the clutch. This heat resistance property makes them ideal for racing applications and for use in brake technology in various high-end automobiles.

The automotive industry has seen a slowdown in the past three years. According to the International Organization of Motor Vehicle Manufacturers (OICA), automotive production witnessed a 15.8% decline from 92,175,805 units in 2019 to 77,621,582 units in 2020. Also, the sales of automobiles declined from 90.42 million units in 2019 to 77.97 million units in 2020.

The decline is majorly attributed to the reduced production in the major automotive hubs such as the United States, China, Japan, and Germany. In 2020, these countries witnessed a decline of 19%, 2%, 17%, and 24%, respectively, compared to 2019.

Therefore, the aforementioned factors are expected to significantly impact the market in the coming years.

The Asia-Pacific Region is Expected to Dominate the Market

Asia-Pacific is expected to dominate the global market due to the vast industrial and automotive sectors in China and India, coupled with the continuous investments done in the region to advance the construction sector.

The growing demand for trucks, buses, trains, industrial machines, and robots in China and India drives the demand for friction materials in various applications.

The Chinese automotive manufacturing industry is the largest in the world. The industry witnessed a slowdown in 2018, wherein production and sales declined. A similar trend continued, with production witnessing a 7.5% decline in 2019. Additionally, the production volume reached 25.23 million vehicles in 2020, registering a decline rate of about 2% compared to 2019.

As the pandemic spread, many auto companies across the country shut down their manufacturing activities due to the nationwide shutdown. In addition to the auto companies based in Hubei, Tesla's new factory in Shanghai was shut down and postponed the production date of its Model 3. Moreover, Volkswagen postponed production at all of its Chinese plants that run in partnership with SAIC.

Additionally, around 3.39 million vehicles were produced in India during 2020 compared to 4.52 million vehicles produced in 2019, witnessing a decline rate of about 25%.

Friction materials also find applications in the railways. According to IBEF, the Indian Railways operates one of the world's largest rail networks, with a route length of 1,23,236 kilometers, 13,523 passenger trains and 9,146 freight trains, and transporting 23 million passengers.

The aerospace manufacturing sector is also growing rapidly in India and China, which is expected to increase the demand in the market. According to Boeing Commercial Market Outlook 2020-2039, around 17,485 new airplane deliveries will be made in the Asia-Pacific region during the period of 2020-2039. With this addition, the total airplane fleet volume in the region will reach about 18,770 units by 2039, which is expected to enhance the demand for friction materials.

Therefore, the aforementioned factors are expected to have a significant impact on the market in the coming years.

Friction Materials Industry Overview

The friction material market is partially consolidated in nature, with a few major players dominating a significant portion of the market. Some of the key players include Nisshinbo Holdings Inc., Akebono Brake Industry Co. Ltd, ITT Inc., Miba AG, and ANAND Group, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Need for Industrial Machinery

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 High Maintenance and Cost of Friction Materials

- 4.2.2 Impact of COVID-19 Outbreak

- 4.2.3 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Discs

- 5.1.2 Pads

- 5.1.3 Blocks

- 5.1.4 Linings

- 5.1.5 Other Types

- 5.2 Material

- 5.2.1 Ceramic

- 5.2.2 Asbestos

- 5.2.3 Semi-metallic

- 5.2.4 Sintered Metals

- 5.2.5 Aramid Fibers

- 5.2.6 Other Materials

- 5.3 Application

- 5.3.1 Clutch and Brake Systems

- 5.3.2 Gear Tooth Systems

- 5.3.3 Other Applications

- 5.4 End-user Industry

- 5.4.1 Automotive

- 5.4.2 Railway

- 5.4.3 Aerospace

- 5.4.4 Mining

- 5.4.5 Other End-user Industries

- 5.5 Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle-East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle-East and Africa

- 5.5.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ABS Friction

- 6.4.2 ANAND Group

- 6.4.3 Akebono Brake Industry Co. Ltd

- 6.4.4 Brembo SpA

- 6.4.5 ITT Inc.

- 6.4.6 Japan Brake Industrial Co. Ltd

- 6.4.7 Miba AG

- 6.4.8 Nisshinbo Holdings Inc.

- 6.4.9 Tenneco Inc.

- 6.4.10 Yantai Haina Brake Technology Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Demand for High Thermal-resistant Friction Materials

- 7.2 Other Opportunities