|

市场调查报告书

商品编码

1683477

汽车光达:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Automotive LiDAR - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

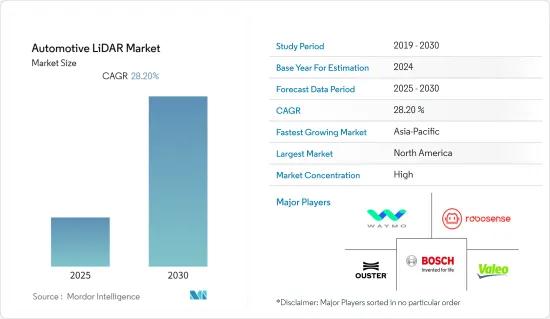

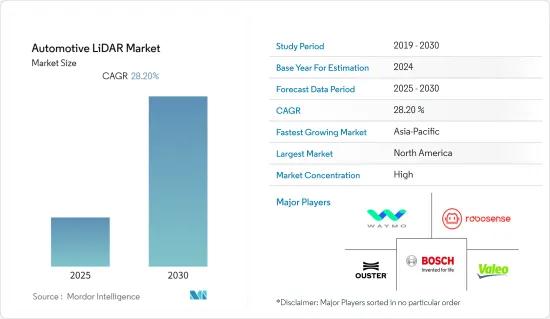

预测期内,汽车光达市场预计将以 28.2% 的复合年增长率成长。

中国工业协会修改了2020年汽车销售的预测,预计受冠状病毒疫情影响,上半年汽车销售将下降10%,全年销售量将下降5%。据 SMMT 称,由于新冠疫情导致英国所有主要工厂关闭,2020 年汽车产量将下降 18%。

主要亮点

- 整个汽车产业都依赖自动驾驶汽车和辅助技术。汽车公司正在利用新型且价格实惠的感测器为 ADAS(高级驾驶辅助系统)引入创新技术。对于全面的车辆安全解决方案,ADAS 系统不能仅依赖视觉或基于 RADAR 的系统。

- 汽车产业向自动驾驶和电动车发展的趋势预计将成为光达新应用的主要驱动力。自动驾驶汽车越来越多地使用 LiDAR 感测器来产生 360° 视野的巨大 3D 地图,并提供精确的资讯来协助自动导航和物件侦测。

- LiDAR 技术的出现为 Leddartech、Quantum Spatial、Geodigital、Topcon Positioning Systems 和 Innoviz Technologies 等众多公司开闢了巨大的成长潜力,这些公司正在不懈地努力在商业领域引入新颖的创新。例如,知名汽车零件製造商大陆集团近期宣布对机器人视觉和感测先驱 AEye 进行大规模投资,以扩大其 LiDAR 技术组合。

- AEye 的 LiDAR 技术能够在仅 160 公尺的距离内透过多个测量点追踪小型、低反射物体。这对于商用车和乘用车的自动驾驶至关重要。

- 这项投资将使大陆集团拓宽其光达技术的范围,并实现感测器的工业化,以生产完整的汽车级产品。

- 此外,2021 年 4 月,Velodyne 和 Ansys 宣布他们正在开发下一代汽车雷射雷达感测器的软体模型,以便为高度先进的自动驾驶汽车提供显着改进的危险识别能力。此次合作将把 Velodyne 的光达设计融入 Ansys 的虚拟感测器套件,加速汽车製造商将 Velodyne 的感测器整合到自动驾驶汽车中。

汽车光达市场趋势

ADAS 预计将占据很大份额

- ADAS 有五个自动化级别,其中 0 级完全依赖人工输入,5 级完全自主。 3、4 和 5 级自动驾驶汽车被认为是最有效的,这些车辆将继续采用雷射雷达。

- LiDAR主要用于汽车ADAS(高级驾驶辅助系统),以提高驾驶员的便利性,并透过人机介面实现安全引导和平稳操作。汽车的自动驾驶特性需要高度的精确度和辅助,以侦测和避开障碍物并在道路上安全行驶。

- 光达感测器连续旋转,每秒产生数千个雷射脉衝。这些来自雷射雷达的高速雷射光束会连续 360 度投射到车辆周围,并被障碍物反射。使用复杂的机器学习演算法,透过此活动接收的资料会转换成即时 3D 图形,通常显示为周围物体的 3D 影像或 3D 地图。

- 随着汽车主动式车距维持定速系统(ACC) 系统的出现,自动驾驶汽车将发展为无人驾驶系统。该装置安装在车辆前部,监测相邻车辆之间的距离,并根据相邻车辆之间的距离和速度的变化做出相应反应。

- 各公司正专注于开发更安全、更可靠的自动驾驶汽车,为客户提供先进的 ADAS 功能,包括行人和骑车人避让、车道维持辅助 (LKA)、自动紧急煞车 (AEB)、自适应主动式车距维持定速系统(ACC)、交通堵塞辅助 (TJA) 等。主要目标是确保安全、降低成本并使运输更安全,这导致公司对雷射雷达技术及其实施进行大量投资。为了降低成本,最终目标是实现固态雷射雷达等其他技术的开发,以取代传统的机械旋转。

- 2021年,Innoviz 宣布与韩国 Vueron Technology伙伴关係,实现仅基于 LiDAR 的自动驾驶。此次合作将是一次强大的组合,将 Innoviz 的高解析度 LiDAR 与 Vueron 的感知软体结合在一起,为该行业带来重大进步。 Vueron 车辆从首都首尔行驶了 414 公里到南部港口城市釜山,完全自动化并仅由雷射雷达驱动,最高时速为 100 公里。在这次历史性驾驶的整个五个小时的旅程中,没有一位安全驾驶员在驾驶。

- 沃尔沃在寻求一种经济高效的雷射雷达解决方案时,同样资助了 Luminar 的技术,而该公司也凭藉其产品成为了一个奇蹟。 Luminar 以其创新和成本效益而闻名,并推出了售价低于 1,000 美元的基于 LiDAR 的解决方案。该公司与丰田、奥迪和大众等品牌密切合作,为自动驾驶汽车提供雷射雷达解决方案。

预计北美将占很大份额

- 以美国、加拿大为代表的北美是全球技术最先进的市场。该地区市场的成长归因于 LiDAR 在环境、走廊测绘、气象学和城市规划等应用领域的日益广泛使用。此外,无人驾驶汽车和 ADAS 中 LiDAR 的使用日益增多也促进了市场的成长,预计未来几年将实现显着成长。

- 此外,Faro Technologies 和 Velodyne Lidar Inc. 等知名供应商也在该地区设有业务。 2020 年 8 月,Velodyne Lidar Inc. 宣布加入美国智慧交通协会 (ITS America),以宣传自动驾驶汽车 (AV) 和智慧交通基础设施的优势。

- 自动驾驶汽车已经在美国加利福尼亚州、德克萨斯州、亚利桑那州、华盛顿州、宾夕法尼亚州和密西根州等州和国家上路行驶。但目前,这种行动仅限于某些测试区域和驾驶条件。

- 此外,随着Google、特斯拉和宝马等大公司已经推出原型车型,自动驾驶汽车可能很快就会成为现实。该地区在本地和国际市场上的伙伴关係和投资正在不断增加,这有助于该地区雷射雷达的发展。加拿大汽车零件供应商麦格纳与以色列光达技术开发商Innoviz将合作为BMW提供创新的感测器和系统。它提供高解析度 LiDAR 技术,可在所有天气条件下产生车辆周围环境的即时 3D 点云资料。

- 此外,沃尔沃汽车还投资了美国雷射雷达感测器新兴企业Luminar,该公司利用红外频谱的不同部分,为其汽车带来感测技术。 LiDAR 可以将汽车变成一台敏锐的感知机器,帮助产生汽车周围一切事物的精确 3D 简介。沃尔沃计划于 2022 年开始生产配备 LiDAR 和感知堆迭的汽车。

- 一些地区(例如美国)的政府强制使用 AEB 和其他使用雷达、感测器、雷射雷达和其他技术的安全系统,这些系统可以单独或结合使用。这些法规鼓励汽车製造商使用 LiDAR 系统作为 ADAS 的一部分,到目前为止,该系统仅在豪华车辆中提供。儘管不断做出努力和采取了措施,但包括特斯拉在内的许多公司和组织仍然不愿加入光达的行列。例如,包括成本效益高的红外线辐射热计在内的替代方案可以将成本降低到几美元,而雷射雷达则需要数千美元。

- 特斯拉和伊隆马斯克也曾提过这样的问题:光达只能侦测移动物体,而无法分辨物体是如何移动的,甚至无法判断物体是什么。此外,将光达系统适应神经网路系统并非易事,这也是特斯拉竞争对手一直坚持的。

汽车光达产业概览

该行业竞争对手之间的竞争主要依靠透过创新来获得永续的竞争优势。该技术的市场渗透速度较慢,许多产业正在探索该技术的潜力。这为企业占领新市场提供了机会并增强了竞争力。该行业行销和广告水平较高,集中度适中,且正在不断增长。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 市场驱动因素

- LiDAR 的技术优势

- 汽车安全法规不断加强,OEM越来越多地采用 ADA 技术

- 市场挑战

- LiDAR高成本,推高了车辆整体成本

- LiDAR 生态系统(光电探测器、积体电路、LiDAR 系统、雷射光源、光学元件)

- ADAS 车辆中的 LiDAR 整合(车辆不同区域的优点和挑战)

- 汽车光达技术蓝图(2018 年 vs. 2020 年 vs. 2025 年)

- 汽车光达技术平均成本的变化(雷射测距感测器、高解析度旋转雷射雷达测绘、用于位置检测的旋转和固态雷射雷达、用于测绘的雷射雷达)

第 4 章 市场细分

- 按应用

- 机器人车辆

- ADAS

- ADAS 2+ 级和 2++ 级

- ADAS 3 级和 4 级

- ADAS 5 级

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

第五章 竞争讯息

- 供应商排名分析

- 公司简介

- Ouster Inc.

- Robert Bosch GmbH

- Valeo

- Insight LiDAR

- Velodyne LiDAR Inc.

- Leddar Tech

- Waymo LLC

- RoboSense

第六章投资分析

第七章 LiDAR 市场的未来机会

The Automotive LiDAR Market is expected to register a CAGR of 28.2% during the forecast period.

The China Association of Automobile Manufacturers revised its predictions for 2020, forecasting a 10% drop in sales for the first half of the year and 5% for the full year, on account of the coronavirus outbreak According to the SMMT, car output would fall by 18% in 2020 as a result of COVID-19 closing all major UK plants.

Key Highlights

- The entire automotive industry is looking forward to autonomous vehicles and assisted technologies. Automotive companies are coming up with innovative technologies in Advanced Driver Assistance Systems, using new and affordable sensors. For inclusive vehicle safety solutions, ADAS systems cannot be dependent on just vision and RADAR based systems; they require more efficient systems capable of providing highly accurate data for improved driver assistance.

- The growing trends in the automotive industry toward self-driving cars and electric vehicles are expected to be the critical drivers for newer applications of LiDAR. Self-driving cars increasingly use LiDAR sensors for generating huge 3D maps for 360° vision and for accurate information to assist in self-navigation and object detection.

- The emergence of LiDAR technology has provided an enormous growth potential to a wide range of enterprises, including Leddartech, Quantum Spatial, Geodigital, Topcon Positioning Systems, and Innoviz Technologies, among others, who have been relentlessly working toward introducing novel innovations in the business space. For example, Continental AG, a prominent name in automotive part manufacturing, announced expanding its LiDAR technology portfolio by investing a massive share in robotic vision and sensing pioneer- AEye.

- The latter's LiDAR technology boasts of the ability to trace small, low-reflective objects at a distance of mere 160 meters with multiple measuring points. It is suited to be vital for automated driving in both commercial and passenger vehicles.

- This investment would allow Continental to make extensive use of this LiDAR technology and industrialize the sensor to produce a fully automotive grade product, which stands as the major need of the hour across the automotive industry and autonomous vehicles.

- Furthermore, in April 2021, Velodyne and Ansys announced that they are developing software models of next-generation automotive lidar sensors to provide substantially improved hazard identification capabilities for highly advanced AVs. The collaboration incorporates Velodyne's lidar design into Ansys' virtual sensor suite and expedites automakers' integration of Velodyne's sensor into AVs - delivering industry-leading driving safety and a drastically faster path to market.

Automotive LiDAR Market Trends

ADAS is Expected to Hold Major Share

- The ADAS has 5 different levels of automation with Level 0 being completely reliant on human input ot level 5 being complete autonomy . Autonomous cars with level 3, 4 and 5 are considered the most effective and LIDARs are continuously implemented in these vehicles,

- LiDAR is primarily used for the advanced driver assistance systems (ADAS) in the automobiles for the convenience of the driver, with human-machine interface for the safe guidance and smooth operation. The autonomous nature of the vehicle needs a considerably high accuracy and assistance for the obstacle detection for avoidance and the safe navigation through the roadways.

- LIDAR Sensors continuously rotate and generate thousands of laser pulses per second. These high-speed laser beams from LIDAR are continuously emitted in the 360-degree surroundings of the vehicle and are reflected by the objects in the way. With use of complex machine learning algorithms, the data received through this activity is converted into real-time 3D graphics, which are often displayed as 3D images or 3D maps of the surrounding objects.

- With the creation of the adaptive cruise control (ACC) systems for the automobiles, the autonomous vehicles will evolve into an automated system. The devices are mounted in the front of the vehicle to monitor the distance between successive cars, to react according to the varying distance and speeds between the successive vehicles.

- Companies are focusing on developing safer and reliable autonomous cars to allow customers to unlock advanced capabilities for ADAS features including pedestrian and bicycle avoidance, Lane Keep Assistance (LKA), Automatic Emergency Braking (AEB), Adaptive Cruise Control (ACC), Traffic Jam Assist (TJA), and more. The primary aim is to ensure safety, reduce costs and make transportation safer and this has enabled companies to make significant investments in to LIDAR technologies and their implementation . To reduce costs , the ultimate goal was to achieve development of other technologies like Soldi State LIDARs to replace the traditional mechanical rotation.

- This Innoviz in 2021 announced a partnership Vueron Technology from South Korea for LiDAR-Only Autonomous Driving . The cooperation will be a powerful combination - together, Innoviz's high-resolution LiDARs and Vueron's perception software will bring significant progress to the industry.. Vueron executed a 414-kilometer, fully automated, LIDAR-only drive from the capital city of Seoul to the southern port city of Busan, at a maximum speed of 100 km/hr. The mandated safety driver on board did not hold the steering wheel at any time during the full five hours of the historic drive.

- Volvo has similarly funded Luminar technologies in their advent of finding cost effective means of LIDAR solutions and the company has been a revelation in its products ever since.. Luminar is renowned for its innovation and cost effective measures and announced LiDAR-based solutions for under USD 1,000. The company is closely working with brands such as Toyota, Audi, and VW on LiDAR solutions for self-driving cars.

North America is Expected to Hold Major Share

- North America, led by the United States and Canada, is the most technologically superior market in the world. The growth of the market in the region is attributed to the increasing use of LiDAR in applications like environment, corridor mapping, meteorology, and urban planning. The market is also witnessing growth due to the increasing use of LiDAR in driverless cars and ADAS, which is expected to grow significantly in the coming years.

- Moreover, prominent vendors like Faro Technologies and Velodyne Lidar Inc. are present in the region. In August 2020, Velodyne Lidar Inc. announced that it had joined the Intelligent Transportation Society of America (ITS America) to promote the benefits of autonomous vehicles (AVs) and intelligent transportation infrastructure.

- Self-driving cars have already hit the roads of California, Texas, Arizona, Washington, Pennsylvania, Michigan and other US states and countries. Though, as of now, their mobility is restricted to specific test areas and driving conditions.

- Moreover, self-driving and autonomous cars are becoming a reality soon with major giants, such as Google, Tesla, and BMW, already releasing their prototype models. The region is witnessing increased partnerships and investments in domestic as well as international market which is contributing towards the growth of LiDAR in the region. The Canadian car components supplier, Magna, and an Israeli LiDAR technology developer, Innoviz cooperated, will provide BMW with its innovative sensor and system. It offered high-resolution LiDAR technology, which generates a 3D point cloud in real-time of the vehicle's surroundings under all kinds of weather conditions.

- Moreover, to implement sensing technologies on its cars, Volvo Cars invested in an American LiDAR sensor startup, Luminar, which utilizes a different part of the infrared light spectrum. This is because LiDAR can turn cars into machines keenly aware of their surroundings, where it helps in generating accurate 3D snapshots of every object surrounding the vehicle. Volvo is expected to start producing vehicles in 2022 that are equipped with LiDAR and Perception Stack.

- Regional governments, like the United States, have mandated the use of AEBs and other safety systems, which use technologies like RADAR, sensors, and LiDAR in combination or used alone. Such regulations prompt the automakers to use LiDAR systems a part of their ADAS, which has been by far incorporated only in the luxury cars. Despite these continual efforts and measures, many companies notably Tesla and many organizations are still hesitant to jump on the LIDAR wagon. The main issue corelates with the cost as alternatives including the cost effective Infrared Bolometers for instance can reduce costs as they ost upto few dollars in comparisons with the thousands for LIDARs.

- Also Tesla and Elon Musk has mentioned the issue of LIDARs while detecting moving objects as to not be able to detect how they are moving or even what these objects are. Also adaptation has been a key issue for LIDAR systems to the neural network system and the competitors of Tesla have maintained this problem consistently.

Automotive LiDAR Industry Overview

The competitive rivalry in this industry is primarily dependent on sustainable competitive advantage through innovation. The market penetration of this technology is moderate, with many industries exploring the potential of this technology. This is providing an opportunity for companies to attract new markets, thus driving the competition. The levels of marketing and advertising in this industry are high, while the firm concentration ratio is moderate and growing.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 MARKET INSIGHTS

- 3.1 Market Overview

- 3.2 Industry Attractiveness - Porter's Five Forces Analysis

- 3.2.1 Threat of New Entrants

- 3.2.2 Bargaining Power of Buyers

- 3.2.3 Bargaining Power of Suppliers

- 3.2.4 Threat of Substitutes

- 3.2.5 Intensity of Competitive Rivalry

- 3.3 Market Drivers

- 3.3.1 Technological Superiority of LiDAR

- 3.3.2 Increasing Vehicle Safety Regulations and Growing Adoption of Adas Technology By OEM's

- 3.4 Market Challenges

- 3.4.1 High Cost of LiDAR Raises Overall Vehicle Cost

- 3.5 LiDAR Ecosystem (Photodetectors, IC, LiDAR Systems, Laser sources and Optical Components)

- 3.6 Integration of LiDAR in ADAS Vehicles (Advantages and Pain Points at Different Areas in the Vehicle)

- 3.7 Automotive LiDAR Technology Roadmap (2018 vs 2020 vs 2025)

- 3.8 Change in the Average Cost of LiDAR Technology in Automotive (Laser Ranging Sensor, High Resolution Spinning LiDAR mapping, Spinning & Solid State LiDAR for Positioning and Detection, and LiDAR for Mapping)

4 MARKET SEGMENTATION

- 4.1 By Application

- 4.1.1 Robotic Vehicles

- 4.1.2 ADAS

- 4.1.2.1 ADAS Level 2+ and 2++

- 4.1.2.2 ADAS Level 3 and Level 4

- 4.1.2.3 ADAS Level 5

- 4.2 By Geography

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia-Pacific

- 4.2.4 Rest of World

5 COMPETITIVE INTELLIGENCE

- 5.1 Vendor Ranking Analysis

- 5.2 Company Profile

- 5.2.1 Ouster Inc.

- 5.2.2 Robert Bosch GmbH

- 5.2.3 Valeo

- 5.2.4 Insight LiDAR

- 5.2.5 Velodyne LiDAR Inc.

- 5.2.6 Leddar Tech

- 5.2.7 Waymo LLC

- 5.2.8 RoboSense