|

市场调查报告书

商品编码

1683427

湿度感测器:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Humidity Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

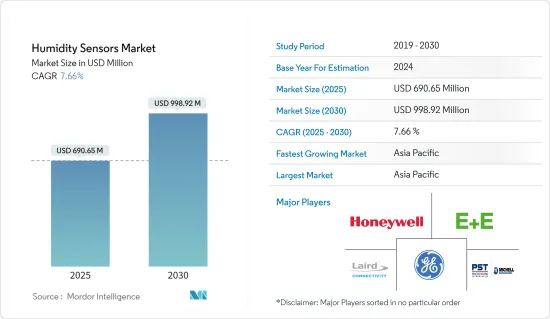

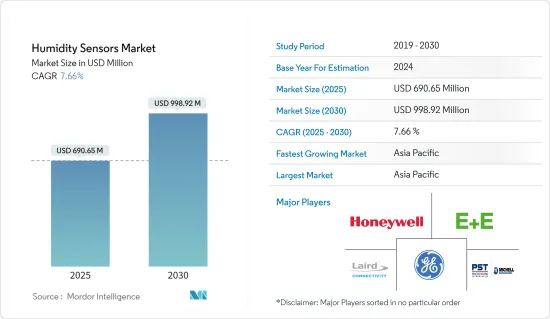

湿度感测器市场规模预计在 2025 年为 6.9065 亿美元,预计到 2030 年将达到 9.9892 亿美元,预测期内(2025-2030 年)的复合年增长率为 7.66%。

湿度感测器是一种测量环境中湿度并将结果转换为相应电讯号的电子设备。它们有各种尺寸和功能;有些整合到手持设备中,而有些则是更大的嵌入式系统的一部分(例如空气品质监测系统)。湿度感测器广泛应用于气象、医疗、汽车、暖通空调、工业製造等领域。电容式感测器具有功耗低、线性度好、RH检测范围宽等优点,但製造流程复杂是主要缺点。

主要亮点

- 湿度感测器的性能主要由其纳微结构(孔径、层厚度、表面结构元素尺寸分布、表面形貌均匀性、电极距离等)决定。要实现湿度感测器,它必须满足各种特性,例如重复性、灵敏度、再现性、线性度、低滞后、快速响应恢復速度、稳定性、低成本以及易于连接到控制单元。感测器应根据这些规范进行设计。

- 湿度感测器可以提高各种应用的性能、降低能耗并增强安全性。越来越多的OEM在其引擎、电子设备和其他产品中设计相对湿度和温度感测器,以提供更好的控制和输出。

- 过去几年,汽车产业取得了长足发展,得益于安全、娱乐或纯粹创新等新技术的出现,汽车数量不断增加。世界各地的政府机构都在实施要求安装感测器的安全和排放标准。因此,汽车公司必须遵守当局製定的安全和排放法规。预计这一趋势将在预测期内增加对汽车温度感测器的需求。

- 然而,无线感测器容易受到窃听、干扰和欺骗等各种攻击。它也容易受到其他无线设备和讯号的干扰,从而降低资料传输的品质。因此,确保网路和收集资料的安全是所研究市场面临的关键挑战。此外,无线设备通常较小,处理和储存能力有限。这使得执行复杂任务或储存大量资料变得困难。

- COVID-19 疫情严重扰乱了全球供应链和多种产品的需求,预计到 2020年终,无线湿度感测器的采用将受到影响。然而,由于对家用电子电器和医疗应用的需求不断增加,市场成长显着增加。各个参与者都在进行投资和合作以满足需求。

湿度感测器市场趋势

汽车产业将经历显着成长

- 汽车产业涵盖从事汽车创造、改进、生产、推广、销售、维护和客製化的各种公司和营业单位。就收益而言,汽车产业是世界上最大的产业之一,许多公司都在持续投资汽车产业的发展。该行业还为用于管理车内湿度水平、减少车窗雾气并提高舒适度的湿度感测器提供了机会。

- 2022 年汽车市场成长至约 6,720 万辆,而 2021 年为 6,670 万辆。由于全球经济衰退,2020 年和 2021 年销量有所下降。新冠疫情和俄乌战争导致2022年汽车半导体短缺,并引发了供应链问题。不过,预计 2023 年将恢復成长,达到 7,080 万台。预计类似的成长趋势将影响未来的汽车需求,从而进一步扩大湿度感测器市场。

- 在汽车领域,湿度感测器用于监测和控制车辆内部气候。这些感测器在调节汽车的气候控制和通风系统方面发挥关键作用,确保车窗除霜以提高安全性。

- 此外,只有当湿度超过一定阈值时,通风过程才会启动,从而最大限度地减少电力使用并提高汽车的整体效率。因此,汽车产业对湿度感测器的需求不断扩大,推动了市场成长。汽车销售的成长和汽车产量增加的投资预计将提升市场潜力。

亚太地区可望主导市场

- 预计预测期内亚太地区的湿度感测器市场将经历显着成长。感测器主要在亚太地区製造,最尖端科技依靠感测器发挥作用,感测器技术在世界各地广泛应用。

- 基础设施建设、技术进步、旅游活动的增加、可支配收入的增加以及政府提高能源效率的倡议推动了暖通空调产业的发展。随着各行各业拥抱自动化、物联网和人工智慧集成,对更高效能和更节能係统的需求正在增加。预计该地区将占据石油和天然气需求成长的主导地位。石油和天然气产业通常在极端天气条件下,在陆上和海上的恶劣环境中运作。 HVAC 系统透过维持空气品质、温度和湿度来确保室内工作空间保持居住,从而推动市场成长。

- 第 22 届 ACREX India 展会是南亚最大的空调、暖气、通风和智慧建筑展览会,将于 2023 年 3 月在孟买展览中心举行。该展会由印度暖气、冷冻与空调工程师学会 (ISHRAE) 与 Informa Markets 合作举办,旨在展示印度蓬勃发展的暖通空调行业,并为总理的 Atmanirbhar 愿景做出贡献。关注 HVAC 领域的技术进步,这对于更美好的未来至关重要。

- 在这个市场运营的公司正致力于将新产品创新作为业务扩展的一部分。例如,2023年7月,Weathernews公司与Omron Corporation共同开发了新型天气物联网感测器,并以「Soratena Pro」为名发布。 Soratena Pro 是一款高性能物联网天气感测器,可监测温度、湿度、气压、降雨量、风向和风速等元素。该技术由专注于感测器开发的OMRON与Weathernews公司共同开发,充分利用两家公司的优势,实现最高水准的天气预报准确率。

- 该地区的食品和饮料行业也经历了成长,各种国内外餐饮企业都在此开展业务。食品工业中技术的使用范围也不断扩大,从食品製备到消费。食品和饮料产业也是湿度感测器的重要用户,湿度感测器可以监测温度和湿度以防止食物变质。

- 根据OICA预测,2022年中国商用车产量将达3,184.53辆,位居世界第一。日本以1,269.16台位列第二、第三位,泰国以1,289.46台位列第三。此外,汽车的电气化和混合动力化、汽车製造商之间的联盟以及可支配收入的增加正在刺激汽车产业对汽车感测器的需求。中国等国家对全球汽车感测器产业的扩张做出了重大贡献。此外,该地区是全球一些主要汽车製造商的所在地,预计将在预测期内推动汽车感测器(包括湿度感测器市场)的发展。

湿度感测器产业概况

湿度感测器市场比较分散。鑑于工业物联网(IIOT)和自动化等技术的重大进步,预计将出现对更多特定技术感测器的需求,这可能会导致更全面的竞争。公司包括通用电气公司、莱尔德连接公司、E+E Elektronik GmbH、霍尼韦尔国际公司和英国米歇尔仪器公司。

2023 年 11 月,E+E Elektronik 推出了新一代精确可靠的房间感测器:CDS201、HTS201 和 TES201。我们为每个设施自动化应用提供用于测量二氧化碳、湿度和温度的 CDS201 三合一设备、HTS201 湿度和温度感测器以及 TES201 温度感测器。每款产品都配有类比输出或数位介面以及大型现代化显示器。功能性卡扣式外壳可最大程度降低安装成本并防止干扰空气污染。

2023 年 9 月,Process Sensing Technologies 宣布收购 Sensore Electronic GmbH。 Sensore 将增强公司现有的感测器产品组合。 Sensore 的产品特别适合要求最严格的产业中的关键应用。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 新冠疫情及其他宏观经济因素对市场的影响

- 主要技术类型:红外线、双金属、冷却镜、氧化铝电容式等。

- 主要技术类型 – 红外线

- 主要技术类型-双金属

- 主要技术类型 – 冷却镜

- 主要技术类型 – 氧化铝电容式

第五章 市场动态

- 市场驱动因素

- 製程工业的安全需求日益增加

- 汽车产业的新应用

- 市场限制

- 非接触式科技的使用限制

第六章 市场细分

- 按最终用户产业

- 化工和石化

- 楼宇自动化 (HVAC)

- 车

- 石油、天然气和天然气

- 药品

- 半导体

- 发电

- 饮食

- 纸和纸浆

- 用水和污水、焚烧炉

- 家电

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第 7 章 通路分析

第八章 竞争格局

- 公司简介

- General Electric Company

- Laird Connectivity

- E+E Elektronik GmbH

- Honeywell International Inc.

- Mischell Instrument UK

- TE Connectivity Ltd

- Sensirion AG

- Bosch Sensortec GmbH

- Texas Instruments Incorporated

- Amphenol Advanced Sensors

- STMicroelectronics International NV

第九章投资分析

第十章 市场机会与未来趋势

The Humidity Sensors Market size is estimated at USD 690.65 million in 2025, and is expected to reach USD 998.92 million by 2030, at a CAGR of 7.66% during the forecast period (2025-2030).

A humidity sensor is an electronic device that measures the humidity in its environment and converts its findings into a corresponding electrical signal. It comes in various sizes and functions; some are built into handheld devices, while others are part of larger embedded systems (such as air quality monitoring systems). Humidity sensors have wide use in meteorology, medicine, automobiles, HVAC, and industrial production. Some advantages to capacitive sensors include low power consumption, good linearity, and wide-range RH detection, but a complicated fabrication process is a major drawback.

Key Highlights

- A humidity sensor's performance is primarily determined by its nano- and microscopic structure, which includes pore size, layer thickness, size distribution of the surface structural element, surface morphology uniformity, and electrode distance. For implementation, humidity sensors must meet a variety of characteristics, including repeatability, sensitivity, reproducibility, linearity, low hysteresis, fast response-recovery speed, stability, low cost, and ease of connection to control units. Sensors should be designed according to these specifications.

- Humidity sensors can improve performance, reduce energy consumption, and increase safety in a variety of applications. Increasingly, OEMs are designing relative humidity/temperature sensors into engines, electronics, and other products to improve control and output.

- The automotive industry has grown significantly in the past few years, aided by the growth in unit volumes with the emergence of new technologies, whether it be for safety, entertainment, or pure innovation. Government organizations in many countries are implementing safety and emission control standards mandating the installation of sensors. Automotive companies are, thereby, required to comply with the safety and emission control regulations set by these authorities. This trend is expected to increase the demand for automotive temperature sensors over the forecast period.

- However, wireless sensors are vulnerable to various attacks, such as eavesdropping, jamming, and spoofing. They can be susceptible to interference from other wireless devices or radio signals, which can degrade the quality of data transmission. Thus, ensuring the security of the network and the data it collects poses a significant challenge to the market studied. In addition to this, they are typically small and have limited processing and storage capabilities. This makes it challenging to perform complex tasks or store large amounts of data.

- Due to the outbreak of COVID-19, the global supply chain and demand for multiple products have majorly been disrupted, and wireless humidity sensor adoption is anticipated to be influenced until the end of 2020. However, the growing demand for consumer electronics and medical applications significantly increased market growth. Various players were investing and collaborating to cater to the requirements.

Humidity Sensors Market Trends

Automotive Sector to Witness Major Growth

- The automotive sector encompasses a diverse array of companies and entities engaged in creating, advancing, producing, promoting, selling, maintaining, and customizing automobiles. It stands as one of the largest industries globally in terms of revenue, with numerous companies consistently investing in its growth. This industry also presents opportunities for the utilization of humidity sensors used to reduce misting-up of the windows and enhance comfort by managing the humidity levels inside the car.

- The car market grew to approximately 67.2 million vehicles in 2022, compared to 66.7 million in 2021. The industry saw a decline in sales in 2020 and 2021 due to a weakening global economy. The COVID-19 pandemic and Russia's war on Ukraine caused a shortage in automotive semiconductors and supply chain issues in 2022. However, it was expected to resume growth in 2023 and reach 70.8 million units. Similar growth trends are expected to shape the demand for automotive in the future, which further translates to an increase in the market for humidity sensors.

- The automotive sector employs humidity sensors to oversee and manage the climate within vehicles. These sensors play a crucial role in regulating the air conditioning and ventilation system of cars, ensuring that the windows defrost adequately for enhanced safety.

- Moreover, they activate the ventilation process solely when the humidity level surpasses a specific threshold, thereby minimizing power usage and enhancing the overall efficiency of vehicles. As a result, the demand for humidity sensors in the automotive industry continues to expand, fostering market growth. The growing sales of the vehicles and investments in boosting vehicle production are expected to drive the market's potential.

Asia-Pacific is Expected to Dominate the Market

- The humidity sensors market in Asia-Pacific is expected to witness significant growth over the forecast period. Sensors are largely manufactured in the Asia-Pacific region, and sensor technology is widely being used worldwide as cutting-edge technologies rely on the functioning of the sensors.

- The HVAC industry is fueled by infrastructure development, technological advancements, growing tourism activities, advancing disposable income, and government initiatives promoting energy efficiency. The industry is adopting automation, IoT, and AI integration, and the demand for higher-performing and energy-efficient systems is increasing. The region is expected to account for the growth of oil and gas demand. The oil and gas industry often operates in severe onshore and offshore environments under extreme weather conditions. HVAC systems ensure that indoor workspaces remain habitable by maintaining air quality, temperature, and humidity, driving the market growth.

- The 22nd edition of ACREX India, one of the largest exhibitions for air conditioning, heating, ventilation, and intelligent buildings in South Asia, was held in March 2023 at the Bombay Exhibition Centre in Mumbai. The event, organized by the Indian Society of Heating, Refrigerating and Air Conditioning Engineers (ISHRAE) in partnership with Informa Markets, showcased India's thriving HVAC industry, seeking to contribute to the Prime Minister's Atmanirbhar vision. The focus would be on technological advancements in the HVAC sector, which are essential for a better future.

- Companies operating in the market focus on innovating new products as part of their business expansion. For instance, in July 2023, Weathernews Inc. and Omron Corporation collaborated and developed a new weather IoT sensor, which was released as Soratena Pro. Soratena Pro is a high-performance weather IoT sensor that monitors elements, including air temperature, humidity, atmospheric pressure, rainfall, wind direction, and wind velocity. Soratena Pro was jointly developed by OMRON, which specializes in sensor development, and Weathernews boasts technology for the highest weather forecast accuracy, leveraging the strengths of both companies.

- The region is also witnessing growth in the food and beverage sectors, with various domestic and international food service outlets entering the region. The use of technology in the food industry is also growing from preparing to consuming food. The food and beverage industry is also a significant user of humidity sensors that monitor the temperature and humidity of food products to prevent any spoilage.

- According to OICA, China took the top position in the production of commercial vehicles in 2022 with 3,184.53 vehicles. Japan and Thailand took second and third positions with 1,269.16 and 1,289.46 production of commercial vehicles, respectively. Moreover, vehicle electrification and hybridization, alliances among automotive players, and rising disposable income stimulate the demand for automotive sensors in the automotive sector. Countries such as China contribute substantially to expanding the global automotive sensors industry. The region is also home to a few large automakers worldwide and is expected to advance its automotive sensors, including the humidity sensors market, over the forecast period.

Humidity Sensors Industry Overview

The humidity sensors market is fragmented. Considering significant advancements in technology, like IIOT and automation, the need for more specific sensors for technology is expected to emerge, which may result in more completive rivalry, and some of the players include General Electric Company, Laird Connectivity, E+E Elektronik GmbH, Honeywell International Inc., and Michell Instrument UK.

In November 2023, E+E Elektronik launched a new generation of accurate and reliable room sensors, CDS201, HTS201, and TES201. Tailored to the respective facility automation application, the company offers a CDS201 3-in-1 device for CO2, humidity, and temperature, the HTS201 humidity and temperature sensor, and the TES201 temperature sensor. Each variant has analog outputs or a digital interface and a large, state-of-the-art display. The functional snap-on enclosure minimizes installation costs and avoids the intake of false air.

In September 2023, Process Sensing Technologies announced the acquisition of Sensore Electronic GmbH. Sensore would be an addition to the existing sensor portfolio. Sensore's products are particularly well-suited for critical applications in the most demanding industries.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 Aftereffects and other Macroeconomic Factors on the Market

- 4.4 Major Technology Types Infrared, Bimetallic, Cooled Mirror, and Aluminums Oxide Capacitive, among others

- 4.4.1 Major Technology Types - Infrared

- 4.4.2 Major Technology Types - Bimetallic

- 4.4.3 Major Technology Types - Cooled Mirror

- 4.4.4 Major Technology Types - Aluminum Oxide Capacitive

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Safety in the Process Industries

- 5.1.2 Emerging Applications in the Automotive Industry

- 5.2 Market Restraints

- 5.2.1 Limitations in the Use of Non-contact Technologies

6 MARKET SEGMENTATION

- 6.1 By End-user Industry

- 6.1.1 Chemical and Petrochemical

- 6.1.2 Building Automation (HVAC)

- 6.1.3 Automotive

- 6.1.4 Oil and Gas and Natural Gas

- 6.1.5 Pharmaceutical

- 6.1.6 Semiconductor

- 6.1.7 Power Generation

- 6.1.8 Food and Beverage

- 6.1.9 Paper and Pulp

- 6.1.10 Water, Wastewater, and Incineration

- 6.1.11 Consumer Electronics

- 6.1.12 Other End-user Industries

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia-Pacific

- 6.2.4 Latin America

- 6.2.5 Middle East and Africa

7 DISTRIBUTION CHANNEL ANALYSIS

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 General Electric Company

- 8.1.2 Laird Connectivity

- 8.1.3 E+E Elektronik GmbH

- 8.1.4 Honeywell International Inc.

- 8.1.5 Mischell Instrument UK

- 8.1.6 TE Connectivity Ltd

- 8.1.7 Sensirion AG

- 8.1.8 Bosch Sensortec GmbH

- 8.1.9 Texas Instruments Incorporated

- 8.1.10 Amphenol Advanced Sensors

- 8.1.11 STMicroelectronics International NV