|

市场调查报告书

商品编码

1683425

氟化学品市场 -市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Fluorochemical - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

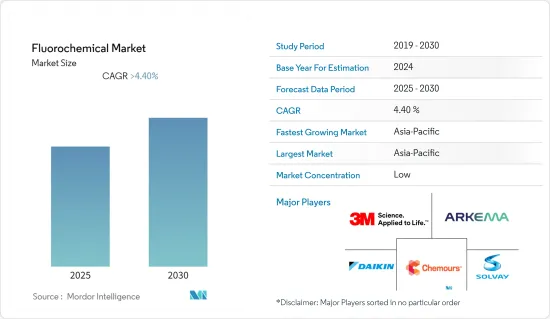

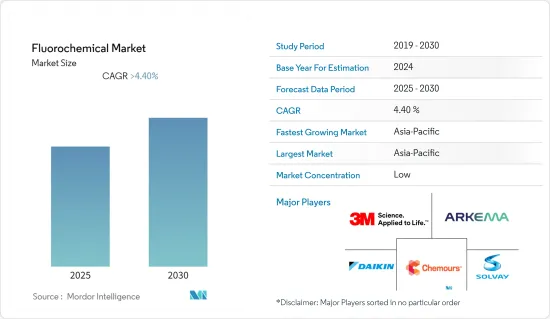

预测期内,氟化合物市场预计将以超过 4.4% 的复合年增长率成长。

受 COVID-19 的影响,氟化合物市场受到负面影响,全国实施封锁、保持社交距离等措施,导致供应链中断。但疫情过后,在政府的支持下,市场预计将迅速復苏,恢復疫情前的状态。

关键亮点

- 短期内,HVAC 系统需求的增加预计将推动市场成长。

- 然而,与氟化合物相关的环境问题可能会阻碍市场成长。

- 未来五年,氟化合物市场可能会受益于增强服装防水性能的氟化合物的研究和开发。

- 预计亚太地区将占据最大的市场份额,并在未来五年内实现最高的复合年增长率。

氟化学市场趋势

氟碳化合物占据市场主导地位

- 由于旨在保护臭氧层和抑制全球暖化的新法规,氟碳化合物部分可能成为最大的部分。

- 氟碳化合物用于推进剂、发泡发泡剂、冷媒和溶剂,随着主要製造商开发出危害较小的氟化学替代品,对氟化合物的需求预计将激增。例如,2021年全球冰箱市场收入为1,266亿美元,而2020年的1,188亿美元则成长了7.8%。预计这将创造对氟化学产品的需求。

- 由于人们对臭氧层的担忧日益加剧,未来几年对氟碳化合物的需求可能会下降。

- 氟碳化合物充当冷媒,由于洁净空气系统在製造业中的重要性日益增加,以及配备 HVAC 系统的汽车数量不断增加,预计市场将会成长。例如,根据OICA的数据,2021年美国汽车产量为9,167,214辆,比2020年增加4%。这意味着随着汽车产量的增加,对氟化学产品的需求也会增加。

- 所有上述因素都可能在预测期内推动氟化合物市场的发展。

亚太地区占市场主导地位

- 预计未来几年亚太地区将成为最大且成长最快的地区。这是由于汽车和基础设施领域的暖通空调系统中冷媒的使用越来越多。

- 氟技术产品广泛用于建筑和建筑业。其中包括填缝材料、电线电缆、建筑膜和涂料,以及防銹、高强度、抗紫外线的材料,如电线电缆。

- 包装和冷冻食品消费量的增加增加了商务用冷冻系统的市场需求,预计这将推动氟化学产业的成长。例如,根据经济产业省的数据,2021年日本产电冰箱的金额将为2,293.9亿日圆,较2020年成长2.64%。

- AHF 等氟化学品因其成本效益而被广泛应用于铝生产。例如,根据中国工业和资讯化部的数据,2021年中国原生铝产量为3,850万吨,较2020年成长3.8%。因此,预计该国通用化学产品市场的需求将呈现上升趋势。

- 此外,铝的重量轻、维护成本低的特性也可能推动铝在电子和汽车应用领域的使用,从而增加对氟化合物的需求。例如,根据 OICA 的数据,印度的汽车产量为 4,399,112 辆,比 2020 年成长 30%。因此,汽车产量的增加可能会增加氟化合物市场的需求。

- 该地区的铝使用量可能会更大,因为中国和印度的铝储量庞大,而且政府希望鼓励外国对金属产业进行直接投资。

- 预计这些市场趋势将在未来几年推动该地区对氟化合物的需求。

氟化学产业概况

全球氟化合物市场本质上是分散的。市场的主要企业(不分先后顺序)包括索尔维、3M、阿科玛、大金工业有限公司和科慕公司。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 暖通空调系统需求不断成长

- 限制因素

- 与氟化学相关的环境问题

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场区隔(市场规模(基于数量))

- 产品

- 氟碳

- 氟树脂

- 特殊/无机

- 其他的

- 应用

- 冷冻和空调

- 车

- 电气和电子(包括半导体)

- 药品

- 纺织品和化学品

- 军事和国防

- 宇宙

- 其他的

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作、协议

- 市场占有率分析(%)**/排名分析

- 主要企业策略

- 公司简介

- 3M

- AGC Chemicals Americas

- Anupam Rasayan India Ltd(Tanfac Industries Ltd.)

- Arkema

- DAIKIN INDUSTRIES, Ltd.

- Derivados del Fluor, SAU(MINERSA GROUP)

- DIC CORPORATION

- Dongyue Group

- Dynax Corporation

- Gujarat Fluorochemicals Limited

- HaloPolymer

- Honeywell International Inc.

- Koura

- MAFLONS.PA

- Navin Fluorine International Limited

- Solvay

- SRF Limited

- The Chemours Company

第七章 市场机会与未来趋势

- 防水服饰用防雨氟化学品的研发

The Fluorochemical Market is expected to register a CAGR of greater than 4.4% during the forecast period.

Due to the impact of COVID-19, the fluorochemical market was negatively impacted because of nationwide lockdowns, social distancing mandates, etc., which caused supply chain disruptions. But after the pandemic, with help from the government, the market quickly recovered and is expected to get back to where it was before the pandemic.

Key Highlights

- Over the short term, the growing demand from HVAC systems is expected to drive market growth.

- However, the environmental problems associated with fluorochemicals are likely to hinder the market's growth.

- Over the next five years, the fluorochemical market is likely to benefit from the research and development of fluorochemicals that make clothing waterproof.

- The Asia-Pacific region is expected to have the biggest share of the market and the highest CAGR over the next five years.

Fluorochemicals Market Trends

Fluorocarbon to Dominate the Market

- Due to new rules meant to protect the ozone layer and slow down global warming, the fluorocarbon segment is likely to be the largest.

- Fluorocarbons are used in propellants, blowing agents, refrigerants, and solvents, and major manufacturers are formulating less harmful fluorochemical substitutes that are anticipated to surge the demand for fluorochemicals. For instance, in 2021, the global refrigerator market generated a revenue of USD 126.6 billion, which showed an increase of 7.8% compared with 2020, which amounted to USD 118.8 billion. Therefore, this is expected to create demand for fluorochemicals.

- Fluorocarbon demand may go down over the next few years because of growing worries about the ozone layer.

- Fluorocarbons serve as a refrigerant, and the growing importance of clean air systems in the manufacturing sector and the growing installation of HVAC systems in automobiles are expected to increase the growth of the market. For instance, according to OICA, in 2021, automobile production in the United States amounted to 91,67,214 units, which showed an increase of 4% compared to 2020. So, if the number of cars made goes up, there should be more demand for fluorochemicals on the market in the country.

- All of the aforementioned factors are likely to be the driving forces behind the fluorochemical market during the forecast period.

Asia-Pacific Region to Dominate the Market

- Over the next few years, the Asia-Pacific market is expected to be the biggest and grow the fastest. This is because more and more refrigerants are being used in HVAC systems in the automotive and infrastructure sectors.

- Fluor Technology's products are often used in the construction and building industries. These include anti-corrosion, high-strength, and UV-resistant materials like caulks, wire and cable, architectural membranes and coatings, and wire and cable.

- An increase in consumption of packaged and frozen food has led to a rise in market demand for commercial cooling systems, which is likely to drive the fluorochemical industry's growth. For example, the Ministry of Economy, Trade, and Industry (METI) says that the value of electric refrigerators made in Japan in 2021 will be JPY 229.39 billion yen ($2.09 billion), which is up 2.64 percent from 2020.

- Fluorine-based chemicals such as AHF are prominently used for aluminum production owing to their cost-effectiveness. For instance, according to the Ministry of Industry and Information Technology of the People's Republic of China, in 2021, the production volume of primary aluminum in China was 38.5 million tons, an increase of 3.8% compared to 2020. Therefore, this is expected to create upside demand for the flurochemical market in the country.

- Moreover, lightweight and low-maintenance characteristics also promoted the use of aluminum in electronic and automotive applications, which is likely to propel the demand for fluorochemicals. For instance, according to OICA, the total automotive production in India amounted to 43,99,112 units, which shows an increase of 30% compared to 2020. Because of this, a rise in the number of cars made is likely to increase demand in the fluorochemical market.

- Aluminum is likely to be used more in the region because China and India have a lot of it and their governments want to encourage foreign direct investment in their metal industries.

- So, all of these market trends are likely to boost the demand for fluorochemicals in the region over the next few years.

Fluorochemicals Industry Overview

The global fluorochemical market is fragmented by nature. Some of the major players (not in any particular order) in the market include Solvay, 3M, Arkema, Daikin Industries Ltd., and The Chemours Company, amongst others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from HVAC Systems

- 4.2 Restraints

- 4.2.1 Environmental Problems Associated with Fluorochemical

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products or Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Product

- 5.1.1 Fluorocarbon

- 5.1.2 Fluoropolymer

- 5.1.3 Specialty and Inorganic

- 5.1.4 Other Products

- 5.2 Application

- 5.2.1 Refrigeration and Air Conditioning

- 5.2.2 Automotive

- 5.2.3 Electrical and Electronics (incl. Semiconductors)

- 5.2.4 Pharmaceuticals

- 5.2.5 Textile and Chemicals

- 5.2.6 Military and Defense

- 5.2.7 Space

- 5.2.8 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis (%)** /Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 AGC Chemicals Americas

- 6.4.3 Anupam Rasayan India Ltd (Tanfac Industries Ltd.)

- 6.4.4 Arkema

- 6.4.5 DAIKIN INDUSTRIES, Ltd.

- 6.4.6 Derivados del Fluor, S.A.U. (MINERSA GROUP)

- 6.4.7 DIC CORPORATION

- 6.4.8 Dongyue Group

- 6.4.9 Dynax Corporation

- 6.4.10 Gujarat Fluorochemicals Limited

- 6.4.11 HaloPolymer

- 6.4.12 Honeywell International Inc.

- 6.4.13 Koura

- 6.4.14 MAFLONS.P.A

- 6.4.15 Navin Fluorine International Limited

- 6.4.16 Solvay

- 6.4.17 SRF Limited

- 6.4.18 The Chemours Company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Research and Development in Rain-Repelling Fluorochemicals Used in Waterproof Clothing