|

市场调查报告书

商品编码

1683511

义大利设施管理:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Italy Facility Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

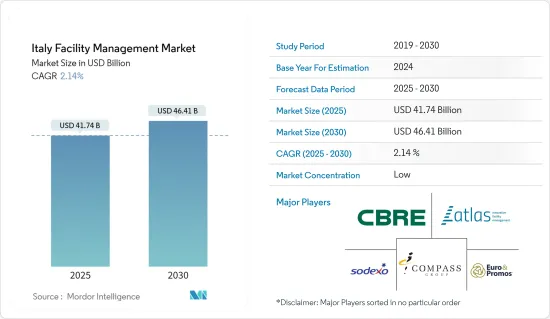

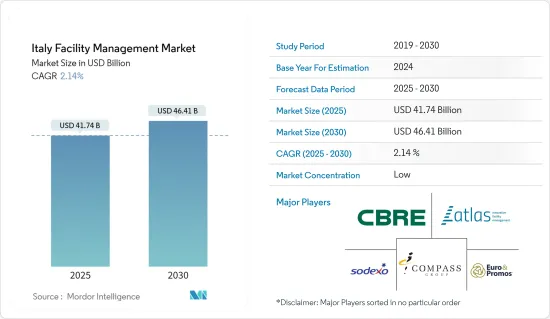

义大利设施管理市场规模预计在 2025 年为 417.4 亿美元,预计到 2030 年将达到 464.1 亿美元,预测期内(2025-2030 年)的复合年增长率为 2.14%。

国际设施管理协会 (IFMA) 将设施管理定义为将实体职场与组织的劳动力和业务连接,包括设备维护、空间规划和投资组合预测。这些服务包括领导和策略、房地产和物业管理、计划管理、品质、人员方面、应急计划和业务永续营运、环境永续性等。

主要亮点

- 例如,物联网 (IoT) 是指使用互联网与 FM 团队连接的实体设备和感测器。这些会产生性能资料并提醒设施管理人员潜在问题。 FM 可让您从任何地方监控和控制您的设备。 FM 团队正在使用物联网来提供对营运的即时洞察。物联网可以与 CMMS(基于电脑的维护管理系统)等 FM 软体结合,以识别问题、自动建立和分配工作订单(无需人工干预)并追踪其执行情况。

- 智慧建筑中的设施管理利用资料、自动化和新技术,使建筑更有效率、更经济地运作。智慧建筑使用感测器和自动化来控制从照明到空间运转率到能源消耗的一切。利用智慧技术可以帮助收集可靠的资料并为设施管理人员提供做出更好业务决策所需的洞察力。

- 义大利拥有多元化的商业房地产市场,包括零售、办公室、工业和酒店。近年来,义大利市场稳步成长,尤其是在办公室和工业领域。义大利的商业房地产价格因位置和房产类型而异,黄金地段通常价格较高。义大利商业房地产行业的主要参与者包括世邦魏理仕 (CBRE)、第一太平戴维斯 (Savills) 和高纬环球 (Cushman & Wakefield)。

- 随着主要企业进入商业领域,义大利设施管理服务市场需要变得更具凝聚力。例如,市场由 Elmet Srl、Rekeep SpA 和 NAZCA 等地区参与者主导。当地参与者在市场上提供有竞争力的价格,从而降低了供应公司的议价能力,并让买家能够以最小的转换成本快速转换设施管理供应商。本地企业与国际联繫较弱,导致其对技术先进的设施管理服务(如用于清洁业务的机器人)的采用率较低,这可能会带来长期的重大威胁。

- COVID-19 疫情对设施管理公司产生了重大的经济影响。人员流动的限制已导致计划工作减少和一些客户现场活动减少。疫情封锁影响了该行业的主要企业,包括索迪斯设施管理服务公司和世邦魏理仕集团。

- 自疫情爆发以来,对转型、创造性解决方案和独特规划策略的需求日益增加。随着对更严格的卫生法规、更好的职场安全和清洁度以及数位化职场环境的发展的日益重视,采购对于设施管理市场的疫情后转型和復苏至关重要。

义大利设施管理市场趋势

内部设施管理部门预计将占据较大的市场占有率

- 内部设施管理是指由客户组织直接聘用的专用资源所提供的服务。这种设施管理监控通常以传统的员工-雇主关係为基础进行绩效管理。

- 内部设施管理僱用专门人员来维护和管理设施或区域的各种功能属性。大多数常见服务通常委託给第三方服务提供者。然而,一些服务,例如保全服务和网路安全援助,仍然在内部运作和监控,以确保我们设施的安全和完整性。

- 零售业和旅馆业在一定程度上为内部员工提供非专业服务支援。然而,低度开发国家的组织和个人继续使用承包商从事电梯、暖通空调和 MEP 等专业工作。

- 私人消费、经济活动和旅游活动增加等因素推动了大型住宅布局/计划、酒店和商业空间的运转率。因此,对更好的设施管理的需求日益增长。

- 该国的住宅正在兴起,这可能会进一步刺激对该公司设施管理服务的需求。疫情爆发之前,建筑业投资持续成长。

- 在义大利,物流业正在扩张。外包和供应链重组正在兴起,其中包括有利于第三方物流参与者并增加其空间需求的策略。不断增加的房地产扩张计划可能会增加物流行业新设施的建设,从而增加对设施管理的需求。

商业和零售领域预计将占据主要市场占有率

- 商业和零售部门包括商业服务供应商(例如製造商、IT 和通讯业者以及其他服务供应商)使用的办公大楼。商业设施管理就是让您的营业地点成为一个健康、安全和温馨的地方,同时提升您的品牌并为您的客户提供便利的服务。清洁地板、卫生间和橱窗展示、组装引人注目的商店展示,有时甚至彻底整修设施或商店地板,都构成了零售设施管理的过程。这些任务会根据客户的要求而改变。

- 国内商业建筑业投资不断增加,带动设施管理业务的发展。各种投资公司聘请物业管理公司来处理他们的房地产投资交易。

- 据仲量联行称,罗马和米兰的办公室租赁量均有所增加。企业租户继续寻求创新租约的弹性,而员工则希望在工作生活中享有更多自由。在罗马,收购面积增加到约 15 万平方米(与前一年同期比较增加 5%)。预计到 2023 年,企业合併、空间缩小和黄金地段迁移将成为整个市场的趋势,同时人们将更加关注 2030 年永续性目标。

- 疫情过后,欧洲实体店重新开幕缓慢,电子商务发展也缓慢。在义大利等欧洲主要市场,电子商务渗透率几乎恢復到疫情前的成长趋势,并持续成长。分店将专注于打造完善的全通路体验,透过无缝融合线上和店内体验来提高客户参与。因此,预计零售商将继续投资实体店,并专注于更优越的地理位置。

- 预计预测期内,零售业和建设产业的成长、商业领域投资的增加以及全国智慧建筑数量的增加将推动设施管理的需求。预计商业和房地产行业的温和成长将推动市场成长。

义大利设施管理产业概况

义大利设施管理市场比较分散。 FM 供应商正在采用强有力的竞争策略来利用他们的专业知识。他们还在广告上投入了大量资金。市场上的领先供应商,如 CBRE Group Inc.、ATLAS IFM SRL、Sodexo Facilities Management Services(SODEXO GROUP)、Compass Group PLC、Euro &Promos Facility Management、SPA(EURO &PROMOS),都专注于提供整合解决方案来吸引消费者。预计市场上的小型供应商和新进业者将专注于保持与大型供应商相比的成本效益,进一步加剧该国的竞争。此外,随着国内公共部门日趋成熟,人们的注意力可能会转向私部门。

- 2023 年 7 月,Mitie Defence Limited 获得国防基础设施组织 (DIO) 颁发的价值 1.9057 亿美元的合同,为驻义大利的英国陆军提供关键服务。该合约主要涵盖义大利学校、办公大楼的维护、维修和服务等硬设施管理,以及废弃物、洗衣服务等软设施管理。

- 2023 年 3 月,世邦魏理仕宣布推出一条新的全球服务线,为建造电动车充电基础设施提供建议,包括电动车充电策略、确定充电地点、规划和推出电动车充电基础设施,以及整体专案管理和持续维护。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 2021-2028 年市场规模及预测

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 对产业的影响

第五章 市场动态

- 市场驱动因素

- 智慧建筑日益流行

- 商业地产领域稳定成长

- 市场限制

- 市场分散,有多家本地供应商

第六章 市场细分

- 依产品类型

- 硬体设施管理

- 软设施管理

- 设施管理类型

- 内部设施管理

- 外包设施管理

- 单一设施管理

- 捆绑设施管理

- 整合性机构管理

- 按最终用户产业

- 商业和零售

- 设施

- 政府、基础设施和公共部门

- 製造/工业

- 其他的

第七章 竞争格局

- 公司简介

- CBRE Group Inc.

- ATLAS IFM SRL

- Sodexo Facilities Management Services(SODEXO GROUP)

- Compass Group PLC

- Euro & Promos Facility Management SPA(EURO & PROMOS)

- Rekeep SpA

- Olly Services SRL

- NAZCA

- Elmet SRL

- Kier Group PLC

第八章投资分析

第九章:市场的未来

The Italy Facility Management Market size is estimated at USD 41.74 billion in 2025, and is expected to reach USD 46.41 billion by 2030, at a CAGR of 2.14% during the forecast period (2025-2030).

The International Facility Management Association (IFMA) defines facility management as combining a physical workplace with an organization's workforce and work, including equipment upkeep, space planning, and portfolio forecasting. These services include leadership and strategy, real estate and property management, project management, quality, human aspects, emergency planning and business continuity, environmental sustainability, and others.

Key Highlights

- Various trends may propel facility management in Italy; for example, the Internet of Things (IoT) refers to physical equipment and sensors that use the Internet to connect with FM teams. They generate performance data that alerts facility managers to potential problems. FMs can monitor and control equipment from any location. FM teams use IoT to deliver real-time insights into their operations. IoT paired with FM software, such as a computerized maintenance management system (CMMS), identifies problems, automatically prepares and assigns work orders without human intervention, and tracks their execution.

- Facility management in smart buildings utilizes data, automation, and new technologies to enable buildings to be run more efficiently and cost-effectively. An intelligent building uses sensors and automation to control all facilities, from lights to space occupancy and energy consumption. With smart technology, robust data can be gathered to give the facilities manager the insights needed to make better business decisions.

- Italy has a diverse commercial real estate market, including retail, office, industrial, and hospitality properties. The Italian market has seen steady growth in recent years, particularly in the office and industrial sectors. Prices for commercial real estate in Italy can vary depending on location and property type, with prime locations typically commanding higher prices. Major Italian commercial real estate industry players include CBRE, Savills, and Cushman & Wakefield.

- The Italian facility management services market needs to be more cohesive as significant local players enter the commercial sector. For instance, the market is dominated by regional players such as Elmet Srl, Rekeep SpA, and NAZCA. Local players offer competitive pricing in the market, which reduces the suppliers' bargaining power and gives the buyers an option to switch their facility management vendors with minimal switching costs quickly. Local players with fewer international relationships are leading to lesser adoption of technically advanced FM services, such as robotics used for cleaning practices, which will be a significant threat with a long-term effect.

- The COVID-19 pandemic had a significant economic impact on facility management companies. People's mobility restrictions resulted in declining project work and decreased activity at several customer sites. The pandemic lockdown impacted major industry businesses, including Sodexo Facilities Management Services and CBRE Group.

- The demand for transformation, creative solutions, and unique planning strategies has increased since the pandemic. Since the emphasis has shifted toward higher hygiene-related rules, better workplace safety and cleanliness, and developing a digitized work environment, sourcing and procurement are essential in the facilities management market's post-pandemic transformation and recovery.

Italy Facility Management Market Trends

The In-house Facility Management Segment is Expected to Hold a Significant Market Share

- In-house facility management refers to services provided by a dedicated resource directly employed by the client organization. In this type of facility management monitoring, performance control is usually conducted under the terms of the conventional employee/employer relationship.

- In-house facility management involves recruiting specialized personnel to maintain and manage various functional attributes of a facility or area. Most generic services are generally outsourced to third-party service providers. However, some services, such as security services or cybersecurity assistance, are still operated and monitored in-house to assure the safety and integrity of the facilities.

- Retail and hotel industries have supported in-house staff for non-specialized services to some extent. However, organizations and individuals in underdeveloped countries continue using contractors for specialized tasks like elevator, HVAC, and MEP work.

- Factors including increased consumer spending, economic activity, and tourism activities have augmented the occupancy of large residential layouts/projects, hotels, and commercial spaces. This has, in turn, increased the need for better facility management.

- The country is witnessing increasing construction in the residential sector, which will further boost the demand for in-house facility management services. Before the pandemic, building investments were continuously increasing.

- In Italy, logistics sectors are expanding. They are outsourcing and restructuring supply chains, including strategies that benefit third-party logistics players and boost their space requirements. Increased real estate expansion plans will increase the construction of new facilities for the logistics sector, thereby increasing the demand for facility management.

The Commercial and Retail Segment is Expected to Hold a Significant Market Share

- The commercial and retail segment includes office buildings used by suppliers of business services, such as manufacturers' corporate offices, IT and communication businesses, and other service providers. Retail facilities management refers to making a company's location hygienic, secure, and welcoming while boosting the brand and simplifying things for the clients. Cleaning floors, restrooms, and window displays, assembling eye-catching retail displays, and occasionally completely renovating the facility or shop floor constitute the retail facilities management process. These tasks vary based on the client's requirements.

- The country's commercial building industry has seen significant investments, propelling the facility management business. Various investment firms have hired real estate management businesses to handle their real estate investments.

- According to JLL, office leasing increased in both Rome and Milan. Corporate tenants continue to seek flexibility with novel leases, while workers want freedom in their working lives. In Rome, take-up climbed to around 150,000 sq. m (+5% Y-o-Y). In 2023, the market-wide trend in company consolidations, space reduction, and prime space relocating and an increased focus on 2030 sustainability targets were anticipated.

- The re-opening of physical retail and e-commerce penetration moderated in Europe after the pandemic. For vital European markets such as Italy, e-commerce penetration broadly returned to its pre-pandemic growth trend and is continuing to grow. Occupiers will likely focus on creating a solid omnichannel experience, seamlessly combining the online and brick-and-mortar experience and increasing customer engagement. Thus, retailers are expected to continue investing in physical stores, focusing more on prime locations.

- The growing retail and construction industry, increasing investment in the commercial sector, and increasing smart buildings in the country are expected to drive the demand for facility management during the forecast period. The gradual growth in the commercial and real estate sectors are expected to drive market growth.

Italy Facility Management Industry Overview

The Italian facility management market is fragmented. FM vendors are incorporating a powerful competitive strategy by leveraging their expertise. In addition, they spend a large chunk of their money on advertising. Major vendors in the market, like CBRE Group Inc., ATLAS IFM SRL, Sodexo Facilities Management Services (SODEXO GROUP), Compass Group PLC, Euro & Promos Facility Management, and SPA (EURO & PROMOS), are focusing on offering integrated solutions to attract consumers. Smaller and new vendors in the market are expected to focus on maintaining cost-benefit over major vendors, further intensifying the competition in the country. The focus will also be directed toward the private sector, owing to the public sector reaching a mature stage in the country.

- July 2023: Mitie Defence Limited was awarded a USD 190.57 million contract by the Defence Infrastructure Organisation (DIO) to provide key services for the UK Armed Forces serving in Italy. The contract primarily involves hard facilities management, such as maintenance, repairs, and servicing and soft facilities management, including waste disposal and laundry services, for school and office buildings in Italy.

- March 2023: CBRE announced the launch of a new global service line that advises clients on establishing their electric vehicle charging infrastructure, including EV-charging strategy, identifying charging site locations, planning and installing EV-charging infrastructure, and providing overall program management and ongoing maintenance.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Market Size and Estimates for the Period of 2021-2028

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Trend of Smart Buildings

- 5.1.2 Steady Growth in Commercial Real Estate Sector

- 5.2 Market Restraints

- 5.2.1 Fragmented Market with Several Local Vendors

6 MARKET SEGMENTATION

- 6.1 By Offering Type

- 6.1.1 Hard Facility Management

- 6.1.2 Soft Facility Management

- 6.2 By Facility Management Type

- 6.2.1 In-house Facility Management

- 6.2.2 Outsourced Facility Management

- 6.2.2.1 Single Facility Management

- 6.2.2.2 Bundled Facility Management

- 6.2.2.3 Integrated Facility Management

- 6.3 By End-User Industry

- 6.3.1 Commercial and Retail

- 6.3.2 Institutional

- 6.3.3 Government, Infrastructure & Public Entities

- 6.3.4 Manufacturing and Industrial

- 6.3.5 Others

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 CBRE Group Inc.

- 7.1.2 ATLAS I.F.M. SRL

- 7.1.3 Sodexo Facilities Management Services (SODEXO GROUP)

- 7.1.4 Compass Group PLC

- 7.1.5 Euro & Promos Facility Management SPA (EURO & PROMOS)

- 7.1.6 Rekeep SpA

- 7.1.7 Olly Services SRL

- 7.1.8 NAZCA

- 7.1.9 Elmet SRL

- 7.1.10 Kier Group PLC