|

市场调查报告书

商品编码

1683434

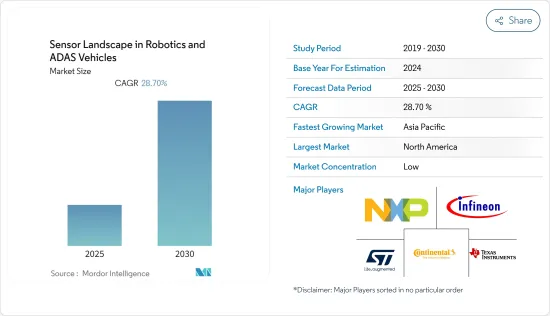

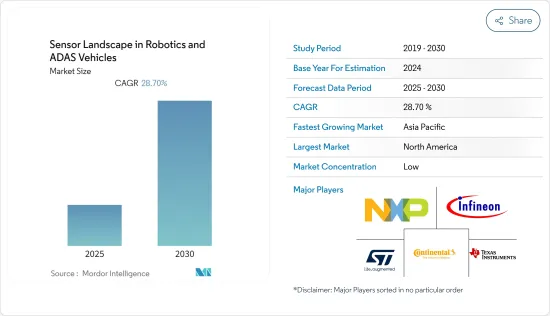

机器人和 ADAS 车辆感测器格局:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Sensor Landscape in Robotics and ADAS Vehicles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

预测期内,机器人和 ADAS 车辆的感测器市场预计将以 28.7% 的复合年增长率成长

关键亮点

- 此外,随着研发活动集中在部署全自动驾驶汽车,实现车辆周围 360 度安全的感测技术变得至关重要。谷歌和优步等公司已开始致力于开发完全自动驾驶无人驾驶汽车。

- 雷达感测器市场正在经历快速的技术创新,比以往任何时候都更具活力。雷达的新用途不断涌现,包括生命征象驾驶员监控系统、底盘对地监控、免持后行李箱开启等等。业界目前正在设想雷达成像的可能性。毫无疑问,这项技术对于自动驾驶汽车、无人驾驶汽车和广告航空领域将发挥重要作用。例如,2019 年,Velodyne 在奥兰多举行的研讨会上推出了 Alphapuck。这是一款专为高速公路上的自动驾驶和高级车辆安全而设计的 LiDAR 感测器。它结合了远距高解析度和宽视野。

- 政府强制安装自动防撞煞车系统等技术正在推动市场的发展。同样,政府强调减少车辆排放气体,要求汽车和其他商用车辆更加节省燃料,这导致压力感测器的成长。例如,中国政府计划在2020年引入新的排放气体标准“6A”,以进一步减少汽车排放气体。

- 随着最近 COVID-19 疫情的爆发,汽车感测器的成长率有所放缓,因为各大汽车製造厂已根据世界各国实施的封锁措施全面停产。此外,自动驾驶汽车将受到衝击,由于近期新冠疫情导致汽车销售和产量急剧下滑,自动驾驶技术的到来可能会被推迟一两年。例如,福特汽车因在新冠疫情后重新考虑其策略,已将自动驾驶汽车的生产推迟至 2022 年。

机器人和 ADAS 汽车市场中的感测器趋势

雷达感测器有望推动市场成长

- 汽车产业目前正在经历以提高安全性、舒适性和娱乐性为重点的技术转型,为雷达感测器应用提供了充足的机会。无人机、自动驾驶汽车和 ADAS 应用等新兴感测器密集型应用进一步推动了对雷达感测器的需求。

- 2020 年 11 月,GroundProbe 发布 SSR-Agilis,扩展了其全面的边坡稳定性雷达 (SSR) 产品线。 SSR-Agilis 是一种 3D 实孔径雷达,可提供不易受污染的独特测量方法。

- 自动驾驶汽车的出现推动了雷达感测器的广泛应用。预计预测期内技术创新将推动汽车产业对雷达感测器的需求。

- 例如,2019年3月,欧盟委员会宣布修改其通用安全法规,将自动安全技术作为欧洲製造的汽车的强制性要求,以降低该地区的事故水准。严格的法规促使汽车供应商推出最新的基于雷达感测器的系统。这为市场创造了机会。

- 然而,儘管雷达感测器功能多样,但初始成本较高,取决于感测器的类型、范围和实施技术。任何雷达感测器的确切价格都有其优点和缺点。雷达感测器的成本取决于多种因素,包括所用感测器的类型、感测器覆盖的范围以及感测器支援的应用,所有这些都包含在总成本中。

预计北美将占据主要份额

- 北美地区是采用 ADAS 车辆和自动运输解决方案的先驱之一。根据德意志银行预测,到2021年美国ADAS产量将达1,845万台。

- 由于其更好的性能,LiDAR 被Google、Uber 和丰田等大公司所采用。同时,相对较低的成本也使特斯拉决定使用雷达感测器作为其自动驾驶汽车的主要感测器。公司不断将替代感测技术融入车辆中,以提高其係统的有效性。

- 该地区的知名汽车製造商(超过 13 家主要汽车製造商)和提供雷达感测器的供应商(如博世、洛克希德马丁等)有望成为技术创新的源泉,并预计在市场上占据重要地位。根据美国汽车政策委员会的数据,在过去五年中,汽车业的出口额达到6,920亿美元,光是汽车业就贡献了该地区GDP的3%,有效促进了研究市场的成长。

- 然而,由于美国贸易战,美国政府计划将从中国进口的汽车和汽车零件的关税提高至多25%。中国是继墨西哥之后美国第二大零件出口国。美国是世界上最大的汽车市场之一,此类关税可能会对汽车产业产生影响。根据世界贸易组织(WTO)统计,这些国家之间的衝突直接影响到全球3%的贸易和8%的汽车产业。预计这种情况将影响该地区机器人和 ADAS 车辆感测器的格局。

机器人和 ADAS 车辆感测器格局产业概览

机器人和 ADAS 车辆感测器市场由许多主要参与者组成,包括英飞凌科技股份公司、大陆集团和德州仪器公司。市场正在快速变化,未来一年许多新技术可能会挑战现有技术。然而,科技公司和汽车製造商正在扩大其市场影响力并加强研发力度,为驾驶者提供最佳的安全功能。

- 2020年1月,大陆集团宣布将在美国德克萨斯州新布朗费尔斯兴建新工厂。新工厂的建设将扩大ADAS(高级驾驶辅助系统)雷达感测器的生产能力。该公司计划未来三年将为该工厂投资约1亿欧元。

- 2019年10月,英飞凌科技股份公司AURIX汽车微控制器系列再添新成员。 TC3A 有可能实现新的汽车 77GHz 雷达应用,例如用于 ADAS(高级驾驶辅助系统)和自动驾驶的高阶角雷达系统。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 市场驱动因素

- 工人安全意识增强,法规更严格

- 亚太地区主要新兴国家工业领域的稳定成长和扩张计划

- 市场问题

- 近期行业内新冠疫情的爆发和主要垂直行业支出的轻微下降可能会引起製造商的担忧

- 轻型乘用车及无人驾驶汽车销售统计(依自动化程度)

- 主要行业标准及法规

- 汽车感测器(雷达、摄影机、光达)技术蓝图

- COVID-19 工业影响评估

第五章 市场区隔

- 类型

- LiDAR(机器人汽车与 ADAS 汽车)

- 雷达(机器人汽车与 ADAS 汽车)

- 相机模组(机器人与 ADAS 车辆)

- GNSS(机器人车辆)

- 惯性测量单元(机器人车辆)

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第六章 竞争格局

- 前三大汽车光达供应商排名

- 前三大汽车影像感测器供应商排名

- 前三大汽车雷达供应商排名

- 公司简介

- Infineon Technologies AG

- NXP Semiconductor NV

- Ouster Inc.

- Velodyne LiDAR Inc.

- Luminar Technologies Inc.

- Aurora Innovation Inc.(包括 Blackmore)

- Waymo LLC

- Robert Bosch GmbH

- Continental AG

- Valeo SA

- ON Semiconductor Corp

- Omnivision Technologies Inc.

- ST Microelectronics NV

- Texas Instruments Incorporated

第七章投资分析

第八章 市场机会与未来趋势

The Sensor Landscape in Robotics and ADAS Vehicles Market is expected to register a CAGR of 28.7% during the forecast period.

Key Highlights

- Also, the increasing research and development activities to roll out fully autonomous cars require sensing technologies that are of great importance to enable 360-degree safety around the vehicle. Companies such as Google and Uber are already working on fully automated robotic cars.

- The Radar Sensor market has never been so dynamic, this market period of rapid technological innovation. New opportunities for radar are still emerging with, for instance, vital-sign driver monitoring systems, chassis-to-ground monitoring, and hands-free trunk opening. The industry is now envisioning radar imaging as a possibility. There's no doubt this technology will be critical in autonomous and robotic cars, ad aviation. For instance, in 2019, Velodyne launched Alphapuck at the Symposium event in Orlando. It is a lidar sensor specifically made for autonomous driving and advanced vehicle safety at highway speeds. It delivers a combination of long-range high resolution and wide field of view.

- Government mandates to install technology such as collision avoiding automatic brake systems are driving the market. Similarly, the emphasis of government to lower vehicle emissions will need cars and other commercial vehicles to be more fuel-efficient, resulting in the growth of pressure sensors. The Chinese government, for example, will introduce the new "6A" emission standard by 2020 to further lower vehicle emissions.

- With the recent outbreak of COVID 19, the Automotive sensor is witnessing a decline in growth due to major automotive manufacturing plants that have entirely stopped their production in response to lockdown being enforced by many countries across the world. Moreover, the self-driving vehicle has taken a hit, and the arrival of autonomous driving tech will be slowed, probably one to two years, because of the recent drastic downturn in auto sales and production due to COVID-19. For instance, Ford delayed its autonomous vehicle production until 2022 to rethink its strategy after the COVID-19 impact.

Sensor Landscape in Robotics and ADAS Vehicles Market Trends

Radar Sensor is Expected to Drive the Market Growth

- The automotive industry, which is presently undergoing a technology transition focusing on increasing safety, comfort, and entertainment, provides ample opportunities for the application of radar sensors. Emerging sensor-rich applications, such as drones, autonomous vehicles, and ADAS applications, are further accelerating the need for radar sensors.

- In November 2020, GroundProbe has extended its comprehensive Slope Stability Radar (SSR) product offering with the release of the SSR-Agilis. The SSR-Agilis is a 3D Real Aperture Radar that provides unique measurements that are less susceptible to contamination, crucial for safety-critical monitoring in high traffic work areas.

- With the advent of autonomous/self-driving cars, increasing the adoption of radar sensors can be witnessed. Over the forecast period, innovations are expected to drive the demand for radar sensors in the automotive industry.

- For instance, In March 2019, the European Commission announced a revision of the General Safety Regulations to make autonomous safety technologies a mandatory requirement for vehicles manufactured in Europe, in a bid to bring down accident levels in the region. Stringent regulations are pushing the automotive vendors to implement the latest radar sensor-based systems. This is creating an opportunity for the market.

- However, radar sensors have high initial costs with diversified functionality, and the cost varies based on the type, range, and technology being deployed for different sensors. Ultimately, the exact price of any radar sensor is unique. The cost for the radar sensor is dependent on a variety of factors, such as the type of sensor used, the range to which the sensor is adapted, and the applications supported by the sensor, which will be bundled into the total cost.

North America is Expected to Hold Major Share

- The North America region is one of the pioneers in adopting ADAS-enabled vehicles and self-driven transportation solutions. According to the Deutsche Bank, the US ADAS unit production volume is expected to reach 18.45 million by 2021.

- Owing to the better performance, prominent companies, like Google, Uber, and Toyota, are using LiDAR. At the same time, the relatively lower cost has persuaded Tesla to use radar sensors as the primary sensors in its self-driving cars. The companies are continuously trying to incorporate multiple alternative sensing technologies in a vehicle to enhance the effectiveness of the system.

- Prominent automakers (over 13 major auto manufacturers), and vendors offering radar sensors (Bosch, Lockheed Martin, among others) in the region are expected to emerge as a source for innovation and is estimated to hold a significant position in the market. According to the American Automotive Policy Council, over the past five years, the exports from the automotive sector were valued at USD 692 billion, and the automotive industry alone contributes to 3% of the region's GDP, which effectively contributes to the growth of the market studied.

- However, due to the trade war among the USA and China, the US government is planning to increase tariffs up to 25% on vehicles and car parts imported from China. China is the second biggest exporter of components to the United States, after Mexico. The United States is one of the largest auto markets in the world, and such tariffs will likely affect the automotive sector. As per the World Trade Organization, the conflict between these countries will directly affect 3% of the global trade and 8% of the automotive industry. Such situations are expected to have an impact on the sensor landscape in robotic and ADAS vehicles in the region.

Sensor Landscape in Robotics and ADAS Vehicles Industry Overview

The market for sensor landscape in robotic and ADAS vehicle is fragmented with the presence of many major players like Infineon Technologies AG, Continental AG, Texas Instrument Incorporated, etc. The market is transforming at a rapid pace, and in the coming year, many new technologies will come to challenge the existing one. However, technology companies and car manufacturers are expanding their market presence and increase their R&D efforts to provide the best safety features to the driver.

- In January 2020, Continental AG announced the construction of a new plant in the city of New Braunfels in the U.S state of Texas. The new building will help it expand its capacity for the production of radar sensors for Advanced Driver Assistance Systems (ADAS). The company plans to invest about €100 million in the plant over the next three years.

- In October 2019, Infineon Technologies AG added a new member to its automotive microcontroller family AURIX. TC3A may address new automotive 77 GHz radar applications, such as high-end corner radar systems for advanced driver assistance systems and automated driving.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Market Drivers

- 4.4.1 Rising awareness on worker safety & stringent regulations

- 4.4.2 Steady increase in industrial sector in key emerging countries in Asia-Pacific, coupled with expansion projects

- 4.5 Market Challenges

- 4.5.1 Recent outbreak of COVID-19 and marginal decline in spending in key verticals expected to pose a concern to manufacturers

- 4.6 Light Passenger Car and Robotic Vehicle Sales Statistics by Level of Autonomy ?

- 4.7 Key Industry Standards & Regulations

- 4.8 Technological Roadmap for Automotive Sensors (Radar, Camera & LiDAR)

- 4.9 Assessment of Impact of Covid-19 on the Industry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 LiDAR (Robotic Vehicles Vs. ADAS Vehicles)

- 5.1.2 Radar (Robotics Vehicles Vs. ADAS Vehicles)

- 5.1.3 Camera Modules (Robotics Vehicles Vs. ADAS Vehicles)

- 5.1.4 GNSS (Robotic Vehicles)

- 5.1.5 Inertial Measurement Units (Robotic Vehicles)

- 5.2 Geography

- 5.2.1 North America

- 5.2.2 Europe

- 5.2.3 Asia Pacific

- 5.2.4 Latin America

- 5.2.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Ranking for Top 3 Automotive LiDAR Suppliers

- 6.2 Vendor Ranking for Top 3 Automotive Image Sensor Suppliers

- 6.3 Vendor Ranking for Top 3 Automotive Radar Supplier

- 6.4 Company Profiles

- 6.4.1 Infineon Technologies AG

- 6.4.2 NXP Semiconductor N.V.

- 6.4.3 Ouster Inc.

- 6.4.4 Velodyne LiDAR Inc.

- 6.4.5 Luminar Technologies Inc.

- 6.4.6 Aurora Innovation Inc. (Incl. Blackmore)

- 6.4.7 Waymo LLC

- 6.4.8 Robert Bosch GmbH

- 6.4.9 Continental AG

- 6.4.10 Valeo SA

- 6.4.11 ON Semiconductor Corp

- 6.4.12 Omnivision Technologies Inc.

- 6.4.13 ST Microelectronics NV

- 6.4.14 Texas Instruments Incorporated