|

市场调查报告书

商品编码

1683460

光纤收发器:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Optical Transceiver - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

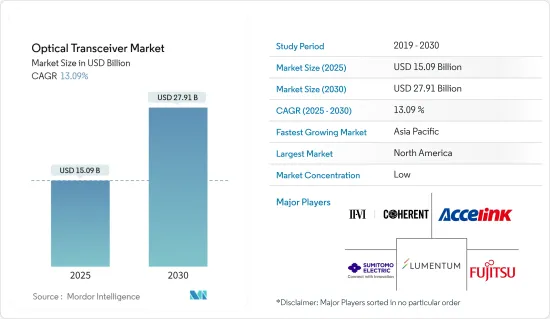

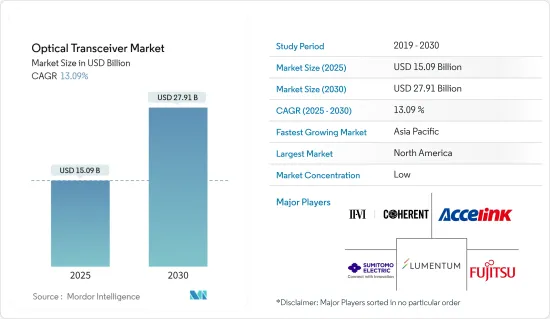

光收发器市场规模在 2025 年预计为 150.9 亿美元,预计到 2030 年将达到 279.1 亿美元,在市场估计和预测期(2025-2030 年)内复合年增长率为 13.09%。

光收发器,也称为光纤收发器,是用于在光纤网路中发送和接收资料的互连组件。它由两个主要部分组成:发射器和接收器。发射器将电讯号转换为光讯号并透过光纤电缆传输。另一方面,接收器接收光讯号并将其转换为电讯号。

主要亮点

- 光纤收发器可以实现远距高速资料传输。它可以支援视讯串流、云端运算和资料中心等高频宽应用。光纤收发器能够远距传输资料,且讯号不会明显劣化。它通常用于需要透过数公里光纤电缆传输资料的通讯和网路应用。

- 有几个因素推动了电讯业对先进通讯的需求。这些因素包括对能源效率的需求、对提供先进连接的关注以及物联网 (IoT) 和人工智慧 (AI) 等新技术的兴起。通讯业者致力于为客户提供先进的连接和更佳的性能。其中包括采用 5G、边缘运算和改进的网路基础设施等技术。这些进步使得通讯服务更快、更可靠。由于承载网的提前建设和升级,预计随着5G技术的进步和基地台的部署,光纤网路设备的需求将会增加。

- 近年来,云端基础的服务的需求大幅成长。云端处理使企业不再需要本地伺服器和硬件,从而降低了IT基础设施成本。相反,企业可以按需获取运算资源和服务,只需为其使用的部分付费。云端服务还允许您根据需求扩大或缩小资源。由于其显着的优势,云端服务的日益普及将对先进的通讯基础设施产生巨大的需求,从而推动光收发器市场的发展。

- 光收发器对于资料中心等大容量资料传输网路至关重要。近年来,光收发器网路变得越来越复杂。现代网路所需的高资料速率推动了能够以 1G 至 400G 速度传输资料的光收发器的发展。更高的资料速率需要更先进的设计和技术来确保可靠、高效的资料传输。

- COVID-19 疫情导致资料使用量增加。根据中国领先的创新网路娱乐服务平台猫眼娱乐发布的《新冠肺炎疫情对中国娱乐业影响》报告显示,电影业受到疫情的严重打击,但由于人们仍被困在家中,包括电视和串流媒体平台在内的线上娱乐市场却蓬勃发展。这导致了市场的成长。

光收发器市场趋势

资料中心成为光收发器成长最快的应用

- 作为现代化数位服务支柱的资料中心的激增需要高效可靠的连接解决方案。光纤收发器提供了这些资料中心内资料不间断流动所需的速度、容量和扩充性。

- 资料中心已成为研究市场的关键驱动因素。随着资料和人工智慧、高效能运算 (HPC) 等技术的激增,快速、可靠且经济高效地连接资料中心资产的需求呈指数级增长。吞吐量、延迟、操作简单性、维护、智慧和安全性正在成为资料中心供应商的首要任务。

- 资料中心网路正迅速采用光纤技术。资料中心的光纤网路是透过组合多台光纤设备建构的。光纤收发器在这种大容量网路中发挥关键作用。如今,大多数现代资料中心网路都需要大容量的资料传输。

- Inphi 总部位于美国,正越来越多地瞄准资料中心应用,并透过利用硅光电和 DSP 技术的 400G资料中心互连光学模组等先进产品扩大其市场。据Cloudscene称,截至2023年9月,美国共有5,375个资料中心,比世界上任何其他国家都多。另外有 522 人在德国,517 人在英国。

- 云端应用、人工智慧和巨量资料的日益普及正在推动各个地区对资料中心建设的需求。随着越来越多的组织将业务转移到云端,他们需要更先进的资料中心来支援其需求。例如,MetroEdge 于 2023 年 1 月与 Kroon Construction 和其他建设公司签署了最终协议,以设计和建造资料中心设施。该计划预计将在未来几个月内获得全面授权,并预计很快就会破土动工。

- 2023年11月,微软宣布将在未来两年内投资5亿美元扩展在云端处理和人工智慧基础设施。公告提到了未来资料中心的位置,包括 L'Ancienne-Lorette、Donnacona、Saint-Augustin-de-Desmaures 和 Levis,并且即将开始建造。

北美占有最大市场占有率

- 北美是由于通讯环境的扩大和互联网的普及而对光收发器市场的发展做出重大贡献的国家之一。这些趋势推动了对增强连接性的需求,从而增加了北美对光纤收发器的需求。根据 SaaS 解决方案公司和线上媒体监测公司 Meltwater 的数据,截至 2023 年 10 月,美国的网路普及率为 91.8%。

- 美国互联网普及率高以及人工智慧、5G、物联网和高效能运算等先进技术的采用,推动了对高资料传输速度的需求,从而推动了市场成长。

- 资料流量的增加产生了开发许多资料中心以支援企业和消费者产生的资料的额外需求。预计美国云端处理服务和应用的使用也将成长,从而推动大型超大规模云端为基础的资料中心的发展。

- 谷歌(美国)、微软(美国)、亚马逊(美国)等主要资料中心公司的存在也为北美光收发器市场的成长做出了重大贡献。谷歌和微软等云端服务供应商正在其资料中心部署高资料速率光收发器。

- 资料的快速成长以及人工智慧和高效能运算 (HPC) 等技术的扩展,推动了对快速、可靠且经济高效地连接资料中心资产的巨大需求。吞吐量、延迟、易于操作和维护、智慧和安全性等因素正在成为该地区资料中心供应商的首要考虑因素。美国在5G部署方面的投资率较高,是5G市场领先的创新者和投资者之一。

光收发器市场概况

光收发器市场高度分散,主要参与者包括 II-VI Incorporated、Accelink Technologies、Lumentum Operations LLC、住友工业工业株式会社和富士通光学元件有限公司。市场参与者正在采取联盟和收购等策略来加强其产品供应并获得永续的竞争优势。

- 2023 年 12 月,II-VI Incorporated 宣布推出适用于光纤网路的超紧凑 QSFP-DD 和 OSFP 外形尺寸的 800G ZR/ZR+ 收发器。相干公司的 800G ZR/ZR+ 收发器是世界上第一款可直接插入 IP 路由器的 QSFP-DD 和 OSFP 收发器插槽的数位连贯光学 (DCO)。

- 2023 年 10 月,Source 光电宣布在苏格兰格拉斯哥举行的 ECOC 2023 上推出用于 AI 集群连接的 800Gbps 短距离多模 (MMF) 收发器和主动电缆。这使得人工智慧资料中心基础设施能够在短距离光学可插拔模组和主动电缆应用方面呈指数级加速。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 新冠肺炎疫情及其他宏观经济因素对市场的影响

第五章 市场动态

- 市场驱动因素

- 对先进通讯的需求日益增加

- 对云端基础服务的需求不断增加

- 市场限制

- 网路复杂度不断增加

第六章 市场细分

- 按通讯协定

- 乙太网路

- 光纤通道

- CWDM/DWDM

- FTTX

- 其他通讯协定

- 按资料速率

- 低于 10Gbps

- 10 Gbps~40 Gbps

- 100 Gbps

- 100Gbps 或更高

- 按应用

- 资料中心

- 通讯

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- Coherent Corp.(II-VI Incorporated)

- Accelink Technologies

- Lumentum Operations LLC(Lumentum Holdings)

- Sumitomo Electric Industries Ltd

- Fujitsu Optical Components Limited(Fujitsu Ltd)

- Smiths Interconnect(Reflex Photonics Inc.)

- Source Photonics(Redview Capital)

- Huawei Technologies Co. Ltd

- Broadcom Inc.

- HUBER+SUHNER Cube Optics

第八章投资分析

第九章 市场机会与未来趋势

The Optical Transceiver Market size is estimated at USD 15.09 billion in 2025, and is expected to reach USD 27.91 billion by 2030, at a CAGR of 13.09% during the forecast period (2025-2030).

An optical transceiver, also known as a fiber optic transceiver, is an interconnect component used to transmit and receive data in a fiber-optic network. It consists of two main parts: a transmitter and a receiver. The transmitter converts electrical signals into light signals, which are transmitted through fiber optic cables. The receiver, on the other hand, receives light signals and converts them back into electrical signals.

Key Highlights

- Optical transceivers enable high-speed data transmission over long distances. They can support high bandwidth applications like video streaming, cloud computing, and data centers. They can transmit data over long distances without significant signal degradation. They are commonly used in telecommunications and networking applications that require data transmission over kilometers of fiber optic cables.

- Due to several factors, the telecom industry is experiencing an increasing need for advanced communication. These factors include the demand for energy efficiency, the focus on delivering advanced connectivity, and the rise of new technologies such as the Internet of Things (IoT) and artificial intelligence (AI). Telecom companies strive to deliver advanced connectivity and higher performance to their customers. This includes deploying technologies like 5G, edge computing, and improved network infrastructure. These advancements enable faster and more reliable communication services. The advanced development and upgrade of the bearer network is anticipated to drive the demand for optical communication network equipment to increase as 5G technology progresses and base stations are deployed.

- Cloud-based services have experienced a significant increase in demand in recent years. Cloud computing allows businesses to reduce their IT infrastructure costs by eliminating the need for on-premises servers and hardware. Instead, companies can access computing resources and services on demand, paying only for what they use. Cloud services also offer the ability to scale resources up or down based on demand. The increasing adoption of cloud services owing to their significant advantages would create massive demand for advanced communication infrastructure, thereby driving the optical transceivers market.

- Optical transceivers, such as data centers, are critical in high-capacity data transmission networks. In recent years, there has been an increase in network complexity in optical transceivers. The demand for high data rates in modern networks has led to the development of optical transceivers capable of transmitting data at speeds ranging from 1G to 400 G. The higher data rates require more sophisticated designs and technologies to ensure reliable and efficient data transmission.

- The outbreak of COVID-19 increased the usage of data. According to a report on the impact of the COVID-19 pandemic on China's entertainment industry by Maoyan Entertainment, a leading platform providing innovative Internet-empowered entertainment services in China, the movie industry was severely hit by the pandemic, whereas the online entertainment market, including TV and streaming platforms, were booming as people were confined to their homes. This has led to the growth of the market.

Optical Transceiver Market Trends

Data Centers to the Fastest Growing Application for Optical Transceivers

- The proliferation of data centers, which serve as the backbone of modern digital services, requires efficient and reliable connectivity solutions. Optical transceivers offer the speed, capacity, and scalability required to maintain the uninterrupted data flow within these data centers.

- Data centers are emerging as significant drivers in the market studied. With the proliferation of data and technologies, like AI and high-performance computing (HPC), the need to connect data center assets quickly, reliably, and cost-effectively is growing significantly. Throughput, latency, simplified operations, maintenance, intelligence, and security are becoming significant priorities for data center vendors.

- Data center networks are rapidly adopting fiber optics technology. A fiber-based network for data centers is built by combining many fiber optic devices. In these high-capacity networks, optical transceivers play a significant role. The majority of modern data center networks currently necessitate high-capacity data transmission.

- US-based Inphi is increasingly targeting data center applications and extending its marketplace with advanced products, including 400G data center interconnect optical modules, which leverage their silicon photonics and DSP technologies. According to Cloudscene, as of September 2023, there were 5,375 data centers in the United States, the most of any country worldwide. A further 522 were in Germany, while 517 were in the United Kingdom.

- The growing adoption of cloud applications, AI, and big data drives the demand for data center construction across various regions. As more organizations shift their operations to the cloud, they require more advanced data centers to support their needs. For instance, in January 2023, Metro Edge finalized agreements with Clune Construction and other construction firms to design and build the data center facility. The project is expected to have full entitlements within the next few months and break ground shortly after.

- In November 2023, Microsoft announced it would invest USD 500 million in expanding its cloud computing and AI infrastructure in Quebec over the next two years. The announcement references future data center locations in L'Ancienne-Lorette, Donnacona, Saint-Augustin-de-Desmaures, and Levis, with construction starting soon.

North America Holds Largest Market Share

- North America is one of the significant contributors to the optical transceiver market's development due to the growing communication landscape and the massive internet penetration. These trends demand improved connectivity, increasing the demand for optical transceivers in North America. According to Meltwater, a software-as-a-service solution company and an online media monitoring company, as of October 2023, the internet penetration rate as of October 2023 in the United States was 91.8%.

- The high adoption of the Internet and advanced technologies like AI, 5G, IoT, and high-performance computing in the United States is driving the need for a high data transmission rate, which drives the market's growth.

- Increasing data traffic has created additional demand for developing many data centers that support data generated by businesses and consumers. The use of cloud-computing services and applications is also expected to grow in the United States, leading to the development of large hyperscale cloud-based data centers.

- The presence of some of the key data center companies like Google (US), Microsoft (US), and Amazon (US) has also contributed significantly to the growth of the optical transceiver market in North America. Cloud service providers like Google and Microsoft are implementing high-data-rate optical transceivers in their data centers.

- With the proliferation of data and expansion of technologies like AI and high-performance computing (HPC), the need to connect data center assets quickly, reliably, and cost-effectively is growing significantly. Factors such as throughput, latency, simplified operations and maintenance, intelligence, and security are becoming major priorities for regional data center vendors. The United States is one of the major innovators and investors in the 5G market, owing to a high investment rate for 5G deployment.

Optical Transceiver Market Overview

The optical transceiver market is highly fragmented, with the presence of major players like Coherent Corp. (II-VI Incorporated), Accelink Technologies, Lumentum Operations LLC (Lumentum Holdings), Sumitomo Electric Industries Ltd, and Fujitsu Optical Components Limited (Fujitsu Ltd). Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- December 2023: II-VI Incorporated introduced its 800G ZR/ZR+ transceiver in ultracompact QSFP-DD and OSFP form factors for optical communications networks. The 800G ZR/ZR+ transceivers from Coherent are the world's first digital coherent optics (DCO) that can plug directly into QSFP-DD and OSFP transceiver slots on IP routers.

- October 2023: Source Photonics announced the availability of 800 Gbps short-reach multimode (MMF) transceivers and active cables for AI cluster connectivity at ECOC 2023 in Glasgow, Scotland, that enables AI data center infrastructure to achieve dramatically higher speeds for short-reach optical pluggable modules and active cable applications.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Need for Advanced Communication

- 5.1.2 Increasing Demand for Cloud-based Services

- 5.2 Market Restraints

- 5.2.1 Increase in Network Complexity

6 MARKET SEGMENTATION

- 6.1 By Protocol

- 6.1.1 Ethernet

- 6.1.2 Fiber Channel

- 6.1.3 CWDM/DWDM

- 6.1.4 FTTX

- 6.1.5 Other Protocols

- 6.2 By Data Rate

- 6.2.1 Less than 10 Gbps

- 6.2.2 10 Gbps to 40 Gbps

- 6.2.3 100 Gbps

- 6.2.4 Greater than 100 Gbps

- 6.3 By Application

- 6.3.1 Data Center

- 6.3.2 Telecommunication

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Coherent Corp. (II-VI Incorporated)

- 7.1.2 Accelink Technologies

- 7.1.3 Lumentum Operations LLC (Lumentum Holdings)

- 7.1.4 Sumitomo Electric Industries Ltd

- 7.1.5 Fujitsu Optical Components Limited (Fujitsu Ltd)

- 7.1.6 Smiths Interconnect (Reflex Photonics Inc.)

- 7.1.7 Source Photonics (Redview Capital)

- 7.1.8 Huawei Technologies Co. Ltd

- 7.1.9 Broadcom Inc.

- 7.1.10 HUBER+SUHNER Cube Optics