|

市场调查报告书

商品编码

1683448

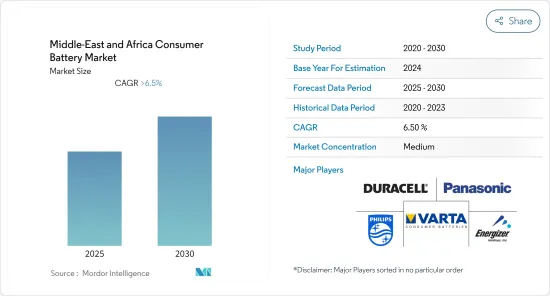

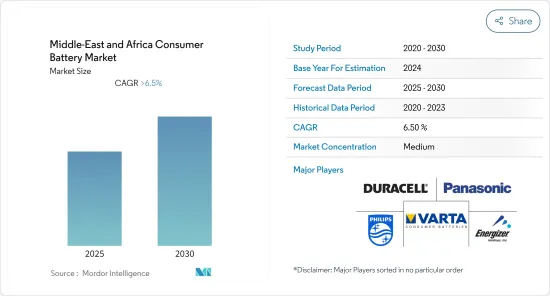

中东和非洲消费电池市场:市场占有率分析、行业趋势和成长预测(2025-2030 年)Middle-East and Africa Consumer Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

预测期内,中东和非洲消费电池市场预计将以超过 6.5% 的复合年增长率成长

关键亮点

- 预计预测期内锂离子电池(LIB)市场将显着成长,因为它具有高电极电位、高充电容量和良好的容量重量比。

- 医疗产业正专注于设计侵入性较小、更适合家庭使用的技术,从而导致对氧气浓缩机和人工呼吸器等小型设备的需求增加。这预计将为消费电池製造商创造市场机会。

- 由于沙乌地阿拉伯人口多元化以及智慧型手机等家用电子电器的购买量,预计该国将主导市场。

中东和非洲消费电池市场趋势

锂离子电池:预计将大幅成长

- 锂离子电池的独特性能为许多家用电子电器设备提供动力,每年生产数十亿块。从历史上看,锂市场一直受到电池需求(尤其是家用电子电器需求)的驱动。

- 锂离子电池的价格通常高于其他电池。然而,锂离子电池市场的领导者正在投资研发活动,以获得规模经济并提高锂离子电池的性能和价格。

- 锂离子电池广泛用于各种消费产品,包括智慧型手机、穿戴式装置、笔记型电脑、数位相机、遥控器和游戏机。

- 锂离子电池更安全、电池组更大、并且比其他替代品的长期使用更经济。

- 锂离子电池还具有较长的电池寿命,因为在不使用时它们具有较低的自放电率。这就是为什么锂离子电池广泛受到便携式电子设备青睐的原因。

- 此外,该地区的许多市场参与企业正将重点转向锂离子等二次电池。因此,未来几年,一次锂电池和可充电电池将继续被各种家用电子电器产品所采用。

- 此外,该地区的经济成长预计将促进设备销售并推动所研究的市场发展。依赖电池的可携式家用电子电器(如数位相机、音乐参与企业、遥控器等)的增加预计将推动对消费电池的需求。阿拉伯联合大公国和沙乌地阿拉伯等国家是所研究市场中消费电池的主要热点。这背后主要因素是该国庞大的人口和消费支出。

- 因此,鑑于上述情况,预计预测期内锂离子电池在中东和非洲将显着成长。

沙乌地阿拉伯可望主导市场

- 沙乌地阿拉伯是中东地区最强大和最大的经济体之一。沙乌地阿拉伯是旅游业的巨大吸引力,拥有包括豪华酒店和餐厅在内的庞大的酒店业。这些饭店和休閒设施为顾客提供各种奢侈品,如电视、空调、音乐系统、电玩游戏和其他使用消费电池的电器产品。在疫情爆发之前,该国的酒店业已经连续几年呈现成长趋势,为消费电池创造了巨大的市场。

- 此外,由于即将上马的大型计划,商业部门最近也出现了成长,预计这种状况将在预测期内持续下去。例如,2021 年正在进行的奇迪亚城 (Qiddiya City) 开发案将成为沙乌地阿拉伯的娱乐、体育和艺术中心。该计划预计将于 2023 年完工,将包括建造多间酒店和旅馆,可居住5,000 人。这座城市的形成预计将增加对电池的需求。

- 该国的住宅产业是手錶、电玩游戏、手电筒等产品中使用的消费电池的重要终端用户。该国拥有一个住宅扩建工厂,该工厂推出了多个与新区开发相关的计划。

- 例如,2017年该国推出了NEOM城市计划。 NEOM 有可能为全球超过一百万居民提供住房和职场。其中包括城镇、港口、企业区、研究中心、体育和娱乐场所以及旅游目的地。 2025年城市发展后,新住宅预计对消费电池的需求将会增加。

- 基于以上所有原因,沙乌地阿拉伯预计将主导中东和非洲的消费电池市场。

中东和非洲消费电池产业概况

中东和非洲消费电池市场适度细分。该市场的主要企业包括松下公司、瓦尔塔消费电池有限公司、荷兰皇家飞利浦公司、劲量控股公司和金霸王公司。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第二章调查方法

第三章执行摘要

第四章 市场概况

- 介绍

- 2027 年市场规模及需求预测(十亿美元)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 限制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场区隔

- 技术类型

- 锂离子电池

- 碱性电池

- 锌碳电池

- 其他的

- 地区

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 伊朗

- 南非

- 埃及

- 其他中东和非洲地区

第六章 竞争格局

- 併购、合资、合作、协议

- 主要企业策略

- 公司简介

- Panasonic Corporation

- VARTA Consumer Batteries GmbH & Co. KGaA

- Electrocomponents PLC

- Anker Innovations Technology Co. Ltd

- Energizer Holdings Inc.

- Duracell Inc.

- GP Batteries International Limited

- Camelion Battery Co. Ltd

- Koninklijke Philips NV

第七章 市场机会与未来趋势

简介目录

Product Code: 71200

The Middle-East and Africa Consumer Battery Market is expected to register a CAGR of greater than 6.5% during the forecast period.

Key Highlights

- The lithium-ion battery (LIB) is expected to witness significant growth in the market during the forecast period due to its high electrode potential, high charge, and favorable capacity-to-weight ratio.

- The healthcare industry is focusing on designing technology that is less intrusive and more portable for home use, which has led to an increase in demand for smaller devices, such as oxygen concentrators, ventilators, etc. This, in turn, is expected to create market opportunities for consumer battery manufacturers.

- The Saudi Arabia is expected to dominate the market, owing to its purchase of consumer electronics, including smartphones and the diverse population of the country.

MEA Consumer Battery Market Trends

Lithium-ion Battery Expected to Witness Significant Growth

- The unique properties have made lithium-ion batteries the power sources for many consumer electronics manufacturers, with a production of the order of billions of units per year. Historically, the lithium market has been driven by battery demand - particularly from consumer electronics.

- The price of LIB is usually high, as compared to other batteries. However, leading players in the market have been investing, in order to gain economies of scale and in R&D activities, to improve LIB's performance and price.

- Lithium-ion batteries find application in a wide range of consumer goods, like smartphones, wearables, laptops, digital cameras, remote controls, and gaming devices.

- Lithium-ion batteries are safer and have higher capacity power packs and are more economical than other alternatives for long-term use.

- Also, Li-ion batteries have a low self-discharge rate when not in use, which ensures a long battery life. Therefore, li-ion batteries are widely preferred for portable consumer electronic devices.

- In addition, most market participants in the region have shifted their focus to rechargeable batteries, such as lithium-ion. As a result, primary lithium batteries and rechargeable batteries are being adopted for various consumer electronics applications in the coming years.

- Further, the growing economies in the region are likely to foster the sales of devices and are expected to drive the market being studied. The increasing number of portable consumer electronic devices that rely on batteries, such as digital cameras, music players, and remote controls, is expected to drive the demand for consumer batteries. Countries such as United Arab Emirates and Saudi Arabia are the major hotspot for consumer batteries in the market studied. The primary factor attributing to this is the high population and consumer spending in the country.

- Therefore, owing to the above points, lithium-ion batteries are expected to witness a significant growth in Middle-East and Africa region during the forecast period.

Saudi Arabia Expected to Dominate the Market

- Saudi Arabia is one of the strongest and largest economies in the Middle-Eastern region. The country is a huge attraction for travel and tourism because of which it has a huge hospitality sector, which includes lavish hotels and restaurants. These hotels and other recreational places mostly provide their customer with all the luxuries including electrical equipment, such as TVs, air conditioners, music systems, video games, and several other appliances that use consumer batteries in every rooms. Before the pandemic, the country's hospitality sector was on the rise for several years and generated a significant market for the consumer batteries.

- Furthermore, the commercial sector has been growing over the recent past with major upcoming projects, and the scenario is expected to continue over the forecast period. For instance, in 2021, the country is developing Qiddiya City, which is being represented to be a capital of entertainment, sports and the arts in Saudi Arabia. The project is expected to completed by 2023, and includes the construction of several hotels, inns, and has 5000 residency capacities. The formation of the city is expected to increase the demand for batteries.

- The country's residential sector is a significant end-user for consumer battery that are used in watches, video games, flashlights, etc. The country has its plants to expanding its residential area fro which in launched several projects related to developing new area.

- For instance, in 2017, the country launched its NEOM city project. NEOM is likely to provide home and workplace to more than a million residents from around the world. It includes towns and cities, ports and enterprise zones, research centers, sports and entertainment venues, and tourist destinations. The city after its development in 2025, is expected to increase the demand for consumer battery in the new residential areas.

- Therefore, owing to the above points, Saudi Arabia is anticipated to dominate the consumer battery market in the Middle-East and Africa region.

MEA Consumer Battery Industry Overview

The Middle-East and Africa consumer battery market is moderately fragmented. Some of the key players in this market Panasonic Corporation, VARTA Consumer Batteries GmbH & Co. KGaA, Koninklijke Philips N.V., Energizer Holdings Inc., and Duracell Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Technology Type

- 5.1.1 Lithium-ion Batteries

- 5.1.2 Alkaline Batteries

- 5.1.3 Zinc-Carbon Batteries

- 5.1.4 Others

- 5.2 Geography

- 5.2.1 Saudi Arabia

- 5.2.2 The United Arab Emirates

- 5.2.3 Iran

- 5.2.4 South Africa

- 5.2.5 Egypt

- 5.2.6 Rest of Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Panasonic Corporation

- 6.3.2 VARTA Consumer Batteries GmbH & Co. KGaA

- 6.3.3 Electrocomponents PLC

- 6.3.4 Anker Innovations Technology Co. Ltd

- 6.3.5 Energizer Holdings Inc.

- 6.3.6 Duracell Inc.

- 6.3.7 GP Batteries International Limited

- 6.3.8 Camelion Battery Co. Ltd

- 6.3.9 Koninklijke Philips N.V.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219