|

市场调查报告书

商品编码

1683447

微型热电联产 (CHP) 市场 -市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Micro Combined Heat & Power (CHP) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

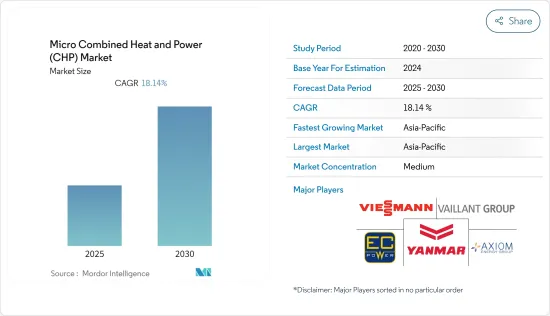

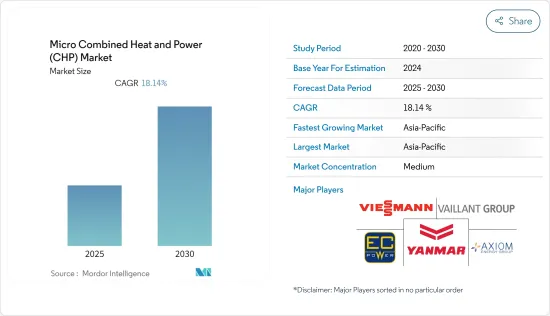

预测期内,微型热电联产市场预计将实现 18.14% 的复合年增长率

关键亮点

- 住宅市场占有率,并在预测期内继续主导市场成长

- 微型热电联产系统的技术进步很可能在不久的将来为市场成长创造机会。例如,2021 年 9 月,领先的微型热电联产系统开发商和製造商 Alkaline Fuel Cell Power Corp. (AFCP) 宣布计划与 Gaskatel GmbH 开始测试下一代发电机组。该合作伙伴目前正致力于部署采用氢动力碱性燃料电池技术的微型热电联产系统。

- 预测期内,亚太地区可能主导市场,大部分需求来自日本和中国。

微型热电联产市场趋势

住宅市场预计将占据市场主导地位

- 微型热电联产系统由于体积小,对于家庭等能源需求相对较低的领域来说是有效的解决方案。这些系统还减少燃料使用,从而降低排放并节省成本。小型微型热电联产系统具有较高的容量係数(高达 95%)。它可以使用天然气、液化石油气(LPG)和石油等传统燃料。它还可以与沼气、可再生天然气 (RNG)、氢气和生物柴油等低碳燃料相结合。

- 此外,住宅微型热电联产提供了本地能源来源,为那些容易受到电网中断或严重自然灾害造成的停电影响的偏远家庭和社区增加了额外的復原力。

- 住宅微型热电联产系统的主要优点之一是其所需空间较小。这些系统的尺寸和形式与标准住宅锅炉系统相似,因此可以壁挂或落地安装。此外,虽然住宅微型热电联产系统的初始资本支出高于类似规模的蒸气锅炉系统,但安装微型热电联产的过程和成本相似。此外,儘管微型热电联产系统的维护需要熟练的专业人员,但维护和服务成本与标准锅炉相当。

- 微型热电联产系统在欧洲和日本等冬季寒冷的高所得国家最为成功,因为用于供暖的天然气基础设施已经存在。相较之下,加拿大、美国和中国等其他国家近年来市场发展较为温和,住宅规模的先导计画很少。

- 此外,在美国,还有多种联邦和州一级的奖励,包括补贴和税额扣抵,除了净计量计划外,住宅微型热电联产用户可能有资格获得各种政府计划的融资。儘管该国住宅微型热电联产系统的采用有限,但该领域仍有巨大的潜力。住宅部门包括1.22亿户家庭,消耗了全国总能源消耗的21%。此外,由于大多数家庭依靠传统锅炉和电网等传统系统来获取能源,微型热电联产系统是一种经济、高效且有弹性的替代方案。

- 因此,鑑于上述情况,预计住宅部门将在预测期内主导微型热电联产 (CHP) 市场。

亚太地区可望主导市场

- 亚太地区是全球最大的微型热电联产市场,预计在预测期内仍将保持主导地位。该地区的微型热电联产市场主要由日本和中国、韩国等一些新兴国家主导。

- 在日本,基于燃料电池的微型热电联产因其节能、能源供应可靠等特点,已成为酒店、公共建筑、医院和研究机构等住宅和商业领域广泛青睐的热电联产方式。 Ene-Farm 计画于 2009 年开始销售微型热电联产,这是一项开创性的倡议。

- 除了向离网发电的转变之外,政府的优惠政策也是该国采用微型热电联产的主要驱动力。外商直接投资和《新能源特别措施法》的实施,加速了日本热电联产市场的成长。此外,日本东部大地震和福岛核电事故发生后,日本政府正在推广工业热电联产系统,作为一种更安全、更具成本效益的发电方式。因此,这些是推动日本微型热电联产市场的关键因素。

- 日本于 2015 年实施了最成功的燃料电池商业化计画之一,即 Ene-Farm 计画。截至 2019 年,该计划已部署了约 306,000 个基于燃料电池的微型热电联产系统,其中约 90% 在住宅领域。每个系统的最大容量为5kW。韩国计划在2030年安装约530万个此类住宅系统。

- 与日本一样,韩国也是最早采用以燃料电池为基础的微型热电联产的国家。自那时起,在政府优惠政策的支持下,住宅热电联产持续成长,早在 2012 年就安装了约 350 台微型热电联产装置。

- 根据韩国政府2019年发布的氢经济蓝图,韩国计划在2040年生产约210万千瓦的家用和建筑微型燃料电池,预计这将在预测期内显着推动所研究的市场。

- 因此,鑑于上述情况,预计亚太地区将在预测期内主导微型热电联产 (CHP) 市场。

微型热电联产产业概况

微型热电联产市场中等程度细分。市场的主要企业包括 Vaillant Group、Viessmann Group、Yanmar Holdings、EC Power A/S 和 Axiom Energy Group, LLC。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第 2 章执行摘要

第三章调查方法

第四章 市场概况

- 介绍

- 2027 年市场规模及需求预测(十亿美元)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 限制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场区隔

- 燃料类型

- 天然气

- 沼气

- 其他燃料类型

- 应用

- 住宅

- 商务用

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 南美洲

- 中东和非洲

第六章 竞争格局

- 併购、合资、合作、协议

- 主要企业策略

- 公司简介

- Navien Inc

- Biomass Engineering Limited

- Qnergy

- Enexor Bioenergy

- Helbio SA

- Enginuity Power Systems

- GRIDIRON LLC

- Vaillant Group

- Viessmann Group

- Yanmar Holdings Co Ltd

- ATCO Ltd

- EC Power A/S

- TEDOM AS

- 2G Energy Inc.

- Remeha

- Axiom Energy Group, LLC.

- SOLIDpower Group

第七章 市场机会与未来趋势

简介目录

Product Code: 71066

The Micro Combined Heat & Power Market is expected to register a CAGR of 18.14% during the forecast period.

Key Highlights

- Residential segment held the largest share of the market in 2021, and is expected to dominate the market growth during the forecast period.

- Technological advancements of micro CHP systems would create an opportunity for the market to grow in the near future. For instance, in September 2021, Alkaline Fuel Cell Power Corp.(AFCP), a leading developer and manufacturer of micro-CHP systems, announced plans to commence testing of next-generation power units with Gaskatel GmbH. The collaboration is currently doing efforts to introduce micro-CHP systems based on alkaline fuel cell technology powered by hydrogen.

- Asia-Pacific is likely to dominate the market during the forecast period, with the majority of the demand coming from the Japan and China.

Micro Combined Heat and Power Market Trends

Residential Segment Expected to Dominate the Market

- Due to the smaller size of micro-CHP systems, they provide an effective solution for sectors with relatively lower energy demands, such as domestic households. These systems also can reduce fuel usage, which leads to lower emissions and reduced costs. Smaller micro-CHP systems have high capacity factors (less than or equal to 95%). They can be powered by traditional fuels such as natural gas, liquified petroleum gas (LPG), or oil. They can also be integrated with low-carbon fuels like biogas, renewable natural gas (RNG), hydrogen, or biodiesel.

- Moreover, residential micro-CHP provides a local energy source, which provides an additional layer of resiliency for remote households and communities susceptible to power loss due to grid outages or severe natural disasters.

- One of the main advantages of micro-CHP systems for residential applications is the low space requirement, as these systems are of a similar size and shape to a standard residential boiler system, they can be wall-mounted or placed on the floor. Moreover, though the initial capital outlay for a residential micro-CHP system is greater than that of a similarly-sized steam boiler system, the process and costs of micro-CHP installation are similar. Additionally, maintenance and service costs are equivalent to standard boilers, although the maintenance of micro-CHP systems requires skilled specialists.

- Due to existing natural gas infrastructure for heating, micro-CHP systems have been most successful in high-income countries with cold winters, such as Europe and Japan. In contrast, the market is being driven moderately in other countries such as Canada, the United States, and China over the past few years owing to few pilot projects at residential scale.

- Moreover, United States also offers several federal and state-level incentives in the form of grants, and tax credits, and are eligible for receiving financing from various governmental schemes, in addition to net metering policies for residential micro-CHP users. Though the deployment of residential micro-CHP systems in the country has been limited, the sector has considerable potential. The residential sector consists of 122 million households that require 21% of the nation's total energy consumption. Moreover, as most families depend on traditional systems such as conventional boilers and the grid for their energy, and micro-CHP systems provide an economical, efficient, and resilient alternative.

- Therefore, owing to the above points, residential sector is expected to dominate the micro combined heat & power (CHP) market during the forecast period.

Asia-Pacific Expected to Dominate the Market

- Asia-Pacific is the largest market for micro CHP in the world and is expected to maintain its dominance during the forecast period as well. The region's micro-CHP market is mainly dominated by Japan and few emerging countries, such as China, and South Korea.

- In Japan, fuel cell-based micro-CHP have become a widely preferred form of heat and electricity generation in residential and commercial segments, such as hotels, public facilities, hospitals, Institutions, to incur power savings and for reliable energy supply. The sales of micro-CHP by Ene-Farm program began in 2009 in the country, much ahead of the rest of the world.

- Apart from a shift towards grid-independent power generation, favorable government policies are also a major driver for the adoption of micro-CHP in the country. Foreign Direct Investments and special measure laws for new energy use were implemented to fasten the growth of the CHP market in Japan. Also, in the wake of the Tohoku earthquake and Fukushima nuclear crisis, the Japanese government is promoting the industrial CHP system as safer and cost-effective electricity generation. Hence, these are the major factors driving the micro-CHP market in the country.

- Japan implemented one of the most successful fuel cell commercialization programs, the Ene-farm program, in 2015. As of 2019, the program led to the deployment of about 306,000 fuel cell-based micro-CHP systems, of which around 90% were in the residential sector. Each system has up to 5 kW of capacity. The country plans to deploy about 5.3 million of these residential units by 2030.

- South Korea has also been an early adopter of fuel cell-based micro-CHP, just like Japan. Residential CHPs were being installed in the country as early as 2012 when around 350 micro-CHPs were installed and have continued to grow since then, supported by favorable government policies.

- According to the South Korean government's Hydrogen Economy Roadmap announced in 2019, South Korea plans to produce around 2.1 GW of micro fuel cells for households and buildings by 2040, which is expected to significantly drive the market being studied during the forecast period.

- Therefore, owing to the above points, Asia-Pacific is expected to dominate the micro combined heat and power (CHP) market during the forecast period.

Micro Combined Heat and Power Industry Overview

The micro CHP market is moderately fragmented. Some of the key players in the market include Vaillant Group, Viessmann Group, Yanmar Holdings Co. Ltd, EC Power A/S, and Axiom Energy Group, LLC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Fuel Type

- 5.1.1 Natural Gas

- 5.1.2 Biogas

- 5.1.3 Other Fuel Types

- 5.2 Application

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 South America

- 5.3.5 Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Navien Inc

- 6.3.2 Biomass Engineering Limited

- 6.3.3 Qnergy

- 6.3.4 Enexor Bioenergy

- 6.3.5 Helbio S.A.

- 6.3.6 Enginuity Power Systems

- 6.3.7 GRIDIRON LLC

- 6.3.8 Vaillant Group

- 6.3.9 Viessmann Group

- 6.3.10 Yanmar Holdings Co Ltd

- 6.3.11 ATCO Ltd

- 6.3.12 EC Power A/S

- 6.3.13 TEDOM A.S

- 6.3.14 2G Energy Inc.

- 6.3.15 Remeha

- 6.3.16 Axiom Energy Group, LLC.

- 6.3.17 SOLIDpower Group

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219