|

市场调查报告书

商品编码

1683453

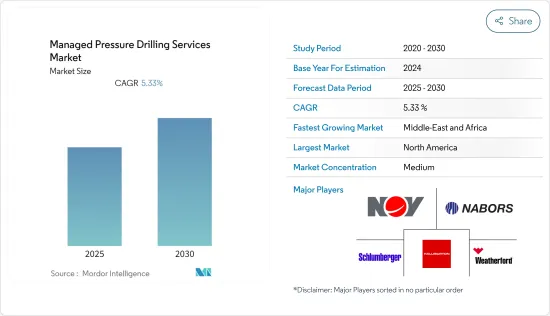

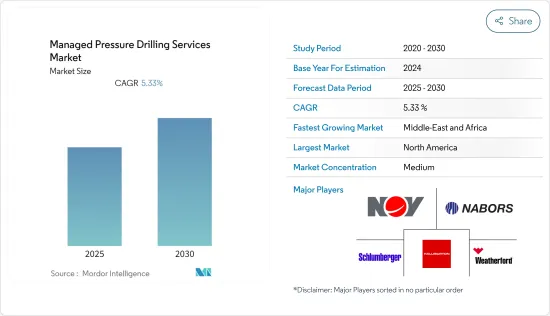

控制压力钻井服务市场 -市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Managed Pressure Drilling Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

预测期内,管理压力钻井服务市场预计将达到 5.33% 的复合年增长率

关键亮点

- 在预测期内,恆定井底压力预计将成为管理压力钻井服务的最大市场。

- 控制压力钻井技术新兴市场的发展加上工业 4.0 的采用预计将在不久的将来为市场参与企业创造新的机会。

- 由于页岩气的繁荣和生产活动的增加,北美预计将主导控制压力钻井服务市场。

控制压力钻井服务市场的趋势

恆定井底压力技术占市场主导地位

- 预计在预测期内,恆定井底压力部分将占据最大的市场占有率。这一增长的动力源于该技术在美国、墨西哥湾以及世界其他地区海上钻井中的广泛应用。

- 恆定井底压力(CBHP)是最广泛使用的控压钻井(MPD)技术之一。此技术的主要原理是在孔隙水压力梯度与破裂压力梯度之间的窗口相对于储存泥浆的等效循环密度(ECD)较窄(0.5-1.5 ppg)且储存渗透率较高的储层中钻井时保持恆定的BHP。

- 由于资金投入较大,该技术主要在生产能力较高的大型海上油田采用。因此,预计墨西哥湾、西非近海(尼日尔Delta)、巴西近海、中东和东南亚等地区对这项技术的需求将会成长。

- 该技术也用于克服其他操作挑战,如高压程序以及由于循环损失和地层气体流入而浪费的非生产时间。

- 因此,基于上述因素,预计恆定井底压力部分将在预测期内主导 MPD 市场。

北美占据市场主导地位

- 北美是世界主要油气生产国之一,2020 年其天然气产量位居世界第一,石油产量位居世界第二,主要受美国和加拿大油气活动的推动。

- 该地区页岩气的开发也是控压钻井市场的最大驱动力之一。非常规井的钻井条件艰苦,只有采用控压钻井等专门技术才能有效率地钻井。

- 根据美国能源资讯署 (EIA) 的数据,预计 2020 年美国干页岩气产量约 26 兆立方英尺 (Tcf),约占 2020 年美国干天然气总产量的 78%。此外,EIA 估计,到 2050 年,美国页岩气緻密油产量可能达到 33.94 兆立方英尺,在 2020 年至 2050 年期间每年稳定成长 1.28%。

- 同时,緻密气和页岩气预计将在加拿大天然气产量中占据越来越大的份额。根据加拿大能源监管机构预测,到2035年,緻密气和页岩气总产量预计将占加拿大天然气产量的80%。

- 除页岩气外,该地区的海上钻井活动也显着增加。 2020年1月,加拿大政府核准了必和必拓、Equinor和雪佛龙计画在大西洋的三个海上钻井计划。

- 因此,由于上述因素,预计北美将在预测期内主导压力钻井服务市场。

控压钻井服务业概况

控制压力钻井服务市场适度细分。该市场的主要企业包括哈里伯顿公司、威德福国际有限公司、斯伦贝谢有限公司、国民油井华高公司和纳博斯工业有限公司。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第 2 章执行摘要

第三章调查方法

第四章 市场概况

- 介绍

- 2027 年市场规模及需求预测(十亿美元)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 限制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场区隔

- 应用

- 陆上

- 海上

- 科技

- 井底恆压

- 泥浆帽钻井

- 双梯度钻井

- 控流钻井

- 地区

- 北美洲

- 亚太地区

- 欧洲

- 中东和非洲

- 南美洲

第六章 竞争格局

- 併购、合资、合作、协议

- 主要企业策略

- 公司简介

- Halliburton Company

- Weatherford International PLC

- Schlumberger Limited

- NOV Inc.

- Nabors Industries Ltd

- Global MPD Services

- Ensign Energy Services Inc

- Air Drilling Associates Inc.

- Blade Energy Partners. Ltd

- Exceed(XCD)Holdings Ltd

- Pruitt MPD

- Beyond Energy Services and Technology Corp.

第七章 市场机会与未来趋势

简介目录

Product Code: 71484

The Managed Pressure Drilling Services Market is expected to register a CAGR of 5.33% during the forecast period.

Key Highlights

- The constant bottom hole pressure is expected to be the largest market for managed pressure drilling services during the forecast period.

- Technological developments in managed pressure drilling techniques coupled with the adoption of industry 4.0 is expected to create new opportunities for the market players in the near future.

- North America is expected to dominate the managed pressure drilling services market owing to the shale gas boom and increasing production activities.

Managed Pressure Drilling Services Market Trends

Constant Bottom Hole Pressure Technology to Dominate the Market

- The constant bottom hole pressure segment is expected to have the largest market share during the forecast period. This growth is attributed to extensive utilization of the technology for drilling offshore wells across the United States, Gulf of Mexico as well as in other regions globally.

- Constant Bottom Hole Pressure (CBHP) is one the most widely-used managed pressure drilling (MPD) techniques. The main principle of the technology is maintaining a constant BHP during drilling in reservoirs where there is a narrow window between the pore pressure gradient and the fracture pressure gradient (0.5 -1.5 ppg) for the Equivalent Circulating Density (ECD) of the drilling mud, and the reservoir permeability is high.

- Due to the high capital investment, this technology is primarily employed in massive offshore fields with high production capacities. Hence, the demand for the technology is expected to rise in regions such as the Gulf of Mexico, Offshore West Africa (Niger Delta), Brazil Offshore, the Middle-East and South-East Asia.

- The technology is also used to overcome other operational challenges such as non-productive time is wasted by lost circulation or gas influxes in the high-pressure procedures and formations.

- Therefore, based on the above-mentioned factors, the constant bottom hole pressure segment is expected to dominate the MPD market over the forecast period.

North America to Dominate the Market

- With the highest natural gas production and second highest oil production in 2020, North America is one of the major oil and gas producers in the world, which is mainly driven by the oil and gas activities in the United States and Canada.

- Development of shale gas in this region is also one of the biggest driver for the managed pressure drilling market, since unconventional wells have extreme drilling conditions which can be done efficiently only with special techniques such as managed pressure drilling.

- According to the United States Energy Information Administration (EIA), in 2020, United States dry shale gas production was estimated about 26 trillion cubic feet (Tcf), which is equal to about 78% of the country's total dry natural gas production in 2020. Furthermore, EIA has also estimated that the shale gas and tight oil plays production in the United States is likely to reach 33.94 Tcf by 2050, registering a steady growth of 1.28% annually, when considered between 2020-2050.

- On the other hand, Canada is expected to increase the share of tight and shale gas in the natural gas production. According to the Canada Energy Regulator, by 2035, it is expected that tight and shale gas production together will represent 80% of Canada's natural gas production.

- Apart from shale gas, the region is also witnessing a significant increase in the offshore drilling activities. In January 2020, the Government of Canada approved three offshore drilling projects in the Atlantic Ocean, planned by BHP, Equinor, and Chevron, respectively.

- Therefore, based on the above-mentioned factors, North America is expected to dominate managed pressure drilling services market during the forecast period.

Managed Pressure Drilling Services Industry Overview

The managed pressure drilling services market is moderately fragmented. Some of the key players in this market include Halliburton Inc, Weatherford International PLC, Schlumberger Limited, National Oilwell Varco, and Nabors Industries Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Onshore

- 5.1.2 Offshore

- 5.2 Technology

- 5.2.1 Constant Bottom Hole Pressure

- 5.2.2 Mud Cap Drilling

- 5.2.3 Dual Gradient Drilling

- 5.2.4 Return Flow Control Drilling

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Asia-Pacific

- 5.3.3 Europe

- 5.3.4 Middle-East and Africa

- 5.3.5 South America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Halliburton Company

- 6.3.2 Weatherford International PLC

- 6.3.3 Schlumberger Limited

- 6.3.4 NOV Inc.

- 6.3.5 Nabors Industries Ltd

- 6.3.6 Global MPD Services

- 6.3.7 Ensign Energy Services Inc

- 6.3.8 Air Drilling Associates Inc.

- 6.3.9 Blade Energy Partners. Ltd

- 6.3.10 Exceed (XCD) Holdings Ltd

- 6.3.11 Pruitt MPD

- 6.3.12 Beyond Energy Services and Technology Corp.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219