|

市场调查报告书

商品编码

1683421

电梯控制市场 -市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Elevator Control - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

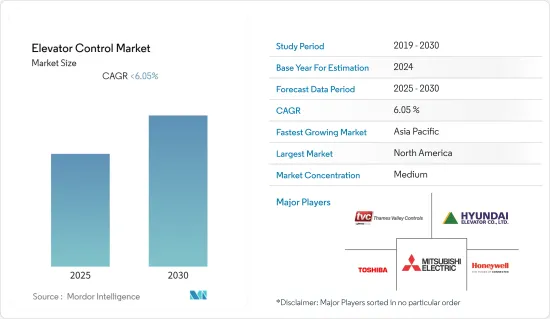

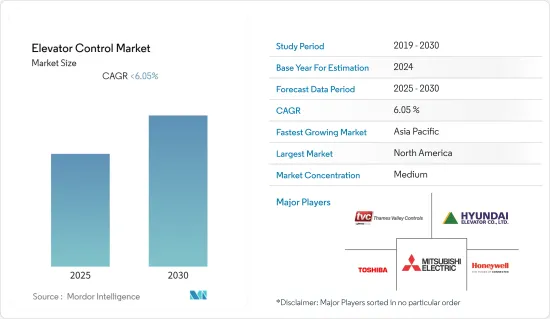

预测期内,电梯控制市场预计复合年增长率约 6.05%

关键亮点

- 寻找工作和提高生活水准正在推动世界各地的都市化,从而增加对住宅的需求。为了满足这一需求,政府支持建造多层建筑,以便在相同的土地面积上容纳尽可能多的家庭。根据联合国统计,全球一半以上的人口居住在都市区,几乎每个国家都在经历都市化。在已开发国家,大多数人口居住在都市区,但在非洲和亚洲的发展中国家,大多数人口仍居住在农村地区。预计这将推动未来几年电梯控制市场的发展。

- 新兴经济体基础设施支出的激增预计将推动电梯市场的发展。报道称,印度政府预计2020-21财年印度基础设施投资将成长43%,将推动电梯和钢铁的需求。预计 2020-21 年中央政府、州政府和私营部门的基础设施支出将达到 2,540 亿美元左右,而 2019-20 年预计为 1,780 亿美元。

- 此外,数位化电梯技术的发展旨在改善拥挤的中高层建筑(尤其是商业建筑)的交通流量和行程时间,从而推动工程师开发下一代智慧电梯控制系统。智慧互联建筑、物联网功能以及不断发展的安全和品质标准是推动电梯市场的新一代因素。主要供应商在实施这些元素后可能会看到好处。例如,通力的 BACnet PR18 控制器是一个原生 BACnet 设备和完全整合的系统,不需要电梯控制整合商或翻译,使建筑业者能够以最佳、高效的方式管理、营运和维护智慧建筑。

- 随着技术的进步,各公司正致力于推出无接触电梯等技术先进的产品,以防止冠状病毒进一步传播。这些新兴市场的发展预计将在不久的将来为市场带来新的前景。

电梯控制市场趋势

建筑基础设施投资增加推动电梯控制市场

- 随着高层建筑的增加,电梯控制系统也得到了快速的发展,其设计也不断的改进和优化。控制系统中先进技术的引入正在推动市场成长。

- 特别是采用人工智慧、智慧感测器和物联网等先进技术,有助于降低能耗,提高电梯安全性,并有效且方便地控制交通和拥塞。

- 相关基础设施投资蓬勃发展,实现永续性,并与都市化趋势紧密相连。 2020年10月,国际货币基金组织(IMF)呼吁成员国政府利用低机会投资基础设施,以协助各国从冠状病毒大流行中恢復并向生态友善能源转型。已开发经济体和新兴经济体的公共投资每增加1%,预计经济成长率将达2.7%。

- 该提案将有助于各国应对疫情危机。由于电梯对于住宅和商务用电梯而言必不可少且有助于出行,基础设施的增加也将推动电梯控制市场的成长。

- 印度、中国、沙乌地阿拉伯和其他金砖国家等新兴经济体正在大规模投资基础建设。作为「2030愿景」的一部分,沙乌地阿拉伯计划投资4,250亿美元用于基础建设计划。该投资将持续到 2030 年,旨在减少该国对石油的依赖。

- 同样,印度也计划在 2025 年前的六年内投资 1.5 兆美元建设国家基础建设。该计划要求进行广泛的投资,从硬体基础设施到社会部门。

- 2021年3月,中国政府核准了「十四五」规划,这是未来半个世纪的宏伟战略蓝图,以及到2035年的长期目标。政府计划在2025年使中国人口都市化达到65%,到2035年达到75%,与已开发国家平等。随着越来越多的人从农村迁移到都市区,人们更加重视加大对基础建设的投资。

预测期内亚太地区将显着成长

- 由于新兴市场在基础设施和低人事费用方面提供的机会,亚太地区跨国公司的数量正在增加。这些公司正在寻找在更成熟的市场中精简业务的方法,并增加其在亚洲国家的员工数量。

- 随着新兴经济体的崛起以及亚太地区对工业化的日益重视,公民纷纷涌向城市和都市区寻找更好的就业和薪资机会。

- 都市化也推动了亚太地区特大城市的出现。预计未来几年都市化将持续,导致商业和居住对现代基础设施的需求增加。

- 根据世界银行的研究,到2019年,澳门、新加坡、香港等国家和地区的城镇人口将达到100%。紧随其后的是日本、纽西兰、澳洲等国家和地区。

- 由于对基础设施和人口密度的需求不断增加,亚太地区的快速都市化改变了高层建筑市场。这导致对于高耸的高层建筑(无论是住宅还是商务用)的需求日益增长。

- 日本等国家正在增加办公大楼的数量,以支持不断增长的城市人口和私人办公空间。例如,根据国土交通省的数据,2020年日本办公大楼开工数约为13,100栋。

- 根据韩国国土交通部统计,2020年韩国商业大楼开工数约132万套(2019年为129万套)。过去十年来,韩国的商业建筑数量一直稳定增加,这主要归因于韩国对现代先进商业空间的需求不断增长。

电梯控制产业概况

预计伙伴关係和联盟投资将成为该市场供应商的策略重点。此外,该地区的供应商正专注于开发前端控制模组,主要使用非接触式技术,以减少延迟并改善频宽控制。市场正在整合,其中包括东芝、现代和三菱等成熟公司。这些公司在电梯和控制设备业务方面拥有丰富的经验,并在区域和全球范围内拥有强大的影响力。因此,市场渗透率仍然很高。供应商正致力于采用新策略来增加市场占有率。例如,三菱电梯已宣布计划在 2022-2023 年专注于高端建筑空间领域的扩张,占领印度 20% 的市场占有率。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查结果

- 调查前提

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 波特五力分析

- 新进入者的威胁

- 购买者和消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- 产业价值链分析

- COVID-19 工业影响评估

- 市场驱动因素

- 控制系统中快速采用尖端技术

- 增加基础建设投资

- 市场问题

- 初期投资成本高

第五章 市场区隔

- 应用

- 住宅

- 商务用

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 其他的

第六章 竞争格局

- 公司简介

- Hitachi Ltd.

- Hyundai Elevator Co., Ltd.

- Toshiba Elevators and Building Systems

- Mitsubishi Electric

- Thames Valley Controls

- Nidec MCE

- Honeywell International Inc.

- SICK AG

第七章投资分析

第 8 章:市场的未来

The Elevator Control Market is expected to register a CAGR of less than 6.05% during the forecast period.

Key Highlights

- Rise in urbanization across the world in search of a job and better life standard has led to an increase in demand for residential apartments. In order to cater to the needs, governments have supported the construction of the multi-storey building to accommodate the maximum number of families in the same land area. According to the United Nation, more than one half of the world population lives in urban areas, and virtually all countries are experiencing urbanization. Developed countries' large population resides in urban areas, whereas developing countries in Africa and Asia, still dwell in rural areas but will urbanize faster than other regions over the coming decades. It will drive the elevator control market in the coming years.

- The rapid increase in infrastructure spending in developing economies is expected to boost the elevator market. According to the report, India's infrastructure investment would grow by 43% in the fiscal year 2020-2021 projected by the government which would strengthen the demand of elevators and steel. Infrastructure spending by central, state governments and the private sector is forecast to be around USD 254 billion in 2020-21 compared with estimated spending of USD 178 billion in 2019-20.

- In addition, developments in elevator technology that leverage digitalizationto improve flow and travel time in busy mid and high-rise buildings, primarily commercial buildings are encouraging engineers to develop next generation smart elevator control systems. Smart connected buildings, Internet of Things capabilities, and evolving standards of safety and quality are the new generations elements evolving the elevator market. Key vendors would benefit after implementing these elements. For instance, KONE's BACnet PR18-compliant controller is a native BACnet device, fully integrated system, that doesn't require any elevator controls integrator or translation and allows building operator to manage, operate, and maintain smart buildings in the best and efficient ways.

- In the wake of technological advancements, companies are striving towards introducing technologically advanced products such as touchless elevators that will prevent the further spread of corona virus. Developments such as these will open new prospects for the market in the near future.

Elevator Control Market Trends

Increased Investment in Building Infrastructure to Drive the Elevator Control Market

- With the growth of high-rise buildings, the elevator control systems have also achieved rapid development, and the design has been constantly improving and optimizing. The implementation of advanced technologies in control systems has been driving the growth of the market.

- The adoption of advanced technologies, such as artificial intelligence, smart sensors and IoT, among others, assist in reducing energy consumption, improving the safety of the elevators, and control traffic or congestion efficiently and conveniently.

- The increased investment in allied infrastructure have been rapidly increasing for achieving sustainability and majorly concerned with the growing urbanization trend. In October 2020, the International Monetary Fund (IMF) announced member governments to seize a low-interest rate opportunity to invest in infrastructure to drive recovery from the coronavirus pandemic and a shift toward greener energy. The increase in public investment by 1% of GDP in advanced and developing economies would grow by 2.7%.

- The suggestion is to help the countries tackle the pandemic crisis. The increase in the infrastructure also promotes the growth of the market for elevator control as they make an essential part of residential and commercial elevator fleet, helping in mobility.

- The major investments in building infrastructure can be witnessed from emerging economies, such as India, China, Saudi Arabia, and other BRICS, which creates new opportunities for the elevator control market. As part of Vision 2030, Saudi Arabia plans on making a USD 425 billion investment in infrastructural projects. The investments will be carried out till 2030, and the nation aims to cut its dependence on oil.

- On similar lines, India also has a USD 1.5 trillion National Infrastructure Pipeline for six years ending 2025. The plan seeks to make investments across a wide range of hard infrastructure and social sectors.

- In March 2021, the Chinese government approved China's 14th Five-Year Plan (FYP) (2021-2025), the grand strategic blueprint for the next half-decade, and longer-term goals for 2035. The government plans to have China's urbanization rate reach 65% of the population by 2025 and 75% that of an advanced economy by 2035. As more people move from rural to urban areas, the focus is on more significant investment in building infrastructure.

Asia-Pacific will Experience Significant Growth in Forecast Period

- The Asia-Pacific region is witnessing the growing presence of multinational companies due to the opportunities offered by the emerging markets, in terms of infrastructure and reduced labor costs. These companies are looking for ways to streamline operations in a more established market and increasing their headcount in Asian countries.

- With the emergence of new economies and an increasing focus on industrialization throughout the Asia-Pacific region, citizens flocked to the cities and urban areas in hopes of better employment and salary opportunities.

- Urbanization has further catalyzed the emergence of megacities throughout the Asia-Pacific region. Urbanization is expected to grow throughout the coming years, thereby increasing the demand for modern infrastructure in both commercial and residential spaces.

- According to a survey by the World Bank, countries like Macau, Singapore, and Hong Kong exhibited 100% of the population as urban populations in 2019. These countries were followed by Japan, New Zealand, and Australia, to name a few.

- The rapid urbanization of the Asia-Pacific region has shaped the skyscrapers' market due to increased demand for infrastructure and population density. It has fueled the need for towering skyscrapers, both for residential and commercial purposes.

- Countries like Japan are increasing their number of office building construction starts to support the growth of urban populations and private offices in the country. For instance, according to MLIT (Japan), in 2020, the number of office building construction starts in Japan was about 10.31 thousand.

- According to the Ministry of Land, Infrastructure, and Transport (South Korea), in 2020, there were approximately 1.32 million units of commercial buildings in South Korea, compared to 1.29 million in 2019. The number of commercial buildings in South Korea has increased steadily in the last decade, primarily driven by the increasing demand for modern and advanced commercial spaces in the country.

Elevator Control Industry Overview

The investments in partnership and alliance are expected to be a strategic focus of vendors operating in the market. In addition, the vendors in the region are focusing on developing front-end control modules, primarily using contactless technologies to reduce waiting time and better control the bandwidth. The market is consolidated and includes mature companies, such as Toshiba, Hyundai, Mitsubishi, etc. Such companies have a strong regional and global presence with a considerable amount of experience in the elevator and control unit business. Hence, the level of market penetration remains to be high. Vendors are focusing on improving their market share with new strategies like Mitsubishi Elevator announced plans to gather a 20% market share by 2022-2023 across India by focusing on expansion through premium building space segments.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Porter's Five Force Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of COVID-19 Impact on the Industry

- 4.5 Market Drivers

- 4.5.1 Rapid Implementation of Advance Technologies in Control System

- 4.5.2 Increase Investment in Infrastructure

- 4.6 Market Challenges

- 4.6.1 High Initial Cost of Investment

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Residential

- 5.1.2 Commerical

- 5.2 Geography

- 5.2.1 North America

- 5.2.2 Europe

- 5.2.3 Asia-Pacfic

- 5.2.4 Rest of The World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Hitachi Ltd.

- 6.1.2 Hyundai Elevator Co., Ltd.

- 6.1.3 Toshiba Elevators and Building Systems

- 6.1.4 Mitsubishi Electric

- 6.1.5 Thames Valley Controls

- 6.1.6 Nidec MCE

- 6.1.7 Honeywell International Inc.

- 6.1.8 SICK AG