|

市场调查报告书

商品编码

1683753

欧洲天然气 -市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Europe Natural Gas - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

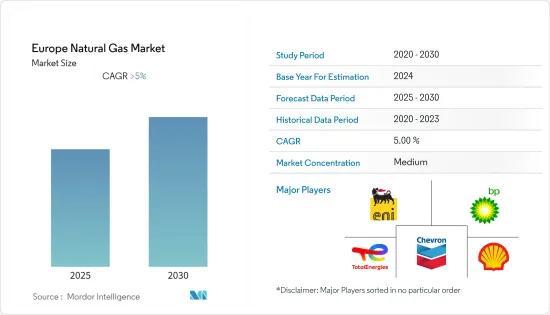

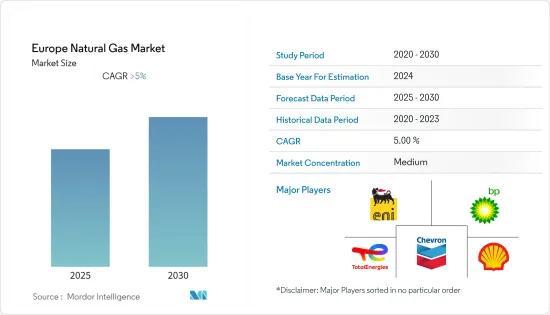

预计预测期内欧洲天然气市场的复合年增长率将超过 5%。

2020 年,市场受到了新冠疫情的不利影响。目前市场已恢復至疫情前的水准。

主要亮点

- 从中期来看,预计液化天然气需求的成长将刺激欧洲天然气市场的成长。此外,预计增加投资将推动市场成长。

- 另一方面,欧洲对替代能源的关注预计将在预测期内阻碍欧洲天然气市场的成长。

- 然而,该地区对液化天然气的需求不断增加,可能会导致智慧技术融入现有的液化天然气基础设施,为预测期内欧洲天然气市场创造有利的成长机会。

- 挪威在市场中占据主导地位,预计在预测期内将实现最高的复合年增长率。这一增长是由于投资增加和政府支持政策增加天然气产量所致。

欧洲天然气市场趋势

上游产业将强劲成长

- 欧洲是世界上最古老的产油国之一。该地区也是世界上最大的海上石油和天然气市场之一。挪威、英国和俄罗斯是该地区石油和天然气产业的主要参与者。

- 2021年,欧洲天然气产量超过1,915.46亿立方公尺。产量较上年减少。

- 由于欧洲各地对勘探和生产的投资不断增加,预计该地区的上游产业将在预测期内显着增长。

- 例如,2022年3月,海上勘探和生产公司IOG在英国酵母英吉利海岸的北海下发现了一个新的天然气田。这项发现旨在帮助英国避免价格上涨。

- 近年来,参与北海石油和天然气开发的公司开始专注于减少温室气体排放。此外,欧洲各国正认真瞄准实现欧盟为2030年设定的短期目标,这是实现2050年零碳排放的重要一步。这是实现2050年零碳排放的关键一步。总体而言,这正导致主要企业正在建立一个更碳中和的模式,利用各种上游技术来减少温室气体排放。

- 因此,由于探勘活动的增加和欧洲国家对可靠天然气的需求,预计欧洲上游产业将经历显着成长。

挪威占据市场主导地位

- 近年来,挪威的石油和天然气活动有所放缓,主要原因是其石油和天然气田的成熟。该国拥有广泛的石油和天然气基础设施,包括石油和天然气钻井和生产平台以及管道网路。

- 截至 2021 年,挪威是仅次于俄罗斯和卡达的世界第三大天然气出口国。它满足欧盟和英国20-25%的天然气需求。这使得天然气成为挪威经济最重要的出口商品。

- 2021年挪威天然气产量达到约1,167亿标准立方米,与前一年同期比较增加0.4%。挪威能源来源中天然气的份额预计将增加。

- 该国也是主要的天然气出口国,需要广泛的管道基础设施将天然气输送到消费中心。截至 2022 年 7 月,挪威的天然气管道长约 8,800 公里。约95%的挪威天然气透过海底管线输送到其他欧洲国家,约5%以液化天然气的形式出口。这将透过船隻从哈默菲斯特的 Melkoya 工厂运出。

- 2022 年 5 月,挪威国家营运商 Gassco 授予工程公司 Wood 一份合同,以支持从挪威大陆棚(NCS) 向美国和欧洲国家安全运输天然气。根据这份为期三年的合同,Wood 将与 Gasco 合作对天然气接收设施进行现代化改造。该公司为英国伊辛顿的天然气接收终端提供工程、采购和施工管理服务;比利时泽布吕赫;法国敦克尔克;德国多尔努姆;以及德国埃姆登。因此,预计该国的中游产业在预测期内将以温和的速度成长。

- 因此,预计预测期内挪威天然气产量的增加将主导欧洲天然气市场。

欧洲天然气产业概况

欧洲天然气市场中等程度分散。市场上的主要企业(不分先后顺序)包括雪佛龙公司、英国石油公司、壳牌公司、道达尔能源公司和埃尼公司。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第 2 章执行摘要

第三章调查方法

第四章 市场概况

- 介绍

- 2027 年市场规模与需求预测

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 限制因素

- 供应链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔

第六章 部门

- 川上

- 在河里

- 下游

第 7 章 部署位置

- 陆上

- 海上

第八章 区域

- 英国

- 挪威

- 荷兰

- 德国

- 欧洲其他地区

第九章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- Chevron Corporation

- BP PLC

- Shell PLC

- TotalEnergies SE

- Eni SpA

- ConocoPhillips

- Exxon Mobil Corporation

- Norwegian Energy Company ASA

- Engie SA

- Electricite de France SA

第十章 市场机会与未来趋势

简介目录

Product Code: 92913

The Europe Natural Gas Market is expected to register a CAGR of greater than 5% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. Presently, the market has reached pre-pandemic levels.

Key Highlights

- Over the medium term, the growing demand for LNG is expected to stimulate the market growth of Europe's natural gas market. Furthermore, increasing investments are expected to drive the market's growth.

- On the other hand, Europe's focus on alternative energy sources is expected to hamper the growth of the Europe natural gas market during the forecast period.

- Nevertheless, increasing demand for LNG in the region leads to the integration of intelligent technologies in the existing LNG infrastructure are likely to create lucrative growth opportunities for the Europe natural gas market in the forecast period.

- Norway dominates the market, and it would likely witness the highest CAGR during the forecast period. This growth is attributed to the increasing investments and supportive government policies in the country to increase natural gas production.

Europe Natural Gas Market Trends

Upstream Sector to Witness Significant Growth

- Europe is home to some of the oldest oil-producing countries across the globe. The region is also one of the world's largest offshore oil and gas markets. Norway, the United Kingdom, and Russia are some of the major countries in the region's oil and gas industry.

- In 2021, Europe's natural gas production volume amounted to over 191,546 million standard cubic meters. The production decreased compared to the previous year.

- The region's upstream sector is expected to witness significant growth during the forecast period, owing to increasing investments in discoveries and production across Europe.

- For instance, in March 2022, the offshore exploration and production company IOG discovered a new gas field under the North Sea off the coast of East Anglia in the United Kingdom. The discovery aims to help the United Kingdom avoid skyrocketing prices.

- In recent years, companies previously involved in the oil and gas activities in the North Sea are becoming more focused on reducing greenhouse gas emissions from the industry. Further, European nations are seriously targeting to achieve the short-term goals set by European Union for 2030, which are significant steps in achieving zero carbon emissions by 2050. Overall, this has led to the creation of more carbon-neutral models with companies using various upstream technologies to reduce greenhouse gas emissions.

- Hence, the upstream sector in Europe is expected to witness significant growth due to its increasing exploration activities and the demand shown by countries in Europe for reliable natural gas.

Norway to Dominate the Market

- Norway witnessed a slowdown in oil and gas-related activities in recent years, mainly due to maturing oil and gas fields. The country has a vast oil and gas infrastructure ranging from oil and gas drilling and production platforms to pipeline networks.

- As of 2021, Norway is the world's third-largest exporter of natural gas, behind Russia and Qatar. The country has supplied 20-25% of the European Union and the United Kingdom's gas demand. This makes natural gas the most important export commodity in the Norwegian economy.

- Norway's natural gas production amounted to some 116,700 million standard cubic meters in 2021, up by 0.4% compared to the previous year. Norway's natural gas share of energy sources is expected to increase.

- Also, the country is a major natural gas exporter, requiring a significantly developed pipeline infrastructure to transport the gas to consumption hubs. As of July 2022, the gas pipeline length in Norway was about 8,800 km. About 95% of the Norwegian gas is transported through a network of subsea pipelines to other European countries, while around 5% is exported as LNG. This is transported by ship from the Melkoya facility in Hammerfest.

- In May 2022, Norwegian state-owned operator Gassco awarded a contract to engineering firm Wood to support secure gas transportation from the Norwegian Continental Shelf (NCS) to the United Kingdom and European countries. Under the three-year contract, Wood will work with Gassco to modernize the gas-receiving facilities. The company provides engineering, procurement, and construction management services for gas receiving terminals in Easington, UK; Zeebrugge, Belgium; Dunkerque, France; Dornum, Germany; and Emden, Germany. Therefore, the midstream sector in the country is expected to witness moderate growth during the forecast period.

- Therefore, increasing production of natural gas in Norway is expected to dominate the Europe natural gas market during the forecast period.

Europe Natural Gas Industry Overview

The Europe natural gas market is moderately fragmented in nature. Some of the major players in the market (in no particular order) include Chevron Corporation, BP PLC, Shell PLC, TotalEnergies SE, and Eni SpA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

6 Sector

- 6.1 Upstream

- 6.2 Midstream

- 6.3 Downstream

7 Location of Deployment

- 7.1 Onshore

- 7.2 Offshore

8 Geography

- 8.1 United Kingdom

- 8.2 Norway

- 8.3 Netherlands

- 8.4 Germany

- 8.5 Rest of Europe

9 COMPETITIVE LANDSCAPE

- 9.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 9.2 Strategies Adopted by Leading Players

- 9.3 Company Profiles

- 9.3.1 Chevron Corporation

- 9.3.2 BP PLC

- 9.3.3 Shell PLC

- 9.3.4 TotalEnergies SE

- 9.3.5 Eni SpA

- 9.3.6 ConocoPhillips

- 9.3.7 Exxon Mobil Corporation

- 9.3.8 Norwegian Energy Company ASA

- 9.3.9 Engie SA

- 9.3.10 Electricite de France SA

10 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219