|

市场调查报告书

商品编码

1683444

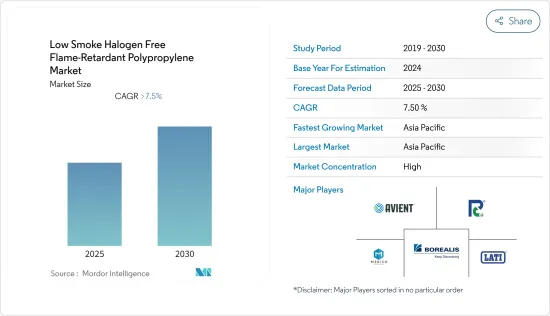

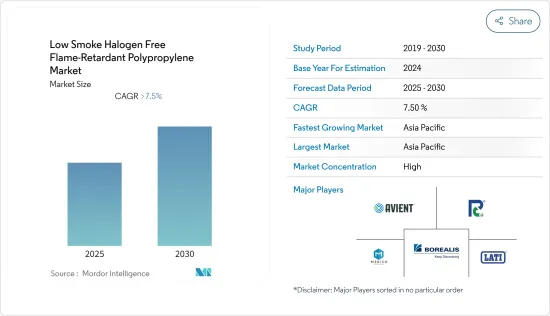

低烟阻燃聚丙烯市场:市场占有率分析、产业趋势、统计、成长预测(2025-2030 年)Low Smoke Halogen Free Flame-Retardant Polypropylene - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

预测期内,低烟、无卤、阻燃聚丙烯市场预计将以超过 7.5% 的复合年增长率成长。

2020 年,市场受到了 COVID-19 的不利影响。由于全部区域各国都致力于拉平感染曲线,COVID-19 疫情产生了重大影响,导致严重封锁,数百万人被困在家中,企业、生产和製造设施关闭,经济活动停止。美国、印度和巴西是受疫情影响最严重的国家,病例不断增加。建筑业遭受损失,并影响全球经济。这进一步扰乱了运输系统并影响了物资供应。许多建设公司成为金融危机的受害者,导致公司解雇了大量工人。总体而言,建筑业在疫情期间受到了严重影响。 COVID-19也扰乱了主要家用电子电器品牌的全球供应链。知名品牌零售店、展示室、超级市场、大卖场等都关闭了一段时间,影响了各类家用电子电器产品的销售。

关键亮点

- 从中期来看,预计电子产品和其他消费产品的需求成长将推动市场发展。

- 然而,汽车产量下降和 COVID-19 疫情造成的不利情况可能会阻碍所研究市场的成长。

- 在预测期内,对火灾健康和安全问题的日益关注可能为研究市场提供机会。

- 亚太地区占据全球主导地位,中国和印度等国家的消费量不断增加。

低烟、无卤、阻燃聚丙烯市场趋势

建筑和施工占据市场主导地位

- 建筑业是低烟、无卤、阻燃聚丙烯的主要终端用户产业。低烟阻燃聚丙烯(PP)聚合物已被证明具有很高的耐火性。无卤阻燃聚丙烯是一种环保材料,在建筑业中需求量大。

- 低烟、无卤、阻燃聚丙烯用于建筑领域的电缆护套应用。低烟卤阻燃PP广泛用于建筑业作为瓦楞纸板,也可作为广告看板材料。

- 监管规范加上商业建筑和公寓建设的高速成长正在推动市场需求。

- 欧洲是率先采用低烟阻燃材料作为产品安全标准的国家。从历史上看,欧洲产品安全标准着重于无卤素电缆设计,而美国设计则着重于阻燃性和电气性能的结合,并强调湿态电气性能。

- IEC 60332-1 标准适用于该地区大多数中型和大型设施,要求在大型集会附近安装的电缆必须采用 LSFRZH(低烟、阻燃、零卤素)护套。这推动了所研究市场的需求,尤其是在欧洲的业务应用方面。

- 考虑到上述因素,预计预测期内建筑业对低烟、无卤、阻燃聚丙烯的需求将快速成长。

亚太地区占市场主导地位

- 亚太地区对低烟、无卤、阻燃聚丙烯的需求近期显着成长,尤其是中国、韩国和印度等国家。

- 一般来说,电子产品和电缆长时间暴露在高温和高温下,火灾是一大威胁。为了克服这些问题,世界各地纷纷推出各种消防安全法规,因此各种消费品和电子产品对低烟、无卤、阻燃聚丙烯的需求大幅增加。

- 中国是世界上最大的电子设备製造基地。智慧型手机、电视、电线电缆、可携式运算设备、游戏系统和其他个人电子设备等电子产品在电子领域中成长最快。该国不仅满足国内电子产品需求,还将电子产品出口到其他国家。

- 预计到2025年,印度电子市场规模将达到4,000亿美元。预计到2025年,印度将成为全球第五大家用电子电器与消费性电子产业国。预计到2025年,印度数位经济规模将达到1兆美元,印度电子系统设计与製造(ESDM)产业预计将创造超过1,000亿美元的经济价值。

- 此外,在建筑领域,由于安全措施的加强,低烟阻燃聚丙烯在电缆、电线和瓦楞板等材料中的使用正在增加。

- 中国是全球最大的建筑市场,占全球建筑投资总额的20%。预计到 2030 年,中国将在建筑领域投资约 13 兆美元,为未来几年所研究的市场带来机会。

- 电动车的市场需求和清洁能源部长级(CEM)倡议,例如中国和印度等国家日益增长的电动车计划和热情,预计将在不久的将来推动低烟、无卤、阻燃聚丙烯的消费。

- 印度的电动车销量正在成长。根据印度电动车製造商协会的数据,2019-2020 年,印度电动车(不包括电动三轮车)销量成长了 20%,达到 156 万辆,其中两轮车销量最大。去年同期电动车销量为130万辆。

- 此外,中国政府计划在 2025 年引进至少 5,000 辆燃料电池电动车,到 2030 年引进 100 万辆。预计政府对电动、混合动力汽车和燃料电池电动车的推广将在预测期内推动市场研究。

- 总体而言,预计所研究市场终端用户产业的积极成长将在预测期内推动市场需求。

低烟阻燃聚丙烯产业概况

全球低烟阻燃聚丙烯市场呈现整合态势。主要企业包括Borealis AG、Avient Corporation、POLYROCKS CHEMICAL、LATI Industria Termoplastici SpA 和 MERICK POLYMERS。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 电子产品和其他消费品的需求不断增长

- 其他驱动因素

- 限制因素

- 汽车产量下降

- 新冠肺炎疫情造成的不利环境

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争程度

第五章 市场区隔

- 最终用户产业

- 汽车

- 建筑和施工

- 电气和电子

- 其他的

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作、协议

- 市场占有率(%)分析**/排名分析

- 主要企业策略

- 公司简介

- RTP Company

- MERICK POLYMERS CO. LTD

- POLYROCKS CHEMICAL CO. LTD

- Dongguan Hengjia Plastic Technology Co. Ltd

- LATI Industria Termoplastici SpA

- Kowa Kasei Co. Ltd

- Borealis AG

- Axipolymer Incorporation

- Avient Corporation

第七章 市场机会与未来趋势

- 对火灾健康和安全的关注度增加

The Low Smoke Halogen Free Flame-Retardant Polypropylene Market is expected to register a CAGR of greater than 7.5% during the forecast period.

The market was negatively affected by COVID-19 in 2020. COVID-19 pandemic majorly affected countries across the region focus on flattening the infection curve, resulting in severe lockdowns, confining millions of people in their homes, and shutting down businesses, production, and manufacturing facilities in no economic activity. The United States, India, and Brazil are the most affected countries as the number of COVID-19 cases increases. Construction industries gained nothing but losses, which left its impact on the world economy. It further disrupted the transportation system, which rippled its way into the supply of materials. Many construction companies went through a financial recession, resulting in companies laying off many of their workers. Overall, the construction industry was significantly impacted during the pandemic period. COVID-19 also disrupted the global supply chain of the major consumer electronic brands. Retail shops and showrooms of major brands, supermarkets, and hypermarkets, etc., were shut down for a definite period, affecting the sales of various consumer electronics products.

Key Highlights

- Over the medium term, growing demand from electronics and other consumer products, is expected to drive the market.

- However, declining automotive production and unfavorable conditions arising due to the COVID-19 pandemic are likely to hinder the growth of the studied market.

- The growing health and safety concerns regarding fire are likely to provide opportunities for the studied market, during the forecast period.

- Asia-Pacific region dominated across the world with increasing consumption from countries like China and India.

Low Smoke Halogen Free Flame Retardant Polypropylene Market Trends

Building and Construction to Dominate the Market

- Construction and building is a key end-user industry of the Low smoke halogen free flame-retardant polypropylene. Low-smoke halogen-free flame retardant polypropylene (PP) polymer offers high resistance to fire. Since, halogen-free flame retardant polypropylene possesses environment-friendly stuffs, its demand is significantly high in the construction industry.

- Low-smoke halogen-free flame retardant polypropylene are used for cable jacketing applications in building and construction sector. Low smoke halogen-based FR PP are extensively used as Corrugated Sheets in building & construction industry and are also used as materials for billboards.

- The regulatory standards combined high growth of the commercial and apartment building is driving the demand for the market.

- European region is the first to adopt the low smoke halogen free flame retardant materials owing to product safety standards. Historically European product safety standards have focused on the cable designs that exclude halogens in their designs while American designs are focused on combination of fire retardance and specific electrical performance, with a high degree of emphasis on wet electrical qualifications.

- IEC 60332-1 standard which applies to the majority of the medium and large-scale installation in the region requires LSFRZH (Low Smoke, Fire Retardant, Zero Halogen) jackets on cables installed near places where large number of people congregate. This had been driving the demand for the market studied especially in the Europe's commercial application.

- From the above-mentioned factors, the demand for low smoke halogen-free flame-retardant polypropylene from the building and construction industry is expected to rapidly grow over the forecast period.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific has seen substantial growth in the demand for low smoke halogen-free flame-retardant polypropylene in the recent past, especially from countries such as China, South Korea, and India.

- In general, fire has been a major threat to the electronic products and cables, as they are continuously exposed to heat and temperature for a long time. To overcome these issues, various fire safety regulations are introduced across the globe, and hence, the demand for low smoke halogen-free flame-retardant polypropylene in various consumer and electronic products is widely increasing.

- China has the world's largest electronics production base. Electronic products, such as smartphones, TVs, wires, cables, portable computing devices, gaming systems, and other personal electronic devices, recorded the highest growth in the electronics segment. The country serves not only domestic demand for electronics but also exports electronic output to other countries.

- The Indian electronics market is expected to reach USD 400 billion by 2025. India is expected to become the fifth-largest consumer electronics and appliances industry in the world by 2025. India is expected to have a digital economy of USD 1 trillion by 2025 and India's Electronics System Design and Manufacturing (ESDM) sector is expected to generate over USD100 billion in economic value by 2025.

- Moreover, in the building and construction Low Smoke Halogen Free Flame Retardant Polypropylene application is increasing in the cables, wires and other materials such as corrugated sheets etc. owing to the growing safety measurements.

- China has the largest construction market in the world, encompassing 20% of all construction investments, globally. China is expected to spend nearly USD 13 trillion on buildings by 2030 creating an opportunity for the market studied in the coming years

- The market demand for electric cars and policies under Clean Energy Ministerial (CEM) in countries like China and India, such as the initiative on electric vehicles and increasing enthusiasm for electric vehicles, are expected to push low smoke halogen-free flame retardant polypropylene consumption in near future.

- In India, the sales of electric vehicles have been rising. According to society of manufacturers of Electric Vehicles, Electric vehicles sales, (excluding e-rickshaws) in India grew by 20 per cent at 1.56 lakh units in 2019-20 driven by two-wheelers. In the same period of previous years, the EV sales stood at 1.3 lakh units.

- Furthermore, the Chinese government is planning to have a minimum of 5,000 fuel cell electric vehicles by 2025 and 1 million by 2030. With the government promoting the use of electric, hybrid, and fuel cell electric vehicles is expected to drive the market studied during the forecast period.

- Overall, such positive growth in the end user industries of the market studied is expected to drive the market demand during the forecast period.

Low Smoke Halogen Free Flame Retardant Polypropylene Industry Overview

The global low smoke halogen free flame-retardant polypropylene market is consolidated in nature. Some of the major companies are Borealis AG, Avient Corporation, POLYROCKS CHEMICAL CO., LTD., LATI Industria Termoplastici S.p.A., MERICK POLYMERS CO.,LTD., amongst others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from Electronics and Other Consumer Products

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 Decline in Automotive Production

- 4.2.2 Unfavorable Conditions Arising due to the COVID-19 Pandemic

- 4.2.3 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 End-user Industry

- 5.1.1 Automotive

- 5.1.2 Building and Construction

- 5.1.3 Electrical and Electronics

- 5.1.4 Other End-user Industries

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 Italy

- 5.2.3.4 France

- 5.2.3.5 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 South Africa

- 5.2.5.3 Rest of Middle-East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 RTP Company

- 6.4.2 MERICK POLYMERS CO. LTD

- 6.4.3 POLYROCKS CHEMICAL CO. LTD

- 6.4.4 Dongguan Hengjia Plastic Technology Co. Ltd

- 6.4.5 LATI Industria Termoplastici SpA

- 6.4.6 Kowa Kasei Co. Ltd

- 6.4.7 Borealis AG

- 6.4.8 Axipolymer Incorporation

- 6.4.9 Avient Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing health and Safety Concern Regarding Fire