|

市场调查报告书

商品编码

1683484

美洲塑胶袋和麻袋:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Americas Plastic Bags and Sacks - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

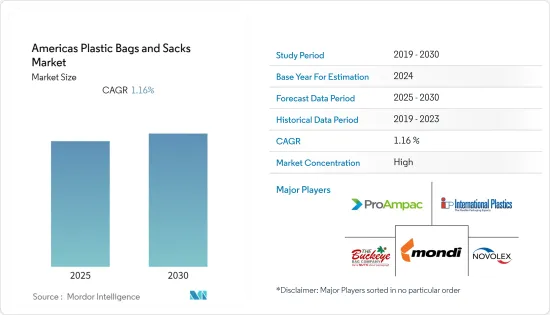

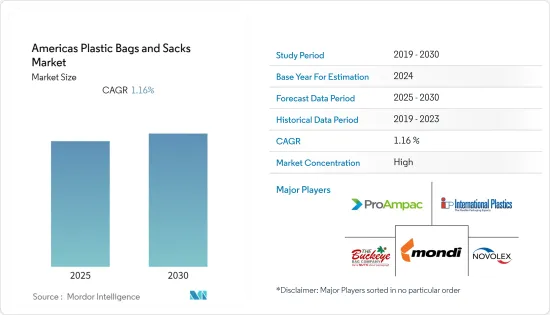

预计预测期内美洲塑胶袋和麻袋市场复合年增长率将达到 1.16%。

主要亮点

- 根据生物多样性中心统计,美国人每年使用约1000亿个塑胶购物袋,生产这些塑胶袋需要约1200万桶石油。美国人平均每人每年使用365个塑胶购物袋。

- 然而,根据美国环保署的数据,塑胶是都市固态废弃物(MSW)中成长最快的组成部分。所有重要的都市固体废弃物类别中都含有塑料,但包装类别的塑胶吨位最高。此类别包括塑胶袋、小袋和包装纸、由聚对苯二甲酸乙二醇酯製成的瓶子和罐子以及由高密度聚苯乙烯(HDPE) 製成的天然瓶等包装。

- 州立法者也采取了多项措施来减少杂货店和其他场所中塑胶袋的普及。减少袋子可以减轻对我们的海洋、湖泊、河流、森林及其栖息的野生动物的有害影响。它还减轻了垃圾掩埋场和废弃物处理的负担。虽然一些州正在努力实施有效的回收计划,但其他州已禁止使用塑胶购物袋或对其使用征收费用。例如,2021 年 5 月,科罗拉多众议院通过了 HB1162,全州禁止使用塑胶外带袋和发泡聚苯乙烯食品服务容器。

- 此外,生活方式的改变以及消费者对加工、包装和已调理食品的依赖也推动了对塑胶包装解决方案的需求。超级市场文化的出现也改变了购物格局,尤其影响了零售业对塑胶袋的需求。人们生活方式的改变导致了从家庭烹饪到已烹调产品的转变。

- 2020 年 7 月,沃尔玛、塔吉特、CVS Health 与克罗格公司和沃尔格林公司宣布成立「重塑零售袋联盟」。这些零售商承诺投入超过 1500 万美元,与封闭式合作伙伴循环经济中心合作推出「超越塑胶袋」计画。

- 此外,全部区域政府正在回应公众对包装废弃物,特别是包括袋子和小袋在内的塑胶包装废弃物的担忧。世界各国政府都在实施法规,以减少环境废弃物并改善废弃物管理流程。在美国,已有 16 个州颁布了州包装废弃物法,倾向于针对一次性塑胶。

北美及南美塑胶袋及袋製品市场趋势

消费者和零售占据最大市场占有率

- 一般来说,由高密度聚苯乙烯(HDPE)製成的薄塑胶购物袋多年来一直是该地区最受欢迎的。但为了保护海洋动物、野生动物和人类,对用于杂货和其他购物的一次性袋子的限制越来越严格。加州、康乃狄克州、德拉瓦、夏威夷州、缅因州、纽约州、奥勒冈州和佛蒙特州等多个州已禁止使用一次性塑胶购物袋。

- 此外,一些零售连锁店正在采取措施应对 COVID-19 疫情。例如,Whole Foods 在疫情期间禁止使用个人可重复使用的袋子。 Nugget Market 也实施了最积极的政策之一,以减轻其商店内冠状病毒的传播。超市网站上关于可重复使用袋子的新政策规定,为了保护客人和员工,目前,超级市场在收银台装袋杂货时只会使用一次性袋子(或在交易期间购买的新可重复使用袋子)。

- 该地区的市场正处于转型时期。这项转变涉及塑胶购物袋监管政策的重大变化以及消费者偏好的改变。随着许多线上零售商扩大实体店规模,预测期内塑胶购物袋的需求预计会增加。此外,随着该地区人们对塑胶废弃物的认识不断提高,各种企业正在采用永续性的解决方案来提升其品牌形象和销售。

- 此外,超级市场扩建计划的增加和客流量的增加也增加了塑胶袋的销售量。此外,超级市场连锁店的多项投资预计将提振零售市场的经济并促进成长。超级市场是该地区客流量最大的商店之一,也是最盈利的商店之一。

- 许多杂货商正在采取行动以实现先前承诺的环境目标并满足客户需求。零售商和品牌正在围绕永续性制定策略。例如,2021 年 1 月,Albertsons Cos 作为合作伙伴加入了「重塑零售袋」联盟,透过其「超越塑胶袋」倡议帮助减少塑胶废弃物。艾伯森斯在美国 34 个州和哥伦比亚特区经营 2,252 家杂货店和药局。

美国占有最大的市场占有率

- 在美国,由于商业、工业和其他领域等各类终端用户的消费量不断增加,塑胶袋和塑胶袋的使用量特别突出。根据地球政策研究所统计,美国消费者每年使用超过 1000 亿个塑胶购物袋,几乎每人每天一个。

- 此外,美国各地的行动生活方式和不断增长的零售市场渗透率也推动了该国塑胶购物袋的使用。根据MRI Simmons的资料,2020年将有7,993万消费者在七天内平均使用两个袋子,2020年将有9,288万消费者在七天内平均使用两个袋子。

- 该零售商位于南加州的商店提供的袋子有高达 90% 是由消费后塑胶製成的,这些塑胶通常会流入海洋和水道。此外,我们正在努力减少结帐通道中的双层包装并增加每个袋子中的商品数量。

- 此外,2020 年 12 月,梅杰签署了「超越袋子」倡议。此外,在 2020 年 1 月,Meijer 开设了第一家小型商店 Woodward Corner Market,该商店不使用一次性塑胶袋。但由于冠状病毒的爆发,可重复使用的袋子受到限制,除非使用该公司的「购物与扫描」技术和自助结帐的顾客。

- 此外,美国产业部门的成长也推动了工业塑胶袋市场的发展。主要有重型塑胶袋、货柜、PP编织袋、挡板袋等。美国出口市场的成长主要受到FIBC塑胶袋成长的推动。 FIBC 的性能标准由美国包装协会化学包装委员会根据 T-4102-85 制定并发布。在交通部将柔性容器与其他类型的 IBC 一起纳入 49 CFR 危险品条款之前,这些标准一直用于获得豁免。

美国塑胶袋和麻袋产业概况

美洲塑胶袋市场竞争激烈,参与企业很少。因此,市场看起来本质上是一体化的。此外,市场上的许多公司正在采用产品创新、合作伙伴关係、合併和收购等策略。

- 2021 年 1 月-ProAmpac LLC 为 Ocean Spray 的 Craveology Tuscan Herb 零食混合物推出可回收包装。包装采用ProActive Recyclable R-1000 薄膜。本产品耐热且密封品质优良。此外,包装设计有雾面饰面和亮光两种选择。

- 2020 年 9 月——美国最大的全通路体育用品零售商迪克体育用品 (DICK'S Sporting Goods) 宣布了两项重大倡议,以消除一次性塑胶购物袋。该集团承诺到 2025 年将从其门市中消除所有一次性销售点塑胶购物袋,并与闭环合作伙伴循环经济中心伙伴关係。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 标记领导者

- 主要终端用户市场销售成长

- 印刷业的进步使得企业能够使用塑胶袋来推广他们的品牌。

- 市场挑战

- 对塑胶袋(尤其是一次性塑胶袋)使用的严格规定对製造商和最终用户构成了重大挑战

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- 产业价值链分析

- 行业标准和法规

- 各类聚乙烯袋的相对需求分析-T恤袋、垃圾袋、瓦砾袋、编织袋等。

5. COVID-19 对塑胶袋和麻袋市场的影响

6. 美国塑胶袋和麻袋市场的细分

- 依材料类型

- 非生物分解

- 高密度聚苯乙烯(HDPE)

- 聚苯乙烯(PS)

- 低密度聚乙烯(LDPE)

- 其他的

- 可生物降解(PLA、PHA 等)

- 非生物分解

- 按应用

- 消费品/零售(服饰、消费品等)

- 对于设施(酒店、医疗保健等)

- 工业用途(麻袋等)

- 其他用途

- 按地区

- 北美洲

- 美国

- 加拿大

- 拉丁美洲

- 北美洲

第七章 竞争格局

- 公司简介

- ProAmpac LLC

- The Buckeye Bag Company

- Mondi PLC

- Novolex Holdings

- International Plastics Inc.

- Gulf Coast Bag and Bagging Co. Inc.

- Berry Global Inc.

第八章 市场展望

简介目录

Product Code: 72272

The Americas Plastic Bags and Sacks Market is expected to register a CAGR of 1.16% during the forecast period.

Key Highlights

- According to the Center for Biological Diversity, Americans have been using around 100 billion plastic bags every year, which requires about 12 million barrels of oil to manufacture. The Americans make use of an average of 365 plastic bags per person every year.

- However, according to the United States Environmental Protection Agency, plastics have been a rapidly growing segment of municipal solid waste (MSW). While plastic is found in all significant MSW categories, the containers and packaging category holds the most plastic tonnage. This category includes plastic bags, sacks, and wraps, among another packaging; polyethylene terephthalate bottles and jars; high-density polyethylene (HDPE) natural bottles; among different containers.

- The state legislatures have also taken multiple measures to reduce the prevalence of plastic bags at grocery stores and other businesses. The reduction of this bag can mitigate harmful impacts to the oceans, lakes, rivers, forests, and the wildlife that inhabit them. It can also relieve pressure on the landfills and waste management. While some states have been focusing on implementing effective recycling programs, others have been imposing bans or fees to discourage plastic bags. For instance, in May 2021, the Colorado House decided to ban plastic carryout bags and expanded polystyrene foam food service containers statewide with HB1162.

- Moreover, changing lifestyles and the consequent dependence of consumers on processed, packaged, and precooked food has also been increasing the demand for plastic packaging solutions. The advent of the supermarket culture has also altered the shopping landscape and has impacted the need for plastic bags, especially in the retail sector. The altering lifestyle of people has resulted in the shift from home-cooked to ready-to-eat products.

- In July 2020, Walmart, Target, and CVS Health announced that they collaborated with the Kroger Co. and Walgreens in the 'Consortium to Re-invent the Retail Bag,' an organization founded to test single-use plastic shopping bags options, which mass retailers across the region now use. The retailers teamed up with The Center for the Circular Economy at Closed Loop Partners and have collectively pledged more than USD 15 million to launch the 'Beyond the Bag' Initiative.

- Further, Governments across the region have responded to public concerns regarding packaging waste, especially plastic packaging waste that includes bags and sacks. They are implementing regulations to both minimize environmental waste and improve waste management processes. In the United States, 16 states have enacted statewide laws around packaging waste, which tend to target single-use plastics.

Americas Plastic Bags and Sacks Market Trends

Consumer and Retail Accounts for the Largest Market Share

- As a general trend, for many years, thin, plastic grocery store bags have been most commonly used in the region that is made from high-density polyethylene (HDPE). However, restrictions are increasing on single-use bags for groceries and other purchases to protect sea animals, wildlife, and humans. Multiple states that include California, Connecticut, Delaware, Hawaii, Maine, New York, Oregon, and Vermont have previously banned single-use plastic bags.

- Multiple retail chains have also taken initiatives in response to the COVID-19 pandemic. For instance, Whole Foods no longer allowed its customers to bring in personal, reusable bags during the pandemic. Also, Nugget Market implemented one of the most aggressive policies to mitigate coronavirus spread in its stores. On its website, regarding reusable bags, the new policy stated that to help protect the guests and associates, for the time being, the supermarket will only be using single-use bags (or new reusable bags purchased during the transaction) when bagging groceries at checkout.

- The market has been in transition mode in the region. This transition includes the significant changes in regulatory policies for plastic bags and the changing consumer preferences. With many online retailers expanding their brick-and-mortar footprint, the demand for plastic bags is anticipated to grow over the forecast period. Also, the rising awareness of plastic waste in the region has led various companies to adopt sustainability solutions to boost their brand image and sales.

- Further, the increase in expansion projects and high footfall in supermarkets have also increased the sale of plastic bags. The growth is additionally expected to increase by several investments made by supermarket chains, boosting the economy of the retail market. Supermarkets are one of the most visited stores in the region, making them one of the most profitable outlets.

- Many grocery stores are taking action to meet the environmental targets they have previously pledged and to meet customer demand. Retailers and brands are setting strategies around sustainability. For example, in Jan 2021, Albertsons Cos joined the consortium to reinvent the retail bag as a supportive partner to help reduce plastic waste through the Beyond the Bag Initiative. Albertsons operates 2,252 food and drug stores in 34 states and the District of Columbia.

United States Accounts for the Largest Market Share

- The United States is witnessing prominent usage of plastic bags and sacks due to rising consumption across various end-users ranging from commercial, industrial, and other sectors. According to the Earth Policy Institute, more than 100 billion plastic bags pass through the hands of U.S. consumers every year, almost one bag per person each day.

- Moreover, the fast-moving lifestyle across the country and the growing retail market penetration are also driving the country's usage of plastic bags. According to MRI Simmons data, 79.93 million consumers used on an average two bags in 7 days in the year 2020, and 92.88 million consumers used on an average two bags in 7 days in the year 2020.

- The retailer's Southern California stores offer bags made with up to 90% post-consumer plastics that would otherwise end up in oceans and waterways. And at the checkout lanes, Albertsons is working to reduce double-bagging and increase the number of items in each bag.

- Moreover, in Dec 2020, Meijer signed onto Beyond the Bag Initiative. Also, in Jan 2020, Meijer opened its first small-format store, Woodward Corner Market, without single-use plastic bags. However, due to the coronavirus pandemic, reusable bags have been restricted with the exceptions of customers using the company's Shop & Scan technology and self-checkouts.

- Further, the industry sector's growth in the United States is also driving the market for industrial plastic bags, mainly heavy-duty plastic sack bags, FIBC bags, P.P. woven sacks, Baffle bags, and others. The rising growth of the export market in the United States is majorly driving the growth of FIBC plastic bags in the country. Performance standards for FIBCs were established and issued by the Chemical Packaging Committee of the Packaging Institute, USA, under T-4102-85. These standards were used to obtain exemptions until DOT included flexible containers with the other types of IBCs in the Title 49 CFR for hazardous products.

Americas Plastic Bags and Sacks Industry Overview

The Americas Plastic Bags and Sacks Market is highly competitive, owing to few players in the market. As a result, the market appears to be consolidated in nature. In addition, many companies in the market are adopting strategies like product innovation, partnership, mergers, and acquisitions. Some of the key developments are:

- January 2021 - ProAmpac LLC has announced the recyclable packaging for Ocean Spray's Craveology Tuscan Herb snack mix. The package uses ProActive Recyclable R-1000 film. The product is heat resistant and offers superior seal quality. In addition, the company offers two options for the design of the packaging, which are the matte finish or the gloss finish.

- September 2020 - DICK'S Sporting Goods, which is one of the largest US-based, omnichannel sporting goods retailers, announced two significant actions to eliminate single-use plastic bags: a commitment to remove all single-use point-of-sale plastic bags from its stores by 2025 and a partnership with Closed Loop Partners' Center for the Circular Economy.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Marker Drivers

- 4.2.1 Growing Unit Sales in Key End-user Markets

- 4.2.2 Advancements in Printing Industry has Enabling Firms to Use Plastic Bags to Promote their Brands

- 4.3 Market Challenges

- 4.3.1 Stringent Regulations over the Use of Plastic Bags (particularly the single-use variety has posed a considerable challenge for manufacturers and end-users)

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Standards and Regulations

- 4.7 Analysis of the Relative Demand for Various Types of Plastic Bags and Sacks - T-shirt, Trash, Rubble, Woven-based, etc.

5 IMPACT OF COVID-19 ON THE PLASTIC BAGS & SACKS MARKET

6 AMERICAS PLASTIC BAGS & SACKS MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Non-Biodegradable

- 6.1.1.1 High Density Polyethylene (HDPE)

- 6.1.1.2 Polystyrene (PS)

- 6.1.1.3 Low Density Polyethylene (LDPE)

- 6.1.1.4 Others

- 6.1.2 Bio-degradable (PLA, PHA, etc.)

- 6.1.1 Non-Biodegradable

- 6.2 By Application Type

- 6.2.1 Consumer and Retail (includes apparel, consumer goods, etc.)

- 6.2.2 Institutional (includes hospitality and healthcare)

- 6.2.3 Industrial (includes sacks, etc.)

- 6.2.4 Other Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Latin America

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ProAmpac LLC

- 7.1.2 The Buckeye Bag Company

- 7.1.3 Mondi PLC

- 7.1.4 Novolex Holdings

- 7.1.5 International Plastics Inc.

- 7.1.6 Gulf Coast Bag and Bagging Co. Inc.

- 7.1.7 Berry Global Inc.

8 MARKET OUTLOOK

02-2729-4219

+886-2-2729-4219