|

市场调查报告书

商品编码

1683487

东南亚锂离子电池:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Southeast Asia Lithium-ion Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

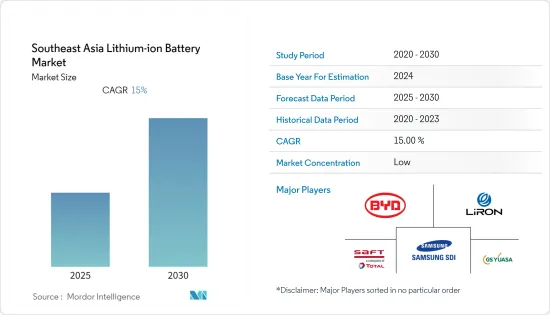

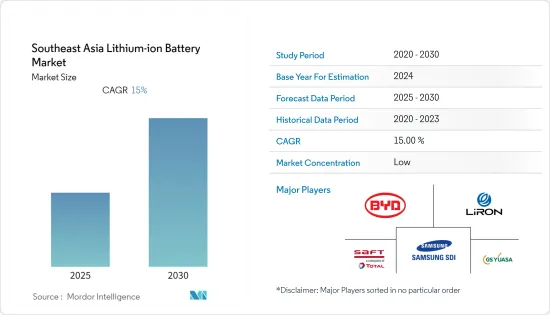

预计预测期内东南亚锂离子电池市场的复合年增长率将达到 15%。

2020 年,市场受到了新冠疫情的不利影响。目前市场已恢復至疫情前的水准。

主要亮点

- 从长远来看,锂离子电池价格下降和电动车普及等因素预计将推动市场发展。

- 然而,原材料需求和供应的不匹配阻碍了市场成长。

- 然而,将可再生能源和电池储存系统纳入各国电网的计画预计将为东南亚的锂离子电池市场创造巨大的机会。

- 由于各个行业,特别是汽车行业的需求不断增加,预计泰国将占据市场主导地位。

东南亚锂离子电池市场趋势

汽车产业占市场主导地位

- 由于汽油和天然气等燃料成本的上升,以及各国对排放法规的要求不断提高,人们的注意力从传统汽车转向电动车(EV)。电动车效率很高,再加上电力成本,意味着为电动车充电比加满汽油或柴油便宜。使用可再生能源可以使电动车更加环保。

- 锂离子电池系统为插电式混合动力汽车和混合动力汽车车提供动力。锂离子电池具有高能量密度、快速充电能力和高放电功率,是唯一可满足OEM对车辆行驶里程和充电时间要求的技术。铅基牵引电池因比能量低、重量大,在全混合动力车或纯电动车的应用上不具竞争力。

- 该地区的汽车销量正在上升。例如菲律宾的汽车销量自2020年以来就成长了20%,2020年这一数字为223,793辆,而2021年则为268,488辆。印尼和新加坡等其他地区的销售额也有所成长。

- 2021 年,印尼政府宣布了到 2025 年将电动车产量提升至国内产量的 20%(约 40 万辆)的目标。由于该国民众更青睐摩托车而非汽车,政府还计划让电动摩托车占国内摩托车产量的 20%。

- 此外,为了鼓励人们使用电动车,印尼政府宣布计划为每辆销售的电动车提供超过 5,000 美元的补贴。这些激励措施将提供给购买在印尼设有工厂的公司生产的电动车的买家。

- 此外,2022年11月,菲律宾政府宣布降低电动车进口关税。此前进口关税为5%至30%,目前已降至0%。此举旨在推动该国电动车的普及。

- 因此,由于电动车需求的增加以及政府的支持性政策和财政激励措施,预计预测期内汽车产业对锂离子电池的需求将会增加。

泰国可望主导市场

- 泰国在汽车领域具有巨大的投资潜力。该国是东协主要汽车生产基地之一。在过去的50年里,泰国从一个汽车零件组装发展成为汽车生产和出口的主要中心。

- 2021年该国汽车产量较2020年成长18%以上,2020年汽车产量为1,427,074辆,2021年为1,685,705辆。预计预测期内的成长率也将相似。

- 此外,预计该国的电动车领域将实现高速成长,尤其是插电式混合动力车 (PHEV) 和混合动力车 (HEV)。例如,2019 年,泰国政府专注于向环保车汽车製造商提供奖励,以推出更多生态电动车,尤其是混合动力电动车。与其他电动车车型一样,这些生态电动车也将享受降低的消费税,从而降低其零售价格。预计这将在未来几年为锂离子电池製造商创造巨大的商机。

- 此外,国家电动车政策委员会 (NEVPC)蓝图指出,到 2022 年,泰国每年将增加 6 万至 11 万辆电动车。到 2025 年,这一数字将增加到 100,000-300,000 辆,到 2026 年将增加到 400,000-750,000 辆。

- 此外,政府正在规划泰国4.0计画下的商业模组。该计划将支持云端处理、互动式媒体、巨量资料和物联网等新技术的兴起。因此,该国对资料中心的需求很高,预计这将在预测期内推动对资料中心电池的需求。

- 因此,由于上述因素,预计泰国将在预测期内主导东南亚地区的锂离子电池市场。

东南亚锂离子电池产业概况

东南亚的锂离子电池市场较为分散。主要企业(不分先后顺序)包括比亚迪、LiRON LIB Power Pte Ltd、Saft Groupe SA、三星 SDI 和 GS Yuasa Corporation。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第 2 章执行摘要

第三章调查方法

第四章 市场概况

- 介绍

- 2028 年市场规模与需求预测

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 限制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔

- 应用

- 车

- 产业

- 消费性电子产品

- 其他用途(医疗设备、电动工具等)

- 按地区

- 印尼

- 马来西亚

- 菲律宾

- 新加坡

- 泰国

- 越南

- 其他东南亚地区

第六章 竞争格局

- 併购、合资、合作、协议

- 主要企业策略

- 公司简介

- BYD Co. Ltd.

- LG Chem Ltd.

- Contemporary Amperex Technology Co Ltd

- LiRON LIB Power Pte Ltd

- Saft Groupe SA

- Samsung SDI Co., Ltd.

- Murata Manufacturing Co., Ltd.

- Panasonic Corporation

- GS Yuasa Corporation

- Tesla, Inc.

第七章 市场机会与未来趋势

简介目录

Product Code: 72361

The Southeast Asia Lithium-ion Battery Market is expected to register a CAGR of 15% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. Presently the market has reached pre-pandemic levels.

Key Highlights

- Over the long term, factors like decreasing lithium-ion battery prices and the increasing popularity of electric vehicles are expected to drive the market.

- On the other hand, a mismatch in the demand and supply of raw materials hinders the market growth.

- Nevertheless, plans to integrate renewable energy coupled with battery energy storage systems with the national grids in respective countries are expected to create enormous opportunities for the Southeast Asia Lithium-ion Battery Market.

- Thailand is expected to dominate the market, owing to the increasing demand from various sectors, especially the automotive sector.

Southeast Asia Lithium-Ion Battery Market Trends

Automotive Sector to Dominate the Market

- The rising fluctuation in the cost of fuels like gasoline and natural gases and the increasing demand for emission controls in various countries have shifted the focus from conventional vehicles to electric vehicles (EVs). Electric vehicles are more efficient, which, combined with the electricity cost, means that charging an electric vehicle is cheaper than filling petrol or diesel for your travel requirements. Using renewable energy sources can make the use of electric vehicles more eco-friendly.

- Lithium-ion battery systems propel plug-in hybrid and electric vehicles. Due to their high energy density, fast recharge capability, and high discharge power, lithium-ion batteries are the only available technology that meets the OEM requirements for vehicles' driving range and charging time. Lead-based traction batteries are not competitive for use in full-hybrid electric cars or electric vehicles because of their lower specific energy and higher weight.

- There has been an increase in the sales of vehicles in the region. For instance, the sales of vehicles in the Philippines have increased by 20% since 2020. In 2021, the total number of vehicles sold in the Philippines was 268,488, compared to 223,793 in 2020. Other regions, like Indonesia, Singapore, and others, also witnessed increased sales.

- In 2021, the Indonesian government announced that they had set a goal for electric vehicles to make up 20 % of all domestic cars manufactured, equal to around 400,000 e-cars, by 2025. With motorbikes favored over cars nationally, the government also aims to have e-motorbikes make up 20 % of the total domestic motorbikes production.

- Furthermore, to increase the adaption of electric vehicles, Indonesia's government announced its plans to offer a subsidy of more than USD 5,000 on every sale of an electric car. The incentives will be provided to buyers of EVs produced by firms with factories in Indonesia.

- Additionally, in November 2022, the Philippines government announced the reduction of import duties on electric vehicles. Earlier, the import duties varied from 5% to 30%, but now it has been reduced to 0%. This step was taken to increase the adoption of electric vehicles in the country.

- Therefore, the increasing demand for electric vehicles and supportive government policies and financial incentives will increase the demand for lithium-ion batteries in the automotive sector during the forecasted period.

Thailand Expected to Dominate the Market

- Thailand has enormous investment potential in the automobile sector. The country has ASEAN's leading car production base. In the last 50 years, the country has grown from an auto component assembler to a leading automotive production and export center.

- The production of motor vehicles in the country increased by more than 18% in 2021 compared to 2020. In 2021 the country produced 1,685,705 units of motor vehicles compared to 1427074 in 2020. The growth rate is expected to be similar during the forecasted period.

- Moreover, the country is expected to witness high growth in the EV segment, particularly plug-in hybrid electric vehicles (PHEVs) and hybrid electric vehicles (HEVs). For instance, in 2019, the Thailand government focused on incentivizing eco-car makers to launch more eco EVs, especially hybrid ones. Like other EV models, these eco EVs will also get an excise tax reduction, making retail prices more affordable. This, in turn, is expected to create significant opportunities for lithium-ion battery manufacturers in the coming years.

- Additionally, under the National Electric Vehicle Policy Committee (NEVPC) roadmap, Thailand will add 60,000 to 110,000 EVs annually until 2022. This will increase to 100,000 to 300,000 by 2025 and between 400,000 and 750,000 by 2026.

- Furthermore, the government planned its business module under Thailand 4.0 Programme. This Programme helps increase new technologies, such as cloud computing, interactive media, big data, and the internet of things. Hence, the country is expected to have a high demand for data centers, which is expected to increase the demand for batteries in its data centers during the forecast period.

- Therefore, based on the above mentioned factors, Thailand is expected to dominate the lithium-ion battery market in the Southeast Asian region during the forecast period.

Southeast Asia Lithium-Ion Battery Industry Overview

The Southeast Asia lithium-ion battery market is fragmented. Some major players (in no particular order) include BYD Co. Ltd., LiRON LIB Power Pte Ltd, Saft Groupe SA, Samsung SDI Co., Ltd., and GS Yuasa Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Automotive

- 5.1.2 Industrial

- 5.1.3 Consumer Electronics

- 5.1.4 Other Applications (Medical Devices, Power Tools, etc.)

- 5.2 Geography {Market Size and Demand Forecast till 2028 (for regions only)}

- 5.2.1 Indonesia

- 5.2.2 Malaysia

- 5.2.3 Philippines

- 5.2.4 Singapore

- 5.2.5 Thailand

- 5.2.6 Vietnam

- 5.2.7 Rest of Southeast Asia

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 BYD Co. Ltd.

- 6.3.2 LG Chem Ltd.

- 6.3.3 Contemporary Amperex Technology Co Ltd

- 6.3.4 LiRON LIB Power Pte Ltd

- 6.3.5 Saft Groupe SA

- 6.3.6 Samsung SDI Co., Ltd.

- 6.3.7 Murata Manufacturing Co., Ltd.

- 6.3.8 Panasonic Corporation

- 6.3.9 GS Yuasa Corporation

- 6.3.10 Tesla, Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219