|

市场调查报告书

商品编码

1683752

中国无机碘化物市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)China Inorganic Iodide - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

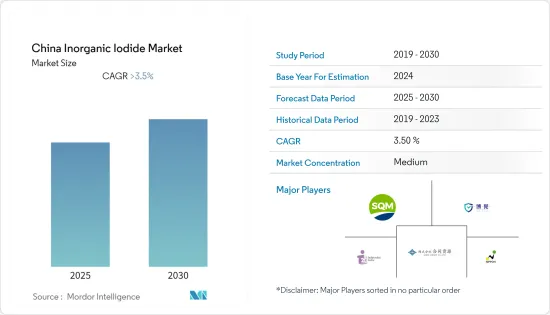

预测期内,中国无机碘化物市场预计将以超过 3.5% 的复合年增长率成长。

由于长期停工和严格的社交距离规定,COVID-19 疫情迫使许多製造厂关闭,阻碍了无机碘化物市场的需求。液晶面板和X射线介质製造速度的放缓以及与食品和动物饲料生产相关的挑战阻碍了研究市场的成长。

预计新冠疫情后的经济復苏、製药业的蓬勃发展以及人们对甲状腺功能亢进症认识的提高将推动该地区的需求。随着製造业活动恢復到新冠疫情之前的水准,X射线介质製造设备以及食品和饲料製造领域对无机碘化物的需求预计将增加。

从 LCD 面板到 DQ(点量子)萤幕的转变可能会长期阻碍需求。尤其是作为最大的液晶面板厂商之一的三星,正逐步由液晶面板转型为DQ面板。与使用无机碘化物相关的健康问题也可能对市场成长造成阻碍。

然而,对无机碘化物在各行业的潜在应用的研究和开发预计将在长期内创造增加需求的机会。

中国无机碘化物市场动态

动物饲料和营养补充品产业有望成为成长引擎

- 动物饲料和营养补充品是无机碘产品的主要用途。无机碘被用作动物和人类的饲料补充剂。

- 碘化钠、碘化钾、碘酸钾、碘酸钙和碘化亚铜是主要用于动物饲料和膳食补充剂的碘盐。

- 中国是世界主要饲料生产国之一,饲料产量约2.6142亿吨,约占世界饲料产量的8.9%。

- 根据中国饲料工业协会统计,2021年中国国内饲料产业总产值为12,234.1亿元人民币(1,807.2亿美元),较2020年成长29.3%。此外,全行业总营业利润为11,687.3亿元人民币(1,726.4亿美元),较2020年成长28.8%。

- 2021年,中国拥有产能10万吨以上的饲料厂957家。

- 除了该国饲料产业的成长趋势外,该国对乳製品、鸡蛋和肉类的需求增加也有望推动对无机碘的需求。这是因为某些碘化物盐可用于提高牛奶、蛋类和肉类的产量,从而提高这些产品的营养价值。

- 目前,乳製品和蛋类产量约为34,157,830,000公斤。预计未来五年将达到500.842亿公斤,复合年增长率约为7.96%。

- 此外,目前全国肉类市场规模为78.678亿公斤,预计未来5年将达173.475亿公斤,与前一年同期比较增17.1%。

- 预计动物饲料和营养补充剂行业的强劲增长将推动该国对无机碘化物的需求。

製药业的需求不断增长

- 无机碘盐用作解痉药、冠状血管扩张药和神经肌肉阻断剂中的活性成分。碘化物是製药业最常用的 API(原料药)之一。

- 此外,这些盐也用于製造内分泌学、胃肠病学、寄生虫学、肺病学和风湿病学的药物化合物。

- 2021年中国医药产业总销售额超过3.3兆元,与前一年同期比较去年同期成长超过20%。由于国内医院强劲的需求和庞大的原料药(API)生产基地,中国已成为仅次于美国的世界第二大医药市场。

- 2021年,中国医药产业新药上市数量创下历史新高,并在新冠疫情期间成为领先的疫苗製造商和供应商。

- 中国是全球原料药生产和出口大国,约占全球原料药产量的20%。这是由于政府的大力支持和低廉的公用事业成本。 2021年,我国原料药市场拥有原料药生产者超过7,000家,较过去5年成长5倍,年产能超过200万吨。

- 预计2022年中国医药製造业与前一年同期比较增约17%,消化器官系统及代谢类药物约占全国医药市场总量的14%。新药研发支出的增加促进了这一成长。

- 预计预测期内製药业的高与前一年同期比较增长率将推动该国对无机碘化物的需求。

中国无机碘化物产业概况

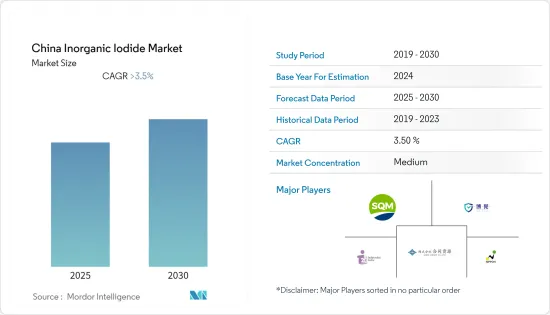

中国的无机碘化物市场由 SQM SA、Godo Shigen、山东博源药化、日宝化学、独立碘中国有限公司等主要企业部分整合。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 製药业的需求不断增长

- 中国饲料工业的成长

- 限制因素

- 无机碘化物的健康相关副作用

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场区隔

- 按产品

- 碘化钾

- 碘化钠

- 碘化钾

- 氢碘酸

- 其他产品

- 按应用

- 饲料和营养补充剂

- 製药和医疗

- 光学偏光片

- 工业化学品

- 其他用途

第六章 竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Godo Shigen Co., Ltd

- Hebei Lingding Biotechnology Co., Ltd

- Hebei Yime New Material Technology Co., Ltd

- Independent Iodine China Ltd

- Jiangsu Kaihuida New Material Technology Co., Ltd

- Jiangxi Shengdian S&t Co., Ltd

- Nippoh Chemicals Co., Ltd

- Shandong Boyuan Pharmaceutical & Chemical Co.,Ltd

- Sqm SA

- Toho Earthtech, Inc.

第七章 市场机会与未来趋势

- 无机碘化物在各行业的潜在应用

The China Inorganic Iodide Market is expected to register a CAGR of greater than 3.5% during the forecast period.

The COVID-19 pandemic, which forced the shutting down of many manufacturing units owing to prolonged lockdowns and strict social distancing norms, hindered the demand for the inorganic iodide market. A slowdown in the manufacturing of LCD panels and X-ray media and challenges associated with food and animal feed production hampered the growth of the studied market.

With the economy recovering from the COVID-19 pandemic, the growing pharmaceutical industry and the rising awareness regarding hyperthyroidism are expected to be the factors driving the demand in the region. The manufacturing sector is now reaching the pre-COVID-19 activity level, and the demand for inorganic iodides is expected to rise from X-ray media manufacturing units and the food and animal feed production segments.

The shift from LCD panels to DQ (dot quantum) screens may hamper the demand in the long term, especially with Samsung, one of the largest LCD panel manufacturers, slowly moving away from LCD panels to DQ panels. Health concerns associated with the use of inorganic iodides too may pose as hindrance to the market growth.

However, the research and development of potential applications of inorganic iodides in various industries is expected to create opportunities for rise in the demand in the long-term.

China Inorganic Iodide Market Trends

Animal Feed and Nutraceuticals Sector Expected to Serve as the Growth Engine

- Animal feed and nutraceuticals are one of the major applications of inorganic iodine products. Inorganic iodine is used as a supplement in the feed for animals and humans.

- Sodium iodide, potassium iodide, potassium iodate, calcium iodate, and cuprous iodide are majorly used iodine salts for applications in animal feed and nutraceuticals.

- China is one of the major animal feed-producing countries in the world, producing around 261.42 million tons of animal feed, accounting for around 8.9% of total global animal feed production.

- As per the China Feed Industry Association, in 2021, the total output value of the national feed industry in the country was CNY 1,223.41 billion (USD 180.72 billion), an increase of 29.3% compared to 2020. Moreover, the total operating income from the industry was CNY 1,168.73 billion (USD 172.64 billion), an increase of 28.8% from 2020.

- There were 957 feed factories in China in 2021, with a production capacity of more than 100,000 tons.

- Other than the growth trends in the feed industry of the country, the increasing demand for dairy products, eggs, and meat in the country is also expected to boost the demand for inorganic iodines, owing to applications of certain iodide salts for boosting milk, eggs, and meat production, along with the nutritional value of these products.

- Currently, the volume of the dairy products and eggs segment is around 34,157.83 million kg. It is further expected to reach 50,084.2 million kg over the next five years, with a CAGR growth of around 7.96%.

- In addition, currently, the meat market of the country is at 7,867.8 million kg , and it is expected to grow at a year-on-year growth rate of 17.1% and reach 17,347.5 million kg over the next five years.

- The strong growth of animal feed and nutraceuticals sector is expected to drive the demand for inorganic iodide in the country,

Rising Demand from the Pharmaceutical Industry

- Inorganic iodine salts are used as an active ingredient in antispasmodics, coronary vasodilators, and neuromuscular blocking agents. Iodides are among the most used APIs (active pharmaceuticals) in the pharmaceutical industry.

- Moreover, these salts are also used in the production of pharmaceutical compounds for endocrinology, gastroenterology, parasitology, pneumology, and rheumatology.

- The Chinese pharmaceutical industry generated total revenue of over CNY 3.3 trillion in 2021, registering a year-on-year growth of over 20%. China's pharmaceutical market is the second largest after the United States due to high domestic demand from hospitals and the large production base of APIs (active pharmaceutical ingredients) in the country.

- In 2021, the Chinese pharmaceutical industry witnessed a record number of new drug launches and emerged as a leading vaccine manufacturer and supplier during the COVID-19 pandemic.

- China is a global leader in the manufacturing and export of APIs, which is about 20% of the world's API production. This is owing to greater government support and the low cost of utilities. In 2021, the Chinese API market had over 7,000 API manufacturers, which increased by five times in the last five years, with a production capacity exceeding 2 million tons per year.

- Pharmaceutical manufacturing industry in China is anticipated to grow by about 17% year-on-year in 2022. Digestive and metabolic drugs account for around 14% of the total pharmaceutical market of the country. Increase in expenditure on R&D of newer drugs is a contributing factor to this growth.

- The strong year-on-year growth of the pharmaceutical industry is expected to drive the demand for inorganic iodide in the country during the forecast period.

China Inorganic Iodide Industry Overview

The Chinese inorganic iodide market is partially consolidated in nature, with a few major players being SQM SA, Godo Shigen Co. Ltd., Shandong Boyuan Pharmaceutical & Chemical Co., Ltd., Nippoh Chemical Co., Ltd., Independent Iodine China Ltd., and others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from the Pharmaceutical Industry

- 4.1.2 Growing Animal Feed Industry in China

- 4.2 Restraints

- 4.2.1 Health-related Side-effects of Inorganic Iodides

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 By Product

- 5.1.1 Potassium Iodide

- 5.1.2 Sodium Iodide

- 5.1.3 Potassium Iodide

- 5.1.4 Hydroiodic Acid

- 5.1.5 Other Products

- 5.2 By Application

- 5.2.1 Animal Feed and Nutraceuticals

- 5.2.2 Pharmaceuticals and Medical

- 5.2.3 Optical Polarizing Films

- 5.2.4 Industrial Chemicals

- 5.2.5 Other Applications

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Godo Shigen Co., Ltd

- 6.4.2 Hebei Lingding Biotechnology Co., Ltd

- 6.4.3 Hebei Yime New Material Technology Co., Ltd

- 6.4.4 Independent Iodine China Ltd

- 6.4.5 Jiangsu Kaihuida New Material Technology Co., Ltd

- 6.4.6 Jiangxi Shengdian S&t Co., Ltd

- 6.4.7 Nippoh Chemicals Co., Ltd

- 6.4.8 Shandong Boyuan Pharmaceutical & Chemical Co.,Ltd

- 6.4.9 Sqm S.A.

- 6.4.10 Toho Earthtech, Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Potential Applications of Inorganic Iodide in Various Industries