|

市场调查报告书

商品编码

1683440

欧洲电池能源储存系统係统:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Europe Battery Energy Storage System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

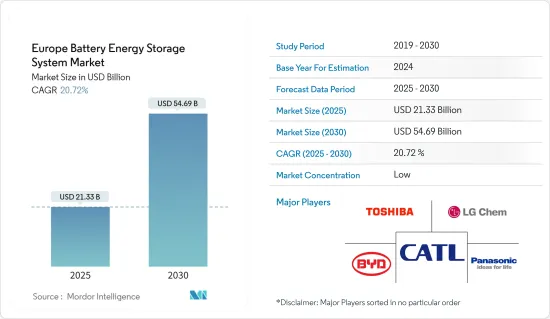

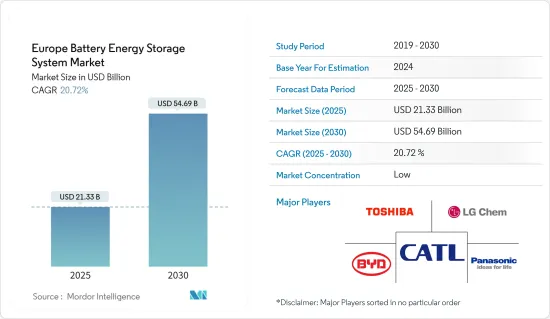

预计2025年欧洲电池能源储存系统市场规模为213.3亿美元,预计到2030年将达到546.9亿美元,预测期内(2025-2030年)的复合年增长率为20.72%。

主要亮点

- 从中期来看,可再生能源的采用增加和锂离子电池价格下降等因素预计将推动欧洲电池能源储存系统市场的发展。

- 然而,预计预测期内电池製造所用原材料的供需不匹配将抑制市场发展。

- 由于效率提高、生产规模扩大等技术改进,预计锂硫电池、固态电池等新一代电池将在 2030 年或 2035 年占据市场主导地位。预计这些电池方面的进步将在未来几年为欧洲电池能源储存市场创造许多机会。

- 由于能源需求的增加,德国是预测期内成长最快的市场。这一增长归因于该国投资的增加以及政府的支持政策。

欧洲电池能源储存系统係统市场趋势

预计锂离子电池将占市场主导地位。

- 锂离子 (Li-ion) 电池在充电和放电时的效率几乎为 100%,允许放入和取出相同数量的安培小时。与铅酸电池等其他技术相比,这种电池具有许多技术优势。可充电锂离子电池平均可提供超过 5,000 次循环。

- 锂离子电池可以多次充电,而且更稳定。此外,它们往往具有比其他二次电池更高的能量密度、电压容量和自放电率。这使得单一电池能够保持更长时间的电量,并且比其他类型的电池更节能。

- 此外,全球锂离子电池製造商都在致力于降低锂离子电池的成本。过去十年来,锂离子电池价格大幅下跌。

- 到2023年,锂离子电池组的价格将从上年的每千瓦时161多美元降至每千瓦时139美元。锂离子电池因其效率而受到全世界的认可,并成为最佳的能源储存设备。

- 近年来,规模化生产蓬勃发展,带动电池製造领域资本投入大幅增加,从而提高了锂离子电池组的效率并降低了成本。这一趋势凸显了全球对能源储存的强劲需求,这主要受到世界向可再生能源经济转型的推动,其中电动车发挥越来越重要的作用。

- 锂离子电池在电池能源储存系统储能係统。根据REPowerEU计划,该地区计划在2030年拥有1,236 GW的可再生能源发电容量。这也有望为电池能源储存系统係统创造商机。

- 在欧洲,到2050年将实现碳中和,可再生能源的引入量正在大幅增加。例如,2023年该地区将新增约5,590万千瓦太阳能光电发电容量和1,700万千瓦风电发电容量。太阳能、风能和地热等再生能源来源都使用锂离子电池作为能源储存系统。

- 欧洲各国正日益收紧补贴规定,以加速引进可再生能源。例如,2024 年 2 月,希腊政府启动了一项名为「屋顶光电」的计划,价值约 2.618 亿美元,用于津贴该国采用屋顶太阳能发电系统和电池储能係统。因此,这项财政措施可能会促进可再生能源计划中的电池能源储存系统的发展,并可能在预测期内有利于欧洲锂离子电池的销售。

- 同样,随着该地区可靠备用电源和主要电源的出现,独立电池能源储存系统係统计划也越来越受到关注。例如,2024年9月,环境能源部颁布了一项法令,确定了电池能源储存系统係统的运作功率配额。加上前两次竞标中获得的支持,总量达到 90 万千瓦,略低于最初的 1000 万千瓦的目标。在希腊,电池能源储存系统(BESS)的资本支出补贴上限为每兆瓦 215,900 美元。竞标的最高竞标上限为每年每兆瓦 156,528 美元。

- 锂离子电池的采用正在增加,主要是因为它们具有最节能的二次电池的特性。此外,由于其技术经济优势,锂离子电池正日益取代传统电池,其使用量也呈现上升趋势。

- 鑑于上述情况,预测期内锂离子电池很可能占据欧洲电池能源储存系统市场的主导地位。

德国可望主导市场

- 德国是欧洲乃至全球最大的能源储存市场之一。近年来,雄心勃勃的能源转型计划和到 2050 年将温室气体排放减少至少 80%(与 1990 年的水平相比)的目标推动了该国的能源储存市场的发展。该国还计划在2023年前逐步淘汰核能发电厂,并有望增加可再生能源开发,以弥补发电能力的下降。

- 近年来,德国能源储存市场蓬勃发展,这在很大程度上得益于该国雄心勃勃的能源转型计划「能源转型」。电池和其他储能技术的蓬勃发展预计将对德国的能源转型产生重大影响。

- 该国电池储存的主要驱动力是由于锂离子电池在消费性电子产品和其他应用中的广泛使用而导致其价格暴跌。过去五年来,德国的电池成本下降了一半以上,预计这一趋势将持续下去。

- 根据欧洲能源储存协会(EASE)的数据,到2030年欧洲将需要约187GW的能源储存,其中电池储能将占122GW。这意味着,德国等国家正在迅速开发电池储存解决方案,以确保能源供应,以克服俄乌战争引发的能源危机的后遗症。

- 此外,德国已开始采取气候变迁措施来抑制温室气体排放,政府要求在 2030 年将再生能源在能源结构中的比例提高到 50%,到 2050 年至少提高到 80%。因此,德国可能需要更多的电池能源储存系统係统来对抗间歇性并在尖峰时段储存多余的能源。

- 据德国政府贸易和投资机构GTAI称,到2031年,德国预计将安装25万个配备电池的光电系统。随着旧款太阳能光电发电的20年保证上网电价逐渐取消,改造安装可能会在预测期内推动德国住宅能源储存市场的发展。

- 在目标方面,德国的国家电池目标是2037年达到21-26 GW,2022年达到0.9 GW。此外,随着国家从煤炭转向再生能源来源,电池能源储存市场在未来几年将变得至关重要。

- 2023年,德国太阳能发电量将达61.2兆瓦时。从2012年到2021年,除了一些波动外,发电量增加了近30兆瓦时。德国是欧盟太阳能领域的主导者,2023 年其电力生产量位居所有成员国之首。

- 例如,2024年7月,法国能源巨头TotalEnergies SE启动了在德国安装100MW/200MWh电池能源储存系统(BESS)的计划。据该法国集团宣布,该计划预计将吸引约8,130万美元以上的投资。该电池将安装在北莱茵-威斯特法伦州的达勒姆,采用道达尔能源旗下电池子公司 ZAFT 的磷酸铁锂技术。商业营运预计于 2026 年下半年开始。

- 因此,这些政府措施可能会增加德国对能源储存系统的需求。

欧洲电池能源储存系统係统产业概况

欧洲电池能源储存系统係统市场较分散。该市场的主要企业(不分先后顺序)包括比亚迪股份有限公司、宁德时代新能源科技股份有限公司、LG 能源解决方案有限公司、松下控股株式会社和东芝。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第 2 章执行摘要

第三章调查方法

第四章 市场概况

- 介绍

- 2029 年市场规模与需求预测(美元)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 增加可再生能源的采用

- 锂离子电池成本下降

- 限制因素

- 转向其他能源储存系统

- 驱动程式

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 投资分析

第五章 市场区隔

- 电池类型

- 锂离子电池

- 铅酸电池

- 液流电池

- 其他电池类型

- 应用

- 住宅

- 商业和工业

- 实用工具

- 地区

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧国家

- 俄罗斯

- 土耳其

- 其他欧洲国家

第六章 竞争格局

- 合併、收购、合作及合资

- 主要企业策略

- 公司简介

- BYD Company Ltd.

- Tesla Inc

- Contemporary Amperex Technology Co Ltd.

- Panasonic Holdings Corporation

- Murata Manufacturing Co., Ltd.

- Leclanche SA

- LG Energy Solution Ltd.

- Samsung SDI Co Ltd.

- Toshiba Corporation

- Wartsila Oyj Abp

第七章 市场机会与未来趋势

- 电池技术的技术进步

简介目录

Product Code: 70501

The Europe Battery Energy Storage System Market size is estimated at USD 21.33 billion in 2025, and is expected to reach USD 54.69 billion by 2030, at a CAGR of 20.72% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as increase in adoption of renewable energy and declining lithium-ion battery prices are likely going to drive the European battery energy storage system market.

- On the other hand, the mismatch in the demand and supply of the raw materials used for battery manufacturing is expected to restrain the market during the forecast period.

- New generation batteries, such as lithium-sulfur and solid-state, due to technological improvements such as an increase in efficiency and production scale-up, are expected to take over the market by 2030 or 2035. These advancements in batteries are expected to create several opportunities for the European battery energy storage market in the future.

- Germany is the fastest-growing market during the forecast period due to the rising energy demand. This growth is attributed to increasing investments, coupled with supportive government policies in the country.

Europe Battery Energy Storage System Market Trends

Lithium-ion Segment Expected to Dominate the Market

- Lithium-ion (Li-ion) batteries are nearly 100% efficient in charge and discharge, allowing the same ampere-hours in and out. These batteries offer various technical advantages over other technologies, such as lead-acid batteries. Rechargeable Li-ion batteries, on average, offer cycles more than 5,000 times, compared to lead-acid batteries that last around 400-500 times.

- Li-ion batteries can be recharged numerous times and are more stable. Furthermore, they tend to have a higher energy density, voltage capacity, and lower self-discharge rate than other rechargeable batteries. This improves power efficiency as a single cell has longer charge retention than different battery types.

- Further, the global lithium-ion battery manufacturers are focusing on reducing the cost of Li-ion batteries. The price of lithium-ion batteries declined steeply over the past ten years.

- In 2023, the price of lithium-ion battery packs fell to USD 139 per kilowatt-hour, a decrease from over USD 161 per kilowatt-hour the previous year. Recognized globally for their efficiency, lithium-ion batteries stand out as premier energy storage devices.

- Recent years have witnessed a surge in large-scale production and significant capital investments in battery manufacturing, leading to enhanced efficiency and reduced costs for lithium-ion battery packs. This trend underscores a robust global demand for energy storage, largely driven by the world's pivot towards a renewable energy economy, with electric vehicles playing an ever-expanding role.

- Lithium-ion batteries have significance in battery storage systems as they are used in solar, wind, and other battery energy storage systems. As per the REPowerEU plan, the region has planned to bring total renewable energy generation capacities to 1,236 GW by 2030. This is expected to create opportunities for battery energy storage systems as well.

- Renewable energy installations are rising significantly in Europe, which has targeted becoming carbon neutral by 2050. For instance, the region installed around 55.9 GW of new solar capacity and 17 GW of wind capacity in 2023. Renewable energy sources such as solar, wind, geothermal, and others rely upon lithium-ion batteries for energy storage systems.

- European countries are increasingly raising the provisions for subsidies to accelerate renewable energy adoption. For instance, in February 2024, the government of Greece rolled out a program named "Photovoltaics on the Roof" worth about USD 261.8 million to subsidize the deployment of solar rooftops integrated with battery storage in the country. Hence, the fiscal measure is likely to uplift battery energy storage systems in renewable energy projects, which could benefit the sale of lithium-ion batteries in Europe in the forecast period.

- Likewise, the standalone battery energy storage system projects are also getting traction at the outset of the region's reliable backup power and prime power supply. For instance, in September 2024, The Ministry of Environment and Energy set a decree to determine the operating power quota of battery energy storage systems. Combined with the support granted in the initial two auctions, the total volume would hit 900 MW, falling slightly short of the initially targeted 1,000 MW. In Greece, capital expenditures (capex) grants on battery energy storage systems (BESS) are capped at USD 215,900 per MW. In the auction, the maximum bid is limited to USD 156,528 per MW annually.

- The adoption of Li-ion batteries has been increasing, primarily due to their property of being the most energetic rechargeable batteries available. In addition, the use of Li-ion batteries is increasing as they are replacing conventional batteries due to their techno-economic benefits.

- Hence, owing to the above points, the lithium-ion segment is likely to dominate the European battery energy storage system market during the forecast period.

Germany Expected to Dominate the Market

- Germany is one of the largest markets for energy storage in Europe and across the globe. The country's energy storage market has witnessed a significant boost in recent years owing to its ambitious energy transition projects and a target of reducing greenhouse gas emissions by at least 80% (compared to 1990 levels) up until 2050. The country also has planned to phase out nuclear power plants by 2023, which is expected to increase renewable energy development for compensating the reduced power-producing capacity.

- The energy storage market in Germany has experienced a massive boost in recent years, majorly due to the country's ambitious energy transition project "Energiewende." The boom of batteries and other storage technologies is expected to have a profound impact on Germany's energy transition.

- The primary driver of battery storage in the country is the sharp price decline in lithium-ion batteries due to their wide use in consumer electronics and other applications. In the last five years, battery costs have more than halved in the country, and this trend is expected to continue in the coming years.

- According to the European Association of Energy Storage (EASE), Europe requires about 187 GW of energy storage by 2030, wherein battery storage accounts for 122 GW of capacity. It signifies countries like Germany's rapid development of battery storage solutions to secure energy supplies to help overcome the after-effects of the Russia-Ukraine war-led energy crisis.

- Moreover, considering the onset of climate change commitments to curb greenhouse gas emissions in Germany, the government has mandated an increase in the share of renewables to 50% by 2030 and at least 80% by 2050 in the energy mix. This will likely necessitate further battery energy storage systems in Germany to counter the intermittency and store the excess energy during non-peak hours.

- According to German Trade and Invest (GTAI), by 2031, Germany will likely have 250,000 solar PVs with battery retrofit potential. Since the 20-year guaranteed feed-in tariff for old PV will phase out, the retrofit installations are likely to drive the residential energy storage market in Germany during the forecast period.

- On the target aspect, Germany's national battery storage target is 21 - 26 GW to be attained in 2037, which stood at 0.9 GW in 2022. Also, as the country moves forward to phase out coal and emphasize renewable energy sources, the battery energy storage market will be most important in the coming years.

- In 2023, Germany generated 61.2 terawatt hours of electricity from solar photovoltaics. From 2012 to 2021, production figures increased by nearly 30 terawatt hours, albeit with some fluctuations. As a dominant force in the EU's solar photovoltaic landscape, Germany led all member states in electricity production volume in 2023.

- For instance, in July 2024, the French energy giant TotalEnergies SE greenlit a project to install a 100-MW/200-MWh battery energy storage system (BESS) in Germany. As announced by the French group, the project is likely to see an investment exceeding about USD 81.3 million. The proposed battery, located in Dahlem, North Rhine-Westphalia, will utilize lithium-iron-phosphate technology from TotalEnergies' battery affiliate, Saft. It is slated to begin commercial operations in the latter half of 2026.

- Therefore, such government initiatives are likely to increase demand for energy storage systems in Germany.

Europe Battery Energy Storage System Industry Overview

The European battery energy storage system market is fragmented. Some of the key players in this market (in no particular order) include BYD Company Ltd., Contemporary Amperex Technology Co Ltd., LG Energy Solution Ltd., Panasonic Holdings Corporation, Toshiba Corp., and others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increase in Adoption of Renewable Energy

- 4.5.1.2 Declining Cost of Lithium Ion Battery

- 4.5.2 Restraints

- 4.5.2.1 Shift Towards Other Energy Storage Systems

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-ion Battery

- 5.1.2 Lead-acid Battery

- 5.1.3 Flow Battery

- 5.1.4 Other Battery Types

- 5.2 Application

- 5.2.1 Residential

- 5.2.2 Commercial and Industrial

- 5.2.3 Utility

- 5.3 Geography

- 5.3.1 Germany

- 5.3.2 United Kingdom

- 5.3.3 France

- 5.3.4 Italy

- 5.3.5 Spain

- 5.3.6 Nordic Countries

- 5.3.7 Russia

- 5.3.8 Turkey

- 5.3.9 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Collaboration and Joint Ventures

- 6.2 Strategies Adopted by Key Players

- 6.3 Company Profiles

- 6.3.1 BYD Company Ltd.

- 6.3.2 Tesla Inc

- 6.3.3 Contemporary Amperex Technology Co Ltd.

- 6.3.4 Panasonic Holdings Corporation

- 6.3.5 Murata Manufacturing Co., Ltd.

- 6.3.6 Leclanche SA

- 6.3.7 LG Energy Solution Ltd.

- 6.3.8 Samsung SDI Co Ltd.

- 6.3.9 Toshiba Corporation

- 6.3.10 Wartsila Oyj Abp

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancements in Battery Technology

02-2729-4219

+886-2-2729-4219