|

市场调查报告书

商品编码

1683761

英国建筑涂料:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)United Kingdom Architectural Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

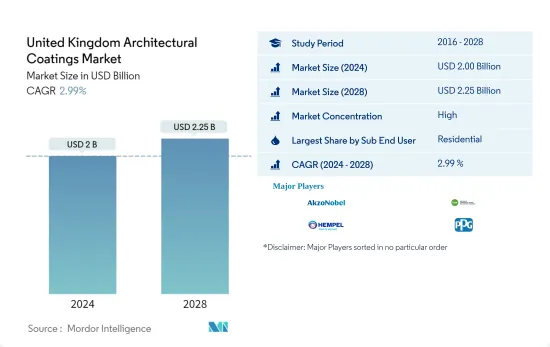

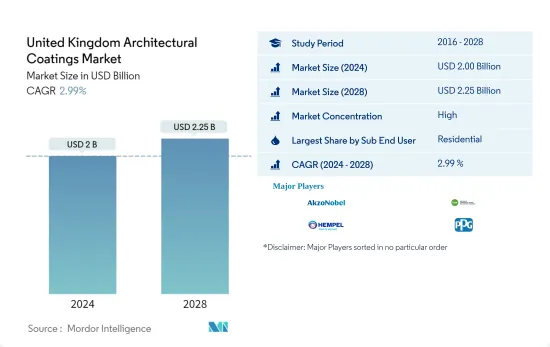

英国建筑涂料市场规模预计在 2024 年为 20 亿美元,预计到 2028 年将达到 22.5 亿美元,预测期内(2024-2028 年)的复合年增长率为 2.99%。

主要亮点

- 最大的终端用户领域:住宅:除了住宅存量增加之外,DIY和木工领域的强劲销售也推动了住宅被覆剂的消费。

- 按技术分類的最大细分市场——水性涂料:严格的 VOC 法规以及人们对 LEED 认证建筑和低 VOC、环保水性涂料的认识不断提高,促进了水性涂料的消费。

- 按树脂分類的最大部分:丙烯酸:英国脱欧后,压克力型涂料的消费量增加,因为它们比溶剂型涂料便宜且排放的挥发性有机化合物 (VOC) 更少。

英国建筑涂料市场的趋势

按终端用户细分,住宅是最大的细分市场

- 在英国,建筑涂料消费量在 2016 年至 2021 年期间录得复合年增长率。这一成长主要得益于 2017 年投资成长 4%,而 2016 年投资成长 2%。私人住宅领域的显着成长和商业领域的混合成长也推动了这一成长。

- 在 2020 年建筑涂料消费量成长放缓之后,由于住宅和商业领域新建筑的復苏,2021 年建筑涂料消费量恢復成长。然而,到 2020 年,新建房屋数量从住宅领域下降到了 DIY 领域。

- 随着住宅和商业领域的復苏,消费将在2021年復苏。政府已宣布食品和餐旅服务业减税等政策,这可能会在未来几年刺激建筑业的成长。

英国建筑涂料产业概况

英国建筑涂料市场较为分散,前五大公司占据的市占率为36.87%。该市场的主要企业是:AkzoNobel NV、DAW SE、Hempel A/S、PPG Industries, Inc. 和 The Sherwin-Williams Company(按字母顺序排列)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章执行摘要和主要发现

第 2 章 简介

- 研究假设和市场定义

- 研究范围

- 调查方法

第三章 产业主要趋势

- 占地面积趋势

- 法律规范

- 价值链与通路分析

第 4 章 市场细分

- 次级终端用户

- 商业的

- 住宅

- 技术领域

- 溶剂型

- 水性

- 树脂

- 丙烯酸纤维

- 醇酸

- 环氧树脂

- 聚酯纤维

- 聚氨酯

- 其他树脂类型

第五章 竞争格局

- 重大策略倡议

- 市场占有率分析

- 业务状况

- 公司简介

- AkzoNobel NV

- Bailey Paints

- Beckers Group

- Bedec Products Ltd

- DAW SE

- DGH Manufacturing Ltd(Andura Coatings)

- GLIXTONE

- Hempel A/S

- Jotun

- PPG Industries, Inc.

- RPM International Inc.

- SACAL INTERNATIONAL GROUP LTD

- The Sherwin-Williams Company

第六章 执行长的关键策略问题

第七章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源和进一步阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

简介目录

Product Code: 93078

The United Kingdom Architectural Coatings Market size is estimated at USD 2 billion in 2024, and is expected to reach USD 2.25 billion by 2028, growing at a CAGR of 2.99% during the forecast period (2024-2028).

Key Highlights

- Largest Segment by End-user - Residential : The rise in the country's housing stock, accompanied by strong sales in the do-it-yourself (DIY) and repaint segments, has increased the consumption of residential coatings.

- Largest Segment by Technology - Waterborne : The strict VOC regulations and growing awareness of LEED-certified buildings and low-VOC, eco-friendly waterborne coatings contributed to waterborne coating consumption.

- Largest Segment by Resin - Acrylic : The lower price of acrylic coatings than solvent-based coatings, after the UK's exit from the European Union, and low VOC emissions have increased their consumption levels.

UK Architectural Coatings Market Trends

Residential is the largest segment by Sub End User.

- In the United Kingdom, architectural paint consumption from 2016 to 2021 recorded a CAGR of . This increase was seen due to a 4% increase in investment in 2017 compared to 2% in 2016. Significant growth in the private housing sector and mixed growth in the commercial sector also contributed to this increase.

- The slow growth in the architectural coating consumption in 2020 was followed by a growth recovery in 2021 due to the recovery in new constructions in the residential and commercial sectors. However, in 2020, there was a decline in new construction in the DIY segment from the residential sector.

- The consumption recovered in 2021 due to a rebound from the residential and commercial sectors. The government announced policies such as tax cuts on food and hospitality, which may add to the construction sector's growth in the coming years.

UK Architectural Coatings Industry Overview

The United Kingdom Architectural Coatings Market is fragmented, with the top five companies occupying 36.87%. The major players in this market are AkzoNobel N.V., DAW SE, Hempel A/S, PPG Industries, Inc. and The Sherwin-Williams Company (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 INTRODUCTION

- 2.1 Study Assumptions & Market Definition

- 2.2 Scope of the Study

- 2.3 Research Methodology

3 KEY INDUSTRY TRENDS

- 3.1 Floor Area Trends

- 3.2 Regulatory Framework

- 3.3 Value Chain & Distribution Channel Analysis

4 MARKET SEGMENTATION

- 4.1 Sub End User

- 4.1.1 Commercial

- 4.1.2 Residential

- 4.2 Technology

- 4.2.1 Solventborne

- 4.2.2 Waterborne

- 4.3 Resin

- 4.3.1 Acrylic

- 4.3.2 Alkyd

- 4.3.3 Epoxy

- 4.3.4 Polyester

- 4.3.5 Polyurethane

- 4.3.6 Other Resin Types

5 COMPETITIVE LANDSCAPE

- 5.1 Key Strategic Moves

- 5.2 Market Share Analysis

- 5.3 Company Landscape

- 5.4 Company Profiles

- 5.4.1 AkzoNobel N.V.

- 5.4.2 Bailey Paints

- 5.4.3 Beckers Group

- 5.4.4 Bedec Products Ltd

- 5.4.5 DAW SE

- 5.4.6 DGH Manufacturing Ltd (Andura Coatings)

- 5.4.7 GLIXTONE

- 5.4.8 Hempel A/S

- 5.4.9 Jotun

- 5.4.10 PPG Industries, Inc.

- 5.4.11 RPM International Inc.

- 5.4.12 SACAL INTERNATIONAL GROUP LTD

- 5.4.13 The Sherwin-Williams Company

6 KEY STRATEGIC QUESTIONS FOR ARCHITECTURAL COATINGS CEOS

7 APPENDIX

- 7.1 Global Overview

- 7.1.1 Overview

- 7.1.2 Porter's Five Forces Framework

- 7.1.3 Global Value Chain Analysis

- 7.1.4 Market Dynamics (DROs)

- 7.2 Sources & References

- 7.3 List of Tables & Figures

- 7.4 Primary Insights

- 7.5 Data Pack

- 7.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219