|

市场调查报告书

商品编码

1683414

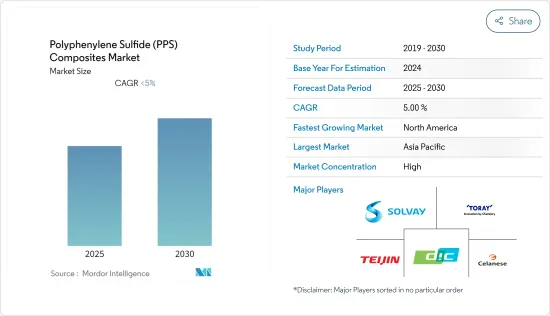

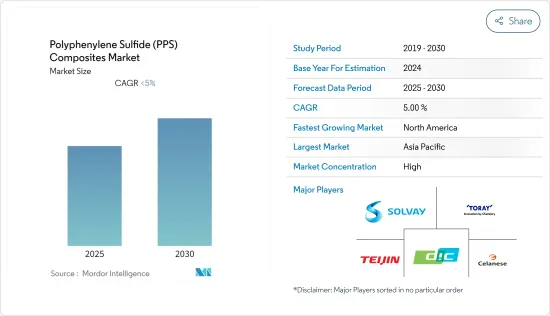

聚苯硫(PPS) 复合材料:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Polyphenylene Sulfide (PPS) Composites - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

预计预测期内聚苯硫(PPS) 复合材料市场的复合年增长率将低于 5%。

主要亮点

- 预计纤维增强复合材料的成型挑战以及 COVID-19 的影响将阻碍市场成长。

- 航太和国防领域占据市场主导地位,预计在预测期内将显着成长。

- 预测期内,亚太地区占据 PPS 市场主导地位。

聚苯硫(PPS)复合材料市场趋势

航太和国防领域的需求不断增长

- 航太和国防最终用户产业是世界上最大的 PPS 复合材料消费产业。该产业消耗了全球 PPS 复合材料总产量的约 48%。

- 与航太工业使用的聚醚醚酮(PEEK)和聚酰亚胺(PI)相比,PPS复合材料的加工成本和原料树脂价格最低。

- PPS 是一种极其坚固、刚性和坚韧的高性能热塑性塑胶。它具有固有的阻燃性和高耐热性,允许在远高于 200°C 的温度下持续使用。

- 此外,它还具有出色的抗氧化和抗化学性、优异的电气性能、最小的吸水率、低蠕变和优异的机械性能。

- 这些复合材料也满足各种军事规格,特别是美国军方制定的规格。它还获得多个机构核准可用于电路基板、插座、插件、电子元件和国防飞机。

- 因此,基于上述因素,未来航太和国防工业对 PPS复合材料的需求预计将进一步成长。

亚太地区占市场主导地位

- 以 GDP 计算,最大的经济体是中国。即使与美国的贸易战导致贸易中断,预计 2019 年 GDP 成长率仍将在 6.1% 左右。

- 国际货币基金组织预测2020年经济成长率为5.8%。以GDP(购买力平价)计算,中国是最大经济体,达25.27兆美元。如今,新冠肺炎疫情正在对经济产生进一步影响。

- 不过,预计预测期内经济将从这些波动中恢復。

- 聚苯硫(PPS) 复合材料因具有耐高温性能、抗蠕变性、优异的尺寸稳定性、耐化学性和阻燃性而广泛应用于航太和国防工业。

- 这项特性与其他特性一起使其适用于高温管道、座椅框架和内装面板等内部应用。

- 据兰德公司(RAND)健康研究与发展部称,中国製造商很可能在全球许多主要市场取代俄罗斯国防工业。由于国防工业的广泛发展,PPS 复合材料市场预计在预测期内将会成长。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 航太领域的需求不断增长

- 石油和天然气产业的需求不断成长

- 限制因素

- 纤维增强复合材料的挑战

- 新冠肺炎疫情对全球经济的影响

- 产业价值链分析

- 波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争程度

- 原料分析

第五章 市场区隔

- 按类型

- 碳纤维增强复合材料

- 玻璃纤维增强复合材料

- 其他类型

- 按最终用户产业

- 航太和国防

- 车

- 工业(包括石油和天然气)

- 电气和电子

- 其他最终用户产业

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 波兰

- 其他欧洲国家

- 世界其他地区

- 南美洲

- 中东和非洲

- 亚太地区

第六章 竞争格局

- 併购、合资、合作、协议

- 市场排名分析

- 主要企业策略

- 公司简介

- Celanese Corporation

- DIC Corporation

- Ensinger

- RTP Company

- SABIC

- Solvay

- Teijin Limited

- Toray Advanced Composites

- Xiamen LFT Composite Plastic Co. Ltd

第七章 市场机会与未来趋势

- 在亚太地区扩大使用

简介目录

Product Code: 69019

The Polyphenylene Sulfide Composites Market is expected to register a CAGR of less than 5% during the forecast period.

Key Highlights

- Challenges to form composites from fiber reinforcement and the Impact of COVID-19 are expected to hinder the market growth.

- The aerospace and defense segment dominated the market, and is likely to witness significant growth during the forecast period.

- The Asia-Pacific region dominated the PPS market over the forecast period.

Polyphenylene Sulfide Composites Market Trends

Growing Demand from Aerospace and Defense Sector

- The aerospace and defense end-user industry is the largest consumer of PPS composites, globally. The sector consumed about 48% of the total PPS composites produced, globally.

- PPS composites have the lowest processing cost and the price of raw resin compared to polyether ether ketone (PEEK) and polyimide (PI), which are used in the aerospace industry.

- PPS is a high-performance thermoplastic, which is extremely strong, rigid, and tough. It offers inherent flame resistance and high heat resistance with continuous service at temperatures well above 200°C (392°F).

- Moreover, it has very good oxidation and chemical resistance, good electrical properties, minimal water absorption, and low creep and excellent mechanical properties.

- These composites also specifically meet the various military specifications framed by the US military. They are also approved by several agencies to be used in circuit boards, sockets, plug-ins, electronic components, and defense airplanes.

- Thus, based on the aforementioned factors, in the aerospace and defense industry, it can be expected that the demand from for PPS composites may grow further in the future.

Asia-Pacific Region to Dominate the Market

- China is the largest economy, in terms of GDP. The country is expected to have witnessed about 6.1% growth in its GDP during 2019, even after the trade disturbance caused due to its trade war with the United States.

- The IMF projects a growth of 5.8% in 2020. In terms of GDP in PPP, China is the largest economy, with a GDP (PPP) of USD 25.27 trillion. Furthermore, the outbreak of COVID-19 has further affected the economy at present.

- However, the country is expected to rise from such fluctuations in economic performance over the forecast period.

- Polyphenylene sulfide (PPS) composites are widely used in the aerospace and defense industry, as they exhibit a combination of high-temperature performance, creep resistance, excellent dimensional stability, chemical resistance, and flame resistance.

- This, along with other properties, makes it suitable for interior applications, such as high temperature ducting, seat frames, and interior panels.

- According to the RAND's Health Organization (Research And Development), Chinese manufacturers are expected to likely displace Russian defense industries in many key markets around the world. Owing to the wide defense industry, the market for PPS composites is expected to grow during the forecast period.

Polyphenylene Sulfide Composites Industry Overview

The global polyphenylene sulfide (PPS) composites market is consolidated in nature, with the five players accounting for the significant share in the global market. Some of the major companies are DIC Corporation, Toray Advanced Composites, Teijin Limited, Solvay and Celanese Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Demand from Aerospace Sector

- 4.1.2 Increasing Demand from Oil and Gas Sector

- 4.2 Restraints

- 4.2.1 Challenges to Form Composites from Fiber Reinforcement

- 4.2.2 Impact of COVID-19 Pandemic on the Global Economy

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Degree of Competition

- 4.5 Raw Material Analysis

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Carbon Fiber-reinforced

Composites

- 5.1.2 Glass Fiber-reinforced

Composites

- 5.1.3 Other Types

- 5.2 End-user Industry

- 5.2.1 Aerospace and Defense

- 5.2.2 Automotive

- 5.2.3 Industrial (Includes Oil and Gas)

- 5.2.4 Electrical and Electronics

- 5.2.5 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Poland

- 5.3.3.6 Rest of Europe

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Celanese Corporation

- 6.4.2 DIC Corporation

- 6.4.3 Ensinger

- 6.4.4 RTP Company

- 6.4.5 SABIC

- 6.4.6 Solvay

- 6.4.7 Teijin Limited

- 6.4.8 Toray Advanced Composites

- 6.4.9 Xiamen LFT Composite Plastic Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Usage in the Asia-Pacific Region

02-2729-4219

+886-2-2729-4219