|

市场调查报告书

商品编码

1683418

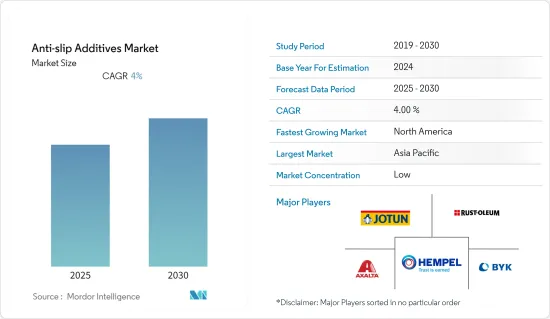

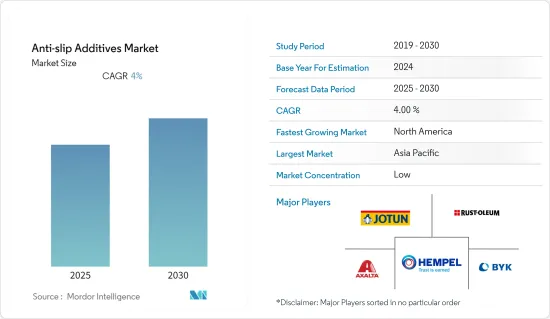

防滑添加剂市场:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Anti-slip Additives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

防滑添加剂市场预计在预测期内实现 4% 的复合年增长率

关键亮点

- 工业地板材料的广泛应用和海洋产业的需求不断增长正在推动市场成长

- 严格的环境法规和其他限制因素预计将阻碍市场成长

防滑添加剂的市场趋势

扩大工业地板的用途

- 防滑添加剂添加到油漆中以提高油漆的防滑性,并可应用于各种基材,包括木材、金属、玻璃纤维和混凝土表面。这种含有防滑添加剂的涂料适用于各个领域,其中工业地板材料的应用处于领先地位。

- 防滑添加剂不会改变所添加的油漆或涂料的颜色、性能或特性。它可以添加到水基或溶剂基系统中,对黏度的影响最小,同时还能提高涂层地板的防滑性。

- 政府为维护工业安全而出台的严格法规导致工业涂料中防滑添加剂的应用增加。

- 截至2019年5月,印度已核准约296个食品加工低温运输计划,为防滑添加剂在该行业的使用提供了巨大的潜力。

- 目前,中国医药产业价值约1,450亿美元,是最大的新兴市场,预计到2022年成长将达到约2,000亿美元,从而未来几年其市场范围将持续扩大。

- 中国、英国、美国、印度和日本在该市场中扮演着重要角色,其中工业领域在防滑添加剂的使用方面处于领先地位。

亚太地区占市场主导地位

- 预计预测期内亚太地区将主导防滑添加剂市场。在中国、印度和日本等国家,由于工业安全性的提高,对防滑添加剂的需求正在增加。

- 最大的防滑添加剂生产商位于亚太地区。防滑添加剂产业的主要企业包括 Hempel A/S、BYK(ALTANA)、Axalta Coating Systems、Jotun 和 Rust-Oleum。

- 防滑添加剂的使用在化学/製药、汽车和包装等製造业中更为普遍。

- 在船舶工业中,含有防滑剂的涂料被涂在船舶地板、甲板和船舶上,以使其更防滑。

- 根据日本船舶工业协会的数据,截至2019年6月底,船舶总吨位为14,354吨,而2018年12月底为15,097吨,从而带动防滑添加剂市场成长。

- 中国政府正在推行大规模建设计画,例如在未来十年内建造可容纳2.5亿人口的特大城市,这为未来几年在建设活动中使用涂料防滑添加剂创造了空间。

- 这些防滑添加剂可用作潮湿区域、干燥区域、无尘室和其他工作空间的工业安全预防措施。

- 上述因素加上政府支持,将推动预测期内防滑添加剂市场需求的增加。

防滑添加剂行业概况

防滑添加剂市场比较分散,每家公司的份额都很小。范例包括 Hempel A/S、BYK(ALTANA)、Axalta Coating Systems、Jotun 和 Rust-Oleum。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 扩大工业地板的用途

- 海洋产业需求不断成长

- 限制因素

- 严格的环境法规

- 其他限制因素

- 价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场区隔

- 添加剂类型

- 氧化铝

- 二氧化硅

- 其他添加剂类型

- 添加剂特性

- 粉末

- 总计的

- 混合物

- 应用

- 建筑学

- 工业地板材料

- 海洋

- 其他的

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作、协议

- 市场占有率/排名分析

- 主要企业策略

- 公司简介

- Akzo Nobel BV

- Associated Chemical

- Axalta Coating Systems

- BYK(ALTANA)

- Hempel A/S

- Jotun

- PPG Industries Inc.

- Pro Chem Inc.

- Rust-Oleum

- SAICOS COLOR GmbH

- Vexcon Chemicals

第七章 市场机会与未来趋势

- 开发更有效的防滑添加剂

- 其他机会

简介目录

Product Code: 69155

The Anti-slip Additives Market is expected to register a CAGR of 4% during the forecast period.

Key Highlights

- Increasing applications in industrial flooring and increasing demand from the marine industry are driving the market growth.

- Stringent environmental regulations and other restraints are expected to hinder the growth of the market studied.

Anti-slip Additives Market Trends

Growing Applications in Industrial Flooring

- Anti-slip additives, when added to coatings, improve the skid resistance to the coatings and can be applied on different substrates, like wood, metal, fiberglass, and concrete surfaces. These anti-slip additives added coatings are applicable for different areas among which industrial flooring leads in the application.

- Anti-slip additives do not change the color, performance or properties of the paint or coatings to which they are added. They can be added to water or solvent-based system with minimal viscosity effects and also increases slip resistance to the coated floor.

- Stringent regulations from government to maintain industrial safety are increasing the application of anti-slip additives to coatings in industries.

- About 296 approved cold chain projects in food processing have been approved in India as on May 2019 creating a major scope for the usage of anti-slip additives in the industry.

- The Chinese pharmaceutical industry, which is valued at about USD 145 billion currently, represents the biggest emerging market with growth tipped to reach about ~USD 200 billion by 2022, thus, increasing the scope of the market over the coming years.

- Industrial sector leads in the utilization of anti-slip additives with China, the United Kingdom, the United States, India, and Japan, playing a major role in this market.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific region is expected to dominate the market for anti-slip additives during the forecast period. In countries, like China, India, and Japan, because of growing industrial safety, the demand for anti-slip additives has been increasing in the region.

- The largest producers of anti-slip additives are located in the Asia-Pacific region. Some of the leading companies in the production of anti-slip additives are Hempel A/S, BYK(ALTANA), Axalta Coating Systems, Jotun, and Rust-Oleum.

- The usage of anti-slip additives is more dominant in manufacturing industries, like chemicals and pharmaceuticals, automotive, packaging, and other industries.

- In the marine industry these anti-slip additives added coatings are applied on floors, decks of ships, and boats to increase slip resistance.

- According to the Ship Builders Association of Japan, the gross tonnage of ship size covered 14,354 by end of June 2019, which was 15,097 tonnage by the end of December 2018 creating growth in the market of anti-slip additives.

- The Chinese government has rolled out massive construction plans, including making provisions for 250 million people in its new megacities, over the next ten years, creating scope for application of anti-slip additives to coatings in its construction activity over the coming years.

- These anti-slip additives added coatings can be used on wet areas, dry areas, clean room areas, and other workspaces as a safety measure in industries.

- The aforementioned factors, coupled with government support, are contributing to the increasing demand for anti-slip additives market during the forecast period.

Anti-slip Additives Industry Overview

The anti-slip additives market is fragmented with players accounting for a marginal share of the market. Few companies include are Hempel A/S, BYK(ALTANA), Axalta Coating Systems, Jotun, and Rust-Oleum, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Application in Industrial Flooring

- 4.1.2 Increasing Demand from the Marine Industry

- 4.2 Restraints

- 4.2.1 Stringent Environmental Regulations

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Additive Type

- 5.1.1 Aluminum oxide

- 5.1.2 Silica

- 5.1.3 Other Additive Types

- 5.2 Additive Nature

- 5.2.1 Powder

- 5.2.2 Aggregate

- 5.2.3 Mix

- 5.3 Application

- 5.3.1 Buildings and Construction

- 5.3.2 Industrial Flooring

- 5.3.3 Marine

- 5.3.4 Other Applications

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Akzo Nobel BV

- 6.4.2 Associated Chemical

- 6.4.3 Axalta Coating Systems

- 6.4.4 BYK (ALTANA)

- 6.4.5 Hempel A/S

- 6.4.6 Jotun

- 6.4.7 PPG Industries Inc.

- 6.4.8 Pro Chem Inc.

- 6.4.9 Rust-Oleum

- 6.4.10 SAICOS COLOR GmbH

- 6.4.11 Vexcon Chemicals

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of More Efficient Anti-slip Additives

- 7.2 Others Opportunities

02-2729-4219

+886-2-2729-4219